Chip Somodevilla

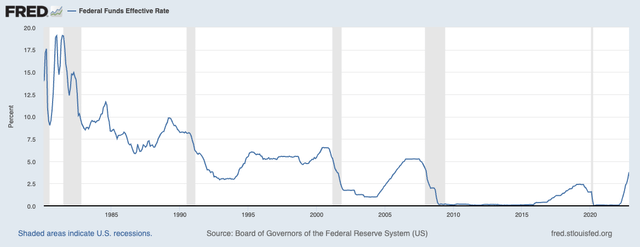

The last time we experienced a soft landing was the period from 1994-1998, when Alan Greenspan took the Fed Funds Rate from 3.1% to 6.0% in 15 months. He later brought rates back down to 4.7% over the course of three years. Throughout that tightening and loosening cycle, the S&P 500 went from roughly $94 to $260.

Fed Funds Rate (St. Louis Fed)

What is a soft landing and why is it seen as a good thing? Let’s first define a hard landing. In hindsight, Fed tightening policy appears to be “raise rates until something breaks.” That something could be the seizing of repo markets such as in 2019, but more often a hard landing entails a recession. Interest rate reductions usually do not begin until the recession has already begun or a few months before – where the lagging nature of credit easing does not prevent a recession.

The Fed does not purposefully plunge the economy into recession, but faces an issue similar to the boiling frog problem. It reacts to slowly deteriorating data. By the time that data screams ease rates, the recession has already begun. A soft landing, therefore, is when interest rates stop and reverse in time to avoid a recession altogether.

Positive Signs of a Soft Landing

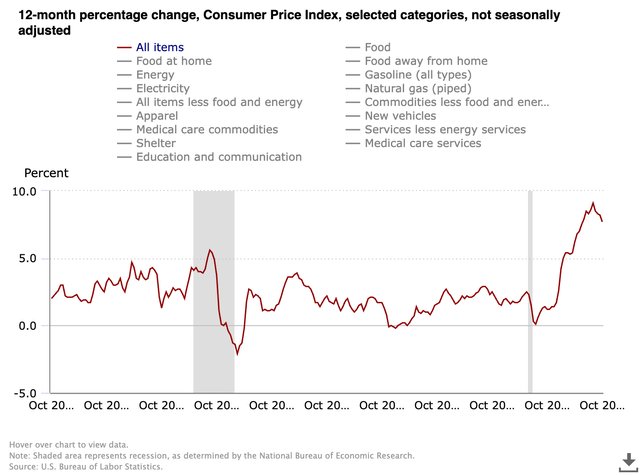

This tightening cycle has a different flavor from every other cycle since 1980. Hikes are not simply tied to rate normalization but combating inflation. That said, CPI is currently backing off from its June highs of 9.1%.

YoY CPI (U.S. Bureau of Labor Statistics)

In late November, Powell said the following: “The time for moderating the pace of rate increases may come as soon as the December meeting.” It appears we are at an inflection point. For additional context, let’s take Morgan Stanley’s forecast for peak Fed Funds at 4.5-4.75% as the Fed’s target.

Here is the million-dollar question: can the Fed make it to 4.5% Fed Funds and 2-4% inflation without plunging the U.S. economy into a recession first?

How it could happen

I was in the camp of Fed critics calling for a 0% chance of a soft landing. I would now put those odds at 25%. I believe the U.S. economy is in a recession in 2023, though not as deep as many would suggest. However, let’s explore ways in which I might be wrong.

First, an early 2023 pivot at the 4% range with continued decreasing inflation is within the realm of possibility. However, because the Fed has been solely focused on inflation which has only come down 2%, a premature pivot is unlikely.

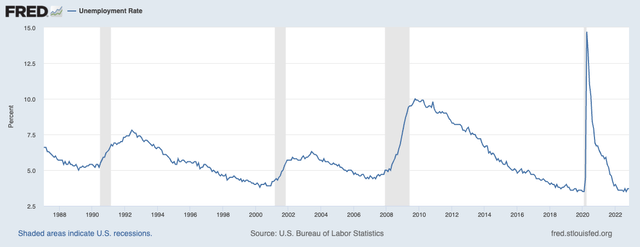

Second, the average consumer has weathered the storm of high inflation and increasing interest rates through an incredibly tight labor market. 3.7% unemployment is considered at capacity historically. Higher cost of living and zero wages is a toxic recession recipe. High levels of employment is likely what’s keeping the lights on.

Unemployment Rates (St. Louis Fed)

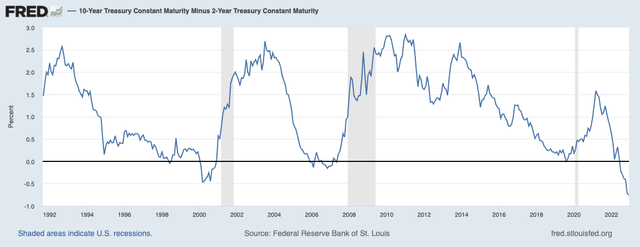

Why it probably won’t

The depth of the yield curve inversion is not indicative of the magnitude of recession as shown by the 2000 inversion being much deeper than 2008. Despite that, the yield curve has inverted before all ten recessions since 1955. It only had one false positive in the mid-1960s. Despite Quantitative Easing mixing signals in bond markets, it’s difficult to argue that the economy will be stronger in 6-24 months.

2s/10s Yield Curve (St. Louis Fed)

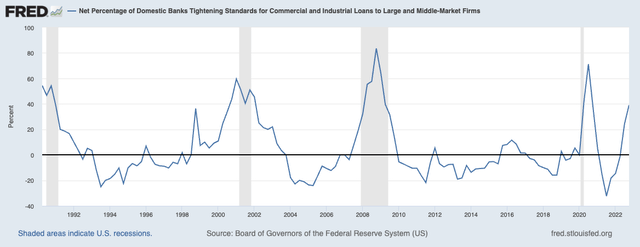

Markets are addicted to liquidity and credit. The fact that bank lending standards are tightening to near recessionary levels is also not a good sign. This additional pressure on corporations could affect employment levels, the glue currently holding markets together in my opinion.

Domestic Bank Tightening Standards (St. Louis Fed)

Manufacturing PMI in the United States fell from 50.2% in October to 49.0% in November. 45% tends to signal a recession as well. On a positive note, we did have 56.5% Services PMI.

Conclusion

To summarize, we are at an inflection point. The tightening cycle appears to be successfully wrangling inflation. However, a deeply inverted yield curve, domestic banks increasing tightening standards, and a Manufacturing PMI at a recession’s doorstep all point to a 2023 recession unless the Fed conducts a premature pivot or employment miraculously holds at these high levels through the rest of the tightening cycle.

Where I differ with some analysts is on the depth of the recession. Morgan Stanley’s forecast of 0.5% GDP growth in 2023 is not out of line. I believe 2023 will be a year of muddling through with a shallow recession or perhaps a near miss. There is no indication of high growth and economic dynamism in the picture for 2023. However, with a Q1 pivot in the cards and the Fed taking its foot off the gas starting this month, it is possible that October was the low in the S&P 500.

Be the first to comment