wildpixel/iStock via Getty Images

This is my first article on Perion Network (NASDAQ:PERI), an advertising high-tech. Its revenues sky-rocketed in the last year. I find the company’s recent results impressive. The company has a sound business model and has been operating in a growing sector since 1999. And yet I would not buy the shares of this company just yet. Let me explain why.

Business model

Perion Network, an Israelian global technology company, provides advertising solutions to brands, agencies, and publishers. It mostly operates in North America and Europe. The segments the company operates in are the publisher platform, search monetization, actionable monitoring, high impact creative and SORT-cookieless targeting. Perion Network has been existing since November 1999.

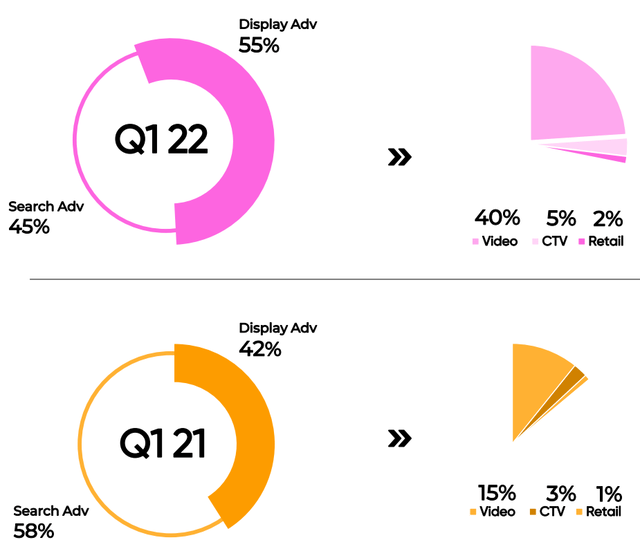

Perion Network – earnings presentation

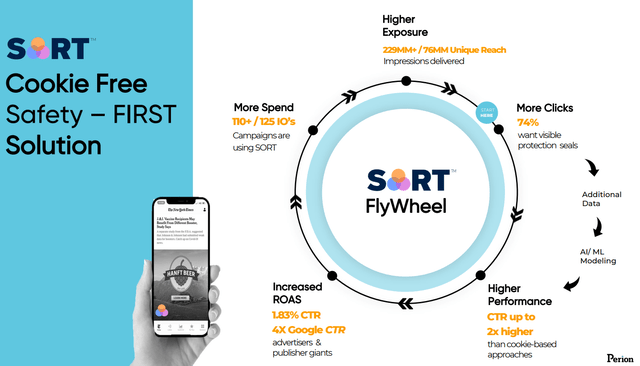

Perion Network offers wide diversification thanks to the fact it relies on several advertising categories. The company is particularly proud of its iHub and SORT technologies. Whilst iHub reduces Perion’s operational and media costs, it also raises customer value. SORT-patented technologies make sure media users enjoy their privacy. At the same time, SORT allows better customer targeting. All this allows Perion to get 74% more clicks from users, whilst providing very good value for money to its clients.

Perion Network – earnings presentation

What is more, the company operates in a fast-growing industry. Digital industry is a popular sector and still provides sound opportunities to expand business operations. All that looks good. But let me also study the company’s finances in some more detail.

Perion’s financials and results history

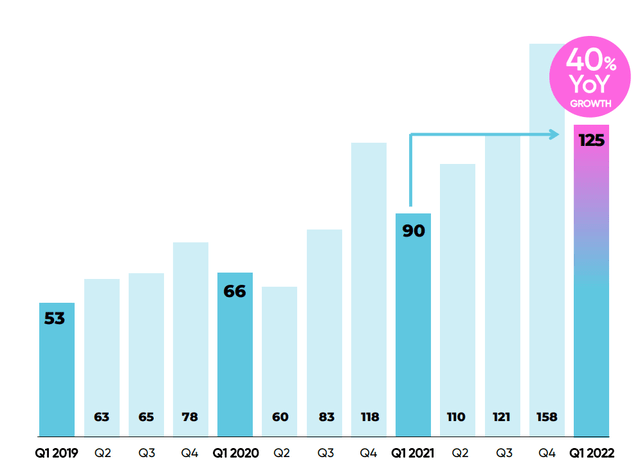

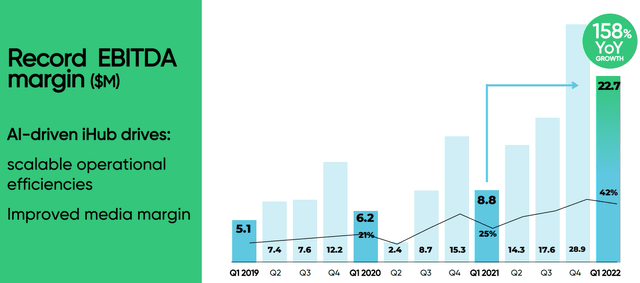

Let me start first with the slides from Perion Network’s recent presentation. The company presented strong revenue and EBITDA growth, both yearly and quarterly. The graphs below show sound but not very stable quarter-on-quarter growth rates.

Perion Network – earnings presentation

Perion Network – earnings presentation

But there are clearly no downward trends.

Yet, I would like to analyze Perion’s results history in some more detail. In order to achieve this, I composed a table with GAAP information from income statements.

GAAP Income Statement (history)

|

Year |

2018 |

2019 |

2020 |

2021 |

|

Display advertising revenue |

126 |

87.9 |

148.7 |

265.3 |

|

Search advertising revenue |

126.8 |

173.6 |

179.4 |

213.2 |

|

Total Sales Revenue |

252.8 |

261.5 |

328.1 |

478.5 |

|

Net Profit |

8.1 |

12.9 |

10.2 |

38.8 |

|

As % of Revenue |

3.2% |

4.9% |

3.1% |

8.1% |

|

Net EPS per share – Basic |

$0.31 |

$0.50 |

$0.38 |

$1.13 |

|

Net EPS per share – Diluted |

$0.31 |

$0.49 |

$0.36 |

$1.02 |

|

No of shares – Basic $M |

25.8 |

26.0 |

26.7 |

34.4 |

|

No of shares – Diluted $M |

25.9 |

26.4 |

28.8 |

37.8 |

The data are given in $ million

Source: prepared by the author based on the company’s presentation (appendix)

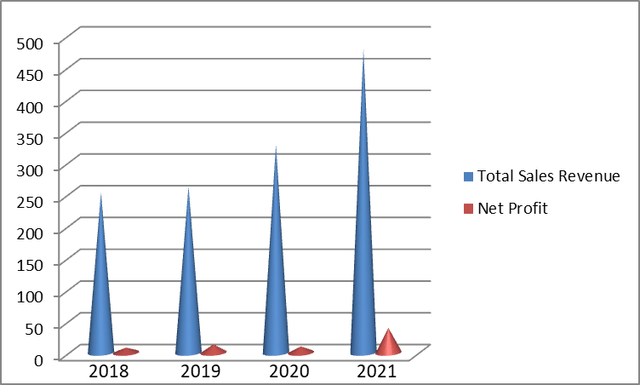

We notice some important facts straight away. First, we can clearly see that Perion is a mid-size company even though it has been operating since 1999. A company with an annual sales revenue figure of between $10 million – $1 billion is considered to be a medium-size one. In 2021 Perion’s annual sales totaled $478.5 million.

Perion’s net profit margin has never been particularly good. It was 3.2% in 2018 and 8.1% in 2021. There is a clear improvement, by all means. At the same time, we cannot say Perion is a highly profitable business.

Another interesting fact, in my opinion, is the number of shares recorded in each of these consecutive years. They have been clearly diluted between these years. It is quite strange. It is a standard practice to dilute shares when a company records losses. This is normally done in order to raise cash when a firm urgently needs it. Perion, in contrast, does not need cash to survive. Instead, it plans to use the proceeds from the offering as additional working capital, to finance the growth of the business, including mergers and acquisitions, and for general corporate purposes.

This, in my view, is not very good news for the company’s shareholders. That is because share dilution decreases PERI’s stock price. A desire for a company to grow is not a problem by definition if that is done by using its net profits. However, if in order to achieve this, a company either borrows heavily or dilutes its existing shareholders, it looks like it is in favor of growth “at all costs”.

Also interesting is PERI’s income statement.

Total sales and net profit history

The diagram above I prepared shows us the sales revenues and the net profits history between 2018 and 2021. Whilst the sales have been rising steadily, the net profits have not shown steady growth. Only year 2021 was good in terms of net profit growth. This is not a great story for a conservative investor.

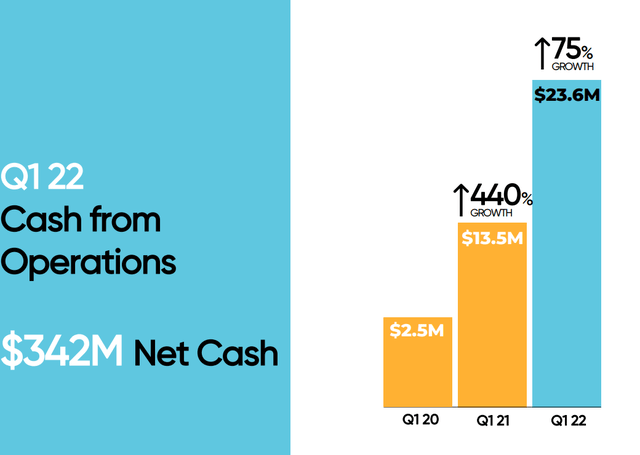

Also interesting looks the net cash from operations history. If we look at the excerpt below, borrowed from Perion Network’s presentation, we will see that the net cash from operations is rising very fast.

However, this diagram below only shows the data for the first quarters of years 2020, 2021 and 2022.

Perion Network – earnings presentation

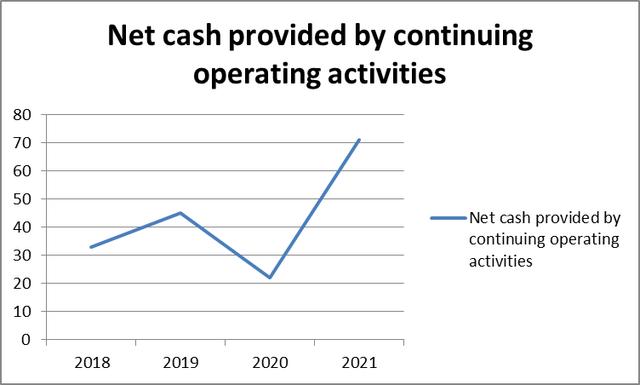

However, the diagram below shows the net cash provided by continuing operating activities from 2018 to 2021. It doesn’t show any quarterly earnings – it only shows the full-year earnings.

Perion Network’s earnings presentation

We can see that only between 2020 and 2021 there was sound growth, which is not very good news for investors.

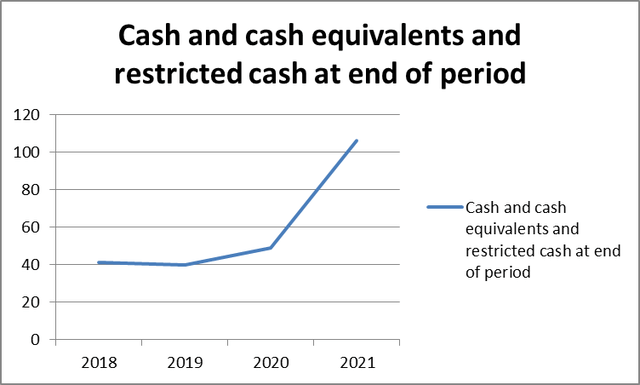

I would also like to have a closer look at Perion Network’s total net cash history. The situation is very similar to the net cash from operations.

We can see that between 2018 and 2020 there was no visible net cash growth. The real progress only happened between 2020 and 2021, which does not make the growth rate seem stable.

Perion Network – Earnings presentation

So, after having looked at the company’s results in some more detail, I am not very impressed. Let me also have a look at Perion’s valuation.

Valuation

As I have mentioned above, Perion works in a high-growth industry. Companies working in such an industry are normally richly valued.

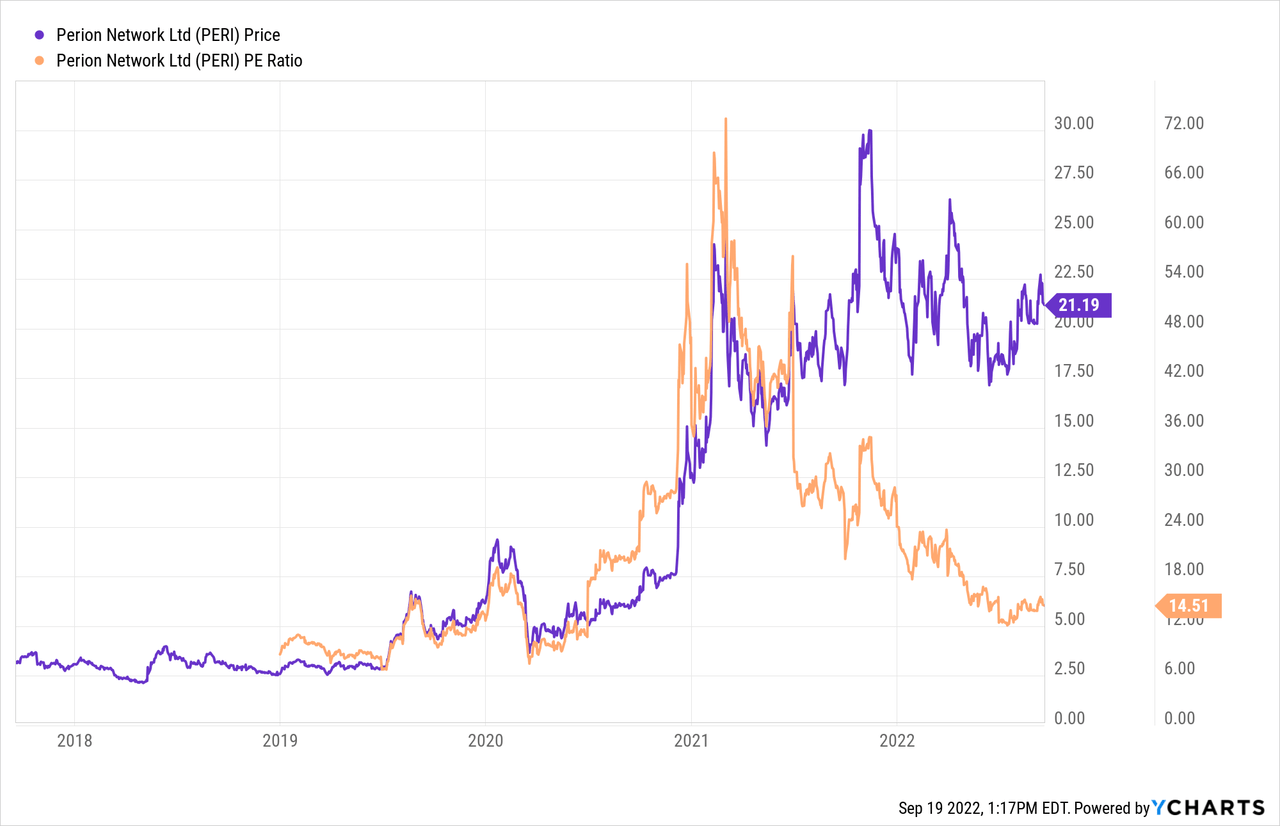

Perion’s price-to-earnings (P/E) history paints a very interesting picture. In the beginning of 2021 the company’s stock used to trade at a P/E of 72, a very high multiple. But the P/E’s all-time low was around 6, far below today’s multiple of about 14.50. Still, the company appears cheap relative to historical multiples.

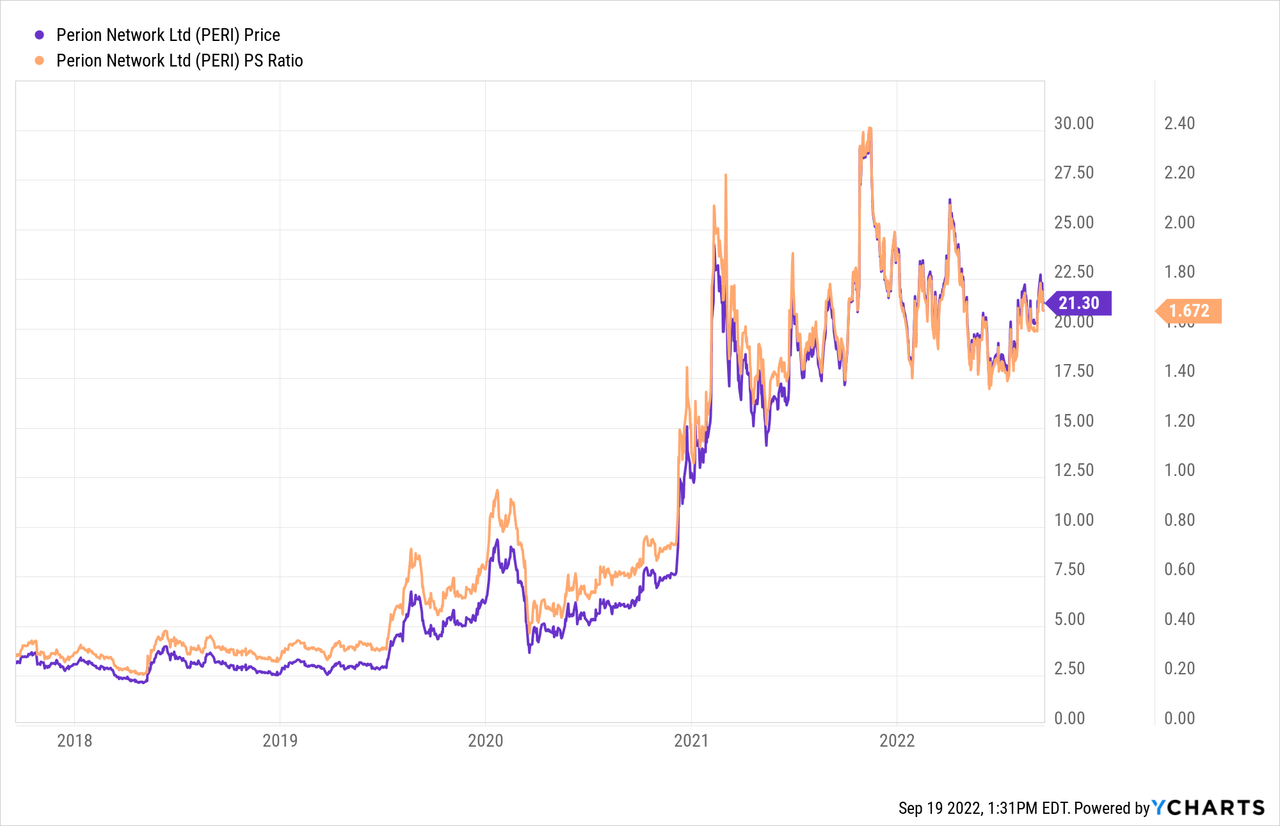

The situation with Perion’s price-to-sales (P/S) ratio is similar. Right now it is lingering near the 1.60 mark. 2.40 was PERI’s record high. A price-to-sales of less than 3 is reasonable, whilst PERI’s P/S has never been above that.

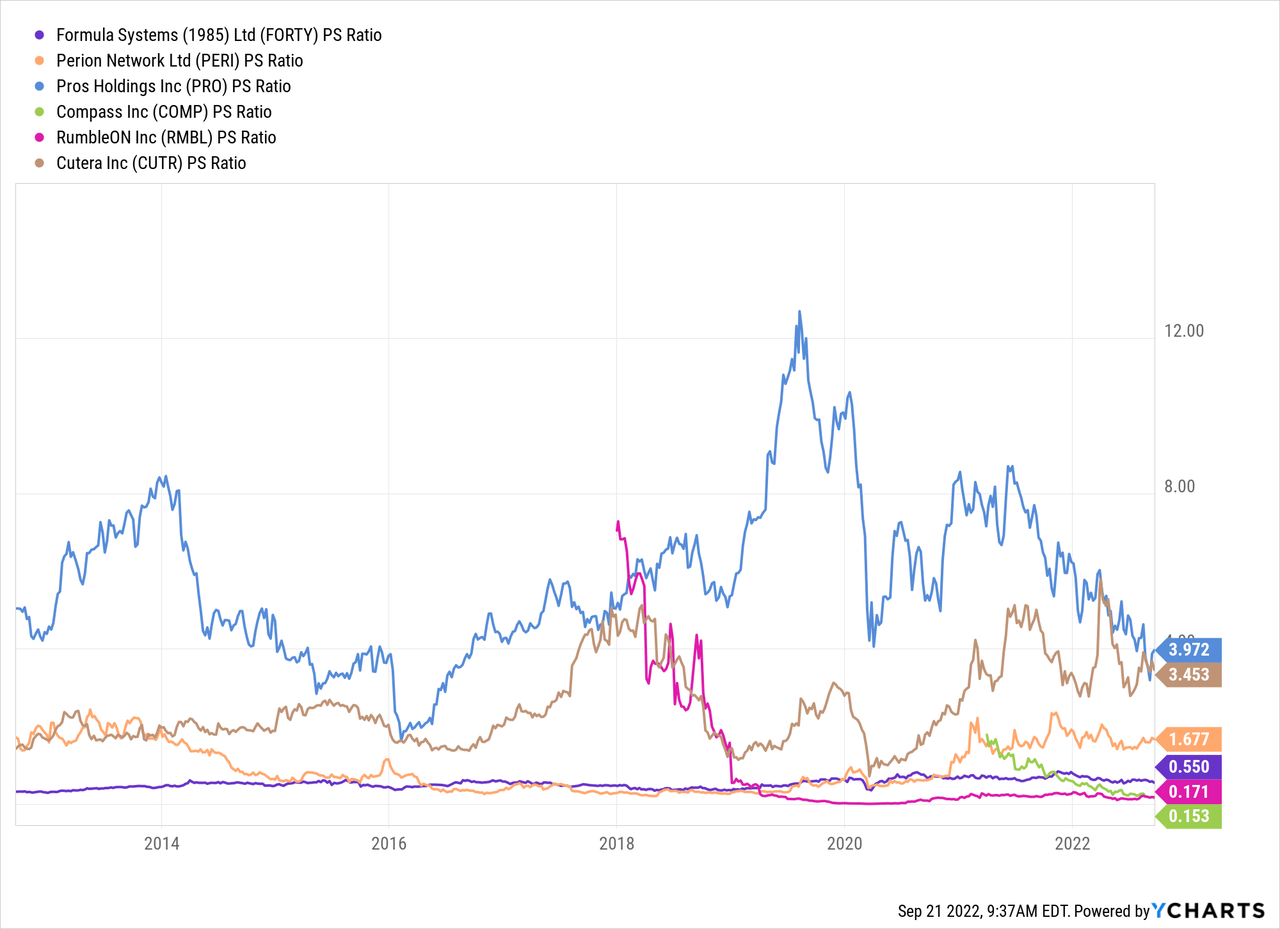

I compared the P/S ratios of PERI’s several competitors, including Formula Systems (1985), RumbleON (RMBL), Perficient (PRFT), Compass (COMP) and PROS Holdings (PRO).

According to the P/S indicator, PERI’s shares are neither too expensive, nor too cheap. I did not use the P/E indicator to measure PERI’s competitors’ valuations since some of these companies are loss-making. In that respect, PERI seems to be reasonably valued compared to its competitors.

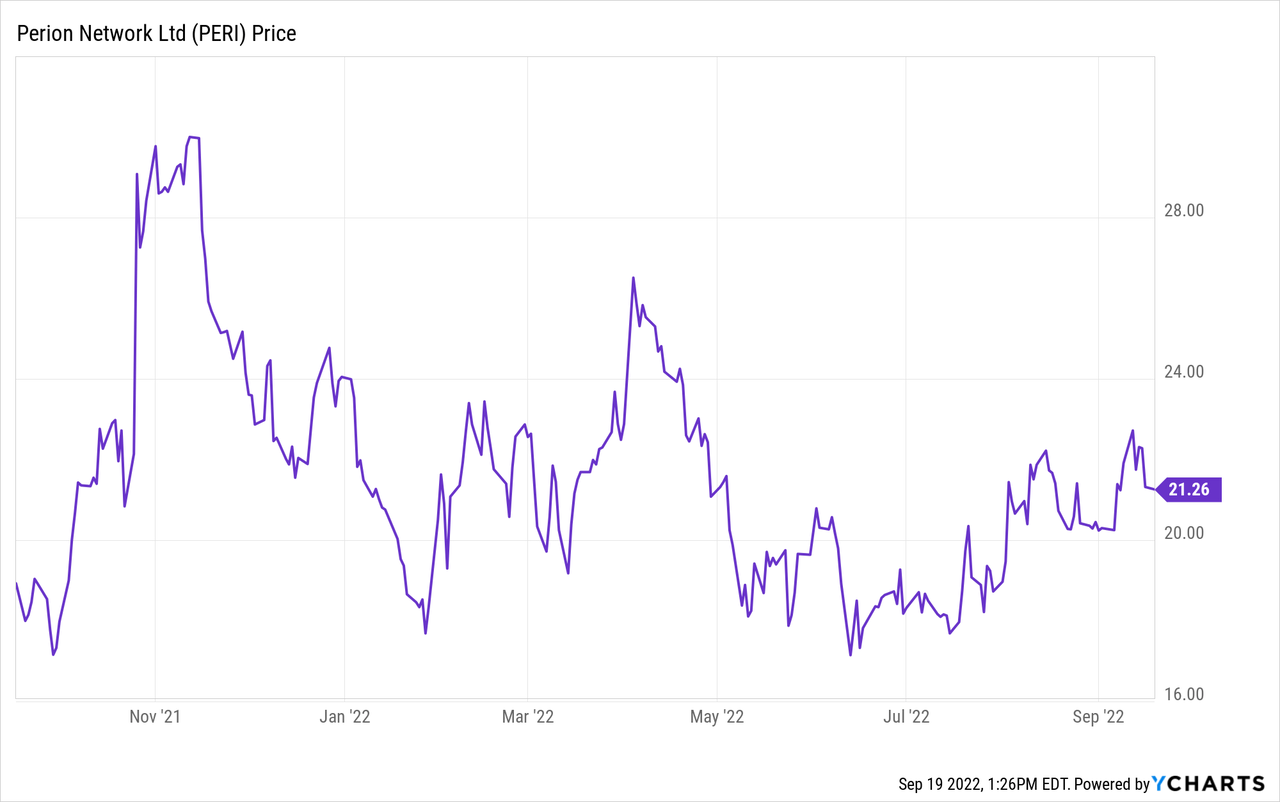

Right now PERI’s shares are also trading below their all-time high of $30 per share but also above their low of about $17 per share. All that means PERI’s shares are not overvalued.

Recession risks

Perion Network operates in an industry relying on sound economic growth. Not many firms would spend much on promotion and advertising during recessions when their main target is to survive.

In that respect, PERI is in a vulnerable position. The reason why I am saying a recession may be upon us is the fact many central banks, most notably the Fed, are getting very hawkish. This week the Fed would most probably raise the interest rates again. Many countries around the world, especially the EU are suffering from the energy crisis, whilst geopolitical tensions are escalating. Inflationary pressures are also near multi-decade highs.

Conclusion

All that is bad news for conservative investors since it means the equity prices have not reached their potential lows just yet. At the same time, PERI’s shares are at risk since their earnings results raise many questions. That means Perion Network’s shares are highly likely to plunge significantly should the next recession happen. I do not suggest that everyone should avoid the company at all costs. Not at all. But I would recommend prospective investors to wait for a full-scale recession and only then buy a small stake at PERI, if they deem appropriate.

Be the first to comment