porcorex

Frequency of dividend payments is more of a psychological thing than anything else. For example, some European companies pay dividends only once per year. Technically, one can exercise discipline and recreate the notion of a monthly payment scheme by deducting only one month’s worth of dividends at a time from the annual dividend received.

However, annual pay is simply not realistic for most people, especially considering that bills don’t come all at once. Hence, it’s better to break up the payments to better match household expenses.

This brings me to Horizon Technology Finance (NASDAQ:HRZN), which is one of the few BDCs to pay shareholders on a monthly basis. HRZN recently upped its dividend, and in this article, I highlight why it makes for an attractive income stock, so let’s get started.

Why HRZN?

Horizon Technology Finance is an externally-managed BDC that provides secured loans to venture capital and private equity backed growth companies in the technology, life science, and healthcare information and services industries.

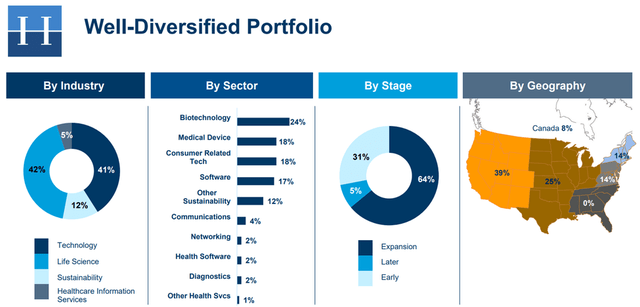

HRZN’s portfolio is well-balanced by industry, with 41% of portfolio fair value allocated to technology, 42% to life science, 12% to sustainability, and the remaining 5% to healthcare information systems. As shown below, most of HRZN’s portfolio is allocated to companies in the less risky expansion and later stages, signaling maturity and more line of sight.

HRZN Portfolio Mix (Investor Presentation)

Importantly, HRZN has more than paid back its original shareholders. This is based on its IPO price of close to $15 in 2010, and $16.32 in cumulative distributions since then, thereby validating the business model and the original thesis for investment at IPO. Shareholders who have held since 2010 are now essentially playing with “house money”.

Meanwhile, HRZN hasn’t shown signs of slowing down, as it took advantage of an attractive investment environment for venture debt financing in the tech and healthcare space, especially considering that many companies have delayed liquidity events such as IPOs as M&A during the down market since the start of the year. This is reflected by robust YoY portfolio growth of 40% to a record $635 million. Plus, HRZN’s pipeline is indicative of more opportunities ahead, as it has a record committed backlog $309 million at present.

Also encouraging, HRZN is benefiting from a rising rate environment, since 100% of its outstanding principal on debt investments bear interest at floating rate, and its debt portfolio currently yields a respectable 15.9%. This has translated to strong bottom line results, as NII per share came in at $0.43 during the third quarter, which is $0.03 higher compared to last year. This gave management the confidence to boost its regular monthly dividend by 10% to $0.11, resulting in a safe payout ratio of 77% on the regular dividend. Plus, HRZN declared a special $0.05 dividend as a bonus for income investors.

HRZN is also modestly leveraged with a debt to equity ratio of 1.18x, sitting slightly below its target leverage of 1.2x, and well below the 2.0x regulatory limit. The portfolio also remains overall healthy, with 97% of the portfolio carrying a 3 or 4 rating, marking a sequential improvement from the prior quarter. It has no 1-rated credits, as its sole 1-rated credit, Kite Hill, was able to raise fresh equity to recapitalize the company and return to a 3-rated credit.

Looking forward, management expects the current lending environment to tighten a bit as growth stage companies become more hesitant to take on additional capital amidst market uncertainty. However, they are supported by record amounts of private equity capital sitting on the sidelines for support should the need arise, thereby giving a buffer for venture debt companies like HRZN. This was noted by management during the recent conference call:

VC-backed exit activity remains muted given the current environment and the near shutting of the IPO window. Total exit value for the quarter was $14 billion, just above last quarter’s total. And it’s likely that the exit value for the year will fall below $100 billion for the first time since 2016.

While the economic environment and investor sentiment remains challenging, VC firms continue to maintain record levels of dry investment powder, nearly $300 billion, which may provide liquidity for new investment opportunities and to support existing portfolio companies. Demand for venture debt has tightened recently, but we continue to see opportunities to invest in growth-stage companies.

Lastly, I see value in the stock at the current price of $12.87 with a modest price to book value of 1.1x. This is considering HRZN’s track record of shareholder returns since IPO, its strong distribution coverage, strong portfolio fundamentals, and recently raised dividend. Analysts have an average price target of $13.29, implying double-digit return potential in the low teens including the dividend.

Investor Takeaway

In summary, I believe that Horizon Technology Finance is a good long-term income play that throws off an attractive and well-covered high yield. The company has strong fundamentals, a healthy portfolio, and is benefiting from a rising rate environment. It also recently raised its dividend and pays a special dividend, which gives income investors an added bonus. The stock is attractively valued at the current price and offers double-digit return potential including the dividend.

Be the first to comment