Drew Angerer

Last week, Bank of America (NYSE:BAC) crashed 10%, as a slew of bad news reports rocked the financial services sector.

First, the yield curve reached its deepest inversion since 1990, with a -75 basis point spread between 2 and 10 year treasuries. Then, Brian Moynihan said that investment banking fees would decline 60% in the fourth quarter–they’d been declining prior to that, but -60% would be the worst decline this year. Finally, Blackstone (BX) saw a wave of withdrawals from one of its REITs, leading investors to question the health of big institutions.

Bank of America got hit harder than most banks in last week’s selling. Among its peer companies, a 1.45% price decline was seen in JPMorgan (JPM) while 4.6% was observed in Citigroup (C) shares. Most likely, BAC underperformed because some news items (e.g. Moynihan’s comment) dealt with the company itself, while the other big banks were only indirectly affected.

The selloff in Bank of America shares could be described as a panic-driven event. There was material news on only one of BAC’s operating businesses (investment banking), a segment that makes up just 4.8% of total revenue. Certainly, the ever-steepening yield curve inversion looks bad for banks, but the “banks borrow short and lend long” theory has been failing empirically in recent years. The yields on term deposits are going up, but they’re still lower than mortgage rates, and savings accounts still pay almost nothing. The sheer magnitude of BAC’s selloff, then, would appear to be motivated by fear.

Amid the panic in Bank of America shares, I bought. Sensing that the shares were unfairly beaten down, I figured that the apparent risk factors would blow over and that BAC would do again in Q4 what it did in Q3: beat expectations.

Why did I make this bet, when I knew that people were getting very afraid of Bank of America’s stock?

It comes down to fundamentals. In its most recent quarter, Bank of America reported 24% growth in net interest income (“NII,”) despite the 2/10 year spread being negative at the time. We’ve seen inverted yield curves before, they didn’t kill BAC’s margins. The yield curve is certainly more inverted now than it was earlier this year, but that’s not the end of the world. So, I would expect Bank of America’s Q4 NII growth to be slower than in previous quarters, but still positive.

Recession – Will it Happen?

“Recession” is the elephant in the room in today’s markets. Stocks have gotten cheaper, but if a recession hits, then maybe they’ll have to go cheaper still. This is particularly relevant to Bank of America, because banks don’t fare well in recessions. During recessions, people and businesses become more likely to default on their loans. This results in rising loan loss provisions when recessions are expected, and higher actual defaults when recessions occur. In its most recent quarter, BAC increased loan loss provisions by $1.5 billion, indicating that it expects an increase in defaults.

Seemingly everybody thinks a recession is coming, and some think that the coming recession will be severe. Goldman Sachs (GS) thinks that there’s a 35% chance of a recession next year, which is below the 65% average estimate from Wall Street Journal’s surveyed forecasters. Overall, the GDP growth consensus calls for full year GDP growth of 0.4%. That’s a positive figure but it’s low enough to have two quarters of negative growth plus declining employment in the mix.

Based on next year’s consensus, the likelihood of a severe recession is quite low. There aren’t that many scenarios in which GDP grows 0.4% for the full year but a deep recession occurs in the interim.

Let’s say we have a country called ‘Growth Land’ that has $10,000 in GDP in 2022. If GDP grows .04%, then it reaches $10,040 in 2023. If you break it down by quarter, there are many ways in which $10,000 could grow to $10,040, as shown in the table below:

|

2022 |

2023 – scenario 1 |

2023 – scenario 2 |

2023 – scenario 3 |

|

|

Q1 |

$2500 |

$1,250 |

$2,510 |

$2,400 |

|

Q2 |

$2500 |

$1,000 |

$2,510 |

$2,350 |

|

Q3 |

$2500 |

$2500 |

$2,510 |

$2645 |

|

Q4 |

$2500 |

$5,290 |

$2,510 |

$2645 |

|

Full year |

$10,000 |

$10,040 |

$10,040 |

$10,040 |

As you can see, all of these scenarios result in 0.4% full year GDP growth. However, scenario 1, in which you get 0.4% GDP growth after wild variance, is extremely improbable. The Q1 drop (50%) would be the steepest in recorded history, while the Q4 gain (111.6%) would also be the highest in recorded history. Therefore, scenario 1 (the “severe recession”) likely won’t happen if the 0.4% full year consensus forecast is hit; it involves two low-probability events occurring one after the other. Then we have scenario 2, where growth is fairly even across all the quarters. Something like this could happen, but then there wouldn’t be a recession, as the consensus implies. Finally, there’s scenario 3, in which we get a mild recession at the start of the year followed by a brisk recovery.

If economists’ average forecast is hit, then we’ll likely get something like scenario 3. 65% of economists say that there will be a recession, and their average forecast is 0.4% growth for the full year. Scenarios in which we get 0.4% full year growth while also having a ‘severe’ recession imply an extremely high standard deviation of quarterly growth rates. This is unlikely (financial/economic data tends to mean revert over time), so the consensus points to something like scenario 3.

Now, it’s possible that we’ll get something totally unlike the forecast. For example, a severe recession and negative full year growth, or no recession at all. What does Bank of America think will happen?

Based on various recent statements by the bank (and its leadership), we can conclude that it expects:

-

Consumer spending to keep rising in 2023 (though at a slower pace than in 2022).

-

A ‘mild’ recession.

-

An overall ‘strong’ consumer.

Statements 1 and 3 above are official forecasts by BAC analysts, the second one is a personal opinion of Brian Moynihan. Taken together, they suggest that BAC does not expect a severe recession in 2023.

BAC – Factors Other Than Recession

It’s nice to know what Bank of America doesn’t expect a recession in 2023, however, it is impacted by a number of other factors related to recession risks:

-

The inverted yield curve.

-

The expected 60% decline in investment banking fees.

-

High brokerage fees driven by market volatility.

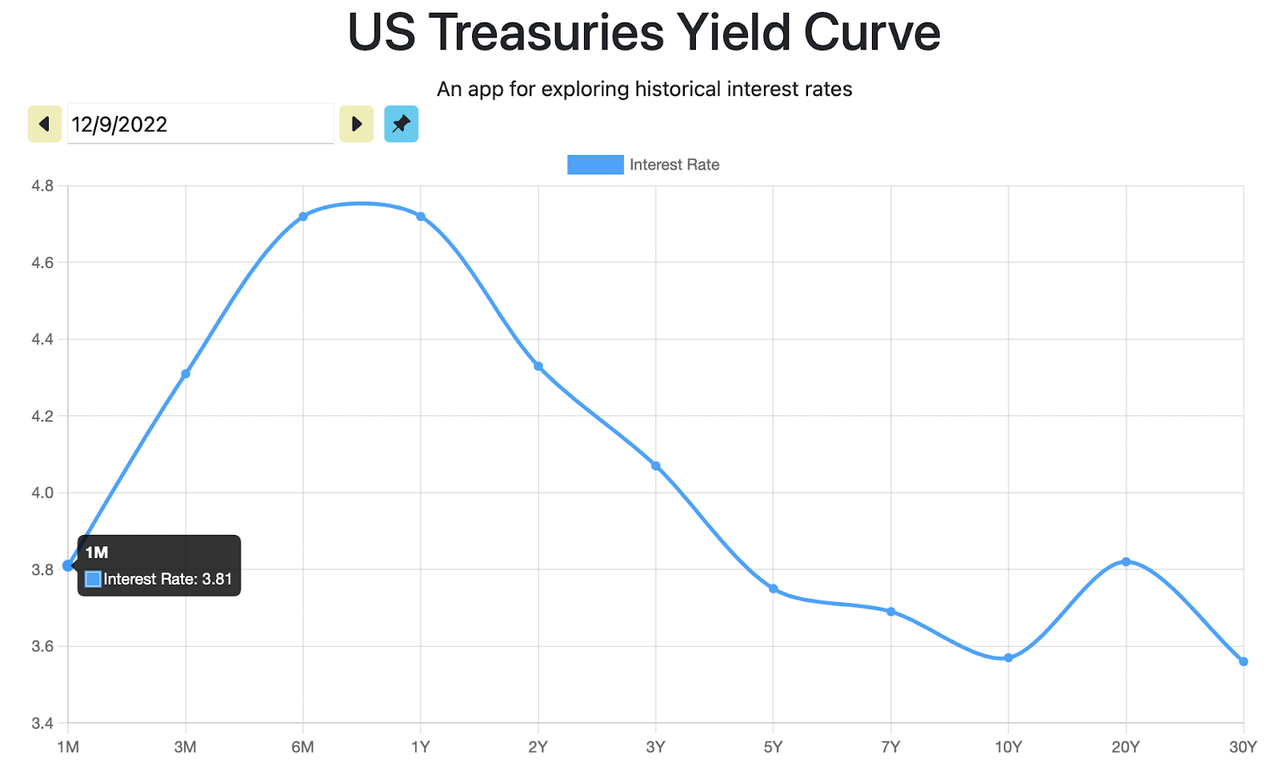

First, we can touch on the yield curve. The treasury yield curve is now fully inverted, with all maturities having higher yields than the 10 year. In the last quarter, the yield curve was only inverted from the 6 month maturity onward. In the current one, even the 1 month bill has a higher yield than the 10 year bond.

Yield curve (U.S. Treasury Yield Curve dot com)

So far, Bank of America hasn’t faced a ton of pressure from yield curve inversion. A negative 2/10 spread isn’t a problem for BAC, because savers have to commit to a 2 year treasury investment in order to guarantee the high yield. If they want to cash out in less than 2 years, they risk selling at a loss. Basically, 2 year treasuries are not viable alternatives to savings accounts.

When the 1 month treasury has a serious yield on it, things change. In that scenario, ordinary Americans can go on Treasury Direct and buy one month 3.8% APY bonds that pay 0.3% when they mature. Most savers can afford to wait a month until maturity: that’s just two pay periods for most people. So, 1 month treasuries are a good alternative to the 0.1% annual interest savings accounts BAC is offering in New York. With short term treasuries offering so much yield, Bank of America may face pressure to up its savings account interest. If that happens, margins will start to shrink.

Next, there’s the decline in investment banking fees. Moynihan’s statement about an expected 60% decline in fees coincided with last week’s 10% selloff. It may have contributed to it. BAC’s investment banking fees declined 47% last quarter, so weakness in the segment is nothing new. It’s being caused by a dearth of tech IPOs, which largely stopped happening when tech stocks crashed. It makes little sense to go public in a weak market. It’s unfortunate for Bank of America that this is happening, but as mentioned earlier, it’s only 4.8% of the total business.

Finally, there’s brokerage fees. Brokerages are generally doing well this year, as the volatile market has led to high trading volume. This can be seen clearly by looking at Charles Schwab’s (SCHW) results. For the year, Schwab’s revenue is up 10.78% and its earnings per share are up 25%. That’s much better than what conventional banks are doing on average, but Bank of America has its own brokerage segment, Merrill Lynch, where Merrill Edge assets are up 32%. So, BAC’s brokerage revenue could help buffer against possible yield curve and deal making impacts in Q4.

Why I Bought

Having looked at various risks and opportunities facing Bank of America in Q4, it’s time to answer the question I started the article with:

Why did I buy after the panic?

Put simply, because Bank of America stock is cheap, and it’s growing at a decent pace if you exclude PCLs.

In the third quarter, BAC’s pre-tax, pre-provision net income grew 10%. The negative growth in earnings was entirely due to the reserve build. It might come to be that the expected defaults materialize, but it might not come to be. As of right now, BAC’s “earnings decline” is due to regulatory factors that apply only to banks. When the economy improves, it will be able to release some of its reserves, and earnings should rise.

But even if Bank of America doesn’t grow its earnings, it will still be a decent value. Today, it trades at 10.25 times earnings and 1.08 times book value. That’s very cheap. The stock remains cheap even if we assume a severe recession hits and causes earnings and other metrics to decline to 2020 levels (that is, the levels seen during the COVID lows).

Using today’s stock price and 2020’s financial performance, we would get the following multiples for BAC:

Price/earnings: 17.3.

-

Price/sales: 3.81.

-

Price/free cash flow: 7.46.

-

Price/book value: 1.12.

Basically, if we assume its financials deteriorate to levels seen during the worst recession in recent memory, Bank of America stock STILL looks cheap! For Bank of America to fall back to 2020 earnings levels, the coming recession would have to be severe, not mild: the second quarter of 2020 saw a 29% GDP drop. The vast majority of economists think the future recession will be mild at worst, non-existent at best. It really looks like the worst has been more than priced in for Bank of America, and that the ongoing panic selling presents a buying opportunity to long term investors.

Be the first to comment