ayala_studio

Generally speaking, when you buy into a small company, you’re buying stock in an enterprise that focuses on one key area. The objective is to grow into that market before expanding into other avenues. However, there are some exceptions to this. One firm that has been doing pretty well lately at capturing upside growth and that has an emphasis not on one but on two distinct lines of business is Envela (NYSE:ELA). That growth has continued into the current fiscal year and, on the whole, the future for the company looks promising. Having said that, shares are not necessarily a sensible investment for investors at this time. Although the company is doing well for itself, the stock looks a bit lofty based on 2021 figures. If my own forecasts for 2022 turn out to be accurate, this picture might change for the better. But even so, there are other specialty firms out there that might be more reasonable for investors to buy into at this time. Because of this, I have decided to rate the enterprise a ‘hold’ for now.

Two Businesses In One

To best understand Envela, we should dig into the two segments that the company has. The first of these is called DGSE, presumably short for Dallas Gold & Silver Exchange. Under that particular brand, as well as under the Charleston Gold & Diamond Exchange and Bullion Express brands, the company buys and resells or recycles luxury hard assets like jewelry, diamonds, gemstones, fine watches, rare coins, precious metal bullion products, gold, silver, and other precious metals. In addition to these activities, the company also offers jewelry repair services, sells custom-made jewelry and consignment items, and engages in other related activities. As of today, DGSE operates seven retail locations, with six of them located throughout Texas and the other in South Carolina. It also has an e-commerce operation, but management has made it clear that they view this as a supplement to their business, not a replacement for, its existing retail footprint. During the company’s 2022 fiscal year, this particular segment made up 68.6% of the firm’s revenue but only 48.3% of its profits.

The other line of business is referred to as ECHG. Through it, the company owns and operates Echo, ITAD USA, Teladvance, CEX Holdings, and Avail Recovery Solutions Through these units, the company buys, for the purpose of reselling or recycling, consumer electronics and IT equipment from businesses, school districts, and other organizations. This includes whole products, as well as components that can be used for replacement parts. When necessary, the company does recycle these products. Last year, this segment made up 31.4% of the company’s revenue but an impressive 51.7% of its profits.

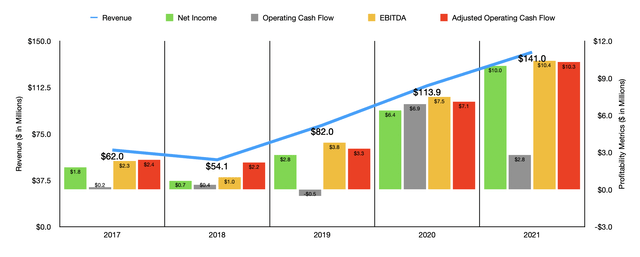

Over the past few years, the management team at Envela has done a good job growing the company’s top line. Revenue has grown from $62 million in 2017 to $141 million in 2021. Recent growth appears to have been largely as a result of the expansion of ECHG, with the company acquiring both CEX Holdings and Avail Recovery Solutions rather recently. In 2020, this particular segment accounted for just $28.3 million of the company’s $113.9 million, or roughly 24.8% of the firm’s revenue. In 2021, sales of $44.3 million translated to a year-over-year growth rate of 56.6%. By comparison, the growth grade achieved by DGSE during that same time frame was a more modest 12.9%.

Profitability for the company has also followed revenue higher. The firm went from generating a net profit of $1.8 million in 2017 to a profit of $10 million last year. Other profitability metrics have been somewhat mixed. For instance, operating cash flow has shown no real trend, with the low point being the negative $0.5 million the business achieved in 2019 and the high point being the $6.9 million generated in 2020. If we adjust for changes in working capital, however, the trend has been mostly positive, with the metric climbing from $2.4 million in 2017 to $10.3 million last year. A similar trend can be seen when looking at EBITDA, a metric that rose from $2.3 million in 2017 to $10.4 million last year.

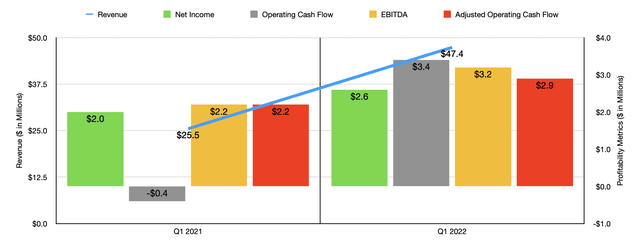

Growth for the company has continued into the 2022 fiscal year. During the first quarter, revenue came in at $47.4 million. That’s almost double the $25.5 million generated the same quarter one year earlier. Growth here was strong across the board, with revenue at ECHG jumping 76.9% year over year, while revenue for the DGSE segment skyrocketed by 89.2%. For the smaller ECHG segment, the increase was mostly related to the two aforementioned acquisitions the company made. And for the DGSE segment, the rise was driven by the company’s effective online advertising and marketing campaign that came as a result of a 56% increase in its advertising budget year over year.

This rise in revenue brought with it some higher profits for the company. Net income of $2.6 million in the latest quarter dwarfed the $2 million generated just one year earlier. Operating cash flow went from a negative $0.4 million to a positive $3.4 million. If we adjust for changes in working capital, it would have risen from $2.2 million to $2.9 million. Meanwhile, EBITDA also improved, climbing from $2.2 million to $3.2 million. Management has not provided any guidance for the current fiscal year. But if we annualize results experienced so far for the year, we should anticipate net income of $13.2 million, adjusted operating cash flow of $13.6 million, and EBITDA of $15.1 million.

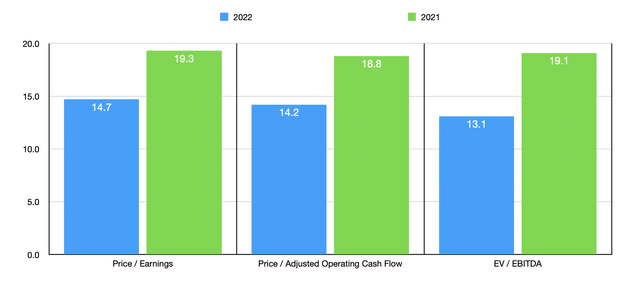

On a forward basis, shares of the company look fairly affordable. The firm is trading at a price-to-earnings multiple of 14.7. The price to adjusted operating cash flow multiple is 14.2, and the EV to EBITDA multiple should be 13.1. Although the company does look quite affordable on a forward basis, it is uncertain that the firm will actually hit these profitability estimates. Instead, if we look at it through the lens of what the firm achieved in 2021, these multiples are less appealing, coming in at 19.3, 18.8, and 19.1, respectively. To put this in perspective, I compared the company to five specialty retailers. On a price-to-earnings basis, these companies ranged from a low of 3.1 to a high of 76. And using the price to operating cash flow approach, the range was from 5.5 to 23.7. In both cases, four of the five firms were cheaper than Envela. Meanwhile, using the EV to EBITDA approach, the range was from 1.6 to 12.8. In this case, our prospect was the most expensive of the group.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Envela | 19.3 | 18.8 | 19.1 |

| Party City Holdco (PRTY) | 5.6 | 8.1 | 12.8 |

| Build-A-Bear Workshop (BBW) | 5.2 | 12.9 | 3.4 |

| Big 5 Sporting Goods (BGFV) | 3.1 | 5.5 | 1.6 |

| JOANN (JOAN) | 76.0 | 23.7 | 9.8 |

| The Container Store (TCS) | 4.3 | 6.1 | 3.3 |

Takeaway

At this point in time, Envela seems to be doing a pretty good job for itself and its investors. If the past is any indication, then the future for the business should look rather appealing. On a forward basis, shares are starting to look affordable, but this assumes that the business performs as I expect that it will. Relying on recent historical results, shares look much closer to fairly valued and are even considered pricey compared to some specialty retailers that I compared it to. In all, I feel like a ‘hold’ rating is appropriate until we get more clarity into the picture moving forward.

Be the first to comment