From January tops, most REITs have had sizable declines, and almost no purchase by investors has gone unpunished. While we understand that the coronavirus is likely to be disruptive to businesses, its impact to healthcare stocks is rather unique. In some cases, there is a direct impact. REITs that focus on senior housing are definitely feeling the heat. Omega Healthcare Inc. (OHI), Sabra Health Care REIT Inc. (SBRA) and Ventas Inc. (VTR) are all examples where there is a negative impact via reduction of move-ins and higher costs associated with cleaning and maintenance.

But there has been some unjustified collateral damage. One of the safest and highest-quality REITs is now trading at a discounted valuation. We are talking about Physicians Realty Trust (DOC), a self-managed healthcare REIT that owns and manages healthcare properties comprising mainly of medical office buildings (MOBs). DOC leases them out to physicians, hospitals and healthcare delivery systems and other healthcare providers. In sympathy with the pains experienced elsewhere in the sector, DOC had trended down as well.

Yes, the stock is down the least, but the logic is lost on us as to why it should even show a modicum of a downtrend. At the current price, it is hovering close to 52-week lows. We explain why we like this stock.

High Quality Exemplified

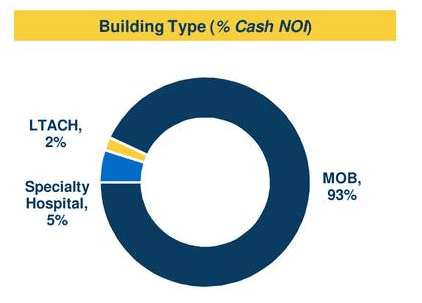

DOC focuses on medical office buildings, and currently, 93% of its Net Operating Income, or NOI, comes from those.

Source: DOC Presentation

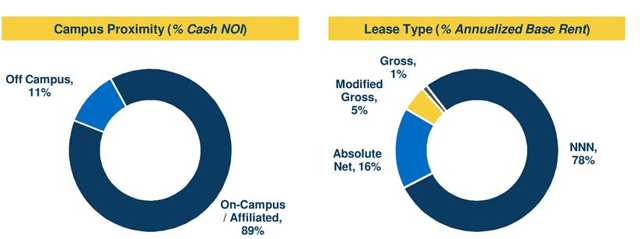

The bulk of the portfolio is close to campus facilities, and DOC takes very little expense risk, as most leases are triple-net.

Source: DOC Presentation

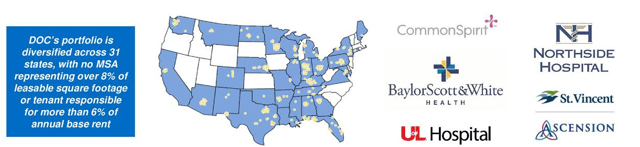

The portfolio is extremely well-diversified and spread across the US.

Source: DOC Presentation

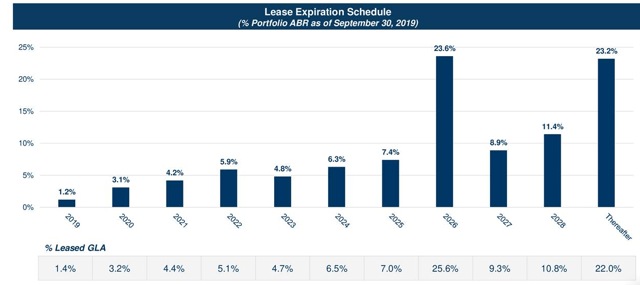

The portfolio is 96% leased with a weighted average lease term, or WALT, of 7.5 years. Near-term lease expirations are almost non-existent.

Source: DOC Presentation

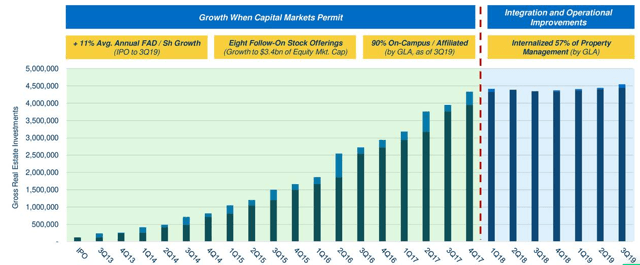

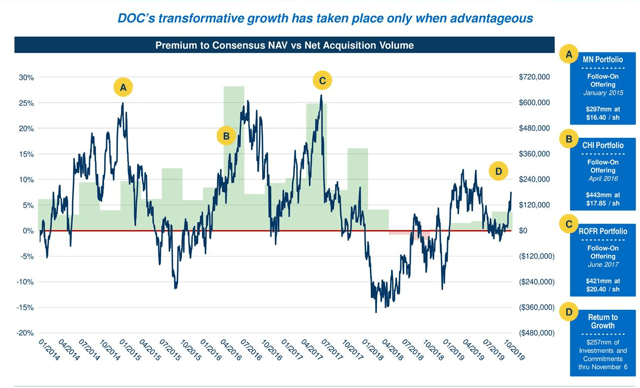

DOC has grown by acquisition like any other REIT. The most important thing that determines the success or failure of a REIT is its acquisition model. DOC has been steady with its growth, but over the years we have seen an extremely disciplined mindset from the company that is often lacking in REITs focused on “empire building”.

Source: DOC Presentation

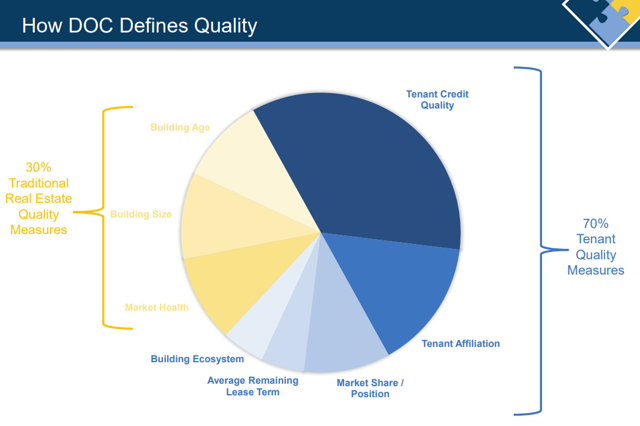

What DOC has done differently is that it has heavily overweighted tenant quality.

Source: DOC presentation

Higher-quality tenants often pay less rent for the same properties than lower-quality tenants would. But in the long run, they also cause less headaches. In DOC’s case, we have seen measurable quality measures show up in the statistics, with the number of investment grade tenants comprising nearly half of base rent. The REIT’s top ten tenant list comprises 8 investment grade tenants.

Source: DOC Presentation

Valuation

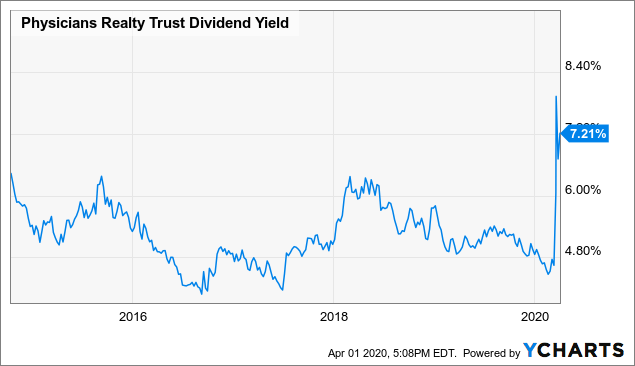

Consensus estimates for 2020 are for a $1.10 and rise to $1.13 of funds from operations in 2021. At under 12X FFO, DOC is about as cheap as it has ever been. The REIT now yields a rather stunning 7.2%, which is head and shoulders above its previous peak yields.

Data by YCharts

Data by YCharts

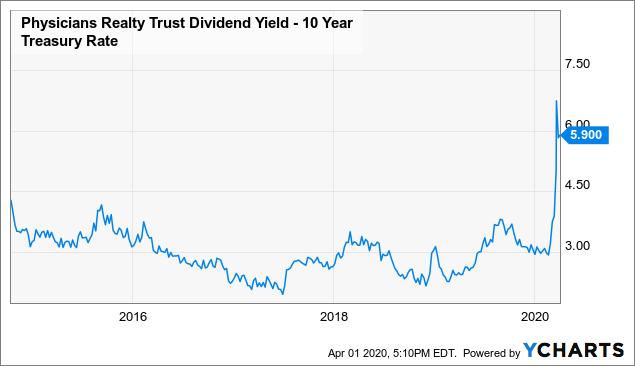

This yield is even more compelling when we view it in light of where the 10-year treasury is trading. The current spread is a whole 155 basis points higher than the previous peak.

Data by YCharts

Data by YCharts

The current pandemic has forced DOC to withdraw its acquisition guidance, but that should not impact its FFO target by a lot. The broader markets are also trading at a big premium to DOC on a multiple basis, and in this pandemic, the company’s earnings appear to be easily the most recession-resistant.

Based on last estimates, DOC’s Net Asset Value was estimated to be around $18.50. It is trading at a wide 35% discount to its liquidation value. Yes, buyers may be scarce in this market, but when any semblance of normalcy hits, that NAV will draw in buyers like moths to a flame. Unlike malls or schools, absolutely no one has considered closing off medical office buildings and hospitals during this pandemic.

Conclusion

DOC is now incredibly discounted. While one would have expected investors to bid this up in the current environment, the exact opposite has happened. At 12X FFO alongside a 7%-plus yield, the stock is poised to return 15% a year over the next 5 years. The current private market values suggest that DOC is at least 30% below liquidation value. Historically, it has traded at a premium, and also rather intelligently, only issued stock when it has traded above the value of its assets.

Source: DOC Presentation

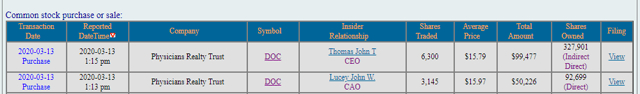

Should it return to a 25% premium to NAV, the stock could double from here, while giving investors 7 times as much yield as Treasury bonds. Insiders recently purchased shares, and they thought it was a good value at even a 20% higher price.

Source: SEC

The fear is palpable in the air, but that is the only time when such exceptional values come around. This is a Strong Buy.

If you enjoyed this article, please scroll up and click on the “Follow” button next to my name to not miss my future articles. If you did not like this article, please read it again, change your mind and then click on the “Follow” button next to my name to not miss my future articles.

TipRanks: Buy.

High Dividend Opportunities, #1 On Seeking Alpha

HDO is the largest and most exciting community of income investors and retirees with 4,400 members. We are looking for more members to join our lively group and get 20% off their first year! Our Immediate Income Method generates strong returns, regardless of market volatility, making retirement investing less stressful, simple and straightforward.

Invest with the Best! Join us to get instant-access to our model portfolio targeting 9-10% yield, our preferred stock and Bond portfolio, and income tracking tools. Don’t miss out on the Power of Dividends! Start your free two-week trial today!

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in DOC over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: HDO is NOT long DOC.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment