Dilok Klaisataporn/iStock via Getty Images

The Invesco Senior Loan ETF (NYSEARCA:BKLN) gives investors a convenient way to invest in a basket of senior loans that should benefit from rising interest rates. However, we currently have a situation where widening credit spreads are offsetting the benefit from increased interest rates. Hence, YTD, the fund has delivered mediocre performance. As I don’t see this dynamic changing in the near term, I would recommend investors stay away from the fund.

Fund Overview

The Invesco Senior Loan ETF gives investors a simple and convenient way to invest in senior secured leveraged bank loans, which are floating rate instruments. The fund is among the largest in this category, with $4.2 billion in assets.

Strategy

The BKLN ETF’s strategy is to track the investment results of the Morningstar LSTA US Leveraged Loan 100 Index (“Index”, author’s note, the index provider was switched from S&P to Morningstar on August 29th, 2022, although the underlying index methodology remains unchanged). The Index is a passive investment index that tracks the market value weighted performance of the largest institutional leveraged loans. To be included in the Index, leveraged loans must be senior secured, denominated in USD, and have a minimum initial term of 1 year and $50 million par value.

As leveraged loans are floating rate instruments with interest payments that rise and fall along with short-term interest rates, the BKLN ETF should theoretically benefit from interest rate increases.

Portfolio Holdings

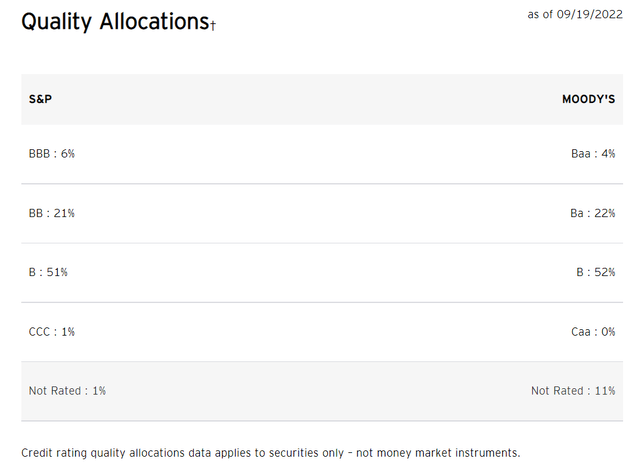

The BKLN portfolio currently has 137 holdings, including money market instruments. Figure 1 shows the portfolio breakdown by credit quality. We can see that the BKLN portfolio is predominantly non-investment grade loans, with only 6% rated investment grade by S&P. Approximately 70% of the portfolio is rated BB or B.

Figure 1 – BKLN portfolio by credit quality (invesco.com)

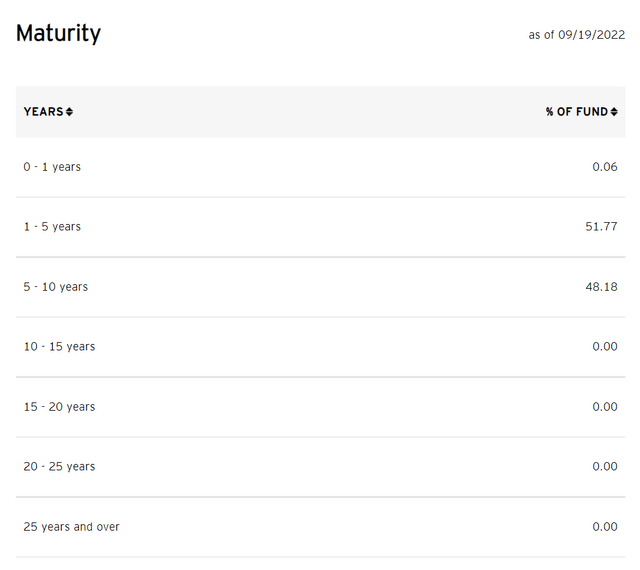

Figure 2 shows the portfolio by maturity. Consistent with the loans market, the fund’s holdings are predominantly short to medium term, with no maturities beyond 10 years.

Figure 2 – BKLN portfolio by maturity (invesco.com)

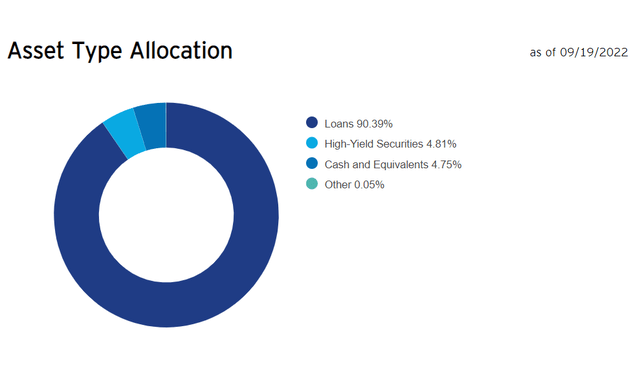

Finally, in Figure 3, we see the portfolio currently consists of 90% floating rate loans, 5% high yield bonds, and 5% cash.

Figure 3 – BKLN portfolio by asset type (invesco.com)

Returns

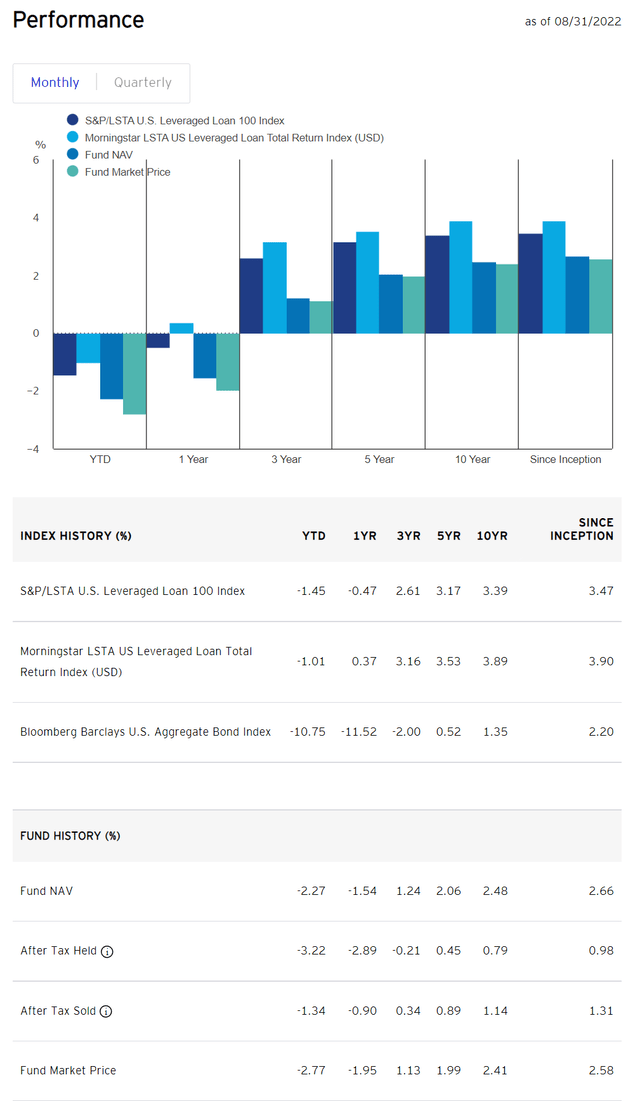

The BKLN ETF’s performance has been mediocre, especially when compared to the underlying index. We can see the fund has delivered 3/5/10 yr annual returns of 1.2%/2.1%/2.5% respectively, significantly underperforming the LSTA US Leveraged Loan 100 Index’s 2.6%/3.2%/3.4% returns in the same time frame. The underperformance is greater than the management fee of 0.65%, so there must also be consistent negative security selection or other reasons for the underperformance.

Figure 4 – BKLN returns (invesco.com)

Distribution & Yield

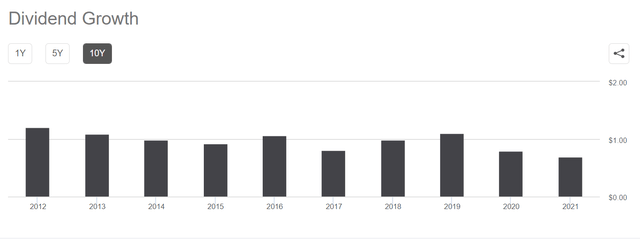

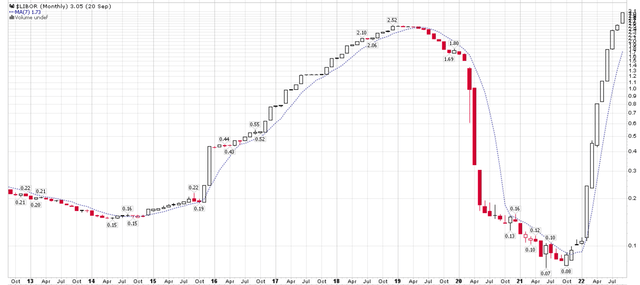

The BKLN ETF pays a moderately high distribution, with an LTM yield of 3.7%. Investors should note that the fund’s distribution is inconsistent (Figure 5), although it generally follows the trend of short-term interest rate benchmarks like LIBOR (Figure 6).

Figure 5 – BKLN annual distributions are variable (Seeking Alpha)

Figure 6 – 1month LIBOR rates (stockcharts.com)

YTD, BKLN’s distribution has been increasing from $0.0573/month ($0.688 annualized) in January to $0.0866/month (or $1.039 annualized) in August.

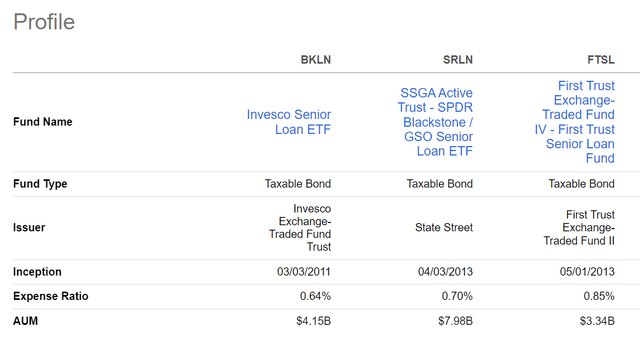

Fees

The fund charges an expensive 0.65% expense ratio, which is more than 25% of its 10-year average annual net returns of 2.5%. This is especially galling since the strategy is a passive investment strategy tracking a market value weighted index of loans. However, relative to peer floating rate loan funds, the expense ratio is in line.

Figure 7 – Senior loan ETFs charge high fees (Seeking Alpha)

Why Are Total Returns Negative This Year?

Sharp-eyed readers will notice that BKLN’s strategy should benefit from rising interest rates, since it primarily owns floating rate senior loans. However, from Figure 4, we see that the fund has actually generated negative total returns of -2.3% YTD to August 31, so what is going on?

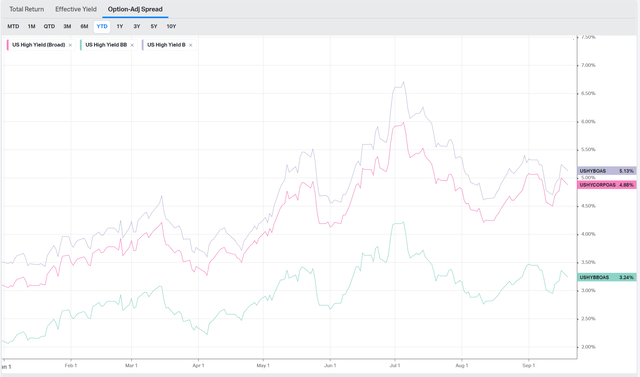

Although BKLN has benefited from the rise in short-term interest rates (see the increase in its distribution), it has also suffered from a widening of credit spreads. From Figure 8 below, we see that BB credit spreads have widened from 2.1% to 3.2% YTD, while B credit spreads have widened from 3.5% to 5.1%.

Figure 8 – credit spreads have widened (koyfin.com)

The benefit from higher floating rate benchmarks like LIBOR have been more than offset by a widening in credit spreads, causing YTD total returns to be negative.

BKLN Needs Specific Circumstances To Outperform

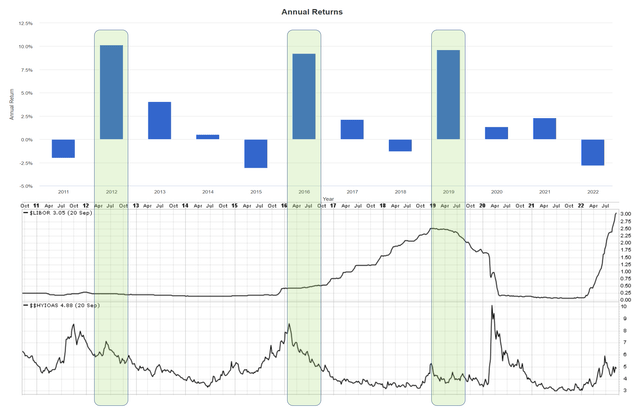

In fact, if we go back and look at BKLN’s historical performance, we see that the fund only delivered solid performance in 3 of the past 11 years (2012, 2016, 2019). Looking at the key drivers of BKLN performance, we see that the fund requires tightening credit spreads (2012 and 2016), or high LIBOR rates with benign credit (2019) to outperform. Aside from these specific cases, the fund’s performance is mediocre at best.

Figure 9 – BKLN performance relative to LIBOR and HY Credit Spreads (Author created with returns from Portfolio Visualizer and price chart from stockcharts.com)

Currently, although we have high LIBOR rates, we also have widening credit spreads, which have led to poor performance.

Conclusion

In conclusion, the Invesco Senior Loan ETF gives investors a convenient way to invest in a basket of senior loans that should benefit from rising interest rates. But if we study historical periods, we see that the fund requires specific circumstances to deliver strong returns. Currently, we have widening credit spreads offsetting the benefit from increased interest rates. As I do not foresee this push/pull dynamic changing in the near term, I would recommend investors stay away from BKLN.

Be the first to comment