We Are

Investment thesis

Owl Rock Capital Corporation (NYSE:ORCC) is the third largest BDC among the 48 publicly traded business development companies. The management introduced a new shareholder-friendly dividend policy based on the original policy established in 2019. From now on there will be a regular and a supplemental dividend in every quarter starting from the fourth quarter of 2022. This might attract more income investors because the management’s previous dividend promises have been kept and with the new policy the forward yield is above 11%. The company also reported great third quarter results and I expect them to continue on this path until the interest rates keep increasing. The slight undervaluation of the stock could also attract investors who want to get exposure to a larger-cap BDC at a fair price.

Dividend policy

Since the company’s IPO in 2019, the management has been paying consecutive dividends. From the beginning, the management tries to implement a stable dividend policy and also builds up its credibility as a dividend-friendly company for income investors. When they started to pay dividends in the third quarter of 2019 as a public company they laid out a plan for the next year and a half for dividends. They swapped the only floating rate dividends to regular plus floating rate dividends. The regular dividend was set at $0.31 per share and the floating rate dividend was announced and accepted by the board.

Quarterly Earnings Presentation Q2 2019

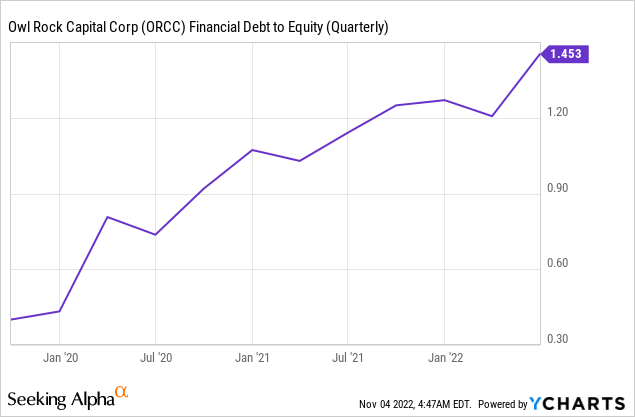

Why is this important? Because investors could have seen that the management has been able to keep its promises and stick to the previously promoted dividend plan. It takes years to build up credibility and within a quarter any credibility can be destroyed. Income investors can feel now that the management is capable of executing its dividend plans. The management even kept its dividend in the turbulent times of 2020 when earnings dropped and the payout ratio skyrocketed for a short period. On one hand, it is good news because investors can make sure the management keeps its dividend promises. On the other hand, it also means that the management is focusing too much on dividends and even in a problematic situation they rather dilute the shares or ramp up the leverage which could be worse for investors in the long term, than a couple of quarters with a lower dividend.

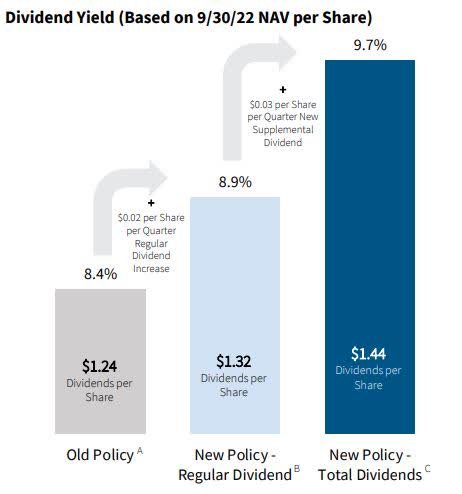

New dividend

A couple of days ago income investors of ORCC received good news. The management decided to increase the regular dividend by $0.02 per share to $0.33 per share quarterly. It is a 6.5% dividend increase which is close to the current inflation levels (with the special dividend included it is higher) so ORCC investors could hedge the inflation by keeping their stake in the company. In addition, the supplemental dividend has been reinstated after a year and a half. The special variable dividend will be the wiggle room for the management if things turn bad. They will only need to “cut” the supplemental dividend but keep the regular one to continue to build credibility in times of business difficulties.

Quarterly Earnings Presentation Q3 2022

Moreover, the goal of the management is that ORCC shareholders could receive a dividend 8 times a year (4 regular and 4 supplemental dividends). The calculation of the special dividend is the following: “The supplemental dividend will be variable each quarter, calculated at 50% of NII in excess of our regular dividend, rounded to the nearest penny, and subject to certain measurement tests.” In practice, it looks like this: The NII for the fourth quarter is expected to be $0.40 per share and the regular dividend is $0.33 per share. The difference between them is $0.07 per share, this number needs to be divided by two and rounded to the nearest penny. So if this will be the case investors can expect a $0.04 supplemental dividend for the first quarter of 2023.

Craig Packer – CEO said: “…we are excited to take this step today to raise our dividend, which we believe we can comfortably cover going forward. And in light of ORCC’s earnings trajectory, we think the addition of the supplemental dividend enhances our distribution profile while leaving us the flexibility to evaluate further increases in a regular dividend if performance warrants it.”

Owl Rock Capital third quarter earnings results

In the third quarter, they reported a NAV of $14.85 per share, up by 2.5% Q-o-Q and down by 0.7% Y-o-Y. When the company went public, the NAV per share was $15.28 so investors experienced a net asset value decline of approximately 3% so far. The NII ($0.37 per share) was up by 15.6% compared to the previous quarter. The management has been very active in lending, within 3 years they doubled the number of portfolio companies from 90 in the second quarter of 2019 to 180 by the end of the third quarter of 2022. The management has been using leverage as much as possible, since the Small Business Credit Availability Act in 2018. They have been raising their debts since the IPO relatively aggressively.

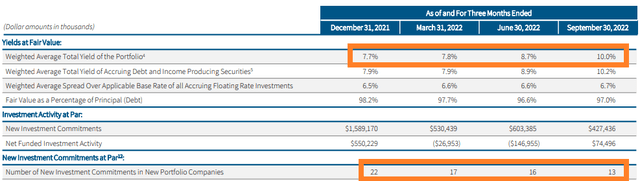

Let’s have a look at what investors can expect in the future from ORCC. The main focus will be on interest rate changes in the next 6-9 months. This will be beneficial for the company and investors. As we could have seen the average yield of the portfolio grew by 2.3% since the start of the rise of the base rate. In the second quarter, there was a 125 basis point interest rate increase and in the third quarter, there was a 150 basis point increase. Looking at the changes, we can see that the 125 basis point rise increased the portfolio yield by 0.9% and the third quarter 150 basis point rise increased the portfolio yield by 1.3%. In the fourth quarter, the Fed has already made a 75 basis point interest rate increase, and for December analysts expect a 50 basis point increase. This will very likely translate to another 0.9% portfolio yield increase for ORCC in the fourth quarter and smaller 0.2-0.4% increases in the first half of 2023 as long as the Fed will keep increasing the base rate. This is due to the company’s 98% floating rate loan portfolio. So I expect the portfolio yield to grow to approximately 11.3-11.5% by the end of the second quarter in 2023.

Quarterly Earnings Presentation Q3 2022

At the same time, this yield growth is also growing the NII. Based on the rate of interest increases for the fourth quarter and the portfolio yield growth I expect an NII of $0.39- $0.40 for the fourth quarter and around $0.4-$0.41 NII during the first half of 2023. The downside of the rapid interest rate increases is loan origination. Both the new investment fundings and the number of new portfolio companies ORCC invests in have dramatically decreased compared to the previous quarters. Year-on-year the new investment funding has dropped by 85% and I expect this trend to continue as long as the interest rates keep climbing. The number of new portfolio companies has also been slowly decreasing (-41% Y-o-Y and down by 19% Q-o-Q).

Due to the vast number of portfolio companies and the relatively large market capitalization among BDCs the main risk is not that the portfolio companies might go bust. There is a 2% unsecured loan part in the current portfolio, this could cause some trouble but not a massive issue. The risk lies with the management and its dual interests. ORCC is just one part of Blue Owl (OWL), the CEO of ORCC is also a board member of OWL. The conflict of interest comes from the fee structure and shareholder interests. OWL shareholders receive a fixed fee over AUM, the bigger the AUM, the better. And the main interest is to grow AUM regardless of performance. However, ORCC shareholders’ priority is to minimize fees, maintain share price and NAV, and receive a stable dividend. This has not led to problems yet, but in the future, there might be some issues due to this conflict of interest.

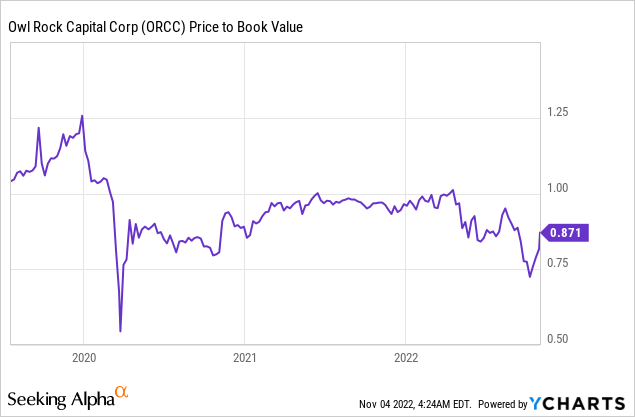

ORCC stock valuation

The company is slightly undervalued based on traditional valuation metrics. It is trading approximately 13% below its book value. It is below its average since the IPO, the average price-to-book ratio is approximately 0.95x. Its earnings multiple is below its 3-year average by 10%. It is not a surprise as the earnings grew in the last quarter but the price has been declining since April and only started to recover in the last month.

The company is trading at a dividend yield of 9.83%. However, if we include the supplemental dividends as well, the dividend yield is above 11%. This is in the top 10% of dividend yields in the last 3 years so it could be an ideal opportunity for income investors.

Summary

Due to the new dividend policy and the interest rate increases, ORCC might be a great choice for income investors who want to get exposure only to large market-cap BDCs. The above 11% dividend yield is attractive, the management has kept its dividend promises previously and the investment portfolio is well diversified. The only problem is the conflict of interest that I am a bit concerned about. However, the NII will very likely grow in the next 6-9 months and I expect the company to deliver good results. What do you think?

Be the first to comment