Justin Sullivan/Getty Images News

Introduction and Thesis

In my previous article, I have been bullish on SoFi (NASDAQ:SOFI). I saw massive opportunity building for the company in the financial sector leading me to believe that SoFi was a buy. At the time, I believed that SoFi had the potential to disrupt the banking industry by creating a financial super-app, a single platform that satisfies users’ entire financial demands. SoFi has everything from multiple loan products to financial services products including credit card and brokerage services. SoFi even had Galileo, a business-to-business product that builds financial infrastructure. Cross-selling of its products and the management team’s execution to capture the market seemed to be creating a powerful trend, especially after its new bank charter approval. However, although I believe all of these long-term trends stand, I am revising my rating on SoFi to a hold from a buy. I believe investors should hold SoFi instead of buying the dip. The company is in great shape, but the political risks beyond SoFi’s control are too great. I think it is extremely likely for the Biden administration to extend the student loan moratorium expected to resume on May 1. Because SoFi has exposure to these student loan products and issued guidance assuming that the student loan will resume on May 1, I see this possibility as a negative catalyst for the company in the coming months. The effect of the student loan pause throughout 2022 will be detrimental, and for this reason, I believe SoFi is a hold. I believe investors can initiate a position or average down on SoFi at a better price in the future.

Student Loan Moratorium Extension

When the pandemic started, the pandemic affected many Americans during the Trump administration leading to the start of the student loan moratorium. Then, because the pandemic continued to challenge Americans, the Biden administration extended the student loan moratorium until May 2022. However, I believe it is extremely likely for the Biden administration to extend the student loan payment once again.

In March, the Department of Education has instructed the companies that service federal student loans not to send notices to borrowers that their payments would resume in May. I believe this is a precursor to an extended student loan moratorium announcement. Here’s Why:

Later in 2022, mid-term elections will take place. Unfortunately for democrats and the Biden administration, the President’s approval rating is at all-time lows. If the President cannot reverse this current trend, it is extremely likely for Democrats to lose the majority in the Senate and possibly the House, and the congress or the senate controlled by the Republicans will set back President Biden’s key agendas that the Republicans do not agree with. Therefore, for Democrats and President Biden, maintaining a majority in the senate is paramount.

Unfortunately for SoFi, the student loan moratorium is hugely popular amongst voters, especially Democratic constituents. According to Forbes, about 50% of Americans support extending the student loan moratorium with only about 33% of Americans against it (27% were unsure). Therefore, ending the student loan moratorium will be hugely unpopular amongst voters decreasing President Biden’s approval rating even further putting additional pressure on the upcoming midterm elections. Knowing this, on April 2nd, House and Senate Democrats sent a letter to President Biden requesting an extension of the student loan moratorium. Considering these facts and political situations for President Biden, I believe it is likely that the student loan moratorium will be extended at least until the midterm elections.

Effect on SoFi

SoFi has a diversified business, so the extension of the student loan moratorium will not cripple the business. However, it will hurt the company’s margins and growth rate.

In the 2021Q4 earnings report, SoFi has guided for a revenue increase of about 55% in 2022 along with an 11% adjusted EBITDA margin. This guidance was given with the expectation of a student loan moratorium ending in May.

[SoFi’s] Management assumes the moratorium on federal student loan payments expires as currently contemplated on May 1, 2022 and student loan refinance origination volume normalizes to pre-Covid levels

Therefore, if the pause is extended, SoFi will need to adjust its guidance downward potentially pressuring the stock price.

For the full year 2021, student loans represented about 34% of the total loan originations. This level is significantly lower than in 2020 when about 50.8% of total loan originations came from student loans. SoFi is more diversified today; however, in 2021, loans still accounted for about 75.6% of total revenue. Further, lending products had a contribution margin of about 52.3% in comparison to the technology platform segment which had a 33% contribution margin, and the financial services segment with a negative contribution margin. Therefore, the absence of student loan segment growth will not only pressure the company’s growth rate but will also pressure the company’s overall margins. These negative catalysts are outside of SoFi’s control, but I believe it is wise for investors to be cautious going forward.

Risks to Thesis

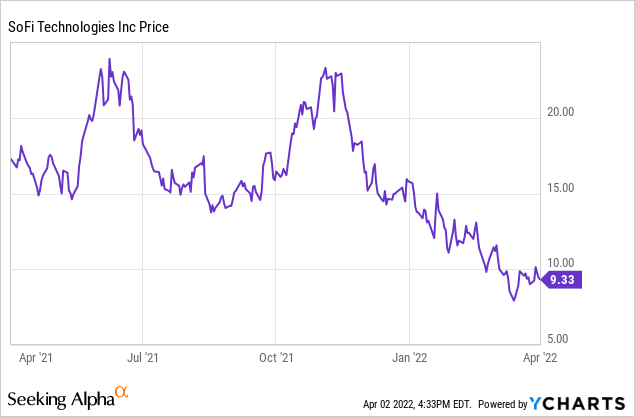

Political actions can oftentimes be unpredictable. There are numerous moving parts involved in every act. It may be unwise to hold off buying and waiting for certain political action as opportunities may disappear. Further, an expectation of a student loan moratorium extension may already be baked into SoFi’s low share price. As the chart below shows, SoFi’s share price saw a dramatic fall in the last few months. Therefore, an announcement of an extension of the student loan moratorium may not have a damaging effect on the share price.

[Chart created by author using YCharts from Seeking Alpha]

Despite these risks to the thesis, I will continue to hold SoFi stock without averaging down on my shares. I believe it is better to be cautious.

Summary

SoFi is a company with strong fundamentals. SoFi is aiming to build a financial super app where a single SoFi platform can meet consumers’ entire financial needs. With a bank charter and a financial infrastructure platform, Galileo, SoFi’s long-term future seems bright. However, I am expecting short-term turmoil. Due to political reasons, I believe it is highly likely for the student loan moratorium to be extended. This will negatively affect SoFi’s growth rate and its operating margins leading to the management team reducing the company’s 2022 guidance. Therefore, I believe it is best for investors to hold on to their SoFi positions instead of buying more.

Be the first to comment