xavierarnau

We have been bullish on Triton International (NYSE:TRTN) for quite some time now, initially buying the stock back in May of 2021 for just under $50 per share. Our investment case has been based on Triton’s multi-year leases attached to its containers, whose hefty profit margins should keep generating record net income levels for the company for several years ahead.

Combined with Triton’s shares consistently trading at a notable discount, along with management’s opportunistic buybacks, we believe that shares of Triton offer fantastic shareholder value creation prospects at a wide margin of safety.

The company’s latest results surprised us positively. While we expected that the company’s top and bottom lines would come in very strong and that the dividend would be increased, it was pleasing to see that Triton has been accelerating its share repurchases. This should create fantastic value for shareholders, especially with the stock trading at a P/E in the mid-single digits.

Latest Developments, Q3 Results, The Market

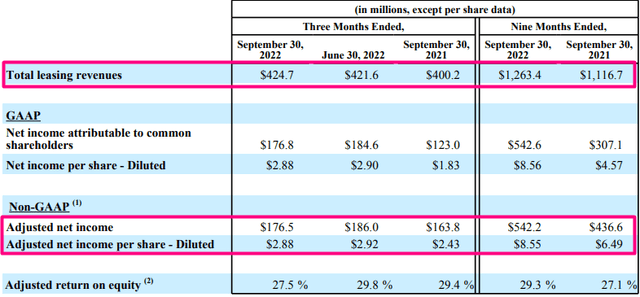

Triton’s Q3 results were quite strong, beating consensus adjusted earnings per share estimates once more. Revenues rose 6.1% to $424.7 million, while adjusted net income came in at $176.5 million or $2.88 per diluted share. This indicates a year-over-year increase of 7.8% and 18.5%, respectively. The significantly higher growth on a per-share basis was due to Triton’s aggressive buybacks (more on that later) over the past four quarters.

Triton International Q3 Performance (Q3 Results)

Following Triton expanding its asset base by 30% last year and fixing these new containers under leases that exceeded a decade in length, the company’s container utilization continues to hover at exceptional rates. It was 99.1% in Q3.

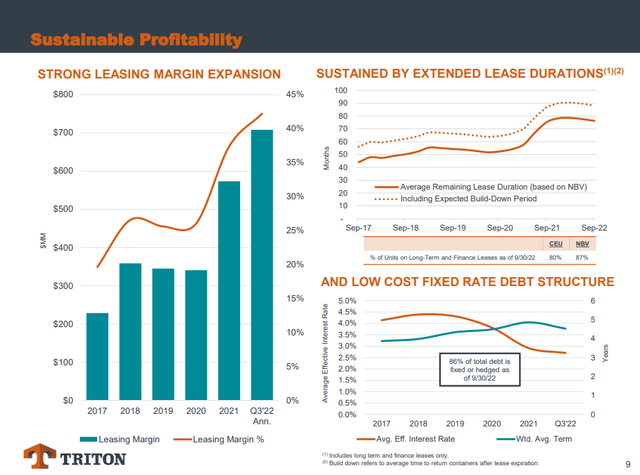

As you can see in the top right graph, Triton’s remaining lease duration is currently standing just under 80 months (around 6.5 years). And if we include the typical time it takes for a client to redeliver containers after their lease expires, the average duration approaches 90 months.

Sustainable Profitability (Q3 Presentation)

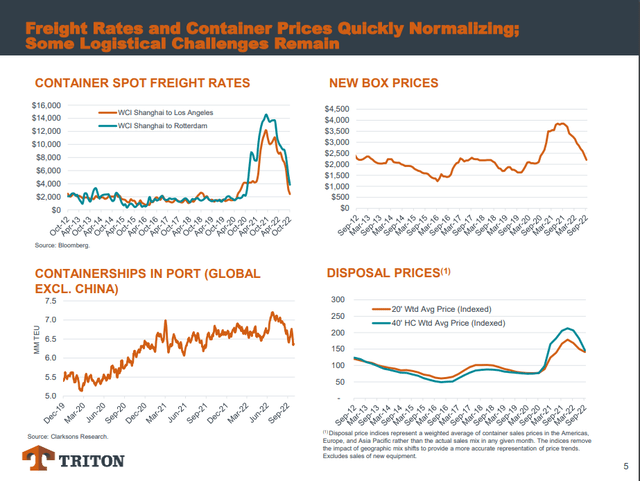

Hence, Triton’s outstanding cash flow visibility and sky-high leasing margins should last for quite some time in spite of the underlying conditions in the container market. This is important to note, as some investors may be intimidated by container spot freight rates plummeting, thinking Triton’s record profitability is only temporary.

Freight Rates and Container Prices (Investor Presentation)

However, backed by the company’s secured multi-year leases, Triton’s record profitability levels are not a transient theme but are set to endure over the medium term.

Dividends and Repurchases To Drive Shareholder Value Creation

With management feeling comfortable about the company’s forward-looking net income prospects, the dividend was raised once again. This time, by 7.7% to a quarterly rate of $0.70 – the seventh consecutive annual dividend hike.

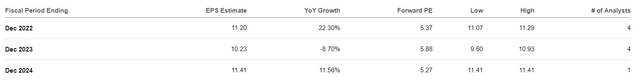

And yet, the company should have enough room to continue growing the dividend moving forward. Specifically, based on the company’s year-to-date results and current lease profile, Triton should achieve earnings-per-share close to $11.20 for fiscal 2022. This implies a healthy payout ratio of just 25%.

Management mentioned that earnings-per-share is likely to decline slightly in Q4, mainly due to used container sale prices decreasing from their recent, extremely high levels. However, this is already priced into the above estimate, and again, results should overall remain near their current record levels for several years to come.

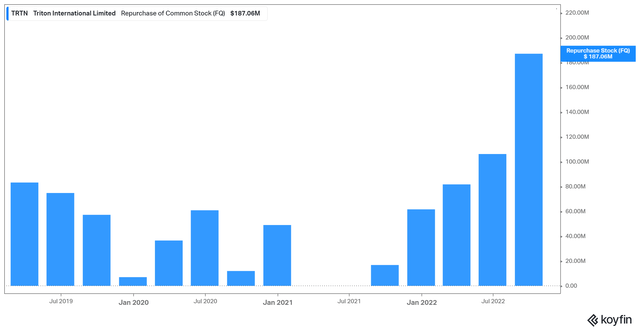

In fact, earnings-per-share should continue to grow at least in the mid-to-high single digits in the coming years, backed by Triton’s aggressive buybacks. Since the start of the year, Triton has repurchased 7.1 million shares, or 10.8% of its outstanding shares, while decreasing its leverage.

In fact, the pace of buybacks has been accelerating, which is a very shareholder-friendly move, as management recognizes that repurchases are going to be super accretive at the stock’s current valuation. Based on Q3’s buyback run rate, Triton could be repurchasing as much as 20% of its own stock per year at its current market cap.

Triton’s Share Repurchases (Koyfin)

Again, the core leasing business is running on autopilot. Thus, the best management can do is opportunistically buy back their own stock. Management reiterated that their focus would remain on buybacks in the Q3 report and extended the share repurchase program, once again, back to $200 million.

Regarding the stock’s valuation, note that besides the P/E of 5.4 implying a significant discount based on the company’s medium-term net income prospects, analysts are expecting earnings-per-share to decline by around 9% next year. However, we find this highly unlikely, as earnings-per-share is set to grow driven by the company’s share repurchases, let alone decline. We saw this outcome in this quarter’s results, with adjusted earnings-per-share growth exceeding adjusted net income growth by 1070 basis points.

If the company remains as undervalued as it is now over the next year and management goes on to repurchase 15%-20% of Triton’s outstanding shares, the stock could be setting up for a major breakout. For this reason, as we have mentioned in the past, we are low-key pleased Triton continues to trade at such cheap multiples, as repurchases can be incredibly accretive to earnings-per-share, which will ultimately sizably boost Triton’s total return prospects over the long run.

In the meantime, however, we are happy to be holding such a quality company and receiving the 4.7% yield. We reiterate our Strong Buy rating.

Be the first to comment