MobileIron, Inc. (MOBL) is a company that has been beaten down more than most during the recent stock market crash. Back in the fall, the stock price was ~$8 but has plunged to a recent price of less than $3.70 for a drop of more than 50%.

(Source: Yahoo Finance/MS Paint)

While I sympathize with existing shareholders, I believe that there are enough issues with this company that one should avoid MobileIron at least for the next year.

One issue is that MobileIron is guiding for negative revenue growth for the first half of the year. MobileIron is in the midst of transforming from a perpetual sales business model to subscription resulting in revenue that is recognized across the length of the contract as opposed to being recognized up-front. Although the company is attempting to convert entirely to subscriptions, it is still taking orders for perpetual licenses for the next 2 quarters before terminating such sales in Q3.

Secondly, given the current market conditions, I believe that MobileIron will struggle with any kind of revenue growth this year due to governments around the world shutting down most business activity and the likelihood of a global recession.

The third issue is that MobileIron has exceptionally high cash burn for the level of revenue growth. 101% of revenue is spent on SG&A expenses and R&D.

Given the anticipated poor revenue growth, extremely high cash burn, and the current market conditions, I am giving MobileIron a neutral rating.

The Rule Of 40

One industry metric that is often used for software companies is the Rule of 40. It is an industry rule of thumb that attempts to help software companies ascertain how to balance growth and profitability. For a further description of the rule and calculation, please refer to one of my previous articles.

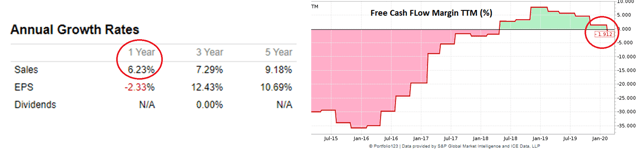

(Source: Portfolio123/MS Paint)

In MobileIron’s case:

Revenue Growth + FCF margin = 6% – 2% = 4%

MobileIron scores an abysmal 4%, nowhere close to fulfilling the Rule of 40. The low score signifies that the company does not have a healthy balance between growth and profitability.

Cash Burn

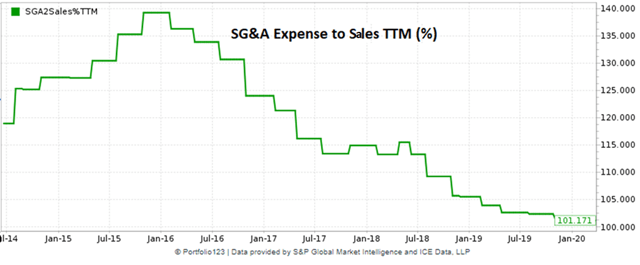

When a company fails on the Rule of 40, I like to examine the cash burn. I monitor a company’s cash burn by examining the SG&A expense relative to sales.

Note that SG&A includes Sales & Marketing, General & Administrative, and R&D.

(Source: Portfolio123)

MobileIron is spending 101% of its total revenue on SG&A expenses (and R&D). This means that MobileIron is spending all of its revenue intake on SG&A and R&D. I believe that this level of cash burn is unhealthy for a company growing less than 20% annually.

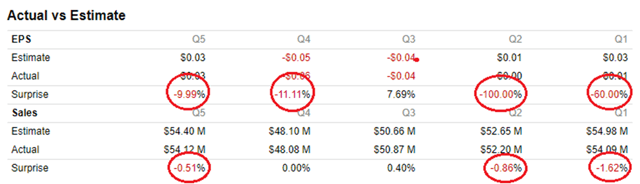

Missed Analysts’ Estimates

MobileIron has missed analysts’ estimates for sales and earnings multiple times in the last 5 quarters. It is my opinion that there is a high probability that MobileIron will miss analysts’ estimates again if not next quarter then sometime in the near future.

(Source: Portfolio123)

This is a reflection of company management as analysts’ estimates are generally based on company guidance.

Relative Stock Valuation

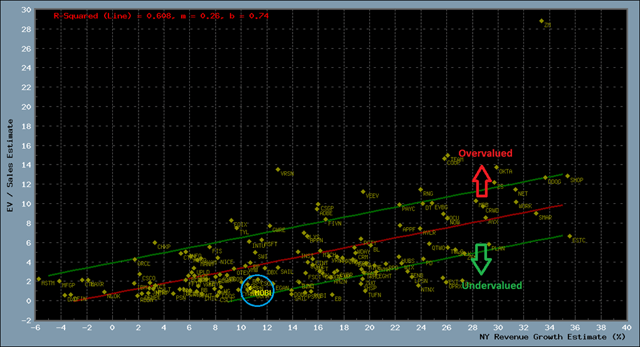

The following scatter plot of enterprise value/forward sales versus estimated forward Y-o-Y sales growth illustrates MobileIron’s stock valuation relative to the 152 stocks in my digital transformation stock universe.

(Source: Portfolio123/private software)

A best-fit line is drawn in red on the scatter plot and represents a typical valuation based on next year’s sales growth. As can be seen from the scatter plot, MobileIron is situated well below the best-fit line, implying that the company is quite undervalued based on forward sales multiple.

In cases where the market doesn’t value a company such as MobileIron, there is usually a reason. In this company’s case, anemic growth, the inability to meet analysts’ expectations, and high cash burn are likely contributors to the low valuation.

Another Perspective On Valuation

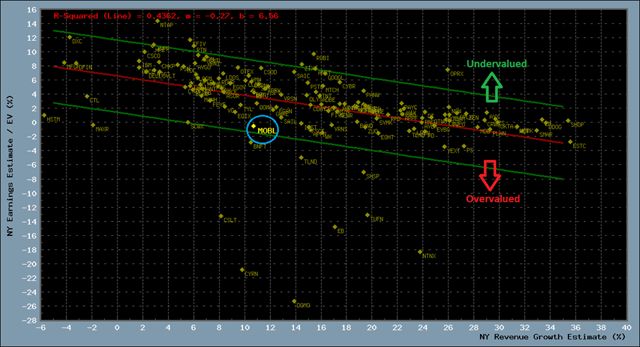

The Sales/EV multiple tells me that the stock is undervalued, but my value assessment changes when I substitute next year’s earnings estimates for forward sales.

(Source: Portfolio123/private software)

The results shown on this second scatter plot suggest that MobileIron is overvalued based on next year’s earnings estimates.

Summary And Conclusions

MobileIron is a player in the cybersecurity industry, introducing the first mobile-centric, zero trust platform for the enterprise. However, the product revenue isn’t growing at a pace to justify the high cash burn. In the words of Kayode Omotosho:

MobileIron isn’t able to deliver on its niche strategy in the EMM space. This doesn’t bode well for the future of MobileIron.

Given the expected negative revenue growth over the next two quarters, headwinds due to Covid-19 and a probable global recession, I am giving MobileIron a neutral rating.

Join My Exclusive Service While the Price is Low…

Digital Transformation is a once-in-a-lifetime investment opportunity fueled by the need for businesses to convert to the new digital era or risk being left behind. You can take advantage of this opportunity by subscribing to the Digital Transformation marketplace service. Tap into three high-growth portfolios, industry/subindustry tracking spreadsheets, and three unique proprietary rating systems. Don’t miss out on the digital revolution. We are still in the early innings and there are plenty of high-growth investment opportunities out there waiting for you!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment