Galeanu Mihai

Introduction

I like writing about undercovered stocks on SA, and today I’m taking a look at Envela Corporation (NYSE:ELA). It’s a re-commerce retailer that has more than tripled its sales since 2016 and looks set to book a net income of over $10 million for 2022. The company has a market capitalization of almost $200 million as of the time of writing, but I think it’s cheap considering how successful its turnaround has been thanks to the venture into electronics. Let’s review.

Overview of the business and financials

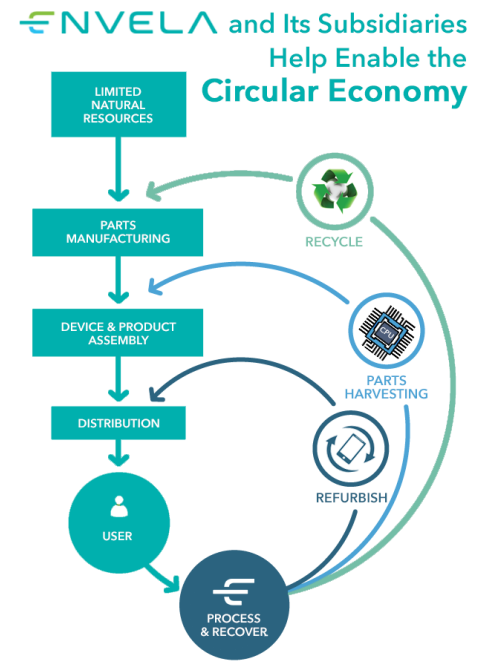

Envela was founded in 1965 and is among the largest authenticated re-commerce retailers of luxury hard assets in the USA. The company’s business is split in two operating segments. Its DGSE subsidiary is involved in the purchase, and re-sale or recycling of jewelry, diamonds, gemstones, fine watches, rare coins, gold, and silver and it has a network of 7 jewelry stores across the state of Texas and South Carolina. Its brands include Dallas Gold & Silver Exchange, Charleston Gold & Diamond Exchange, and Bullion Express. Envela’s ECHG subsidiary, in turn, specializes in the purchase and recycling or refurbishment of consumer electronics and IT equipment. This segment generates revenues through re-selling, end-of-life electronics recycling, and IT assets disposition services. ECHG aims to extend the useful life of electronics through re-commerce whenever possible, and it recycles products through the removal of usable components for re-sale as components, or by extracting the valuable metals.

Envela

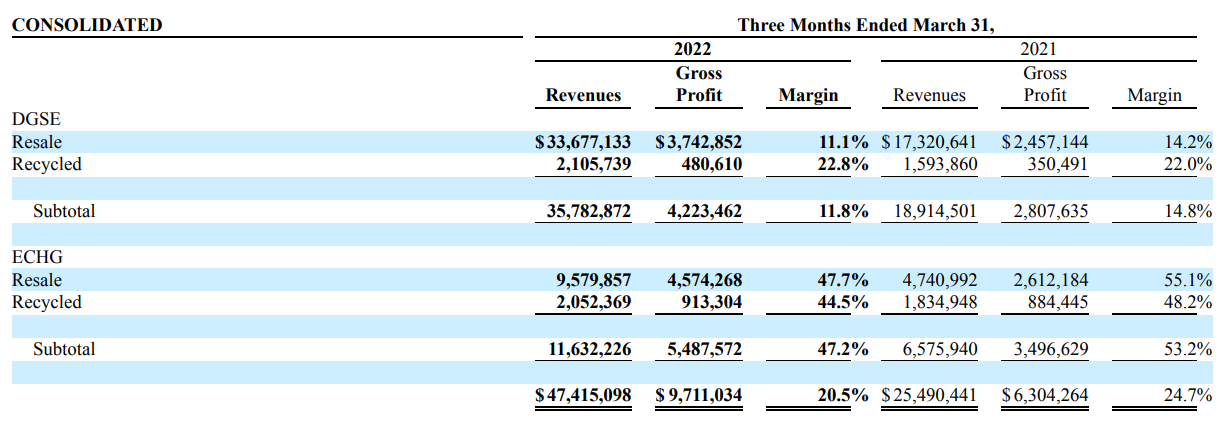

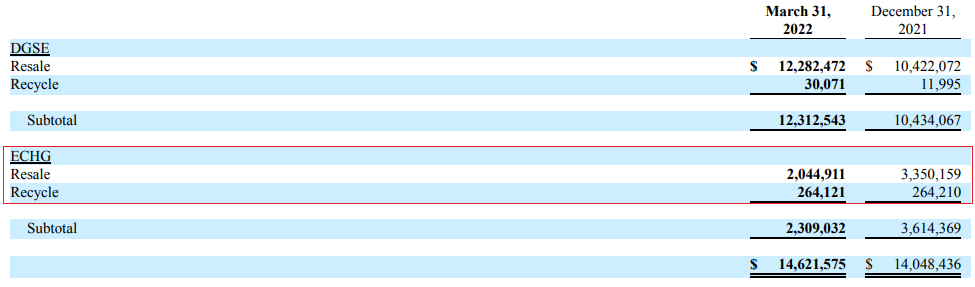

Looking at the latest available financials of Envela, we can see that the vast majority of the company’s revenues are coming from re-selling and not recycling and that ECHG has much better margins than DGSE.

Envela

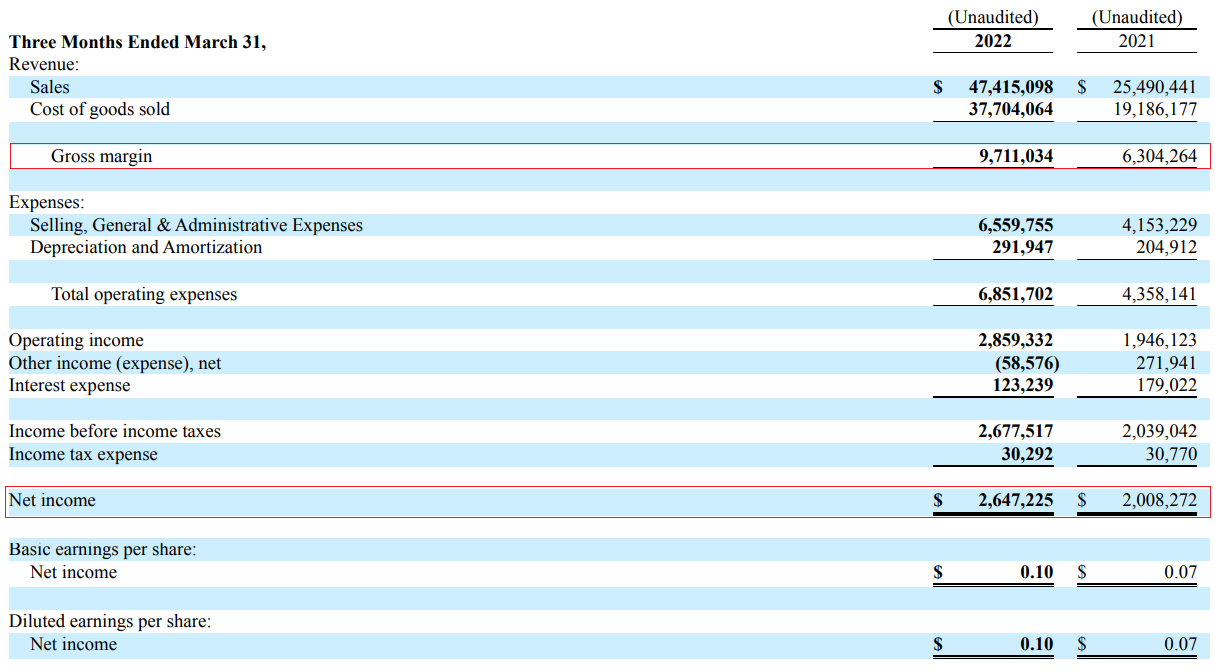

You can also notice that the revenues of both segments registered significant growth in Q1 2022. DGSE’s embarked on an online advertising and marketing campaign during the period and boosted its advertising budget by 56%. It seems the marketing campaign was effective. I think the increase in ECHG’s revenues, in turn, can be attributed to the purchase of two businesses in 2021. In June 2021, Envela bought electronics trade-in and recycling service provider CExchange. In October, the company acquired IT asset disposition services provider Avail. Overall, I think Q1 2022 was a pretty strong period from a financial point of view for Envela as the gross profit soared by 54% to $9.7 million while the net income rose by almost 32% to $2.7 million. In my view, the company is likely to book a net income of over $10 million for 2022.

Envela

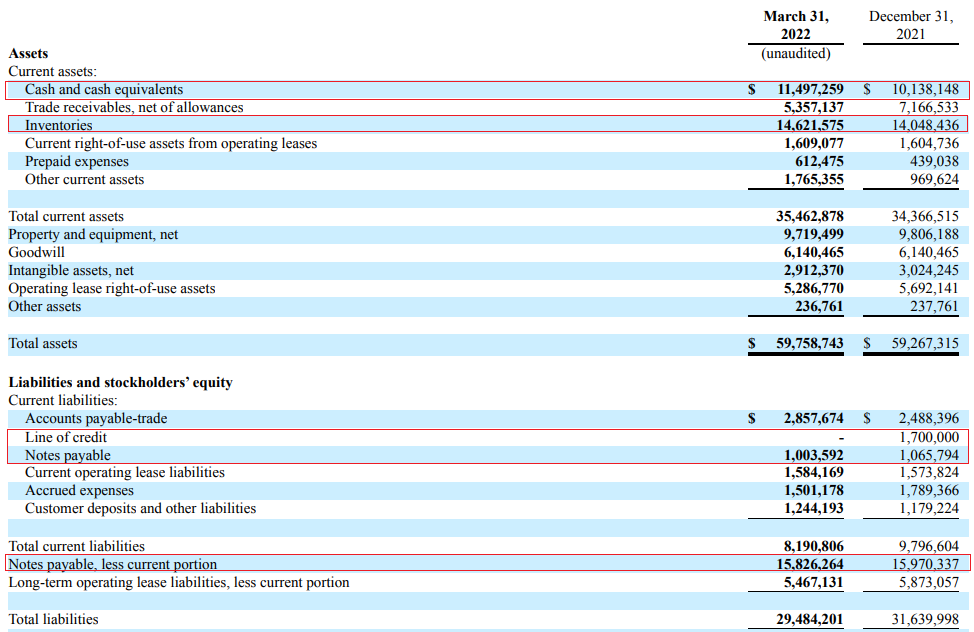

Turning our attention to the balance sheet, we can see that Envela has a somewhat asset-light business with cash and inventories accounting for almost half of the asset base as of March 2022. Debt stood at $16.8 million at the end of the quarter, which I think is easily manageable considering cash and cash equivalents were $11.5 million. In addition, capital expenditures are expected to be just around $1 million over the coming 12 months. In my view, Envela has enough liquidity to finance one or two more acquisitions in the near future.

Envela

Envela seems overvalued at first glance, as it has a market valuation of $197.1 million as of the time of writing. The company is trading at an EV/EBITDA multiple of 17.8x on a TTM basis. However, I think it’s cheap as its business has been growing rapidly since the appointment of John Loftus as CEO and President in December 2016. Envela closed 2016 with sales of $48.3 million, down from $127.9 million in 2012. The net loss, in turn, had widened $1.6 million to $4 million. So, how has the company managed to get back in the black and surpass its 2012 sales level in a period of less than 5 years? Well, it all started with slashing SG&A expenses. And in 2019, Envela bought Echo Environmental and ITAD USA for $6.9 million from Loftus to create ECHG. You see, the gross margin of Envela was 17.2% in 2016, but the business was barely sustainable as SG&A expenses were over $10 million per year. I think that DGSE still isn’t a good business due to the relatively low margins, and it seems that most of the significant improvement in profitability over the past three years has been coming from the consumer electronics and IT equipment segment. I think that this growth is likely to continue as it has strong momentum that even the COVID-19 pandemic couldn’t put an end to it. The company has also made several bolt-on acquisitions over the past several years, and CExchange and Avail are the latest ones.

Looking at the risks for the bull case, I think that the major one is the sourcing of inventory. While Envela inventory was at a healthy level of $14.6 million as of March 2022, most of that amount was linked with DGSE. The high-margin ECHG business had inventories of just $2.3 million at the end of Q1 2022.

Envela

One of the main sources of inventory for ECHG is school districts, and it’s possible that a recession in the USA could lead to lower education spending, which would in turn hurt this business.

Another risk to consider here is that the financial results of ECHG’s recycling business and DGSE are significantly affected by precious and other non-ferrous metal prices. If gold and silver prices decline, Envela’s margins will fall.

Investor takeaway

Envela has achieved a significant turnaround of its business over the past few years, and I think that the most important factor for this was the purchase and development of the high-margin consumer electronics and IT equipment ECHG business. This segment is growing rapidly, and its margins remain over 40% which is why I view Envela as undervalued at the moment. If growth rates are sustained, I think that the company’s shares should be trading at something like $9.00 in the near future.

However, I’m concerned that inventories at ECHG were at a low level as of March, and this could lead to issues down the road. In view of this, I rate Envela as a speculative buy.

Be the first to comment