spooh

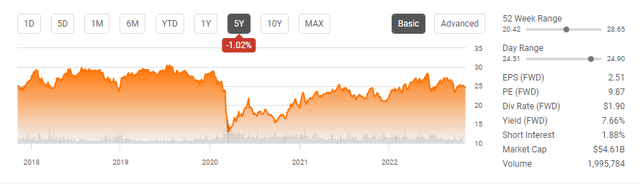

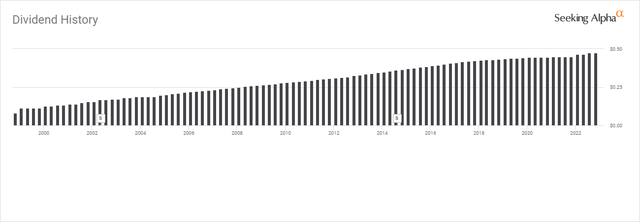

One of the most common aspects income investors look for in an investment is stability. No matter what the macro challenges are or the economic environment, income investors want dependable income-producing assets that generate continuous streams of dividends. Enterprise Products Partners (NYSE:EPD) may not trade at the cheapest valuation of its peer group or have the largest yield on its distributions, but when it comes to reliable income generation, EPD should be looked at as old faithful. Few companies have paid dividends consecutively for a decade, and even fewer have created a track record that exceeds 2 decades. EPD is synonymous with returning capital to shareholders, as they have distributed cash to their unitholders over the course of 24 years through annualized increased distributions. EPD just reported Q3 earnings, and once again, EPD has proved this is a reliable income-producing investment that can overcome adversity and deliver for its unitholders.

Seeking Alpha

Throughout the pandemic, a rising rate environment, and inflation not seen in 4 decades, EPD continues to deliver high single-digit yielding distributions.

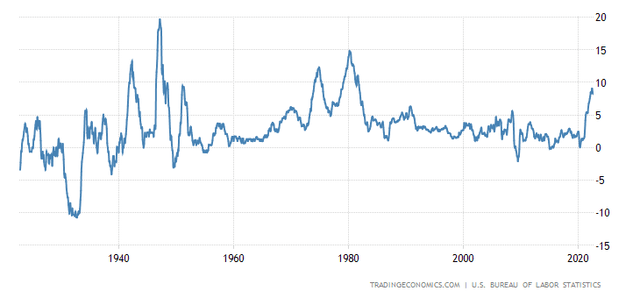

There is a group of investors today that have never lived through an inflationary environment that exceeded 5%. You would need to look back to the early 80s to see an inflationary environment that matched today’s levels. Looking back at the past 2 decades, companies have operated through the financial crisis, the mortgage crisis, commodity cycles where oil exceeded $100 per barrel, the pandemic, and now a rising rate environment. There hasn’t been an extended period where everything just clicked, and it was smooth sailing. There are always obstacles companies must face and adversity to overcome. Investors are no longer in a yield-starved environment, and banks such as SoFi Technologies (SOFI) offer 3% APY on savings accounts and 2.5% APY on checking balances when you’re a direct deposit member. As rates rise and banks can offer yields that mimic many Dividend Aristocrats, investments that have stood the test of time, offering higher yields and increasing payouts, are becoming more desired. Throughout every crisis over the past 24 years, EPD hasn’t just paid a quarterly distribution; it’s consecutively raised its distribution for 24 years. EPD has been considered a top-tier income play in the oil patch and has proven its reliability time and time again.

Inflation

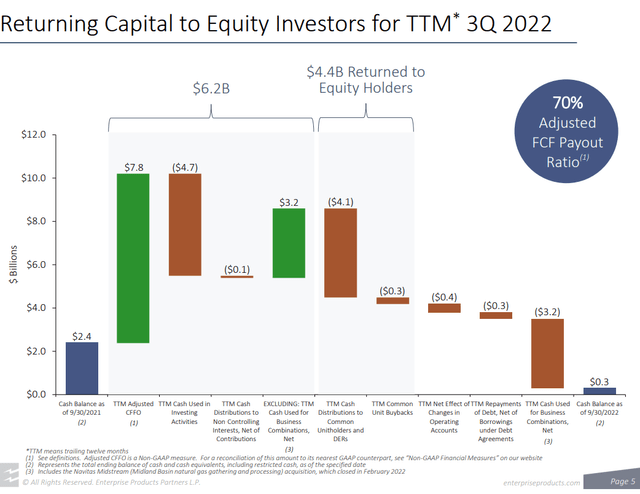

On 11/14/22, EPD is set to pay its next quarterly distribution of $0.475 per unit which is an increase of 5.6% compared to its Q3 2021 distribution. EPD pays an annualized distribution of $1.90 per unit, which is a forward yield of 7.68%. Since EPD’s IPO, they have provided 24 years of consecutive distributions and returned $46.2 billion of capital through distributions and buybacks to its shareholders. EPD implemented a buyback program in 2019 and has repurchased 5.3 million units for $130 million YTD in 2022.

In Q3 2022, EPD generated $1.87 billion in distributable cash flow (DCF), and retained $826 million of excess DCF after its distributions were paid. EPD operated at a 1.8x DCF coverage ratio, allowing over ¾’s of a billion dollars to be reinvested into EPD, lowering its debt, and buying back units. EPD has $5.5 billion of organic growth projects under construction, which should solidify EPD’s future while replicating its past. EPD has created a reliable track record and established a level of trust with its investors that their quarterly distributions will be paid like clockwork. Regardless of what happens with inflation, or rising rates, EPD’s distribution provides a large level of cash that many other investments simply cannot replicate efficiently. EPD is a quintessential income-producing investment that can find a place in any income investor’s portfolio.

Seeking Alpha

There was a lot to be excited about from Q3, even if the market isn’t ecstatic

Shares of EPD are relatively flat for the week, as a solid earnings report hasn’t been enough to move the needle. EPD came in with a 42.8% YoY revenue increase of $15.46 billion which was $1.64 billion ahead of the consensus estimate on the street. I had a feeling the major energy infrastructure companies would see revenues increase due to production levels increasing from the oil majors. I had written an article earlier in the week about why I thought Energy Transfer (ET) would produce strong earnings and cited that Exxon Mobil (XOM) just reported their most lucrative quarter as Q3 net income totaled $19.66 billion. XOM saw a 52% YoY Q3 revenue increase from $73.78 billion to $112.07 billion as its production totaled 3.7M boe/day. Chevron (CVX) also reported a 49% YoY increase in revenue as they reported $66.64 billion in Q3. CVX’s net liquid production increased by 49 MB/D, net natural gas oil-equivalent production increased by 49 MB/D YoY. As upstream production increases, more capacity through energy infrastructure systems such as EPD’s will be needed.

EPD delivered net income attributable to common unitholders of $1.4 billion, or $0.62 per unit on a fully diluted basis, for the third quarter of 2022, compared to $1.2 billion. Their DCF increased 16% to $1.9 billion, and its adjusted cash flow by operating activities (CFFO) came in at $2 billion compared to $1.7 billion in Q3 of 2021. This was supported by across-the-board volume increases throughout their infrastructure. Crude pipeline volumes increased by 6.35% YoY while marine terminal volumes increased 13.33%, natural gas pipeline volume increased 19.86%, NGL fractionation increased 7.69%, Propylene plant production increased 5.21%, fee-based natural gas processing increased 30%, and equity NGL-equivalent production increased 21.33%. EPD achieved a record of 11.3 million bpd/e of NGLs, crude oil, natural gas, refined products, and petrochemicals being transported during Q3. On the natural gas side, EPD’s pipelines transported a record 17.5 trillion Btus per day. EPD’s strong results were positively impacted by increased activity, and with the demand for reliable energy sources increasing, I am speculating that EPD will deliver a string of future quarterly results that mimic Q3 2022.

EPD is growing organically and making all of the right capital investments to support not just growth but the growing demand for energy. EPD’s capital investments throughout Q3 were $474 million, which includes $397 million for organic growth capital projects and 77 million for sustaining capital expenditures. EPD has a backlog of $5.5 billion worth of growth projects under construction. EPD has a busy year ahead of them as 3 major NGL projects, 2 natural gas projects, and 2 petrochemical & refined products projects are expected to come online in 2023. EPD has 2 projects that are expected to come online in 2024 and 3 that are projected to come online in 2025. I am quite bullish that these projects will increase capacity and generate new fee-based and fixed contracts, which will drive revenue to the top line while increasing the DCF which is distributed to unitholders. EPD has a remarkable track record of rewarding its investors, and its slate of growth projects should ensure that its current trends remain intact.

Enterprise Products Partners

How EPD’s valuation looks compared to its peers.

EPD isn’t the cheapest valued energy infrastructure company, but its current valuation is more than fair for income investors looking for a high-yielding cash cow to increase their stream of income. So far, EPD and ET have reported, and I will continue to adjust these figures as more companies report. I will compare EPD to the following companies:

- Energy Transfer (ET)

- MPLX LP (MPLX)

- Kinder Morgan (KMI)

- Plains All American Pipeline (PAA)

- Williams Companies (WMB)

- Targa Resources (TRGP)

- Magellan Midstream Partners (MMP)

- ONEOK (OKE)

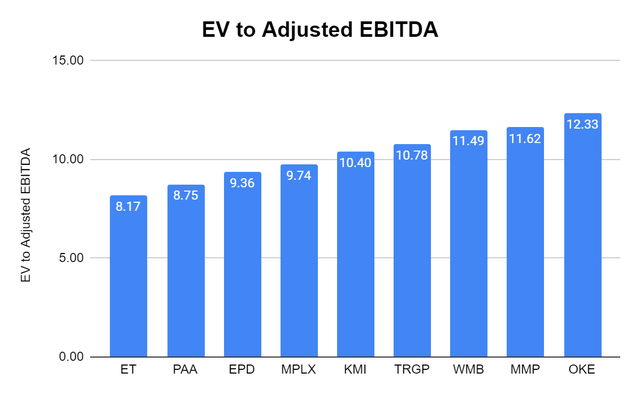

The EV/EBITDA metric is a popular valuation tool that helps investors compare companies as EV calculates a company’s total value or assessed worth, while EBITDA measures a company’s overall financial performance and profitability. The average EV to Adjusted EBITDA level across the peer group is 10.3x, and EPD trades at a tighter valuation of 9.36x, indicating that there is some room for its unit price to appreciate compared to how the rest of the peer group is being valued.

Steven Fiorillo, Seeking Alpha

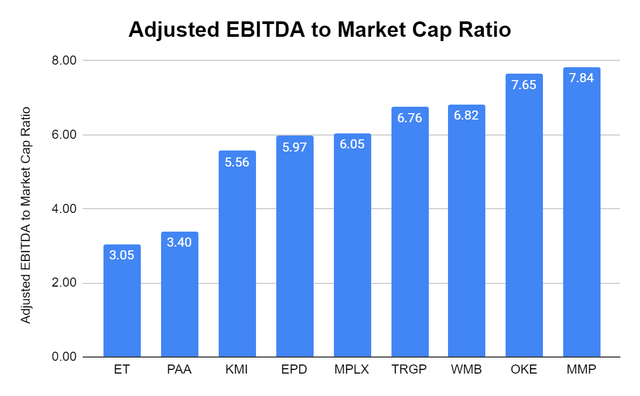

I am a strong believer in looking at the Adjusted EBITDA to market cap ratio because Adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) basically tells you how much cash is left over after paying the business operating costs, excluding one-time charges. I want to see how much I would be paying for a midstream operator’s Adjusted EBITDA. EPD has a 5.97x Adjusted EBITDA to market cap ratio, which is slightly higher than the peer group average of 5.9x. EPD is significantly more attractive by this metric than many of its popular peers, and paying slightly above the peer group average for what many believe is the gold standard isn’t unreasonable, in my opinion.

Steven Fiorillo, Seeking Alpha

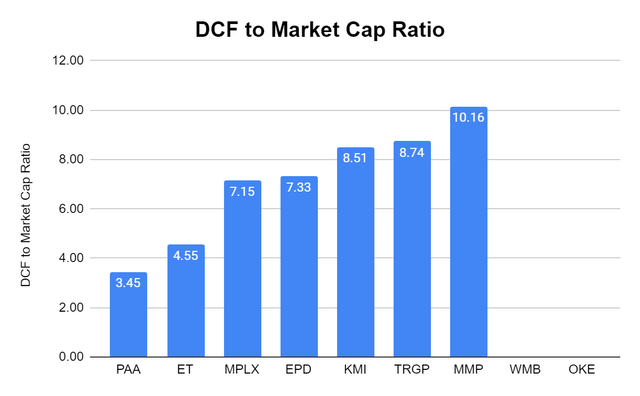

I always want to know how much I am paying for an energy infrastructure’s DCF. I look at the DCF to market cap ratio because DCF is the pool of capital distributions are paid from. I want to make sure I am paying a fair price. WMB and OKE doesn’t report DCF, so these numbers are blank. The range Mr. Market has valued their DCF at from the remaining companies is 3.45x to 10.16x. I have felt that 3.45x and 4.55x for ET are far too low. When I look at EPD, I have to consider my feelings toward ET and PAA, then look at the rest of the group. EPD trades at a 7.33x DCF to market cap ratio, and I feel this is more than fair as the peer group average is 7.13x when I include ET and PAA. When I take them out, the average from MPLX, EPD, KMI, TRGP, and MMP is 8.38x which EPD is significantly under.

Steven Fiorillo, Seeking Alpha

Conclusion

EPD has been a steady income investment for many investors over the years. At the same time, EPD’s performance is -1.02% over the past 5 years, it’s been a reliable income generator, paying $8.08 in distributions since Q3 of 2018, which is 32.17% of its $25.11 unit price on 11/3/18. EPD isn’t likely to become a large capital appreciator anytime soon, but the distribution is well covered and is likely to grow YoY. EPD is an income investor’s dream in any operating environment as it produces a high single-digit yield, with a large backlog of projects to drive revenue and DCF higher. I think the energy landscape is setting up well for EPD as its infrastructure will be well in demand for years to come, making this a solid income investment well into the future.

Be the first to comment