Eoneren/E+ via Getty Images

Investment summary

The drawdown in equities has pulled long-duration stocks from the mantlepiece and quashed the high-beta/growth trade. Questions now arise on the direction of the markets looking ahead. Equities are likely to remain volatile over the near-term. We’ve downgraded equities in our strategic allocations as growing evidence shows several, albeit uncorrelated systematic risks have yet to be fully priced in. As such, we are looking for a moderation in growth risks for a market-wide rally, although our research has indicated profitability factors to be driving equity returns in healthcare this year. As such, we’ve continued to deploy risk across uncorrelated sources of returns in balanced strategies, trend following, multi-directional and long/short plays to name a few. Within that selection, profitability and quality of management are paramount.

LMAT 12-Month price action

That turns us to LeMaitre Vascular (NASDAQ:LMAT), a company we’ve been increasing our size exposure to for some time now. We reckon it’s got idiosyncratic risk drivers that separate it from peers. These are centered around management’s control over the balance sheet, as we’ll demonstrate. With the pullback in share price, it’s enabled us to scale in more to the position and we’re now expecting big things from LMAT.

What stands out most is the company’s management over the balance sheet and working capital. Its recent decisions to put the balance sheet to effective use in starting its acquisition trail has proven to provide it with meaningful compounders and have interesting economics underpinning the case. Moreover, these acquisitions have been realized with superb management over working capital and liquidity, whist building out the salesforce. With organic growth of key products such as Artegraft, XenoSure, valvulotomes, and allografts, alongside a heavy sales push, we remain bullish on LMAT. We rate it as a buy based on fundamental strength.

Q1 earnings illustrates momentum

LMAT’s Q1 results were strong with revenue of ~$40 million, up 13% organically YoY and ahead of consensus. It printed operating income of ~$8 million ($0.36/share), in line with the previous quarter and ~200bps down YoY. COGS of $13.6 million was more than 12.5% higher YoY and gross profit of $26 million ($1.18/share) was in line with Q4 FY21. Gross margins of 65.63% came in ~100bps lower YoY but were in line with the previous quarter. Margins were helped by pricing tailwinds of ~170bps net tailwind pricing in Artegraft. It carried $6 million down to net income and $0.27 in EPS, in line with the previous quarter but down ~340bps YoY. LMAT also printed FCF of $4.3 million ($0.19/share) in Q2, down from $5 million 1 year ago and $12 million in Q3 FY21.

Importantly, LMAT’s Artegraft acquisition added $0.31/share or ~$7 million in revenue during the quarter, an 18% YoY increase. Since the acquisition in 2020, Artegraft has been a continuous compounder for LMAT and this quarter’s result shows its commercial potential. We are constructive on this segment and have covered its benefits previously here. Management also expect CE Mark submission in late 2023 and approval in 2024/25′ from language on the earnings call. Importantly, management successfully passed through an 11% cost increase in the segment which helped revenue volume. This new price point seems sticky and fits in line with similar cost increases in the sector.

Also noteworthy are the clauses for consideration embedded into the Artegraft deal. It includes a “catch-up feature” on the earn-outs. Specifically, per the most recent 10-K:

[A]t the end of the three-year period, if the sum of the unit sales for all three years is greater than or equal to 58,240 unit sales (80% of the combined individual-year targets), Artegraft, Inc. will receive a “catch-up payment” in an amount equal to (1). $17,500,000 times a fraction, the numerator of which is the aggregate number of unit sales for the three-year period, and the denominator of which is 72,800 less (2). any individual-year earn-out previously paid.

It records this impairment as a liability at fair value of $0.4 million, which demonstrates management’s confidence in achieving the above targets.

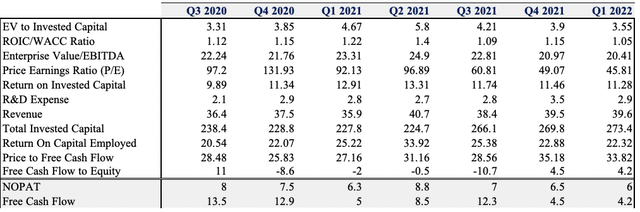

LMAT Return on Capital Summary

Data: LeMaitre Vascular, HB Insights. Image: HB Insights

On a side note, LMAT has also shifted its capital objectives to a more capital light model that focuses on margin performance and unit turnover. To illustrate, it has semi-rationalized its product line by throwing out 6 devices within the last 18 months. It hasn’t fully scrapped them, but they’ve been written off. This adds to another 60 SKU’s that were removed in FY21 due to their thin margins and negative growth. All in all, management has written off ~16% of its SKU’s, when including other divestments. None have been sold, either.

Adding to that, LMAT has concentrated its efforts on building out its salesforce. It now has a rep headcount of 112, back above pre-Covid levels. Management says it is hiring reps in 14 more cities throughout the U.S. and Europe, and is aiming for 120 reps by December. In our estimation, this is a tailwind yet to be priced into the upside narrative. In order to meet its FY22 sales guidance of $160-$164 million, each rep needs to add another $50,000-$80,000 in additional sales for the remainder of the year.

In total, LMAT needs to push $1.46 million per rep to meet FY22 sales guidance, assuming reps are responsible for all new and ongoing sales. Doubtlessly, the increase in rep headcount can act as a sales tailwind. However, the reps need to be of quality, and we need some clarity on how effective they will be. This is an execution risk. We’ve seen the impact of overdoing it with new reps before (think Zynex, for example). Hence, revenue per rep is a key litmus test for the company’s performance looking ahead.

Balance sheet well managed

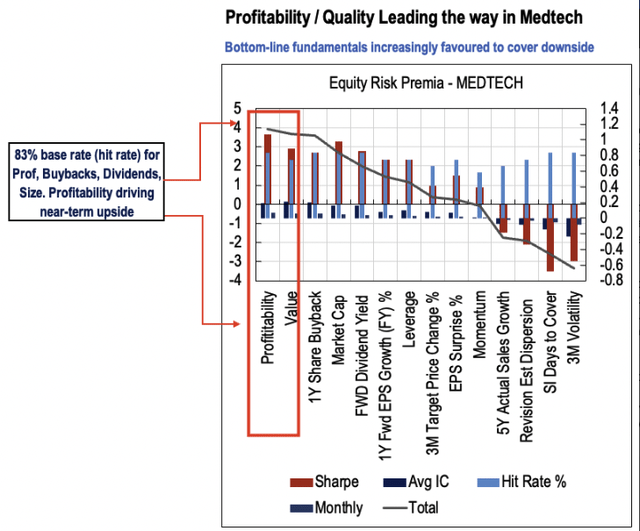

Investors continue to reposition to absorb macro-related headwinds that are still being priced into equity markets. In medical technology (“medtech”), investors are no longer prioritizing top-line growth, but instead are rewarding bottom line fundamentals and profitability. The equity risk premium the sector commands over risk-free rates has now inverted and there’s realistically a lack of equity premium to be found in medtech right now. However, a focus on profitability metrics and diversifying sources of return are key to de-risking investor portfolios moving forward. LMAT achieves this in a couple of ways.

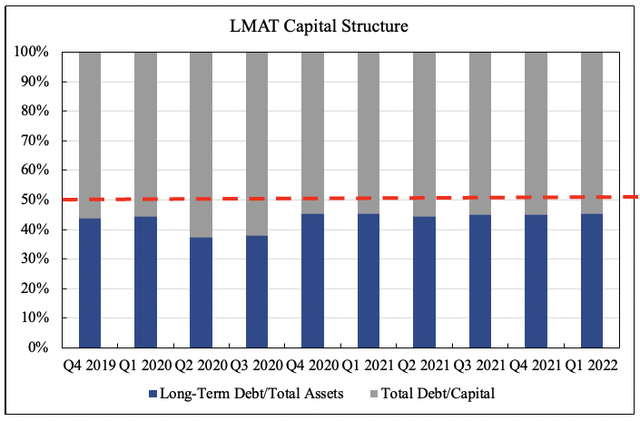

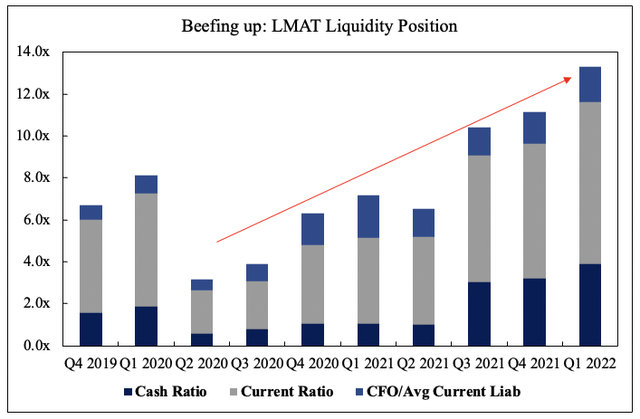

Firstly, its balance sheet is impeccably managed by our findings. LMAT has paid down ~$39 million in debt since starting its acquisition spree in 2020. On top of that, liquidity has been well preserved. Short-term obligations are covered more than 6.4x from liquid assets and 3.2x from cash alone. Each of these figures have actually increased over the last 2 years. Total debt to total capital is now at 5.7% after trending down since Q1 FY20. Meanwhile, total debt to equity is just 6%.

Working capital is equally as well managed. Accounts receivable turnover and days sales outstanding have held tight in the last 2 years whilst inventory turnover has increased to 1.2x. Days inventory outstanding has tightened to 306 days resulting in the cash conversion cycle narrowing to just 340 days, down from 370 days in Q1 FY20.

Data: LMAT. Image: HB Insights

With that, profitability has been a standout for LMAT over the last 2 years, by our estimate. This is key as our research demonstrates profitability is key in driving medtech returns in 2022. We are firm in the thesis that investors have wound back their support for top-line growth and are rewarding cash-rich and profitable names. For LMAT, ROA came in at 10% on the last print whereas ROIC was 11.3%, each up from Q1 FY20. Each of these are well ahead of the GICS Industry peer median scores.

HB Insights factor model June 2022:

LMAT has also averaged a 9.6% ROIC over the last 5 years, leading to substantial free cash conversion in FY21. It printed ~$30 million in FCF in FY21, having grown FCF 35% geometrically for the last 5 years. It’s also averaged an ~18% FCF margin since FY18. Investors currently enjoy a 3.07% FCF yield with LMAT as well. In addition, it’s grown its book value per share at CAGR 19% for the last 5 years, ahead of the S&P 500’s annualized total return. These are above-industry and above-average profitability metrics. Importantly, the company’s acquisition efforts increases the tail of returns and will continue to build out earnings. Retained earnings grew to $91 million in the last earnings period and shareholder value continues to be realized.

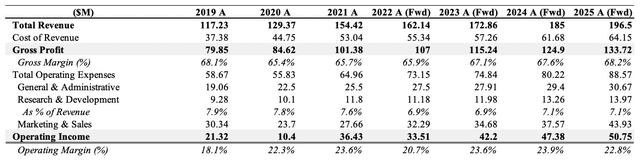

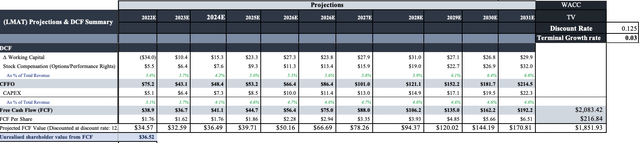

We project sales of $162 million at the top for LMAT in FY22 building to $173 million and $185 million in FY23 and FY24 respectively. On these revenues we expect it to carry ~$38 million ($1.76/share) in FCF in FY22 jumping to ~$42 million ($1.90/share) by FY24. Adding further torque to LMAT’s tailwind is its recent decision to close its St. Etienne France factor. After a one-off ~$3 million impairment, management estimate another $1 million of savings per year from FY23.

LMAT Forward Estimates FY22-FY25′

Data: LMAT: HB Insights Estimates

Valuation

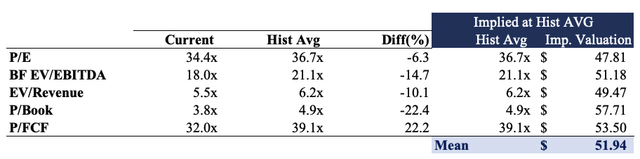

Shares are trading at 34x our FY22 EPS estimates, well below 4-year normalized P/E of 70x. Shares are also priced at 32x FCF, again below 4-year average 39x P/FCF. Investors have enjoyed an average 3% FCF yield over the past 2 years and multiples have expanded in keeping with earnings momentum since FY18.

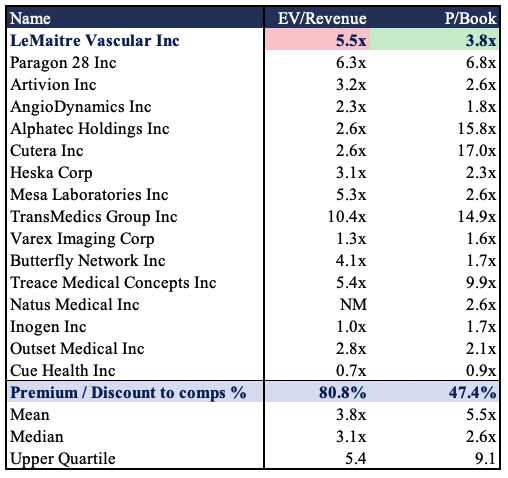

Multiples & Comps analysis

Data & Image: HB Insights

Shares currently trade at a premium across key multiples to peers in the GICS Industry group. Trading at 5x sales assumes for a 10% payback, or that LMAT can pay us 100% in revenues in dividends over the next 5 years, assuming no costs below the bottom line. Whilst that’s a hypothetical situation, we need to focus on what we can get with LMAT here. It also pays a $0.50 forward dividend payout and has grown its dividend for the past 11 years. Investors can expect a forward yield of 1.12% on that amount. Hence, LMAT misses the mark on the yield front. Opportunities exist in stocks with yields above 3% and short-duration to capture medium-term upside that rests above the risk-free treasury rate.

Forecasting out and we see LMAT delivering more than $36.50 in unrealized FCF per share, without considering a terminal value on these calculations. We’ve discounted the unrealized FCF at a 12.5% rate to reflect the opportunity cost of holding the SPX plus the yield and the long-end of the treasury curve.

DCF Summary

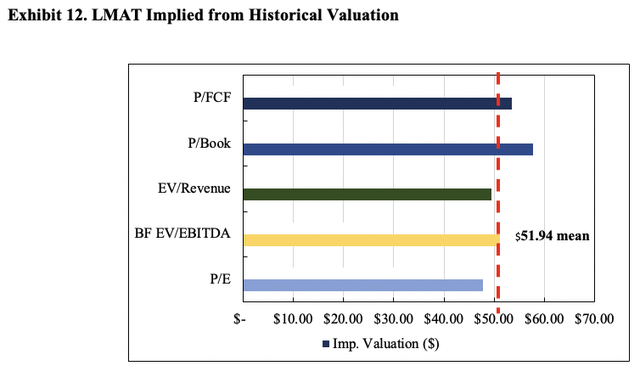

In addition, using normalized figures in our forecasts enables for a cleaner projection by our estimate. Assigning 4-year normalized figures to our FY22 estimates for LMAT sees us form a composite that values the company at $51.94. At the current share price, we are seeking a return objective of 16% to this price target.

Data: HB Insights Estimates Data: HB Insights estimates

In short

The market has beaten LMAT down amid a sector-wide selloff in medical devices. The company still offers long-term value through its product offering and ongoing sales growth. However, chief to the LMAT investment debate is management’s display over liquidity, working capital and the balance sheet. It’s managed to integrate its first acquisitions successfully, setting the pace for further transactions into the future.

With that, we’ve priced LMAT at ~$52 chasing a medium to long-term return objective of around 16% in this name. Add in its defensible and niche sales segment that continues growing and we’ve got a long-term compounder on our hands with LMAT, by estimation. A thin ~1% dividend yield gives hope for longer-term return potential should its dividend growth offer opportunities. Nevertheless, we are buyers of the stock at these prices adding to a long-term position. Rate buy.

Be the first to comment