Torsten Asmus

Investment thesis: The pullback in oil prices that we have seen in the past few months is not likely to last for much longer, despite expectations of continued demand destruction, due to a slowing global economy. A number of potential oil supply shocks are set to hit the market, with the first potential hit coming from the ending of oil releases from the U.S. strategic petroleum reserve. Sanctions on Russia’s oil exports are set to reduce global supplies by as much as 2.3 mb/d between now and February in a worst-case scenario. Social unrest and conflicts could potentially disrupt supplies from places like Iraq, Libya, and Azerbaijan, as well as from other major oil exporters.

There are very few potential sources of spare capacity available or about to come online to make up for some of these sources of potential production shortfalls we are likely to see in the coming months. A major oil price spike is therefore highly likely as more demand destruction will be needed to bring the supply/demand balance back into harmony. The current soft patch in oil prices should be considered to be a buying opportunity, where solid oil producers are likely to see a stock price rally on the back of higher oil prices. Cash is also looking increasingly appealing, given the rising odds of a deep global recession.

OPEC and IEA are both forecasting minimal demand destruction this year and next

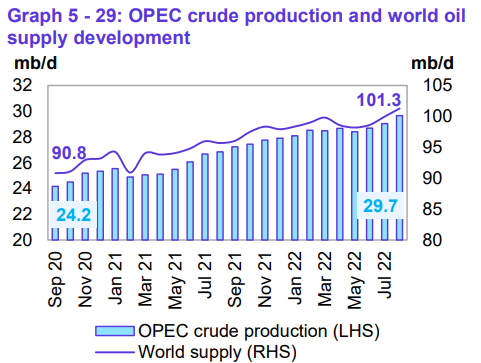

There is little doubt that a slowing global economy will lead to a slowdown in demand in many sectors of the global economy. Having said that, the IEA raised its oil demand outlook for 2022 in its August report by 380 kb/d, in large part due to a rising trend of switching out of increasingly expensive natural gas use, in favor of cheaper oil in many regional markets, such as in Europe. In 2023, global oil demand will rise by a further 2.1 mb/d to reach a record high of 101.8 mb/d. As of July of this year, global supply reached 100.5 mb/d according to the IEA. The gap between recent high supply rates and average daily expected demand next year does not seem to be very high. At the same time, it is getting to be increasingly hard to see a path forward in terms of global oil production gains, given prospects of disruption, as well as geological realities that made themselves evident in the past few decades.

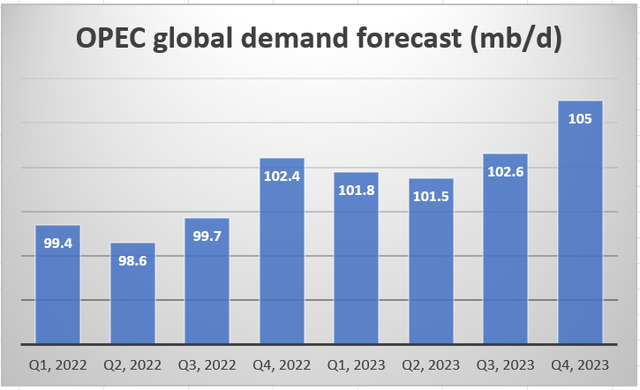

OPEC similarly does not see a major drop in global oil demand. Its quarterly forecast numbers are a useful illustration of the major upward shift in demand.

OPEC has a preliminary total global liquids production estimate out for August and it looks rather encouraging, at 101.3 mb/d.

OPEC

It is just 1.1 mb/d short of the volumes that will be needed to meet demand in the last quarter of this year.

It is entirely feasible for global liquids production to meet demand in the last three months of this year. It is less clear where 105 mb/d in production will come from for the fourth quarter of next year. It is especially challenging to find a path for supply to meet demand, given the growing list of potential cuts in supply.

The end of the US strategic petroleum supply release, Russia sanctions, and social unrest in key net oil exporting nations all have the potential to derail any chance we have of meeting demand in the next 15 months and beyond

Not long ago, we were being bombarded with warnings of impending peak oil demand, with oil companies as well as petro-states facing an imminent threat of having hundreds of billions of barrels in reserves permanently shut in, as demand was going to collapse. There is yet to be any evidence of collapsing demand. Even after the disruptive effects of COVID, we are now looking at new monthly global demand records being set this year, with some estimates such as OPEC’s demand forecast suggesting that by this time next year we might be faced with a need to see a severe demand destruction event occur in order to achieve oil market balance. That might be the case even in a best-case scenario, where all possible sources of oil supply will provide the world with all that can be physically produced. The situation at hand does not suggest we will be anywhere near ideal in terms of getting as much crude to the market as the world could potentially achieve under perfectly ideal circumstances. A number of factors are set to potentially kick in within the next few months, just as the world will need to see all available potential supply capacity hit the market.

US petroleum reserve drawdowns are set to end perhaps as soon as November

The first potential hit to market supplies will come courtesy of the impending end to the roughly 1 mb/d in supplies we have seen in the past half year or so, courtesy of the U.S. government’s willingness to sell a large part of its strategic petroleum reserve. The original release program is set to end in October. There is some speculation that it was meant to last just until the November midterm elections and no more than that. An additional 10 million barrels were offered to be released in November, apparently in support of the impending EU ban on Russian oil imports.

The total size of the reserve stood at 578 million barrels when the flare-up in the Ukraine conflict started in February. It is currently at 434 million barrels as of the EIA’s last weekly report, and it will be below 400 million barrels by the end of October at the current pace of the drawdown. The highest point that the reserve volumes reached was over 700 million barrels, over a decade ago. There are probably countless government officials who already feel very uncomfortable with such a severely depleted strategic petroleum reserve. The Biden administration recently announced a willingness to start buying oil in order to replenish the reserve if the price drops below $80/barrel. This could potentially act as a price floor mechanism to some extent, although it is not entirely certain that such a price floor will be triggered beyond the end of this year.

The EU & G7 sanctions on Russian oil are to begin at the end of the year

While things may still change, as it stands right now, the EU is set to end most Russian oil and refined product imports from Russia, starting with crude in December, and refined products in February. Additionally, the G7 price cap scheme on Russian oil exports may play a role in cutting some Russian oil exports as well. It is unclear as of now just how much of an impact these measures will have. Most forecasts suggest that the global market might lose anywhere from .4 mb/d of oil next year as is being forecast by OPEC, to as much as 2.3 mb/d from current levels. The latter high rate of Russian export loss assumes that the entirety of the current level of Russian oil imports in the EU by ship will be lost, with Russia being unable to divert any of these volumes to other markets. It remains to be seen how much of an impact these sanctions will have on global supply. It is unlikely that the effect will be net neutral.

Social unrest and armed conflicts may threaten oil exports in many current and potential future hotspots

The social unrest as well as armed conflict factor is a wildcard in the global oil supply/demand balance equation. Armed conflict between Azerbaijan and Armenia could result in the potential loss of Azeri oil exports, due to infrastructure damage or due to other factors. Social unrest in Iraq has the potential to disrupt its sizable oil exports. Libya is still mired in constant crisis. Rising food prices could potentially impact a large number of African nations, including many net oil exporting countries, with prospects of unrest, war as well as other forms of strife threatening to disrupt those oil exports. Even if just a few of these potential or currently active hotspots will lead to oil production or transport disruptions, it will put a significant additional strain on an already tough situation that we are facing in regard to the global oil supply/demand balance within a matter of weeks or months.

U.S. shale and other potential sources of production growth around the World will not come to the rescue

With memories of the blistering pace at which the shale revolution dumped massive volumes of liquids and gas onto the U.S. and global markets still fresh, there are still many who believe that a massive surge in U.S. oil production on short notice can be achieved. OPEC is among the institutions that are forecasting an outcome that will lead to significantly higher U.S. oil production volumes going forward.

While I think the increase in U.S. production that the likes of OPEC are forecasting is achievable, it will be nowhere near enough to plug a gap between global supply and demand, which if the worst comes to pass and we lose about 2 mb/d in Russian supplies for the whole of next year will lead to a roughly 6 mb/d gap between recent production highs and the average daily demand that is being forecast for the fourth quarter of 2023. OPEC and other entities could partially fill the gap, but there is currently no way of making up such a massive potential shortfall. In fact, it is questionable if the world can even produce 105 mb/d by the fourth quarter of 2023, even if global peace and understanding will suddenly break out and all current and future potential global capacity will be made available to the market.

Investment implications:

There is always a chance that the world will be plunged into a severe recession, perhaps of a magnitude similar to that of 2008, which might pre-empt a price-induced oil demand destruction event. Either way, it looks like by the end of next year at the latest, the world will go on a consumption diet in terms of oil, which generally means an overall decline in production & consumption of goods & services worldwide. For this reason, I am increasingly moving into cash, which currently fluctuates at around 30% of my total portfolio, in the expectation that there are likely to be some opportunities to pick up stocks at a bargain price in the aftermath of the current impending economic crisis. Prospects of upside from current levels in the broader markets are looking increasingly dim, therefore it is starting to make less sense to be fully invested.

I currently do not expect an economic slowdown of the magnitude needed to pre-empt an oil price spike scenario at some point next year, or possibly even at the end of this year, depending on the continued unfolding of events. For this reason, while I sold some Suncor (SU) stock when oil prices were around $120/barrel in the spring, I used the summer decline in oil prices to buy some CNQ (CNQ) stock, as well as buying a small amount of Suncor stock over the summer. If the price of these stocks will decline further in the next few weeks, I will consider further increasing my position in both stocks. We should keep in mind that the U.S. government is set to potentially provide significant price support for the global oil market if it will move to rebuild its strategic petroleum reserve volumes.

Because we are looking at an increasingly volatile global monetary, financial, and investment environment, I also increased my gold positions this year. I currently own Barrick (GOLD) stock, GLD (GLD) fund shares, as well as some physical gold and silver. I also bought some Wheaton (WPM) stock earlier this year. In the event that gold & silver prices will continue to decline, I will consider increasing my position in gold & silver.

I wrote an article some months ago entitled “‘Watch The Fed’ Era Ends For Investors, As Commodities Scarcity Era Begins.” The main thesis was that the commodities market outlook is now more important for investors to pay attention to than central bank actions. Central banks are increasingly mostly reacting to the physical realities of the commodities market, rather than driving trends. This idea will probably never catch on with the markets, but I think it is nevertheless an advantage for investors to think in these terms because even though the market will probably continue to react to central bank actions, the central bankers themselves are reacting to realities created by scarcities issues, driven by commodities supply/demand issues. Those issues, in turn, drive inflation, economic growth, and other factors that then necessitate central bank reactions, while also affecting stock markets and other investment assets in a direct way. It is in my view a much better indicator for investors to follow, as a way of positioning one’s portfolio for the desired results, within the prevailing investment context.

Be the first to comment