wutwhanfoto/iStock via Getty Images

If global financial markets had a theme for 2022 it would be this: the buck stops nowhere. My adaptation derives from President Harry Truman when he said “the buck stops here.” His reference was that of political responsibility. My reference is the U.S. dollar.

Carnage has spread among bonds, equities, currencies, and now even commodities as the U.S. Dollar is the last man standing. The U.S. Dollar Index DXY has risen over 18% year to date, reaching a level of 114 which was last seen in 2002. In comparison, the SPY is down 25% YTD.

Charts by TradingView

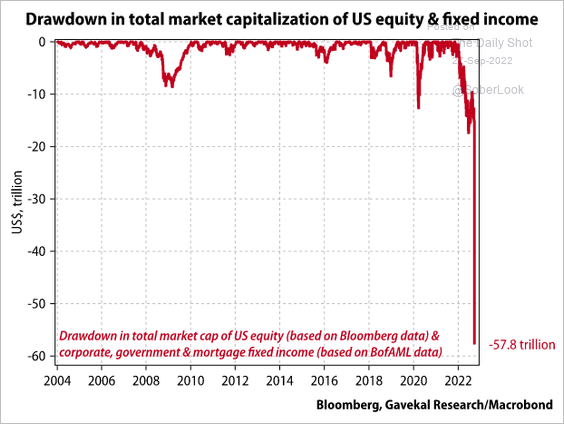

The rising dollar is a sign of tightening financial conditions and increased stress in the global financial system. Investors have been feeling the stress as the drawdown in market cap of U.S. equity and bond markets has declined by a staggering $57.8 trillion in less than one year. As a result, markets are anxiously waiting for signs of a Fed pivot that would mark a turn in monetary policy.

The Daily Shot (used with permission)

The Fed has been clear with markets: they will not rest until inflation is tamed. It begs the question: but what if something breaks?

Things are beginning to break, creating a line of dominoes to those able to put the pieces together. Problems have appeared in Japan, the U.K., and Switzerland. The Fed has reacted with accommodation. This accommodation should not be mistaken as dovish. On the contrary, it allows the Fed to continue tightening further.

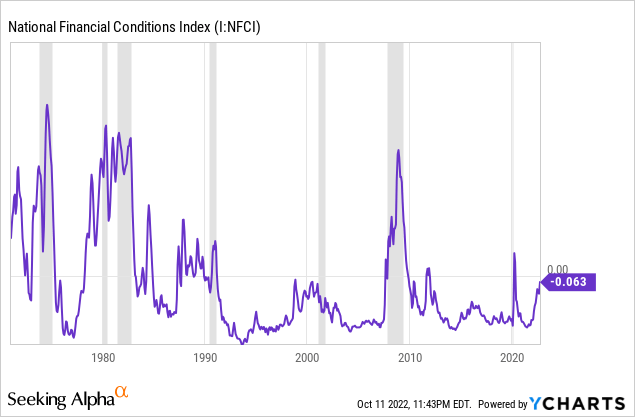

Financial Conditions Are Getting Tight

The National Financial Conditions Index has been steadily rising this year and has nearly reached the zero bound which indicates tighter than average financial conditions. The move is signaling greater stress in financial markets as a result of monetary tightening by central banks.

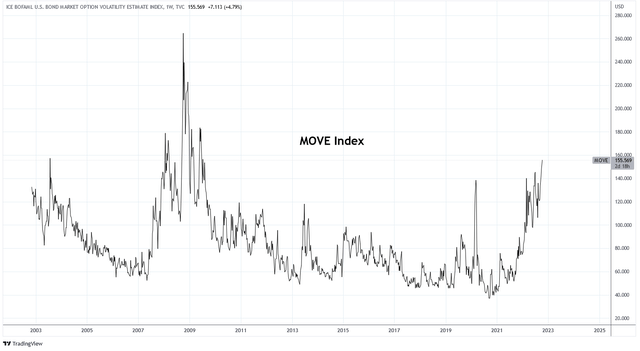

Likewise, the U.S. Bond Market Option Volatility Index, or MOVE Index, is registering levels that are higher than the 2020 flash crash and equal to levels last experienced in 2010. The pace and span of this change is exceptional and suggests increasing stress in bond markets.

Charts by TradingView (adapted by author)

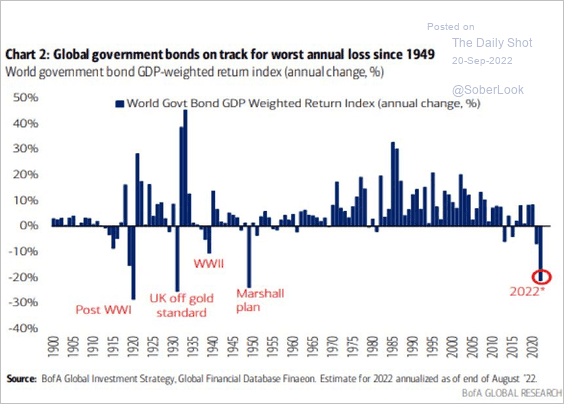

One of the causes of this stress is the historic losses experienced by bonds. Global government bonds are having their worst year of performance since the 1940s. This becomes a significant issue when market participants trade bonds with significant leverage.

The Daily Shot (used with permission)

U.K. Rescues Gilts

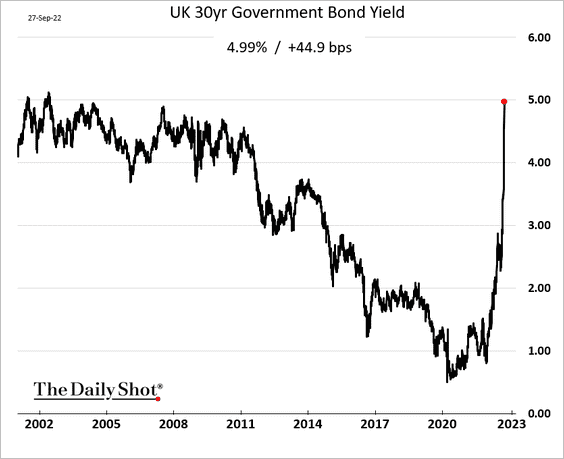

Among those bonds that are suffering is U.K. Gilts. The rate on the UK 30 year Gilt has risen by more than 4% in 2022. On September 28, the Bank of England announced that it was intervening in long-dated UK government bonds, including this statement:

… the Bank is monitoring developments in financial markets very closely in light of the significant repricing of UK and global financial assets. This repricing has become more significant in the past day – and it is particularly affecting long-dated UK government debt. Were dysfunction in this market to continue or worsen, there would be a material risk to UK financial stability. This would lead to an unwarranted tightening of financing conditions and a reduction of the flow of credit to the real economy.

The Daily Shot (used with permission)

The Bank of England announced it would continue this Gilt market operation until October 14th but they have since suggested that the intervention could continue through this deadline. The Bank has purchased over £8,761 million in Gilts so far. In addition, the BOE will enact a Temporary Expanded Collateral Repo Facility to address issues around tight liquidity in the banking system. This is how the BOE described these repo facilities:

Under these operations, the Bank will accept collateral eligible under the Sterling Monetary Framework (SMF), including index linked gilts, and also a wider range of collateral than normally eligible under the SMF, such as corporate bond collateral.

The reason that the BOE had to act in this way is because the declines in bond value was threatening the solvency of liability-driven investment funds (LDI), a component of pension funds. LDI funds are heavily invested in long duration Gilts, often with significant leverage. The funds were warning policy makers on September 27th that they could not maintain orderly liquidation of assets and would be subject to insolvency.

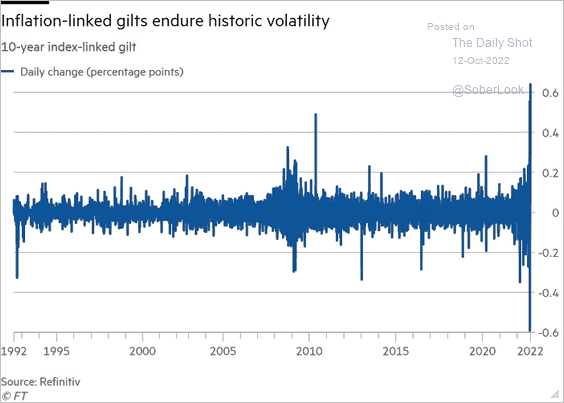

The intervention by the BOE was necessary to avoid collapses of pension funds invested in LDIs. Otherwise, the BOE warned that there was a “material risk to U.K. financial stability” and that the LDI funds were within hours of collapse. Initially, Gilts rallied as rates fell in response to the announcement. But over the last few days rates have continued to rise, resulting in some of the greatest volatility in Gilt markets in decades.

Charts by TradingView (adapted by author)

The Daily Shot (used with permission)

Japan Defends the Yen

Earlier in September, Japan announced that it was intervening in the Forex market by buying Yen for the first time in 24 years. The move comes after a steep decline in the Yen against the U.S. dollar to levels that were last seen in 1998, which was the last time the Bank of Japan intervened.

Charts by TradingView (adapted by author)

The BOJ continues to maintain very low interest rates which is contributing to the Yen weakness. This action requires the BOJ to sell USD or USD denominated assets and would be scrutinized by the Federal Reserve. The Fed has expressed support for the decision. Treasury spokesman Michael Kikukawa said:

The Bank of Japan today intervened in the foreign-exchange market. We understand Japan’s action, which it states aims to reduce recent heightened volatility of the yen.

Initially, the Yen rallied on the news but has since given back the gains and is currently trading around 146-147.

The Daily Shot (used with permission)

Credit Suisse and Swap Lines

On October 3rd, shares of Credit Suisse (CS) dumped by 10% before recovering by close. The move came after reports that the bank has plans to raise capital which caused its CDS spreads to rise to levels last seen during the 2008 financial crisis.

In response, Komal Sri-Kumar had this to say as published by CNBC:

I think the Federal Reserve is going to have to face the consequences of a credit event. Something is going to break. This may or may not be a Lehman moment.

A few weeks ago, CEO Ulrich Koerner wrote in a memo to staff:

I know it’s not easy to remain focused amid the many stories you read in the media – in particular, given the many factually inaccurate statements being made. That said, I trust that you are not confusing our day-to-day stock price performance with the strong capital base and liquidity position of the bank.

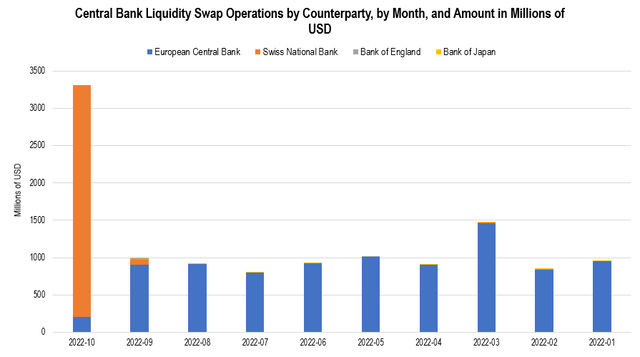

But then, on October 5th the Fed delivered a USD swap line of $3.1 billion to the Swiss National Bank, the jurisdiction where Credit Suisse is domiciled. The swap line is the largest year to date to any counter-party and brings the monthly total for October to more than twice the next highest month, and it’s only October 12th.

Chart by author (data from newyorkfed.org)

This $3 billion in swap lines is not a significant quantity, historically speaking. But the rate of change deserves attention. If further swap lines are required it will signal that financial stress is accelerating.

One issue with a strong dollar is that it causes foreign central banks to sell USD reserve assets to defend their currencies, meet financial obligations, and maintain sufficient dollar liquidity. As they sell USD denominated assets, such as U.S. Treasuries, it causes Treasury rates to rise which further strengthens the USD against foreign currencies. The process has the potential to feed on itself.

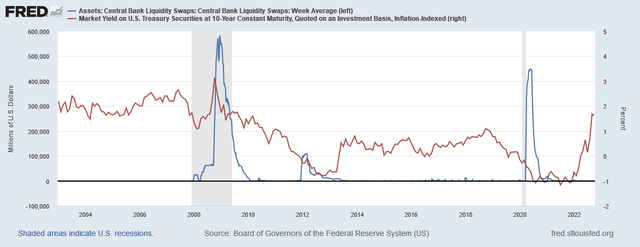

This is one reason why USD swap lines are used to provide USD liquidity to foreign central banks. Notice in the chart below that rates on the 10-year Treasury have declined during the significant deployment of USD swap lines in 2009, 2012, and 2020.

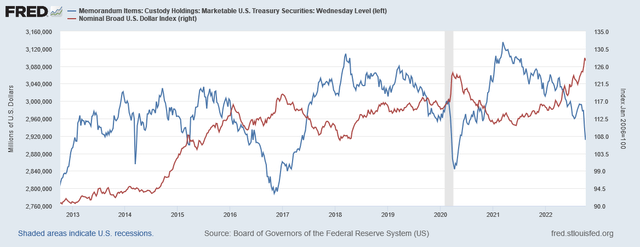

FRED

Today, the foreign holdings of U.S. Treasury Securities is in decline as the U.S. Dollar Index rises. A similar occurrence took place in 2016 and 2020. I expect that this decline in foreign Treasuries is pressuring the need for additional swap line liquidity which may transpire over the coming months.

FRED

Summary

I initially opened a long position in long duration U.S. Treasuries via TLT in August on the thesis that degrading economic conditions and signs of inflation abatement would encourage a rally. That trade has been wrong thus far. I continue to believe that the trade is early and have stopped out of my position for the time being. The developments that we have discussed have supported my bullish view. For example, if the quantity of swap lines expands significantly it may cause a peak in long duration rates.

Thus far, the Fed has shown to be accommodating by supporting the interventions in Japan and the U.K. and offering swap lines to Switzerland. I do not think this should be interpreted as a dovish policy reversal. Instead, it permits the Fed to continue further in its tightening efforts.

On September 27, Treasury Secretary Janet Yellen stated:

We haven’t seen liquidity problems develop in markets — we’re not seeing, to the best of my knowledge, the kind of deleveraging that could signify some financial stability risks.”

I think the swap lines beg to differ. It reminds me of something Secretary Yellen said in 2017:

Would I say there will never, ever be another financial crisis? … Probably that would be going too far. But I do think we’re much safer, and I hope that it will not be in our lifetimes, and I don’t believe it will be.

Five years later, we could be working on #2.

Be the first to comment