Adrian Wojcik/iStock Editorial via Getty Images

It’s easy to overlook Coca-Cola Europacific Partners PLC (NASDAQ:CCEP). Although CCEP is either the first or second-largest independent bottler in the Coca-Cola System (it depends on what metric you use – revenue or volume), its relationship with The Coca-Cola Company (KO) – hereafter referred to as TCCC – means that economic profits and value creation typically accrue to the latter.

In very simple terms, TCCC produces the beverage concentrate and sells it to CCEP, which then produces and bottles the finished product and distributes it to retailers in its territories. The former is operationally simple and asset-light while the latter is more complex and asset-intensive. TCCC can’t push things too far, of course, as the bottlers are an integral part of the system, but it basically controls the economics of the entire process and skews it primarily to its benefit.

While that makes TCCC the “better” company from an earnings quality perspective, that doesn’t mean there aren’t things to like here. The contracts by which CCEP has the right to produce and distribute TCCC brands are typically long-lasting (10-year initial lengths plus 10-year renewals), and we all know that TCCC brands are rock solid. Coca-Cola is going to be around in 10, 20, 30-plus years – a degree of certainty which is attractive to long-term oriented investors.

The valuation is also reasonable right now in my view, with CCEP currently trading on a sub-20 P/E ratio based on COVID-hit 2021 earnings. Granted, there are some headwinds to consider, but recovery-driven EPS and dividend growth make these shares quite interesting right now. Buy.

An Intercontinental Bottler

CCEP is the result of a series of bottler consolidations, the most recent of which saw Coca-Cola European Partners purchase Coca-Cola Amatil last year. The latter was an Australian-listed bottler whose territories included key Oceanian countries (Australia, New Zealand, Papua New Guinea, etc.) as well as Indonesia, while the former covered Western and Northern Europe, plus the Iberian Peninsula.

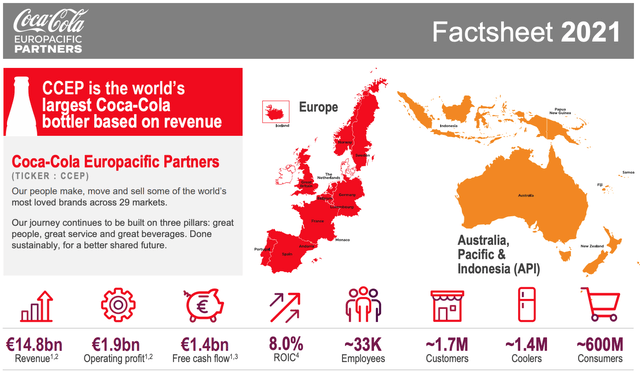

Coca-Cola Europacific Partners Factsheet

As a result, the newly combined CCEP produces somewhere in the region of three billion unit cases of beverage per annum, putting it slightly behind Latin American bottler Coca-Cola FEMSA (KOF) on that measure, albeit ahead in terms of revenue.

In terms of its beverage portfolio: around 60% of the volume is in Trademark Coca-Cola products, which includes “classic” Coca-Cola as well as its various zero-sugar formulations; 25% is in Flavors, Mixers and Energy, which includes other TCCC sparkling brands like Fanta and Sprite, plus non-TCCC brands like Monster Energy; 8% is in ready-to-drink tea, RTD coffee, juices and other; and the rest is in Hydration (water, electrolyte drinks, etc.). All told, sparkling beverage brands make up almost 85% of total company-wide volume.

Recovery Still In Progress

Like TCCC, CCEP has been heavily affected by COVID. 45% of the company’s pre-pandemic sales were attributable to the away-from-home channel, and its territories were among the harshest in terms of lockdown measures, severely affecting on-trade venues like restaurants, pubs, hotels and so on.

In 2020, that dynamic saw volumes fall 10% – an unprecedented drop given the hitherto stability of TCCC brands. Revenue fell slightly more, with a supplemental 1.5% fall in revenue per unit case again a result of adverse effects from COVID. Operating profit fell significantly more still, declining nearly 50% to €813m, in part due to significant operating deleveraging (i.e., fixed costs still need to be paid regardless of volume). Excluding restructuring charges, costs related to the Amatil acquisition and FX, operating profit fell around 30% in 2020.

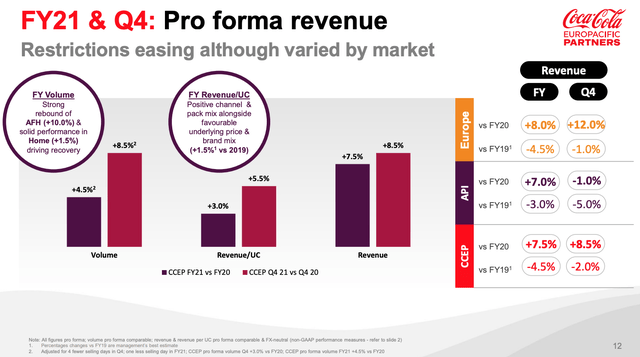

2021 saw the expected recovery, albeit that recovery is progressing slowly as many territories maintained significant restrictions, especially in the first half of the year. For FY21 as a whole, pro forma comparable volume increased 4.5% to a little over 3B unit cases, driven by a recovery in the away-from-home channel, where volume increased circa 10% versus 2020 as restrictions eased.

Coca-Cola Europacific Partners 2021 Results Presentation

Importantly, the recovery picked up steam in the latter part of the year, with company-wide pro forma comparable volume growth clocking in at 8.5% in Q4, just 1.5% lower versus pre-COVID FY19. That momentum should continue as we head deeper into 2022, with any impact from Omicron likely to fade as quickly as it surfaced.

Shares Reasonable Value

Based on still-depressed 2021 comparable EPS of €2.83, CCEP shares trade on a P/E of circa 16. The dividend yield is 3.2%, with that based on an FY21 payout of €1.40 per share – in line with the company’s policy of a 50% payout ratio.

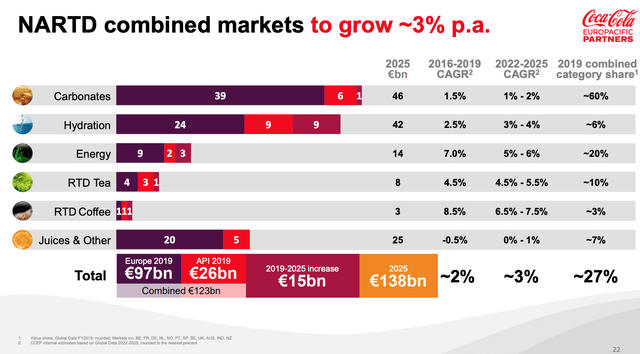

Looking ahead, there are some headwinds to consider. Firstly, the company is obviously facing a secular headwind in terms of increasingly health-conscious consumers turning away from sugary carbonated drinks. Given its operating footprint – typically developed markets where demographics are poor and per-capita consumption is maxed out – the scope for organic volume growth is pretty limited. Sure, there are offsetting factors – it can grab value from, for example, more profitable smaller serving sizes while it also has exposure to faster-growing beverage categories such as Energy and RTD tea/coffee – but the point stands nonetheless, and long-term volume growth is probably consigned to the 1-2% per annum region.

Coca-Cola Europacific Partners March 2022 Investor Presentation

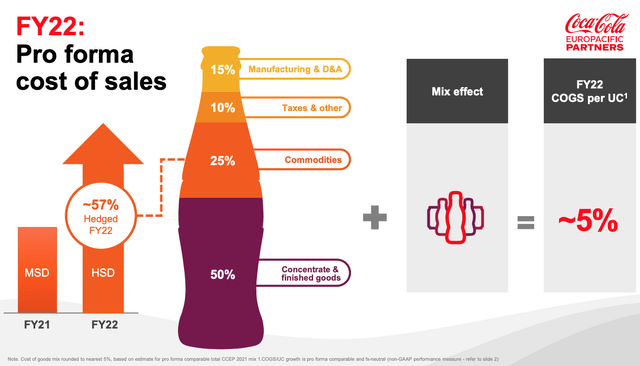

A more immediate, but hopefully more transient issue, is the war in Ukraine. The company doesn’t have direct exposure to the country (or Russia), but commodity and energy cost inflation is obviously a significant factor in terms of its operations. Previously, management guidance was for a circa 5% increase in COGS per unit case, with that incorporating high single-digit commodity price inflation. The company does have significant hedging in place, especially for the first half of the year, though given the impact of recent events this is definitely something to keep an eye on.

Coca-Cola Europacific Partners 2021 Results Presentation

Notwithstanding the above, there is still the low-hanging fruit to EPS growth from a COVID recovery. On-trade COVID restrictions are less and less of an issue now, notwithstanding a likely dip due to Omicron, and comps are going to be soft vis-à-vis COVID-hit 2021. Volumes should more or less recover to pre-pandemic levels this year which, combined with pricing per unit case growth, should be good for double-digit EPS growth as per analyst estimates. A targeted 50% payout ratio would see that translate into comparable dividend growth, which analysts see maintained through fiscal 2024. Given the stability of the company’s revenues, backed by one of the world’s strongest FMCG brands, plus a decent starting dividend yield, that looks attractive to prospective income investors. Buy.

Be the first to comment