tommaso79

Co-produced with Treading Softly

How has your sleep been lately?

With the election mostly in the rearview mirror – save for a few last nets to untangle – and the holiday season all around us, many might be running on a short supply of rest.

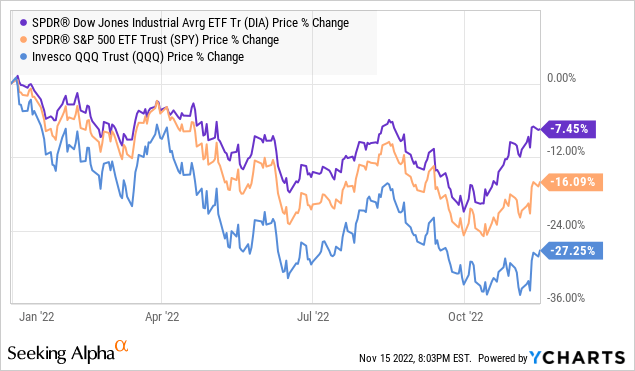

The market hasn’t been exactly sleep-supporting either. Year to date, it’s pummeled investors:

The market, represented by the three major indexes (SPY) (QQQ) (DIA), is still deep in negative territory.

I have to be honest – my sleep has been great. Why? How? Great questions. It comes down to how I approach the market and investing. I use my unique Income Method to leverage excellent returns from all sorts of market conditions. Even as the market has fallen, my income has gone up. I use a portion of my dividends to reinvest for more income next year. I can rest easy knowing that whatever mood the market is in, bullish or bearish, my income will climb.

My dividends are a warm blanket that brings me comfort and allows me to rest when the storms of the market come raging.

Today, I want to share two threads in my blanket of dividend income which, along with others, provide me so much comfort. You can have it too!

Let’s dive in.

Pick #1: ACRE – Yield 11.4%

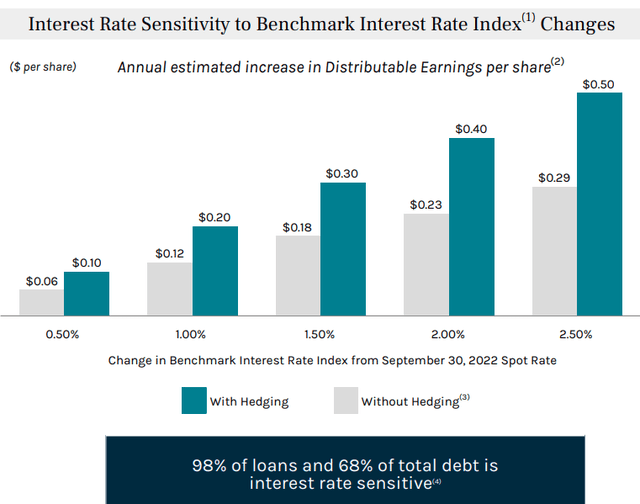

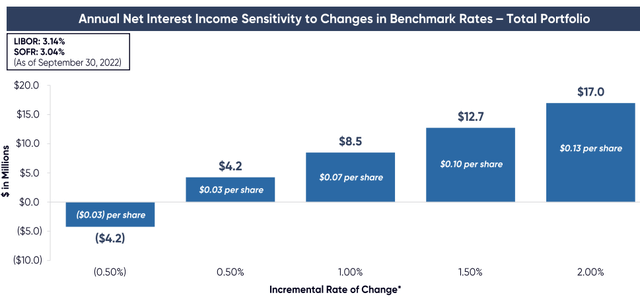

Ares Commercial Real Estate Corporation (ACRE) reported distributable earnings of $0.39, comfortably exceeding their $0.33 dividend and $0.02 supplemental dividend. ACRE’s portfolio easily covers the dividend, and as interest rates rise, its portfolio will produce even higher earnings. Here is a look at ACRE’s interest rate sensitivity. (Source: ACRE Q3 2022 Presentation)

ACRE Q3 2022 Presentation

It should be noted that ACRE tightened up lending in Q3. With only $78 million in originations and $167 million in repayments, its portfolio contracted slightly. Management expects repayments will slow down materially as borrowers are unwilling to refinance in the current environment. While on the origination side, ACRE expects to be highly selective and biased toward keeping leverage low.

For the foreseeable future, we can expect earnings growth to come primarily from the benefit of rising interest rates, while the portfolio remains approximately the same size.

Going forward, we expect the dividend will remain well covered and the supplemental dividend will likely be extended. Going into Q1 2023, with the Fed continuing to hike aggressively, we could see the supplemental dividend raised.

On the other hand, ACRE is clearly taking a more defensive position – maintaining significant liquidity and being more selective in originations. With credit spreads wider, new originations should have higher returns than the investments that are being paid off.

The bottom line is that the Fed has scared the credit markets. The fear is that the Fed is likely to overshoot and will cause a recession. So we’re seeing lenders like ACRE preparing for that risk. After all, there’s plenty of cash flow in lower-risk investments today.

Pick #2: BRSP – Yield 11%

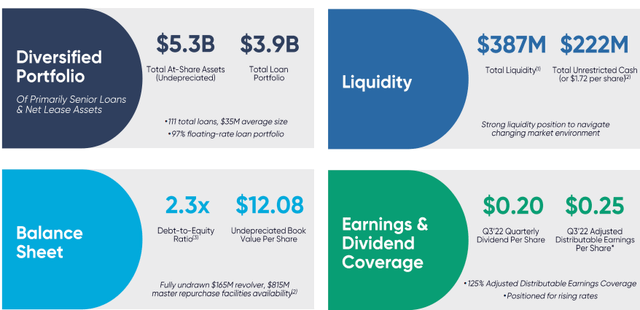

BrightSpire Capital (BRSP) had distributable earnings of $0.25. Covering its $0.20 dividend by 125%. Despite this great coverage, BRSP trades at an enormous 38% discount to undepreciated book value. (Source: BrightSpire Q3 2022 Supplement)

BrightSpire Q3 2022 Supplement

Perhaps it was the Fed meeting the day earnings were released, but the market remained tepid on the share price throughout the day despite such strong earnings.

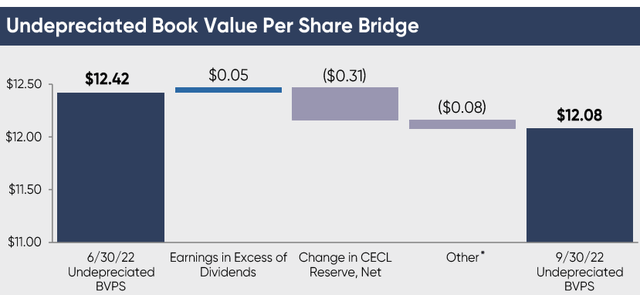

The only blemish on earnings was a sizable CECL (Current Expected Credit Loss) Reserve relating to two office properties on Long Island, New York. This is a non-cash charge that impacted book value.

BrightSpire Q3 2022 Supplement

CECL is a new accounting standard for reflecting credit risk that stems from the perceived inadequacy of disclosure during the Great Financial Crisis. Under the prior standard, credit losses were not recognized until the borrower stopped paying or were just assumed to be similar to what they were in the past. When you’re driving in the rearview mirror, eventually, you will crash, and that’s what happened in the GFC. Many argued that many of the credit problems were foreseeable but inadequately disclosed. The CECL standard is the result.

CECL seeks to be more proactive, reflecting the negative impact when risk increases and the company identifies a problem even if cash is still flowing from the loan. Companies are required to use forward-looking models that take into account macro data as well as company-specific risks. CECL hasn’t been around long enough to know how accurate it is, but it’s certainly more proactive than earlier procedures.

BRSP reports a “general” CECL, which is based on the model’s predictions of credit losses, and a property-specific CECL which is based on known problems with specific properties. In Q3, the two office property loans in Long Island were impaired. BRSP is working with the borrowers, but the resolution is uncertain.

Thanks to CECL, we can see the potential negative impact already in book value. There’s some potential positive upside like we saw with Apollo Commercial (ARI), which reversed a specific CECL reserve when the property was sold for a recovery. We wouldn’t count on it. We would assume the currently reflected loss, meaning that BRSP is trading at a valuation of a 38% discount to book value, assuming the loss on these properties. I think we can say that this issue is “priced in.” It’s worth noting that these loans originated in 2019 before current management took over and Colony was removed as manager of the company. So we don’t see this issue as a red flag for underwriting quality.

BRSP’s management continues to build a high-quality portfolio, and Michael Mazzei made no secret of his view of the risks in the market.

With single-family mortgage rates recently hitting a 20-year high over 7% and we like others are concerned the Fed has a bias to overshooting the mark and dealing with the consequences later.

Given this backdrop, BrightSpire expects the first half of 2023 to remain challenging. More presently, over the course of 2022, BrightSpire has been preparing for the impact of rising rates and the current risk-off investment environment. To this end, we have been throttling back our loan originations and maintaining higher cash balances.

This is a very different tone from last year when BRSP was focused on originating loans as quickly as possible. Even without expanding the balance sheet, BRSP will continue to experience earnings growth with rising rates.

BrightSpire Q3 2022 Supplement

BRSP has become a much more conservative company since its time as Colony Credit. It focuses on senior loans, multi-family, and management has been proactive in preparing for changes in macro conditions.

It’s trading at an enormous discount to NAV, outearning its dividend, and likely to continue seeing earnings growth, even while pursuing a conservative strategy. In our opinion, BRSP is currently the best opportunity in the Commercial mREIT space.

Dreamstime

Conclusion

There’s an age-old tale of a ship caught in a terrible storm. The mariners were running about in fear and panic. The storm was so sudden, so strong, and so swift that it was surely going to capsize their boat!

They were throwing items off the boat to lighten the load, helping it sit higher in the water and avoid waves crashing over the top of it.

They were crying out in panic to their deities, begging for salvation from the storm.

All along, a man slept soundly in the hull of the ship. Completely unphased, unafraid, and unconcerned, he was sound asleep.

They came and shook him awake. How could he be asleep at a time like this?!

It’s because he was invested in BRSP and ACRE, his income was flowing into his account, and he need not fret about the storms others were worried about – just kidding. You can look up the tale to see why he was sleeping.

With BRSP and ACRE, you can layer additional income into your portfolio. Weaving it and combining it with your other income investments to create a blanket of comfort which will allow you to rest your weary mind and soul when the storms of life are raging all around you.

So much in this life is designed to create fear, worry, and panic. Often it’s done in order to sell you a solution to the fear they generated in you! Instead, let the income from the market allow you to take a step back and give you breathing space to evaluate the situation with a clear mind and level head.

You’ll be thankful you did. you’ll be thankful you can. You’ll be a believer in the Income Method.

Be the first to comment