Foryou13

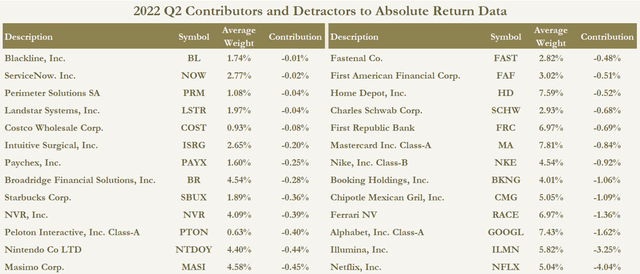

The performance of securities mentioned within this letter refers to how the security performed in the market and does not reflect the performance attributed to the core equity portfolio. Please see the chart at the end of letter, which reflects the full list of contributors and detractors based on each security’s weighting within the core equity portfolio.

For a copy of Ensemble Capital’s equity strategy performance track record, please email a request to info@ensemblecapital.com.

The first half of 2022 has been particularly challenging for Ensemble’s investment strategy. On a year-todate basis, the Ensemble Equity Composite is down an estimated 32.7% vs the S&P 500 down 20.0%. Due to our very strong returns in 2019, 2020 and 2021, even after this year’s decline, our strategy has returned an estimated 7% annually over the last three years, and 10% annually over the last five years. However, these results are less than the S&P 500’s return and are not an outcome we are satisfied with (final composite calculations will be available at the end of this month. You can download a copy of our composite performance track record here).

We recognize that our investors are not used to this degree of underperformance from us, particularly during a market decline. Over our 18-year history leading up to this year, our equity composite only underperformed by a similar amount from mid-2012 to early 2013. Because that period of underperformance occurred during a rising market, we recognize that the current underperformance occurring during a declining market is more difficult for our clients.

Relative to the S&P 500, our strategy’s performance bottomed in early May and outperformed from then until the end of this quarter. While we expect our relative performance compared to the S&P 500 to fluctuate in the months and quarters ahead, the persistent headwinds we were experiencing did begin to dissipate almost two months ago and we are hopeful that our nascent recovery will continue in the medium term.

In this letter, we will discuss the current economic and market environment and then lay out the drivers of our underperformance as well as the reasons why we believe our strategy will return to its more familiar level of performance going forward.

Coming into 2022, the US economy was robust. Real GDP in the fourth quarter of 2021 grew 5.5% vs the year ago period. Inflation was running at between 4% and 7% depending on the measure of inflation used, but most economists and investors believed this inflation was primarily being driven by a shortage of workers, supply chain issues, and the relatively slow restarting of production that was shut down during the pandemic. Because capitalism is extremely good at producing whatever level of goods and services that customers demand, it was assumed that once the pandemic related constraints on economic production faded that supply would catch up with demand and inflation would decline.

In addition, because employment was still below pre COVID levels but growing quickly, wage growth was strong, and American households had low levels of debt and high levels of cash on their balance sheets, it appeared very likely that strong demand growth would continue.

But over the first half of 2022, a number of developments shattered confidence in this positive outlook so dramatically that today most people assume that a recession is inevitable and that even a contraction in demand may not bring inflation down to reasonable levels. With the growth outlook greatly diminished and inflation worries still raging, investors have greatly downgraded the valuation multiples they assign to most stocks, with a particularly dramatic reduction in valuations for high growth businesses or those whose fundamental results are economically sensitive.

Despite the market being down 20% so far this year, revenue and earnings for the S&P 500 increased by over 10% in the first quarter with continued growth expected in the second quarter. This has led to the PE ratio on the S&P 500 to contract by nearly 30% in the last six months with much larger contractions in higher growth or economically sensitive stocks.

Back in early March, two weeks after the Russian invasion of Ukraine, we authored a piece about thestagflation panic sweeping the stock market. The inflation prior to the invasion was a function of pandemic related supply and demand imbalances which meant that the inflation would be mitigated either through supply recovering or a contraction in demand. But the inflation related to the war in Ukraine is being driven by supply constraints that may not be resolved in the near term and these constraints are primarily on necessary products, such as food and energy, for which demand rarely declines even in the face of high prices. Thus, unlike typical inflation issues which can be cured via slower growth or a recession, the risk of stagflation, or periods when inflation remains high even in the face of slow or contracting growth, increased significantly.

In addition, after successfully preventing mass spreading of COVID over the past two years, China experienced new outbreaks in some of their major cities. With a population that is far more at risk to contracting COVID due to the relatively ineffective Chinese vaccine, low levels of vaccination among older people, and a population that has mostly not contracted COVID to date, the risk of a major, deadly wave in China is very real. This risk caused China to put some of their major cities into lockdown, limiting production of goods that the rest of the world would like to buy and putting further pressure on inflation. That being said, a slowdown or recession in China also reduces demand for oil and global transportation of goods, so there are also ways in which China’s COVID issue causes some parts of the inflation issue to dissipate.

But despite these major developments, the outlook for real economic growth and inflation are still uncertain. Recessions, inflation and the economy more generally are hard to forecast, as evidenced by how dramatically the economic outlook has changed over just the past six months. Just as the economic recovery of the past two years has been highly unusually, so too is the current slowdown and possible recession likely to look very different from historical patterns.

On the positive side, companies continue to report that supply chains are healing. The cost of moving goods around the world by ocean, air or truck have declined materially this year as supply and demand have become more balanced. The price of lumber, which soared as much as 400% in 2021 as home building activity increased sharply while lumber suppliers raced to restart production, has now declined by nearly 60% since early March of this year. Even the price of oil and wheat, two products facing significant supply constraints due to the war in Ukraine, have seen their prices decline significantly from post invasion highs.

Importantly, American households, whose spending makes up 70% of the US economy, have been resilient. With approximately 2.7 mil new jobs added in the first half of this year, the base of American workers grew at an annualized rate of 3.6% with wage growth increasing by between 4.5% and 6% depending on the measure used. Putting these together, American households are seeing on the order of 8% to 10% annualized increases in spending power.

Despite widespread concerns about a recession, demand for hiring new workers remains robust, with approximately twice as many job openings as there are people who tell government surveyors that they are actively looking for a job. While the majority of Americans say that they expect a recession, they are also optimistic about their own financial situation, which makes sense given record high levels of home equity, an outstanding market for job seekers, and low levels of consumer debt.

But it is absolutely true that Americans are changing the things they spend money on. After two years of being cooped up inside spending money on products for the home, Americans are streaming back into the world and shifting their spending to the things they were unable to buy during the pandemic.

This rotation in spending, as distinct from a reduction in spending, was illustrated in the May earnings report from Target (a company that we do not own in our strategy). In mid-May, the company announced that they expected much lower earnings, despite actually raising their outlook for revenue growth this year. This unusual outcome was a result of a very large and very rapid shift in what Target customers are spending money on, even as they continue to increase the amount of money they spend.

Speaking on their earnings call, Target’s (TGT) CEO Brian Cornell said that spending on items such as kitchen appliances, TVs and outdoor furniture – products that consumers splurged on while stuck at home – has declined sharply. While they had expected there to be a shift from spending on goods to services as America exited pandemic lifestyles, they didn’t anticipate the speed and magnitude of the shift. On the other hand, they saw luggage sales grow by an astounding 50%, along with robust growth in “going out” categories such as sunscreen, beauty products, and even toys as families return to hosting large birthday parties for their children.

So, despite Target seeing increasing foot traffic and higher spending overall, they got caught with the wrong inventory relative to what customers wanted to buy. What this means for investors is that it is incorrect to say that the consumer is weak, despite weakness in some consumer facing companies. Rather what people are spending money on is changing rapidly, which is good or bad for a given company based on what they sell.

Importantly, with demand shifting from items that were in short supply, there is good reason to think that inflation in these categories will moderate. Indeed, Target stated that their plan was to put their excess inventory on sale, something that consumers haven’t seen a lot of over the past two years. But as demand for COVID era goods moderates, demand for activities such as travel has surged, driving up inflation in airline tickets and hotel rooms. This illustrates the way that the shock waves from the pandemic have scrambled the typical economic cycle such that even at a time when all signs point to the biggest summer travel season in history, investors are worried that we are headed into, or are already in, a recession.

And so, today we stand at a highly unusual point in the economic cycle. We have inflationary pressures related to the war in Ukraine and COVID in China that the Federal Reserve’s policy of increasing interest rates will do little to relieve. We have an incredibly strong consumer base, with a strong job market, strong wages, record high levels of home equity, and far more cash in their bank accounts than was there prior to COVID. Notably, 66% of households own their home and of those with a mortgage, over 90% have a 30-year fixed rate loan at an average interest rate of 3.3%. This means that the majority of the country is not seeing rising costs of shelter, despite rising rents and rising interest rates impacting renters and new buyers of homes.

In addition to these two major opposing forces, the focus of consumer spending is rotating from goods that were desired during the pandemic, towards services and goods that people have missed out on over the past two years. And so, with all of these opposing forces and high levels of uncertainty about what economic normalcy means in a post COVID world, investors have reacted by selling companies that may have long-term bright futures and instead preferring companies that can generate cash or otherwise reward investors in the very short term.

This rapid reduction in investors’ time horizons is characteristic of market panics. When humans become highly stressed, their mental focus shifts away from long-term considerations to prioritize short term considerations. For instance, even bearish economic forecasters today generally agree that the economy will recover in the years ahead. Recessions are not typically long events. Yet today, investors are ignoring the level of earnings that companies are likely to generate over the next 3-5 years and instead focusing on whether the coming quarter or year will generate results that are weaker than expected. This is a mistake that investors make time and again. It is such a repetitive behavior that psychologists have given it a name; “hyperbolic discounting” is an issue we wrote aboutat the beginning of 2019 just after the market had declined by 20% due to recession worries that ended up being misplaced.

For instance, over the ten-year period from 2011 to 2021, the S&P Energy sector generated an annualized return of just 1%. While there is a shortage of oil supply today, the fact is that demand for oil is not a long-term growth engine. You don’t have to take our word for it, the CEO of Exxon (XOM) recently said that he expects all new cars sold globally in 2040 to be electric and at that point global demand for oil will be all the way down to 2013 levels. Yet today, investors don’t care about the long-term. They care about the very short term and have driven the price of energy stocks up 31% so far this year as current oil prices have spiked.

The S&P Utilities sector trailed the S&P 500 by 5.5% annually over the decade ending in 2021. But these stocks are flat so far this year, despite the 20% market decline. Today, utility stocks trade at one of their most expensive valuations in history, even exceeding valuation levels seen at the peak of the Dot Com bubble.

Another sector where investors have been hiding out are consumer staples, businesses like Procter & Gamble (PG), Philip Morris (PM), and General Mills (GIS). The Consumer Staples sector trailed the S&P 500 by over 4% a year over the last decade but has avoided much of the selling this year given their perceived safety. But here too, we find record high valuations for the entire sector. Proctor & Gamble, the largest company in the Consumer Staples sector, trades at a near record high valuation. The last two times the stock reached this valuation level was during the Dot Com bubble and briefly in mid-2015. Over the three years subsequent to the 1999 episode the stock declined by 16%. After the 2015 period of similar valuation, the stock underperformed the S&P 500 by 30% during the following three years.

At the end of the second quarter the manager of the Russell 1000 indices announced that the statistical valuation measures they use to assign stocks to growth or value indices had triggered them to move some energy stocks into the growth index while moving Facebook (META), Netflix (NFLX) and Zoom (ZM) into the value index (Netflix is part of the Ensemble portfolio, while Facebook and Zoom are not). With stocks like Procter & Gamble trading near their most expensive valuation since the Dot Com bubble, while stocks like Netflix trade at their cheapest valuation in history, investors are forced to pick between the risks of high valuations for “safe” businesses, vs the risk of owning more volatile businesses, but paying low valuations.

Across our portfolio, we have witnessed a huge decline in valuations. For our current holdings, the Wall Street consensus is that all of them will report higher earnings in 2022 than in 2021 with the exceptions of First American (FAF) and Nintendo (OTCPK:NTDOY), two companies for which we entered this year expecting 2022 earnings to decline on a temporary basis. With earnings up, while the market value of our portfolio has declined by 32%, the compression of valuations has been extraordinary. While stocks that are perceived to be “safe” may be trading at near all-time high valuations many of the stocks in our portfolio are trading at multiyear low valuations.

Google (GOOG, GOOGL) trades at its lowest valuation since 2012. Home Depot (HD) is the same. First Republic (FRC) last traded this cheaply in 2013. Booking Holdings (BKNG) trades at the low end of its valuation range going back to the financial crisis. Housing related stocks like NVR (NVR) and First American trade at their lowest valuations in a decade.

In May of this year, we highlighted the major disconnectbetween the corporate results of our portfolio holdings and their stock prices. While stock prices are falling, the outlook for 2022 corporate results remain very solid in aggregate across our portfolio.

As the CEO of portfolio holding Landstar (LSTR) put it “I don’t think in the history of my career, I’ve seen this sort of differential between what some of The Street is saying and some of the information out there [in the media], compared to what we’re seeing.” Mastercard (MA), which gets real time data on consumer spending, said in April that “consumer spending remains strong globally,” “US retail spending remains healthy” and “our business fundamentals remain robust.” In mid-June, the company said that their data points to continued growth in US consumer spending, on the order of 8%, in the months ahead.

We fully recognize the challenges the economy faces as well as the company specific headwinds some of our investments are facing. But investing is a matter of seeking to understand what a company’s long-term future cash generation will be and ensuring you pay a fair price for those cash flows. If the corporate outlook faces headwinds, it makes sense that the valuation would contract. But headwinds do not need to send stocks down to record low valuations. When this happens, investors are best served by checking (and double checking!) their analysis of the future outlook and then simply waiting for the market to stop panicking and return to more rational valuations.

Our underperformance this year is best understood as an acute valuation contraction across two particular groups of stocks.

High Growth Stocks: Illumina (ILMN), ServiceNow (NOW), Netflix & Masimo (MASI)

This group of stocks in our portfolio has declined by an average of 51% this year and collectively are responsible for 14% of our strategy’s 33% decline.

Companies with very strong long-term growth opportunities, and the competitive advantages to protect those opportunities from competitors, are relatively rare. Forecasting growth over long time periods is difficult, an issue we explored in depth in a multipart series that we published about our approach to growthforecasting, and so we are highly selective in investing in these types of businesses.

However, there are two things that can negatively impact investment performance for these types of stocks. 1) We may overestimate the magnitude or duration of a company’s growth rate, or 2) during periods of fear about the future, other investors may suddenly start to ignore the long-term opportunity and focus instead on the very near term. This is the issue of hyperbolic discounting that we discussed above.

At this point, we believe that our long-term growth outlooks for Illumina, ServiceNow and Masimo remain intact.

Illumina has 90% market share in the key technology platform know as gene sequencing that enables a wide range of genetic research and clinical applications. You can learn more about our full thesis on the company here. The company sells some of their equipment into China, where COVID related shutdowns is temporarily impacting sales. However, we don’t believe that China, or any country around the globe, has any intention of backing away from the long-term opportunity to use genetic research and applications to radically improve human health. For instance, the novel MRNA vaccines developed for COVID (the virus was sequenced on Illumina equipment) have demonstrated a broad new class of vaccines for development while at the same time major strides are being made in combatting cancer using genetic testing.

Illumina did lose a court battle this year related to some of their patents, but we do not think their competitive advantages and growth opportunity rests primarily on a couple patents. In a recent interview, a former executive of the company, now working for a different life sciences company said, “It’s going to make business for Illumina a little bit more difficult. But there’s such a big, big installed base of Illumina’s NovaSeqs across a lot of these companies that it’s going to take a while to have anybody kind of displace what’s there.”

Meanwhile Illumina announced back in January that they would be launching a new series of breakthrough products to reduce costs and enhance output, about which the former employee said, “The company has known that their patents are expiring for a while, so you know they’re sitting on something, right? Just waiting for the right time. But the NovaSeq has such a huge installed base with a lot of big labs that I don’t see anybody switching those out anytime soon because the switching costs are just so flipping high.”

So, while Illumina does face some headwinds, we believe that investors are radically overreacting in selling the stock down to such low levels. Relative to the amount of revenue they generate, the stock is now the cheapest it has been since 2013, prior to the company’s emergence as the dominant incumbent. If you separate Illumina’s core business from the early-stage cancer detection business called GRAIL that they acquired last year you’ll find that relative to earnings, Illumina has never been so cheap. In fact, the last time Illumina traded at today’s share price was in 2017, when its revenue was more than 40% lower, and it did not own the cancer detecting GRAIL business whose purchase price now make up over a quarter of Illumina’s market value.

ServiceNow is an enterprise software company that helps their corporate customers integrate all of their various software products into a unified platform. Their products are a key element of driving the digital transformation nearly every large company is undergoing. At the recent JP Morgan investor day, CEO Jamie Dimon explained that while the company could reduce expenses if needed should the economy slow, that their spending on digital transformation would continue as this spending was critical to the company managing costs and maximizing revenue over time. As an example of this type of spending, Dimon specifically pointed to ServiceNow, calling out that the company’s products now oversaw the single largest collection of JP Morgan data and highlighted that working with them had saved JP Morgan $50 million over the past few years.

While we have high expectations for ServiceNow’s long-term growth rate, at the company’s investor day in late May they offered an increased growth outlook for the next five years as they target even higher levels of growth than we have been expecting.

Masimo stock has also traded down to extremely low levels. You can read our thesis on this health sensing technology business here. In their case, there has not been a deceleration in their growth rate nor is one expected. The company has very solid, and in our view very durable, growth related to selling their existing products to hospitals. But the company also has a very large opportunity to expand the range of products they sell within the hospital as well as selling health sensing technology products that are used in the home.

In February, the company shocked investors (including us) by announcing that as part of their strategy to bring these additional products to market, they would be buying a home audio technology company called Sound United. In our view, the company’s communication to investors about the strategy related to the acquisition has fallen far short of what it should be. The company insists that explaining the strategy in more detail at this time would tip off competitors as they race to market, and they plan to provide an in-depth strategy update at an investor day in September.

Our own research since the deal was announced, as well as our conversations with management and other major shareholders of the company, has helped provide us with confidence that the company’s strategy, while unexpected, is likely to succeed. That being said, the company’s full explanation of their strategy won’t come until September and based on what we learn at that time, we remain completely open to changing our minds.

The reaction to Masimo’s acquisition helps illustrate the short-term thinking that currently permeates financial markets. While waiting two more months to hear from the company might be an unacceptably long time for investors who are not willing to think longer than a few days or weeks into the future, our investment in Masimo is based on our view of the tremendous positive impact the company can have over the next decade as they reduce the cost of health care and improve patient outcomes, while rewarding long-term oriented shareholders handsomely along the way. But it would not be truthful to say that we are immune from short-term pressures. Holding stocks that other investors have dumped is challenging to say the least.

Netflix on the other hand has run into real growth challenges. After reporting very strong levels of subscriber additions in recent years and reporting very strong growth as recently as the fourth quarter of 2021, the company has seen incremental subscriber growth slow to a standstill. While you may read media reports about the company “hemorrhaging” subscribers (a phrase seemingly used in many news reports about the company), the fact is that the company reported first quarter subscriber levels were up 8% vs a year ago and they guided to second quarter subscribers being up 5%.

But there is no doubt that something has caused the company’s growth rate to decelerate very quickly, vs the low double digit growth rate we had been expecting. While some investors believe that Netflix is simply losing subscribers to competitors, those competitors are not seeing the sort of surge in subscribers that would be expected if a significant number of Netflix’s customers or potential customers were switching services. Importantly, the increased competitive intensity in streaming is most prevalent in the US, where HBOMax and other services have seen strong adoption. Yet the main areas of weakness for Netflix has been Latin America and Europe, where intense inflation pressures and the war in Europe are, in our view, the likely culprits of the company’s growth deceleration rather than competition.

With Netflix continuing to dominate viewing time across streamers (in the US, most all of the top 10 streaming TV shows in any given week are almost always Netflix shows according to Nielsen), we simply do not believe that people around the globe have suddenly, and permanently, lost interest in the company’s service. Far more likely in our view, is that the service is more discretionary in Latin America than we believed and European households face their own economic challenges as well as being worried about the war.

But given the unexpected and sharp deceleration in growth, we have reduced our longer-term growth outlook. We have long thought that the US market was mature, but we have expected the other regions to continue to grow with substantial growth coming from Latin America and Asia. While the Asian market has continued to post growth, we recognize that even if the slowdown is due to economic issues and not competition, the company’s long-term growth potential may be less than we previously thought.

That being said, Netflix’s stock now trades at levels that suggest the business is done growing for good. This seems highly unlikely to us. Netflix is not a fad. Streaming TV is not a fad. Netflix is the originator and dominant leader of the global shift to streaming TV. Households around the world are never going to go back to linear cable TV. As more and more households fully cut the cord and watch TV only via streaming, we remain confident that Netflix will form the core of the streaming bundle as the leading global provider of TV content.

In the aggregate, this group of stocks has been the biggest drag on our performance this year. While investors tend to fall in and out of love with higher growth businesses depending on market conditions, our long-term returns in these stocks will be dictated by whether or not our long-term expectations for their corporate results are met. But while we recognize that our longer-term expectations may not be met, today US equity investors have simply abandoned a wide range of attractive long-term growth businesses as current worries about inflation and economic growth have taken center stage. Given these stocks have not just traded down to pre-COVID valuations, but instead traded down to valuations not seen in many years, we think current market prices more than incorporate any rational level of concern about their long-term corporate outlooks.

Housing Related Stocks: NVR, First American & Home Depot

This group of stocks in our portfolio has declined by an average of 32% this year and collectively are responsible for 5% of our strategy’s 33% decline.

While rising interest rates won’t end the war in Ukraine or prevent a COVID outbreak in China, this blunt tool is the primary mechanism by which the Federal Reserve can attempt to moderate inflation. The process by which this works is multifaceted, but one important mechanism is the way that higher interest rates reduce consumers’ willingness to use debt to finance purchases. Since inflation is a function of demand being in excess of available supply, debt financed demand can be reduced by increasing interest rates. Housing is the largest debt financed consumer purchase and thus, the impact of accelerated Fed rate hikes is most apparent in this industry today.

For many years now, well before COVID, housing activity in the US has been subdued. While home prices increased, the number of homes bought and sold, as well as the number of new homes being built, ran far below levels seen prior to the Financial Crisis of 2008/09. After building too many homes during the housing bubble, home builders were extremely wary of overbuilding in the decade after the crash. In fact, they were so cautious that the level of underbuilding far exceeded the amount of overbuilding during the bubble.

Many existing homeowners who did not default on their mortgage during the Financial Crisis were underwater on their mortgage and thus, prevented from selling their house unless they were able to come up with additional cash to pay off the mortgage. As home prices recovered, these homes became sellable again, yet the increase in home sale transactions remained abnormally low as first time home buyers struggled to afford down payments, older homeowners chose to age in place rather than move into a retirement community, and a generation of young people delayed home buying as they went to school for longer, got married later and had children later. This shift in prime home buying years from the mid to late twenties to the mid-30s caused a period of slow sales activity.

Indeed, by the eve of COVID, most housing industry experts believed there was a severe shortage of available housing. After an initial expectation that COVID would decimate the housing industry, the opposite proved to be true. With the Federal Reserve lowering interest rates once the pandemic struck, people living in apartments finding it was a difficult place to sit out quarantine relative to being in a single-family home, remote work creating new opportunities for people to move to new geographies, and forced savings plus stimulus dollars padding bank accounts to fund down payments, the housing market boomed.

But the boom in housing was more about home prices rather than transaction activity. With limited supply and increased demand, prices soared. New and existing home sales combined in 2019 totaled just over six million units, or slightly less than the number of sales completed in 2001-2002, a period prior to the housing bubble when there were 15%-20% fewer American households than there are today. During 2020 and 2021, an average of 6.7 mil single family homes were sold, an increase for sure, but still below long-term normalized levels of transactions. In fact, existing home sales were growing at about a 7% rate in the months just before COVID, so the growth in housing transactions seen during the pandemic may well have occurred even if the pandemic hadn’t happened.

It is clear that far more homes would have been sold if there had been enough homes on the market. The dramatic price rise of homes in the US was partly due to low interest rates fueling the ability to pay more for a house, but it was also due to a very low levels of homes for sale. Today, the number of homes listed for sale stands at a record low going back many decades to a time when the US population was much smaller.

While we expect the large increase in mortgage rates to bring a sudden halt to home price appreciation and likely result in a decline in home prices over the next year or two, it is important to recognize that there are far more people who want to buy a home than there are homes on the market. Over time, while the path over the next two years may be bumpy, we expect home sales activity to recover and grow to new highs, as newly built homes come to market, a generation of first-time buyers reach prime home buying years, and remote work allows for a shuffling of households across the country as some people are freed from living within commuting distance of their workplace.

Those homes that were purchased during the pandemic were done with fully underwritten, 30-year fixed rate loans for the most part. The sloppy credit underwriting and easy money mortgages of the housing boom 15 years ago are nowhere to be seen. Today, American homeowners have all-time record high levels of home equity such that even if home prices decline and some homeowners lose their jobs, they can sell and easily pay off their mortgage, not default and end up a forced seller as happened during the housing crash. But today, investors in housing related stocks appear to worry that a housing slowdown must mean a crash.

Home builder NVR trades at a PE ratio of 8, or less than half its valuation in the years prior to COVID. Yet, while we fully expect housing demand to slow sharply in the near term, we have no doubt that America needs to build a huge number of new homes in the years ahead if we are ever going to build our way out of the housing shortage that has pushed up the cost of living. NVR’s unique business model helps protect it during periods of declining home prices, which is why the stock outperformed other home builders by so much during the Financial Crisis. The company also believes their stock trades at a low valuation, as illustrated by them buying back 5% of their shares outstanding in the first quarter of this year.

First American, a title insurance company, makes money for each home sale, refinance transaction or commercial real estate transaction that they participate in. If the buyer is going to use a mortgage as part of the transaction, the lender requires title insurance because in the US there is no central, validated record keeping system that ensures that a person representing themselves as owning real estate actually has clear title to the property.

There is no doubt that refinance transactions have fallen dramatically. But we’ve long expected this to happen, and we expect refinancing to remain at very low levels over the long term. In addition, First American earns about 2.5x more revenue on home purchase transactions than on refinance transactions.

While the price of homes or commercial real estate may well take a step back, we think it is unlikely that home purchases and commercial real estate transactions decline significantly and stay at depressed levels. Rather we believe that near term declines in real estate transactions will recover to new highs in the years ahead given how depressed activity levels have been.

The stock is now trading at a PE of 8, its lowest valuation in over a decade except when it briefly fell to even lower levels in the early days of COVID when there was worries about a complete collapse of the housing market.

Home Depot is a very different business from NVR and First American. Its focus is on home remodeling, not housing transactions. Historically, the level of interest rates has not had a material influence on demand for Home Depot’s products and services. With employment at very strong levels, households sitting on record levels of cash, home equity at all-time highs, and existing homeowners having locked in low, fixed mortgage payments during 2020-2021, we expect remodel demand to remain solid.

Certainly, after the boom in remodeling over the past two years, Home Depot is likely to see growth decelerate, as was already expected coming in to 2022. And growth may be hard to find over the next year or two. But for homeowners who wish to move, but no longer can due to high interest rates on new mortgages, remodeling their existing home to better fit their needs is the next best option.

Importantly, our analysis indicates that the 50% of Home Depot revenue that comes from Do-It-Yourself homeowners has already fallen back to normalized levels after surging dramatically in 2020 when people were stuck inside during COVID. The other 50% of revenue comes from professional contractors. This segment continues to boom, growing at an estimated 20% in the most recent quarter ending on April 30th. With homeowners desiring a remodel being forced to wait until 2023 due to extremely long backlogs of job activity, it appears very likely that strong remodeling activity will persist.

The rest of the stocks in our current portfolio are down an average of 20%, or similar to the overall market. These stocks are collectively responsible for 12% of our strategy’s 33% decline. We also exited some stocks this year, primarily due to us believing other stocks in our portfolio offer better risk adjusted return potential. The stocks that we’ve sold are responsible for 2% of our year-to-date decline.

We have managed the Ensemble Capital equity strategy since 2004. Over those more than 18 years, we have demonstrated our ability to outperform the market over the long term. Yet we have encountered many periods of underperformance along the way, including one other period during which we underperformed to a similar degree as today. Periods of underperformance, including sharp or extended periods, are part of every long-term successful investment manager’s track record. It simply isn’t possible to build a portfolio that is different from the broader market, a requirement for outperformance, while avoiding periods of underperformance. That being said, the magnitude of our current underperformance is not consistent with our goals, and we are deeply unsatisfied by our returns over the last six months.

We believe that all our portfolio holdings are very strong businesses that have demonstrated over time their ability to outcompete would be challengers. Our current period of underperformance is primarily due to the segment of our portfolio invested in higher growth companies and the segment of our portfolio invested in housing-related companies. These two areas of the market now trade at or near historically low valuation levels, in some cases all-time low valuations.

In addition, we have little to no investments in consumer staples, utilities or other “bond proxy” type stocks. This segment of the market trades at or near historically high valuation levels, in some cases all-time high valuations. We also do not have any investments in energy companies, which after a decade of horrific investment returns have performed extremely well this year despite even industry insiders recognizing that long-term demand for fossil fuels will be flat to down.

We recognize that the confluence of our investment decisions and the events of this year have combined to generate returns that are well below the long-term expectations we have of ourselves and that our clients should expect of us. But we remain confident in the highly successful investment approach we have built over the last two decades. We believe that our current portfolio is significantly undervalued, particularly the higher growth and housing-related businesses that we highlighted in this letter. In addition, we are focused on seeking out new investment opportunities that have gone deeply on sale this year to add to our portfolio, should we believe doing so will enhance the risk adjusted return potential of our portfolio.

Full list of contributors and detractors

Source: Ensemble Capital

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment