Marina Vol/iStock via Getty Images

Introduction

Celanese Corporation (NYSE:CE) is currently trading at $103.82 per share, 41% below its 52-week-high, and at a forward P/E of 5.73. From a profitability perspective, ROCE of 45.84% and ROTC of 15.26% also look great and are well above the sector median. At the same time, Celanese has consistently paid a growing dividend to its shareholders for over 12 years, and in 2021 company made share repurchases worth $1 billion. At first glance, Celanese appears to be a typical example of a market-rejected value stock that is currently trading at a very attractive valuation. But is this the case? In this article, I would like to offer some thoughts on why I think that despite the above-mentioned facts, this stock is still overvalued and from my point of view has little to offer to investors at the moment.

Unfavorable future growth prospects

Celanese is one of the global leaders in the chemical industry. The company itself divides its business activities into three main segments, which are Engineered Materials, Acetate Tow, and Acetyl Chain. The Engineered Materials segment is engaged in the production of “high-performance specialty polymers”. Various types of these polymers find applications across automotive, healthcare, electronics, and other sectors. According to the 2021 annual report, this segment accounts for a relatively high 32% share of Celanese revenue. Because of that, it is important to focus on how this segment could fare in the future. One of the most well-known and widely used polymers is polypropylene.

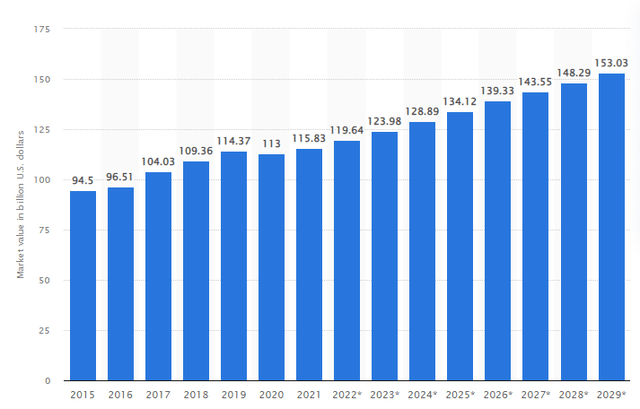

Market value of polypropylene worldwide (statista.com)

If we look at the chart of the market value of polypropylene, we can see that it is a slow-growing market, with essentially no further growth between 2019 and 2021. Of course, the explanation that COVID is a reason for this development is offered, but we must also acknowledge the possibility that, especially in United States and Europe, there are pressures to reduce the consumption of single-use plastics, most of which are made of polypropylene or other close polymers. And even if we accept that the market will start to grow again in future years, the projected CAGR is at 4.2% annually, which is still very low. Of course, polypropylene and its other polymers are not the only products in the Engineered Materials segment. But even if you look at the development of others, you will find that it is very similar.

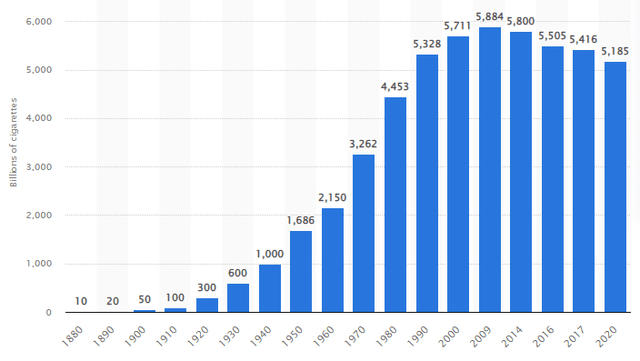

The second segment is the production of Acetate Tow, which is primarily used as a filter material in cigarettes. This segment is relatively small and accounts for only about 6% of the company’s revenues. Since 2009 global cigarette consumption has been declining year over year.

Global cigarette consumption (statista.com)

This is also causing a decline in sales of this sector at Celanese. In just the last 5 years since 2017, there has been a decline from the original $783 million in revenue to the current $514 million. This represents a decline of almost 35%. In terms of future developments, it can therefore be assumed that sales in this segment will continue to weaken noticeably.

The Acetyl Chain segment accounted for the largest share of Celanese’s sales. This segment specializes mainly in the production of acetic acid and other products made from it.

Example products in the Acetyl Chain segment (www.celanese.com)

If we focus on the development of the acetic acid market, it is very similar to that of the Engineered Materials segment. However, the growth is slightly higher and the future CAGR is expected to be 5%.

If we should draw any conclusion from the figures found, it is that the growth that the company’s total sales can achieve in this way will be at most around the 3 or 4% mark annually, which is certainly not a dazzling figure. All in all, it can be said that the development of the market for these products won’t be the driver of Celanese’s future revenue growth. This has not been the case in the past either.

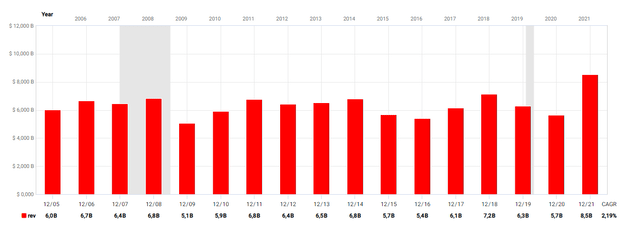

Celanese Corporation sales chart (fastgraphs.com)

If you look at the company’s revenue trend, you will see that revenue has been essentially stagnant from 2005 until 2020, always averaging around $6 billion per year.

The financials look better than they are

The other thing I would like to mention concerning Celanese Corporation’s sales is the cyclical nature of their business. The cyclicality can be verified fairly easily using the beta ratio. Cyclical companies are usually characterized by a beta greater than 1. It’s because the volatility of their stock is usually higher due to its dependence on the market cycle. Celanese has a beta of 1.22, so the beta ratio confirms the cyclicality of the stock. But even if we look closely at the development of their earnings, we can see the different market cycles quite clearly. The first cycle started in 2004 and ended with a global financial crisis in 2009. The next cycle lasted from 2009 and reached its next bottom in 2016, and the third market cycle started in 2016 and has lasted until now. This would mean that the market cycle for this company can last approximately 5 to 7 years depending on economic conditions.

If this is indeed the case, then it would mean that 2019 and 2020, which were heavily impacted by COVID lockdowns and other restrictions, were originally supposed to be the peak years of demand for Celanese’s products. However, because of the COVID restrictions and the disruption to supply chains caused by them that demand was deferred and this deferred demand did not fully materialize until 2021 when the restrictions imposed were mitigated. The impact of this deferred demand on revenue growth in 2021 was also confirmed by management:

Net sales increased for the year ended December 31, 2021, compared to the same period in 2020 primarily due to:

- Higher pricing for all of our products, primarily due to increased customer demand and supply constraints across all regions

- Higher volume for most of our products driven by increased demand across most regions due to recovery from the COVID-19 pandemic

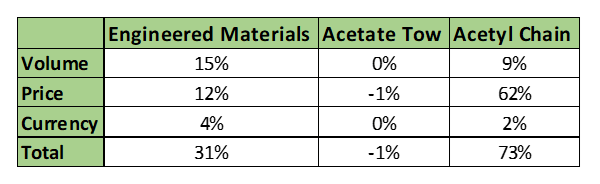

The impact of this deferred demand on the various segments in which Celanese operates is illustrated in the following table.

Impact of deferred demand on the segments of Celanese business (Annual report 2021)

In the Engineered Materials and Acetate Tow segment, I still find this influence relatively OK. From an investor’s perspective, I am most concerned about the sudden increase in sales in the Acetyl Chain segment, which saw a 62% YoY increase in prices. This is certainly an unsustainable situation in the long run. There was not enough production capacity in the market to meet all the deferred demand and that caused such a spike in price. As soon as this deferred demand is met in the market, prices will fall inversely. We as investors now have the difficult task of discerning what part of this price increase is sustainable in the long term and what part is only due to short-term influences. In this case, I will be basing this on historical data of price growth in the Acetyl chain business.

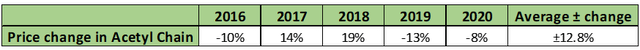

Price change in Acetyl Chain segment (Annual reports 2016 – 2020)

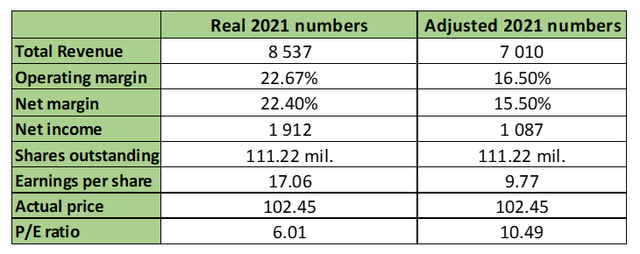

Average ± price change in this segment was historically 12.8% so I think that it does make sense to assume that 12 percentage points of this year’s price growth will be sustainable and the remaining 50 percentage points will just be the impact of deferred demand. Same price growth of 12% in 2021 was also seen in the Engineered Materials segment. The following table shows the incorporation of this assumption into the company’s earnings to give at least an approximation of the company’s financial results without the impact of deferred demand.

Estimation of the effect of deferred demand on financial results (Author’s estimate)

If we now compare the adjusted P/E ratio of 10.49 with the sector median P/E, which is 11.06, this stock does not look like a very good buy. However, we must not forget that we are not buying the current earnings of the company, but we are trying to buy stocks that will mainly bring us future earnings. From our market cycle analysis, we have found that the market cycle for the Celanese stock lasts approximately 5 to 7 years. This would suggest that we are currently approaching the final phase of the market cycle and should expect a real decline in sales and earnings. In the last market cycle, the difference between the peak in sales achieved in 2014 and the low in 2016 was 20%. Under the current macroeconomic conditions especially in the context of an unprecedented high inflation and actions by the FED, which is tightening its quantitative easing, I consider this scenario to be very likely. So what would happen if we took this possible future decline into account in the scenario we have calculated?

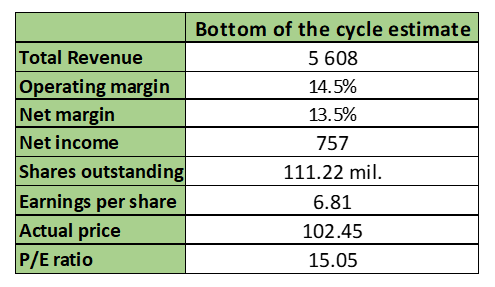

Estimation of financial results on the bottom of the market cycle (Author’s estimate)

If this negative scenario comes true, the stock does not appear to be cheap anymore. On the contrary, it still appears overvalued relative to the sector median P/E. Personally, I follow the rule for similar stocks, where no significant earnings growth can be expected, that I don’t want them to be valued higher than ten times the projected earnings or free cash flow. In this case, the stock price would have to get down to $60 or $70 per share, so I could consider it an attractive investment.

Acquisitions destroying shareholder value

In the third part of this article, I would like to discuss acquisitions. As we have seen in the long-term development of revenue, the company has not been able to grow much in the long term. This is probably why management decided that they wanted to accelerate growth by making acquisitions. First, I would like to discuss the acquisitions that were made in 2016 and 2017, specifically the acquisition of SO.F.TER. Group and Nilit. Because with these acquisitions, we can see the results that they have delivered and these results will not be distorted by the impact of the coronavirus pandemic.

In the year 2016, Celanese announced the acquisition of the Italian company SO.F.TER. Group. Management was very optimistic about this acquisition as it was said to almost double the number of Celanese global engineered materials product platforms. What impact did this acquisition have on Celanese’s financial results? The Engineered Materials segment saw a 46% year-over-year increase in volume in 2017, which translated into a $656 million increase in revenue in this product segment. More importantly, we also saw a decline in operating margin in this segment, from the original 24.2% to just 18.6%. Operating profit therefore increased by just under 10% from the original $350 million to $383 million as a result of the acquisition. This is relatively small in contrast to the almost 50% increase in sales.

The second acquisition I would like to mention is the acquisition of the nylon compounding division of Nilit. The result of this acquisition was slightly better, but again, not entirely pleasing. Revenues within the Engineered Materials segment increased by $380 million, an increase of 17.2%. The operating margin further declined to 17.7% from the original 18.6%. Operating profit in the year was up 11.7%.

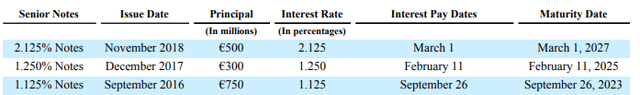

It is also important to note that both of these acquisitions were done in very favorable economic conditions for the company. It was a growing phase of the market cycle when Celanese should be showing improving economic results and debt financing at the time offered extremely low interest rates (around 1 to 2%).

Table of issued senior notes (Annual report 2018)

And now let’s move to the present, where in February 2022, the company announced that it was going to acquire DuPont’s Mobility & Materials business. I won’t describe that deal in detail here, as it has already been covered by other writers on Seeking alpha (for example here). I’ll just mention that it is a whopping $11 billion deal by the company’s standards (when compared to its market capitalization of $11.10 billion as of September 20, 2022). This one, again like the others, will be mostly financed by debt. However, there is one major difference now. If the previous relatively smaller acquisitions have not had a positive impact on the company’s operating margin, can you imagine what the impact will be if the company finances this acquisition with $10.5 billion of debt at an effective interest rate of 5.4% instead of the 1% or 2% interest rate it used to finance acquisitions in the past?

Summary

Overall, I think Celanese corporation is not a bad business. Of course, as I mentioned in the introduction there are some positive aspects, for investors. It offers a long-term growing dividend, management has done share buybacks, etc. However, to deliver a sufficient rate of return to investors, as with all cyclical businesses, you need to choose the right timing to buy. And based on the research I’ve done, I currently don’t think the right timing is now. I see too much risk here. I have doubts about the future of the industry in which the company operates, about the long-term sustainability of the current financial results, and the strategy of growth through acquisition that management has chosen. At the same time, the classic risks associated with this business cannot be ignored, such as the risk of rising input prices, the individual risks associated with the global spread of the company’s activities, but also the risks of working with chemicals where health or environmental damage may occur at any time.

Be the first to comment