Andrew Burton

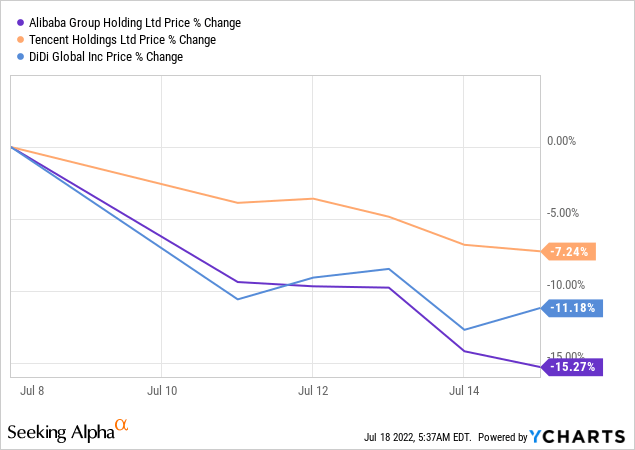

It is difficult to make the case for investing in Alibaba (NYSE:BABA) given the headlines of the last year or so: Government crackdowns and a slowing e-Commerce business have driven shares of Alibaba into a long-term down-trend. Just last week, Alibaba and Tencent (OTCPK:TCEHY) were fined for violations of disclosure regulations by China’s anti-monopoly agency which drove a new sell-off in shares of Chinese tech companies.

I last analysed Alibaba in May. I added to my pile of Alibaba’s shares, however, and expect the e-Commerce company to submit a strong earnings card for FQ1’23 in August.

New round of fines for large Chinese tech companies

Last week, China’s anti-trust regulators reminded investors once again that Chinese companies remain in their cross hairs when they fined Alibaba and Tencent for violations of disclosure rules. The State Administration for Market Regulation/SAMR, which is China’s anti-monopoly agency tasked with overseeing mergers and acquisition deals, said that 28 deals violated its disclosure rules, including five from Alibaba, 12 from Tencent and 4 from Didi Global (OTCPK:DIDIY). Fines for reported disclosure violations were 500,000 yuan (US$74,600) per case which is the maximum amount the State Administration for Market regulation can impose. Alibaba was also fined for its investment in Youku Tudou, a video streaming platform into which Alibaba invested $1.2B back in 2014. After the transaction, Youku Tudou became a subsidiary of Alibaba Group Holding Limited.

After new fines on Chinese tech companies were disclosed to the public, shares of the affected companies plunged with Alibaba crashing the most. This sell-off creates a new buying opportunity for investors that like to focus more on the fundamentals of the businesses in question instead of the latest regulatory actions.

While the absolute USD amount of the imposed fines is negligible, it shows that the anti-monopoly agency continues to review Alibaba’s past acquisitions and new fines remain a risk going forward. However, the new down-leg in Alibaba’s shares creates a new opportunity to buy Alibaba as the company will soon report earnings for its first fiscal quarter in FY 2023.

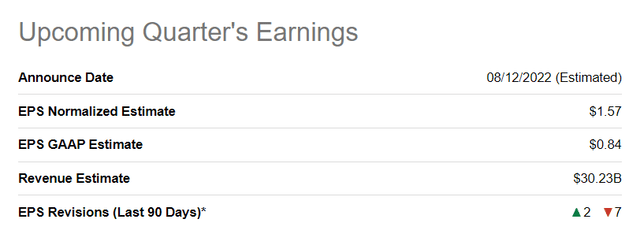

Alibaba will submit its earnings card for FQ1’23 in August and the company could do better than expected. This is because earnings expectations are very, very low which creates a low bar for Alibaba. Earnings estimates have been lowered seven times in the last 90 days and the market currently only expects $1.57 in EPS, implying a 39% year over year decline.

Why Alibaba’s Commerce performance may be set to improve

China’s economic activity has slowed down in the first half of the year, largely because of new COVID-19 lockdowns that suppressed commerce. Strict lockdown measures greatly affected the economy: it grew at only 2.5% in the first six months of the year which is a weak growth rate for a country that until the pandemic grew at rates of about 6% annually.

I believe, however, as the Chinese economy emerges from its lockdown state, that Alibaba’s overall financial performance is set to improve. While the slowdown in the economy will take time to gain momentum, stronger economic growth and an improving outlook for consumer spending could drive Alibaba’s e-Commerce results going forward.

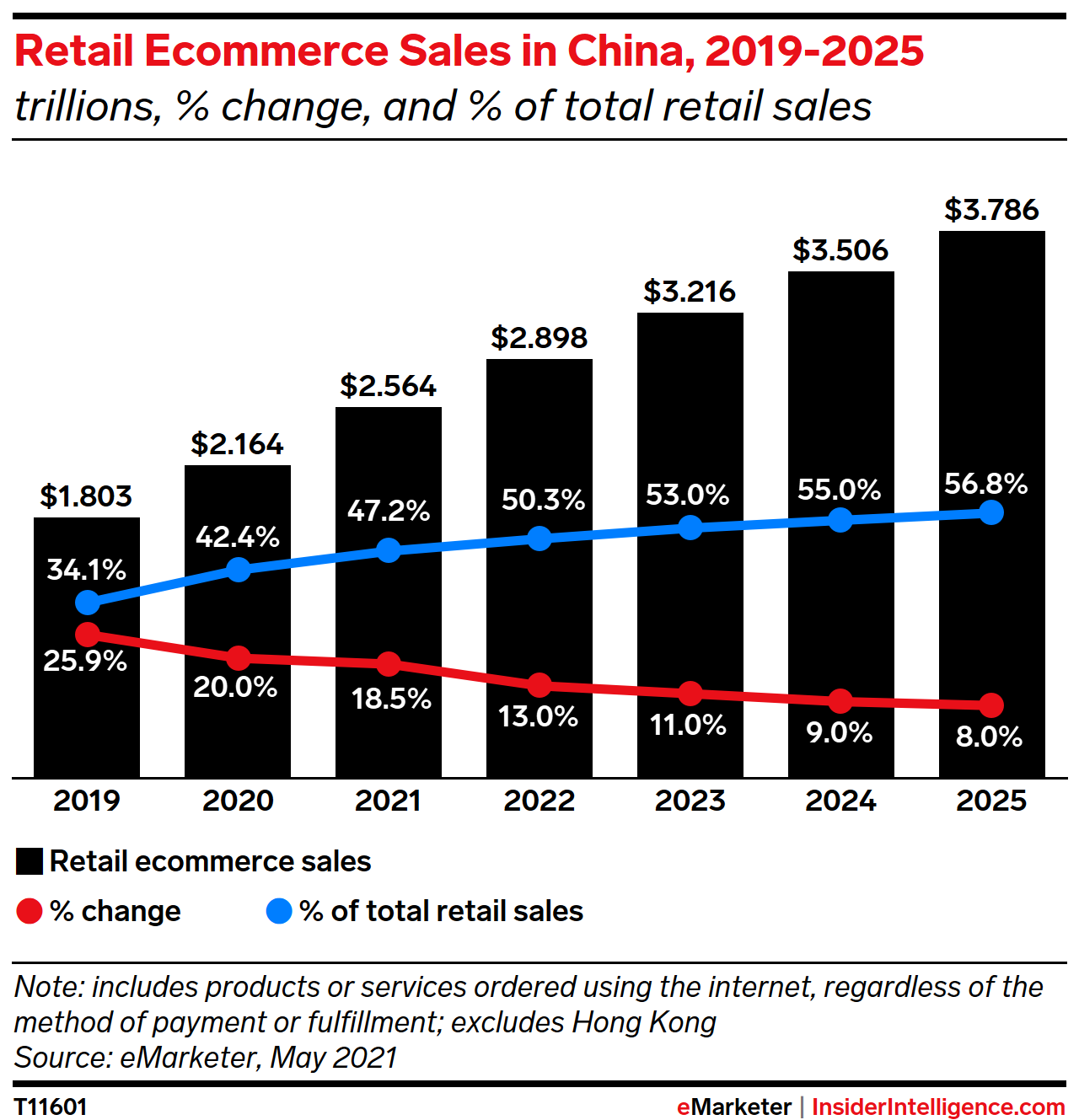

While COVID-19 lockdowns hurt China’s economic performance in the short term, and Alibaba’s sales, the long term outlook for China’s e-Commerce market is extremely positive: China’s retail e-Commerce sales are expected to more than double from FY 2019 levels to $3.8T by FY 2025.

eMarketer

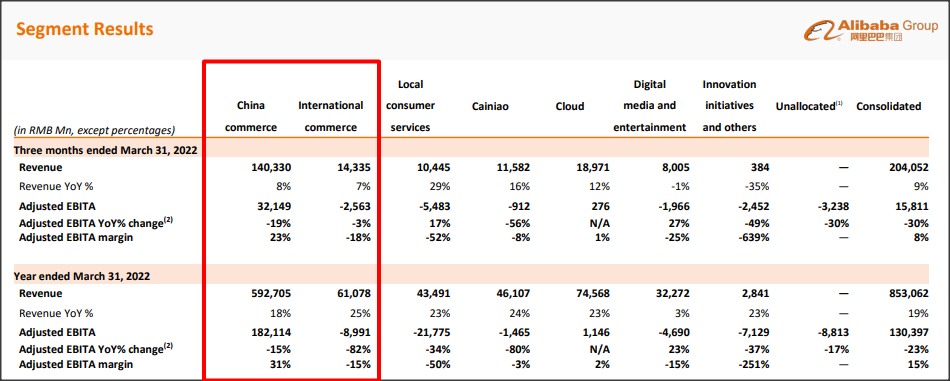

E-Commerce sales in China contribute 69% of Alibaba’s total sales, so no market is more important to Alibaba’s growth prospects than China. Alibaba has seen a serious slowdown in e-Commerce growth rates in the last quarter — Alibaba’s domestic and international e-Commerce businesses saw only 8% and 7% year over year revenue growth — but this trend could reverse in the second half of the year if China gets a grip on its COVID-19 situation and releases large city populations in Beijing and Shanghai out of COVID lockdowns.

Alibaba

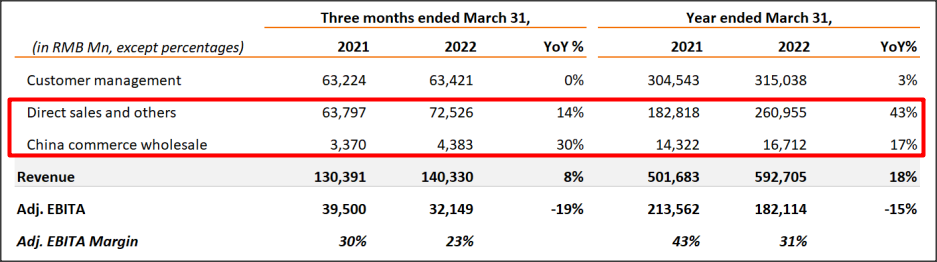

But even within the challenged domestic e-Commerce segment, there are bright spots for Alibaba. Direct sales and China’s e-Commerce wholesale business still have momentum and grew their top lines at 14% and 30% year over year in FQ4’21, chiefly because of the roll-out of value-added services and higher revenues from Alibaba-owned business-to-consumer brands like Freshippo and Tmall Supermarket.

Alibaba

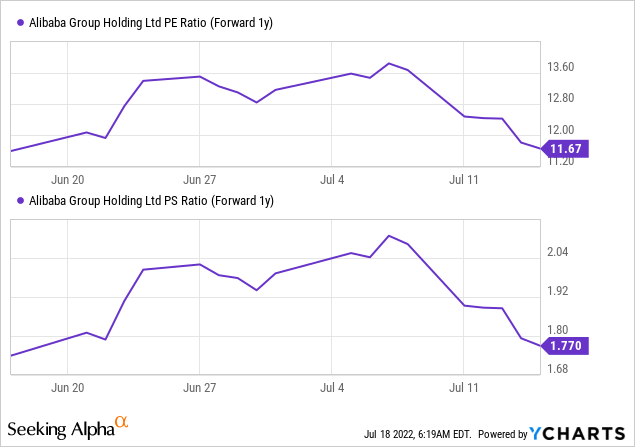

Alibaba’s valuation got another discount last week

It is hard to argue with Alibaba’s low valuation: the company appears undervalued by every metric in the book, but of course there have been good reasons for that. Because of the recent crackdown on big Chinese companies, valuation ratios for Alibaba have further improved.

Shares of Alibaba now sell for 11.7 X earnings and 1.8 X sales (FY 2023), indicating that Alibaba remains significantly undervalued given the e-Commerce opportunity in China.

Risks with Alibaba

The real risk for Alibaba is represented by the enormous power China’s anti-trust agencies have. While recent fines were not really damaging financially, a new crackdown can always occur. Authorities also have the power to decide what will happen to Alibaba-owned Ant Group, which owns the world’s largest mobile payment platform.

Regarding commercial risks, I believe a massive new lockdown campaign could set back Alibaba’s recovery as well as the recovery of the Chinese economy. What would change my opinion about Alibaba is if the company were to see a dramatic slowdown in its core businesses or was forced by regulators to sell off company assets.

Final thoughts

The Chinese economy has been weighed down by widespread COVID-19 lockdowns in the first half of 2022 which took a toll on the Chinese economy as well as on Alibaba’s top line growth. New fines imposed on Alibaba last week didn’t help sentiment.

But as China’s economy emerges from its lockdown state, a powerful economic force could be unleashed that finds its outlet in higher consumer spending and stronger e-Commerce sales for Alibaba. Since earnings estimates have trended down hard in the last couple of months and because predictions for FQ1’23 are low, Alibaba is a buy heading into earnings. I believe the Alibaba dragon will soon awaken from its sleep and shares could be pushed into a new up-leg!

Be the first to comment