xijian/E+ via Getty Images

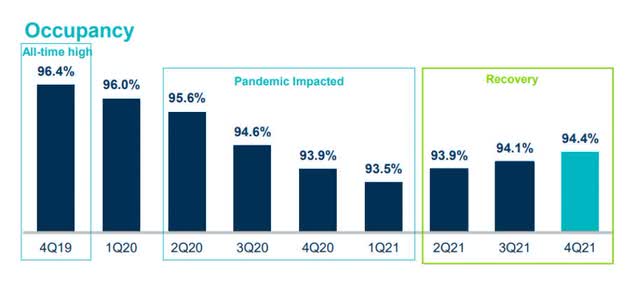

Kimco Realty Corporation (NYSE:KIM) is benefiting from the real estate sector’s and the trust’s portfolio’s recovering fundamentals. In the fourth quarter, occupancy rates improved for the third quarter in a row, indicating additional potential for net operating income and dividend growth.

In 2020, the real estate investment trust adjusted its payout, but the recovery is real and sustainable, and investors may soon see a higher dividend.

I previously discussed Kimco Realty’s investment case here, and I now like the stock even more as the recovery continues and the trust’s pay-out ratio remains very conservative.

Portfolio Recovery Is Ongoing

The dividend cut by Kimco Realty in 2020 was precipitated by the coronavirus outbreak, which threw the entire real estate industry into disarray. The dividend of the real estate investment trust was reduced from $1.12 per share in 2019 to $0.82 per share in 2020, but it has since begun to grow again. The dividend increase, which has risen from $0.10 per share to $0.19 per share (quarterly), is currently being supported by strong underlying recovery trends in Kimco Realty’s shopping center portfolio. Increasing portfolio occupancy primarily explains the trust’s growing confidence in its ability to support a higher dividend in the future.

In the fourth quarter of 2021, Kimco Realty saw its third quarter in a row of portfolio occupancy growth, indicating that the trust no longer has to worry about tenants being unable to pay their rents. Simply put, the worst is over for Kimco Realty, and the REIT can now focus on capitalizing on its recovery trend.

The trust’s portfolio occupancy rate increased to 94.4% in the fourth quarter, up from 94.1% the previous quarter. The trust’s current portfolio occupancy rate is only 2.0% lower than its all-time high of 96.4%.

Occupancy Rates (Kimco Realty Corp)

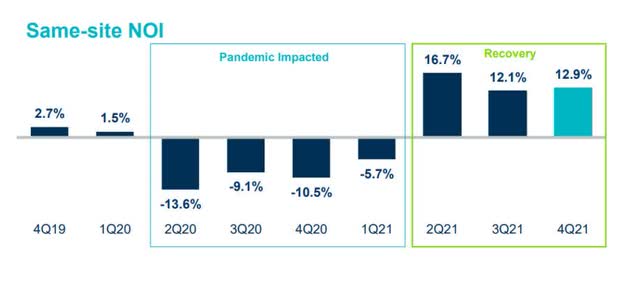

The recovery of the trust’s occupancy rate is a prerequisite for higher net operating income. Net operating income, or NOI, is a figure that is frequently used to evaluate income-producing real estate, whether residential or commercial.

Net operating income indicates how much income a specific property (shopping mall, office building, or apartment) generates on a recurring basis. Kimco Realty’s net operating income has recovered strongly post-Covid, with NOI growth increasing to 12.9% in the fourth quarter, up from 12.1% in the previous quarter.

Net Operating Income (Kimco Realty Corp)

Major Metro Market Focus And Tenant Roster Limit Risks

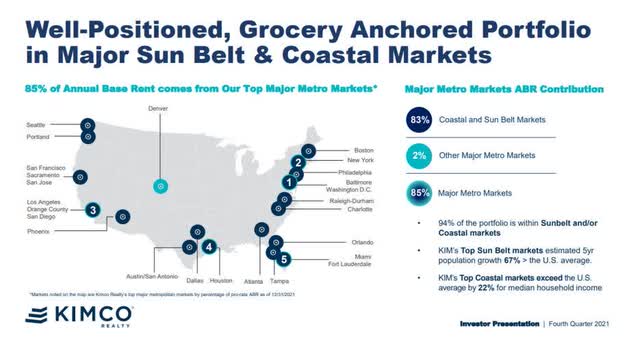

Kimco Realty primarily invests in metropolitan areas with incomes that are higher than the national average. These markets include densely populated cities such as Denver, Seattle, San Francisco, Los Angeles, Phoenix, Boston, and New York, where people can find employment and investment opportunities. Approximately 85% of Kimco Realty’s rents come from major metropolitan areas.

Portfolio Within The U.S. (Kimco Realty Corp)

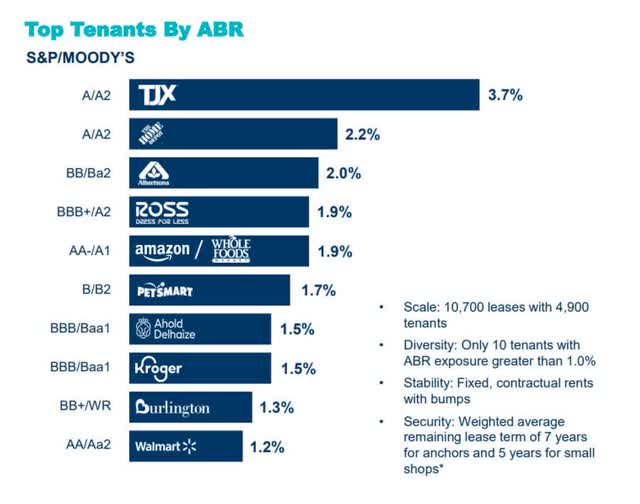

The real estate investment trust focuses primarily on necessity-based shopping categories such as grocery stores and pharmacies that sell products that are in high demand. Furthermore, Kimco Realty has a diverse tenant base.

TJX, the trust’s largest tenant, accounts for only 3.7% of the trust’s annualized base rent. Despite the fact that Kimco Realty has over 10,000 leases in its portfolio, only ten tenants account for more than 1% of the trust’s annualized base rent.

Top Tenants By ABR (Kimco Realty Corp)

Very Low Pay-Out Ratio

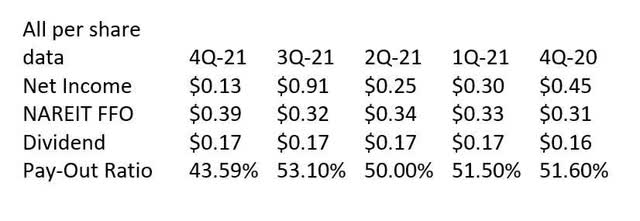

The extraordinarily low funds from operations pay-out ratio gives me confidence that Kimco Realty will increase its payout. Kimco Realty out-earned its $0.17-per-share dividend with $0.39-per-share funds from operations in the fourth quarter, and the pay-out ratio was just under 50% last year.

Kimco Realty’s quarterly cash dividend on common shares was recently increased by 12% to $0.19 per share by the trust’s board of directors. KIM stock pays a 3.1% yield at a price of $24.87.

Pay-Out Ratio (Author Created Table Using Company Financials)

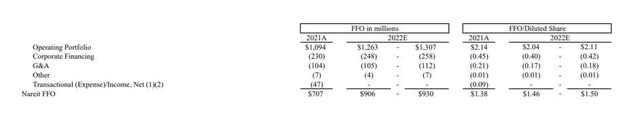

FFO Multiple

Kimco Realty anticipates $1.46 to $1.50 per share in funds from operations in 2022, implying 7.2% YoY FFO growth. The 2022 guidance assumes a funds from operations multiple of 17.7, which is neither low nor high. Given the dividend growth potential, I believe this is a reasonable price to pay for Kimco Realty’s recovering shopping center business.

FFO Multiple (Kimco Realty Corp)

Dividend Growth

Kimco Realty’s dividend payout will most likely increase in 2022 as net operating income and portfolio occupancy trends improve. While I do not believe Kimco Realty is yet in a position to return its dividend to pre-Covid levels, it may only be a matter of time before the trust does.

Kimco Realty has significant dividend recovery potential if current recovery trends continue in 2022 and 2023.

My Conclusion

Kimco Realty is experiencing a healthy recovery following the Covid-19 pandemic, and the reversal in the occupancy rate indicates that the trust has moved past the crisis’s trough.

Investors may see continued gains in net operating income and a higher level of portfolio utilization (lower vacancy rate) in the future. Kimco Realty’s low pay-out ratio, which fell to 44% in the most recent quarter, makes me believe that the REIT will be able to return its dividend rate to its pre-Covid level very soon.

Kimco Realty’s dividend is well covered by earnings, and the stock is not overpriced given its potential for recovery.

Be the first to comment