Colin Anderson Productions pty ltd/DigitalVision via Getty Images

Banks stocks have had a challenging year in 2022 as the yield curve has become extremely inverted. Banks often find their net interest margins squeezed when long-term borrowing rates are well-below short-term bank financing costs. Even more, the inverted yield curve signals growing economic turbulence that could cause bank asset losses to increase. Following the development of the U.S. Basel accords, many banks have greater capitalization today than they had before 2008. However, some banks, such as Ally Financial (NYSE:ALLY), may have stretched their balance sheets too far, creating excess exposure to high-risk economic segments.

On the surface, ALLY may seem cheap, given its extremely low forward “P/E” ratio of 4.7X. The stock has lost over a third of its value over the past year due to its relatively high leverage and high exposure to U.S. auto debt. Roughly $107B, or ~60% of the company’s assets, are in auto loans and leases (primarily loans). These assets have much higher average yields of 6-7%, allowing Ally to operate at a very high ROTCE of 23.2% with a 4% net interest margin. In perspective, Wells Fargo’s (WFC) net interest margin is closer to 2.4%, with an ROTCE of 8.6%.

In my view, Ally’s high margins are not due to any genius on behalf of the company, but by taking on highly excessive risk exposure to boost yields. As is almost always the case with banking, leveraging risk can be a great cash-flow-raising strategy for years. Banking losses are often low until they surge in an economic slowdown, causing risk-exposed banks to lose capital quickly. Given the boom in the auto market is finally slowing, I believe Ally Financial’s bankruptcy risk is likely to grow significantly over the coming months, making ALLY a probable “value trap” today.

Ally Financial’s Balance Sheet Dynamite

A stock’s valuation is only low if its business risk is not. Ally trades at a low valuation of 14% below its book value and a “P/E” of 4.7X, but I believe this is due to its high chance of failure. Due to high leverage, bank stocks often face highly asymmetric risk exposure, where losses are minimal until catastrophic. I believe Ally’s business model greatly exacerbates its asymmetric risk.

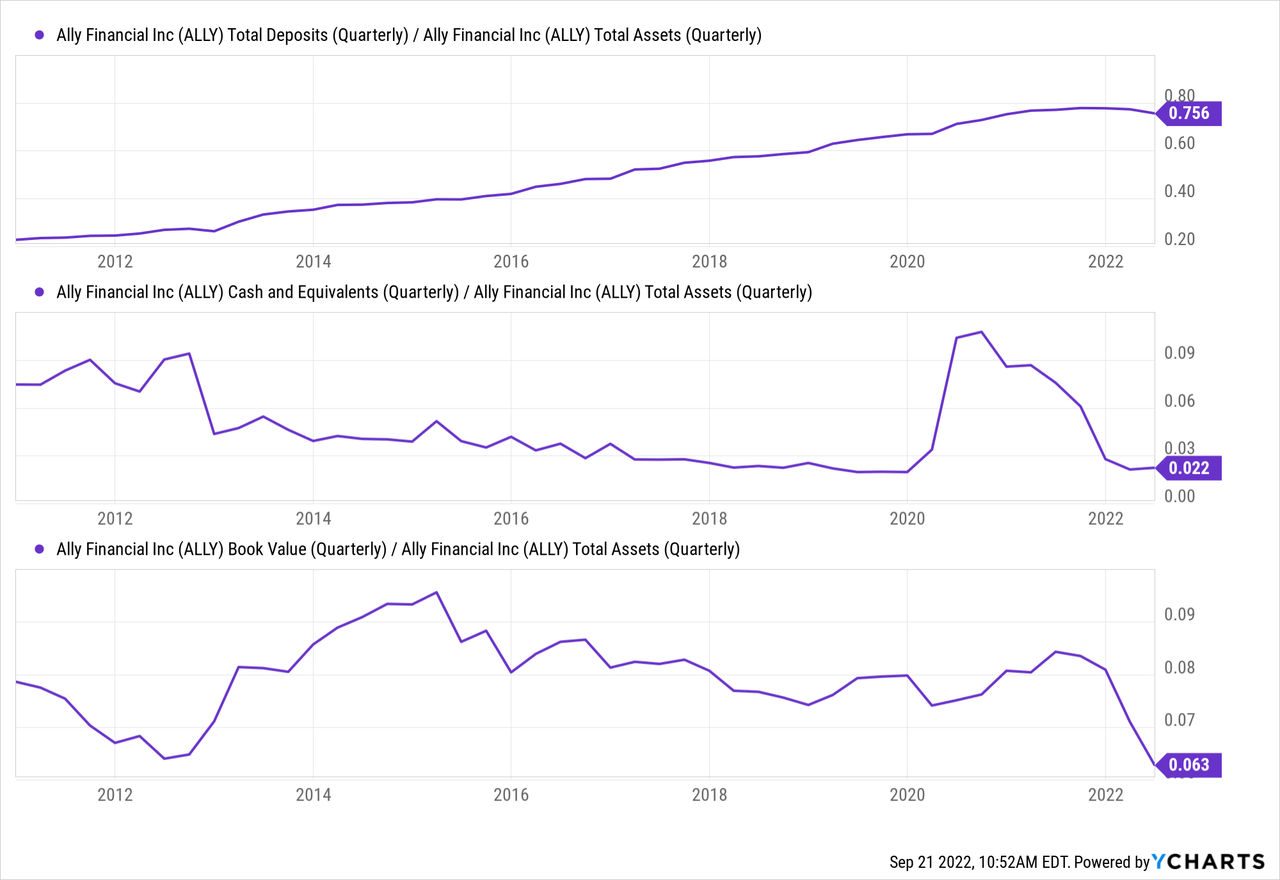

Ally Financial’s CET1 ratio is 9.6%, which is lower than that of all of the largest banks in the U.S. Further, its common-equity-to-asset ratio is only 6.3% and is the lowest it has ever been. The bank also has very little cash compared to its assets, creating some potential liquidity risk in the event of a market shock. Its total-deposit-to-asset ratio is similar to most banks but is beginning to trend lower, potentially exacerbating its liquidity risk. See below:

Ally Financial has a very high-risk balance sheet compared to most banks. It has high leverage on its core equity and is ill-positioned if deposits trend lower faster. Given the shocking declines in U.S. personal saving rates and real wages, it seems very likely the bank will face a growing strain on deposits, risking worsening its undercapitalization. That said, the most significant concern regarding Ally is not necessarily its total leverage, but its lack of diversification and immense exposure to the U.S. auto market (making up ~60% of assets). In perspective, the second-largest U.S. auto lender by U.S. market share, Wells Fargo, only has around 2.6% of its assets in auto loans.

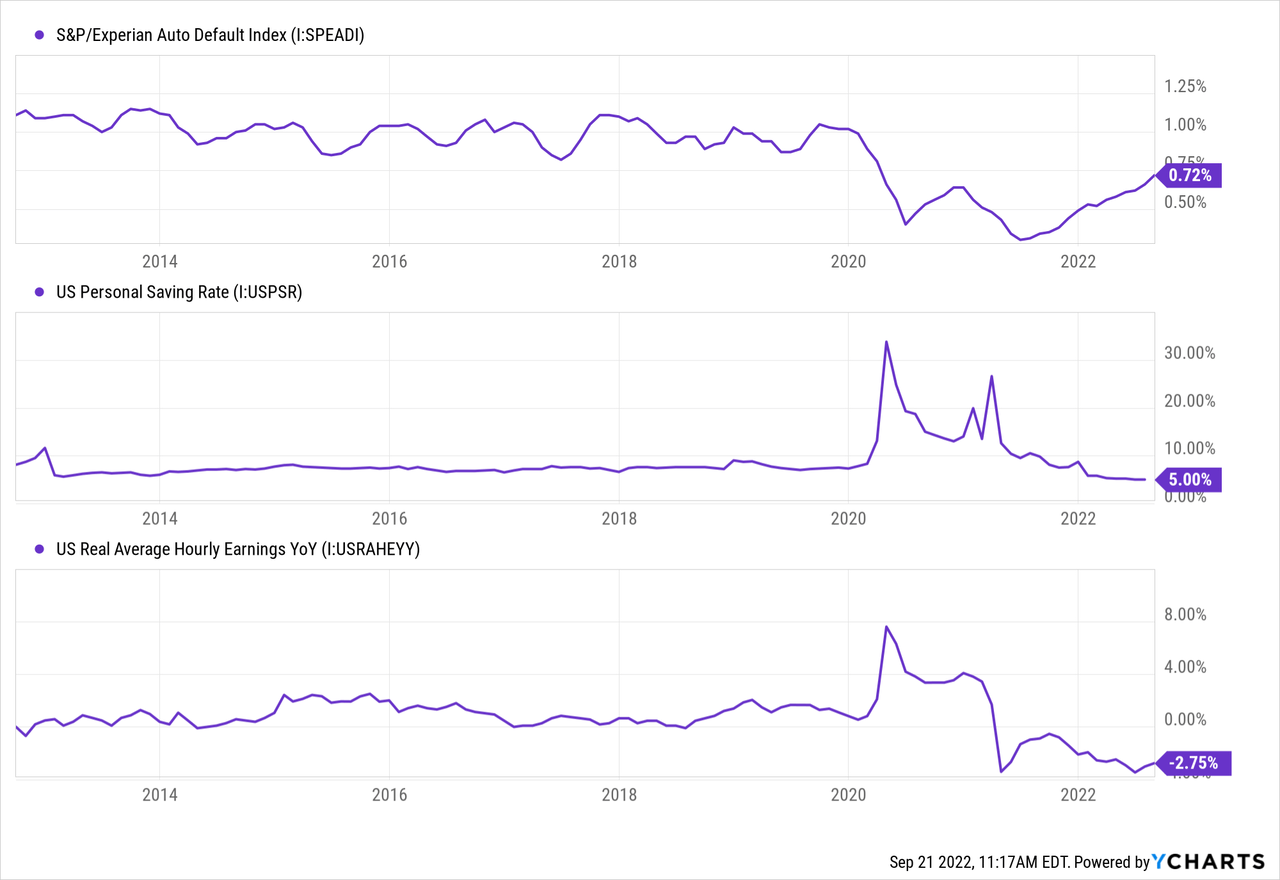

If the U.S. auto lending market suffers, Ally is liable to lose its equity, given its high leverage and exposure to the vehicle financing market. Unsurprisingly, falling real hourly incomes and low savings are correlated to a higher national average auto default rate. See below:

The average U.S. auto default rate is still below average and was boosted by the spike in savings rates and incomes during 2020 as many people reduced spending and received stimulus. Today, falling real wages have caused the saving rate to decline below pre-2020 levels, leading to a rapid rise in the auto default rate. For the time being, the default rate is not high enough to substantially impact Ally’s balance sheet, but it almost certainly will if the trend continues much longer.

Growing Slowdown In the U.S. Auto Market

The past two years have seen a boom in the U.S. vehicle market as supply shortages led to an extreme rise in new vehicle prices despite falling sales. This trend caused vehicle debt to surge, rising to a record high of ~$40,300, or a monthly payment of $667 during Q2 2022. This rise represented a 15% YoY increase in payments and a 13.2% rise in amounts borrowed, though used vehicle loan amounts and payments rose even faster at 18.7% and 17%, respectively.

For years, auto loans have come at higher loan-to-value ratios, averaging around 108-120%. Ally does not publish its specific average LTVs for its auto loans; however, LendingTree has stated its refinance loan program offers LTVs up to 155%, which is “much more generous than other lenders.”, as well as balloon loans. While it is unclear how much of Ally’s auto loan assets are in ultra-high LTV loans or balloon loans, the fact that it offers these products is a risk factor, particularly considering high LTV ratios in the auto lending industry. Given the decline in real wages and savings levels, many recent borrowers may soon struggle to make payment obligations, particularly if those payments rise.

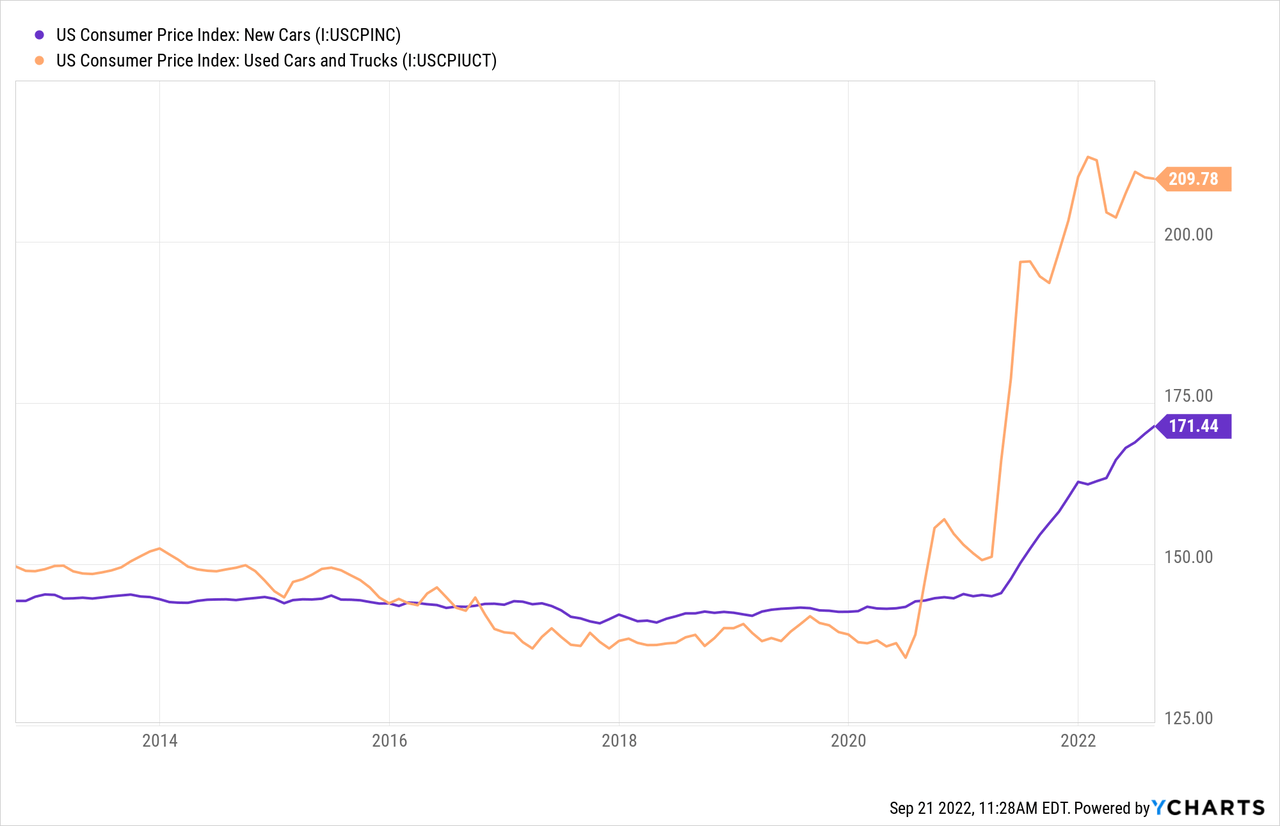

New and particularly used vehicles have become far more expensive since 2020. On the one hand, this partially reduces some of Ally’s risk, since it may increase the securitization quality of its outstanding loans. However, considering a large increase in new loans since 2020, high prices also mean much higher borrower payments, exacerbating default risks. See prices below:

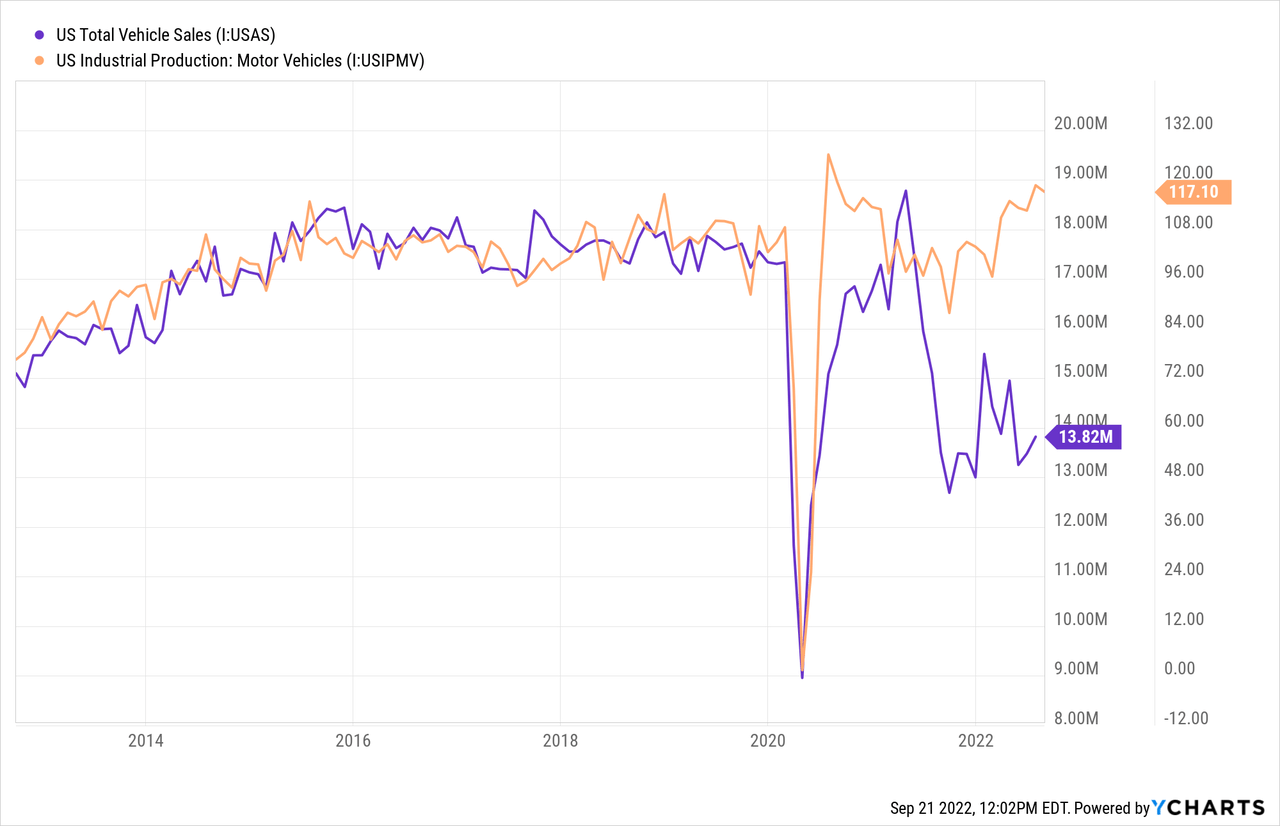

The surge in vehicle prices is due to the decline in vehicle production, stemming from supply chain shortages. Used car prices have stopped rising and are now showing signs of declining while the pace of growth for new cars has slowed. I believe this trend will continue, given the recent rise in motor vehicle production and relatively low sales volume. See below:

If motor vehicle production continues this high despite weak sales, new car prices will likely level off and decline. I believe used car prices will almost certainly fall in this scenario, creating potential risks for Ally, given its used car loan exposure. If used vehicle prices decline while defaults increase, the bank will likely find itself struggling to repossess vehicles that have lost value.

The Bottom Line

I believe Ally Financial is best avoided, and I am bearish on ALLY. In my view, the bank’s leverage is far too high, particularly given its immense exposure to the auto lending market. On the one hand, the bank’s aggressive strategy has caused its margins to be very high. On the other, it creates a substantial potential risk of bankruptcy given an economic downturn.

Today, rising costs have caused real wages and savings levels to decline. This trend has promoted a decline in Ally’s deposit growth, which may increase its liquidity risks. Additionally, the economic slowdown has already caused a reduction in vehicle sales and used vehicle prices, indicating the boom in the car market is becoming a bust. I believe Ally’s abnormally large exposure to this high-risk economic sector may cause severe strain on the value of its equity over the coming months.

ALLY is a seemingly cheap stock, given its low “P/E” and “P/B” ratios. However, it is inexpensive because it would probably not take a significant increase in auto loan defaults to force the company into financial restructuring. Since 2020, the auto market has become far riskier given the surge in prices and borrowing rates, combined with a decline in household discretionary spending capacity. As the economic trend facing durable goods shifts in the other direction, I believe there may soon be a considerable rise in auto loan defaults that will cause Ally to face liquidity pressures. Ally may be saved temporarily if economic pressures subside, but I would avoid the stock until it fixes its significant balance sheet risks.

Be the first to comment