jeffbergen

I think Microsoft (NASDAQ:MSFT) – when compared to other mega-caps – offers the strongest short and long-term growth prospects when modeled across different economic environments. Microsoft is in a unique position, as firms continue to build up their hybrid infrastructure, Microsoft Office and Azure can continue to accelerate growth in market share. This effectively shields Microsoft from an impeding slowdown in IT spending on the back of a recession in my opinion. There are many reservations about the Activision (ATVI) acquisition, which we believe will be successful (with large compromises), though closure will further iterate Microsoft’s leading position in gaming.

Cloud

In our view, Microsoft’s predominance in ‘on-premise’ infrastructure and hybrid cloud workflows, provide it with a competitive advantage when compared with Amazon’s AWS (AMZN) or Alphabet’s Google Cloud (GOOG, GOOGL). Companies are continually working to update their on-premise infrastructure, which will continue to support a steady runway of growth for Azure.

Furthermore, Microsoft’s Fortune 500 penetration is staggering with 95% using Azure. This was achieved through hybrid computing where Microsoft was first-to-market on serving a mix of on-premise, private and public clouds for their large enterprise customers.

Today, Microsoft is leveraging its lead in hybrid by undercutting other services on price in order to win the aggregate, long-term contract. By owning the entire cloud stack, Microsoft can offer the ultimate differentiator during macro headwinds, which is “more value for less price” whereas competitors do not own enough of the stack to undercut on price quite like Microsoft.

Compared to pure-play public cloud systems, hybrid cloud systems are growing much faster and have a significantly larger addressable market. This is due to the sheer volume of IT spending that legacy (older) companies contribute (85% of their spending is on legacy systems) who would be reluctant to take their infrastructure exclusively onto the public cloud. Reasons for this include lack of flexibility to maneuver billion-dollar IT budgets, regulations, and/or compliance. This is the prevailing sentiment in the banking and healthcare industries.

Worldwide end-user spending on public cloud services is forecast to grow to a total of $494.7 billion in 2022, according to the latest research from Gartner. This is to be contrasted with the total of $1.9T in IT spending for 2021. This equates to just 21% of total IT spending attributed to growing cloud infrastructure. This is forecast to continue to accelerate within the next decade.

We believe that any de-acceleration in 2023 growth in Azure, due to cuts in IT budgets, will bounce back in 2024. For continued accelerating growth rates in revenues, Edge Computing appears to be at the forefront of this next stage as discussed by management.

Businesses use edge computing to improve the response times of their remote devices and to get richer, more timely insights from device data. Edge computing makes real-time computing possible in locations where it would not normally be feasible and reduces bottlenecking on the networks and datacenters that support edge devices.

I think that’s going to drive a lot of these purchases and a lot of this additional on premises spend. Certainly, sovereignty and the desire to be able to have data or servers within proximity is also continuing to see growth. And that is of course governments, but there’s also industries that are regulated and thus also follow some of the requirements of those governments, and we’re seeing those opportunities, too.

Corey Sanders, Microsoft’s Vice President of cloud

There is a bleak and uncertain future for the economy, but Microsoft’s Azure appears well suited to thrive regardless of the economic environment. This is due to the many growth prospects that are currently at play.

Office

The Productivity and Business Processes segment is defined mainly by Office 365 and LinkedIn. LinkedIn is empirically sensitive to economic activity and therefore may continue to be a drag on margins and growth. Reasons for growth within the Office product suite is the continued growth of Teams. This growth comes in twofold: growth in adoption and price increases to include a security offering.

Microsoft announced its global license price increases in the middle of 2021. They were varied from $1 to $4 per user per month dependent on the plan. This equated to a 20% increase for lower tier licenses and a 12.5% increase for the more expensive high end tier licenses… the increase in price was due to a new security offering… and innovation.

I think the growth rate for the Productivity and Business Processes segment could decrease to 2-4% in a recession.

Financial

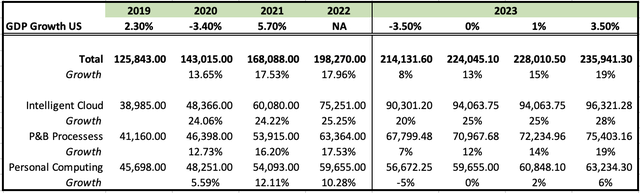

IT budgets are directly correlated to GDP growth, our analysis of Microsoft’s sensitivity to GDP growth in the US, with 2020 as a base, indicates continued growth in a contractionary environment – albeit, at a slower pace.

Provided that US GDP contracted 3.5% in 2020, while revenues grew ~15%, further demonstrates Microsoft’s resiliency to the economic environment. Adjustments are to be made as both recessions are starkly different, namely with the growth in Xbox sales in 2020. We believe that cloud will continue to drive growth this time around (much like 2020), but without the tailwinds in other segments. We forecast revenue to grow at 8% for an identical 3.5% contraction in GDP (compared to ~15% in 2020).

The below stress analysis further demonstrates this perspective by modeling 4 scenarios: -3.5%, 0%, 1%, and 3.5% growth in GDP. The catalyst for cloud to continue to drive revenue growth within this economic contraction is the continued shift of legacy IT to cloud infrastructure as the need to cut costs materializes. This structural shift is contrasted with the pandemic which saw firms ‘shocked’ into the transformation. Within contractions, companies look for economics of scale, and that is often best provided by large service providers who can offer a full suite of services under one roof and usually at a discounted price.

Company Fillings, Author’s Work

Final Thoughts

Not many companies are in a position to be expected to continue their growth trajectory throughout a wide variety of economic environments. This is where Microsoft lands within today’s economic climate, and therefore could be the catalyst that places Microsoft as a market leader over the next decade.

Be the first to comment