RichLegg/E+ via Getty Images

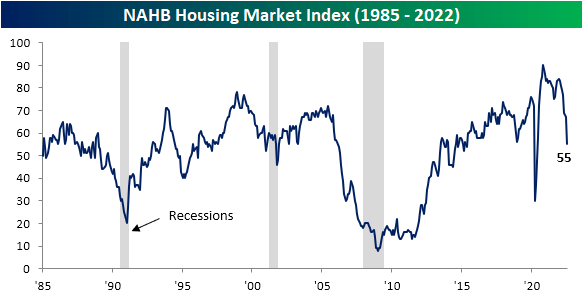

Another bad reading for housing hit the tape on Monday as the NAHB’s Housing Market Index measuring the confidence of US homebuilders experienced its second-largest decline on record behind the drop in April 2020. Homebuilder sentiment cratered 12 points month-over-month, sending the index to the lowest level since May 2020, which is also one point below the late-2018 low.

NAHB Housing Market Index (1985-2022) (Author)

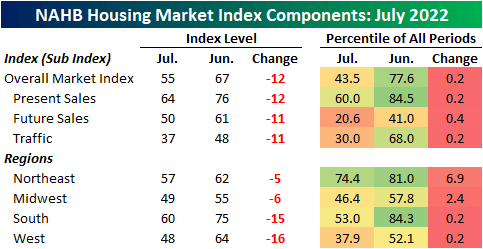

Given the drop in the headline number, each of the individual components (present and future sales and sales traffic) similarly experienced historic declines month-over-month. Like the headline index, Present Sales and Traffic only experienced larger declines at the start of the pandemic. The same goes for Future Sales, although there was also a slightly larger drop in December 1987, making this month’s drop the third-largest on record.

NAHB Housing Market Index Components: July 2022 (Author)

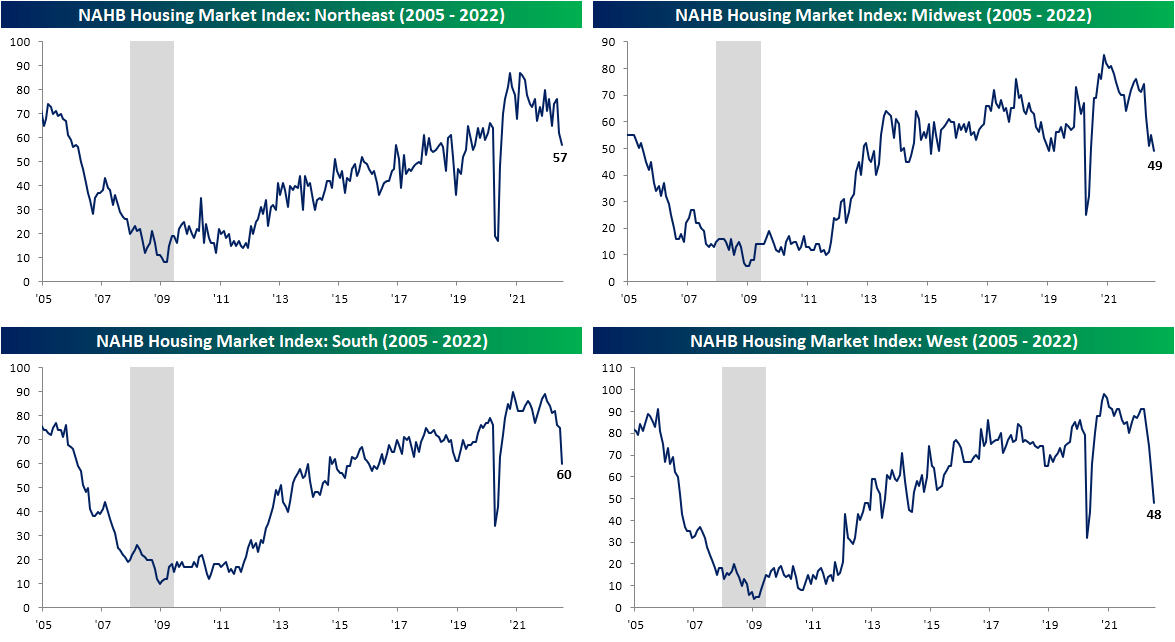

Geographically, no area of the country has been safe from plummeting sentiment, but the Northeast has held up remarkably well. Whereas the South and West saw double-digit monthly declines that both were the second-largest on record, the Northeast only fell five points to 57. That is a reading just shy of the top quartile of readings, unlike the other regions that are in the 52rd percentile at best (South).

NAHB Housing Market Index: Northeast, South, Midwest, West (2005-2022) (Author)

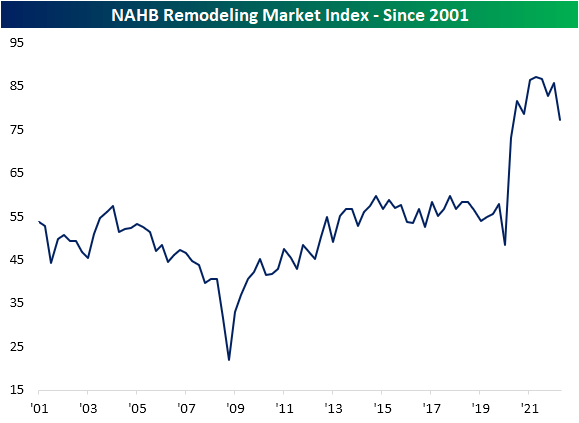

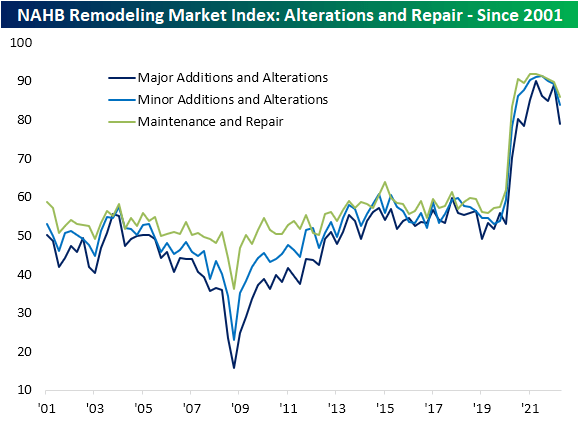

The lower sentiment for homebuilders is, of course, a function of rising mortgage rates and the subsequent dampening demand as a result. As for builders’ roles in existing homes, sentiment is also rolling over. In addition to Monday’s release, last week saw the quarterly release of the NAHB’s Remodeling Market Index measuring builders’ sentiment regarding remodeling projects. Unlike the Housing Market Index, this index remains historically elevated and down just a bit. In other words, remodeling demand has taken a hit but not to the same extent as projects to build a new home.

NAHB Remodeling Market Index – Since 2001 (Author)

The most pronounced decline in remodeler sentiment has come from the projects carrying the highest costs ($50K or more), even though smaller project outlooks have also been falling for a few quarters now.

NAHB Remodeling Market Index: Alterations And Repair – Since 2001 (Author)

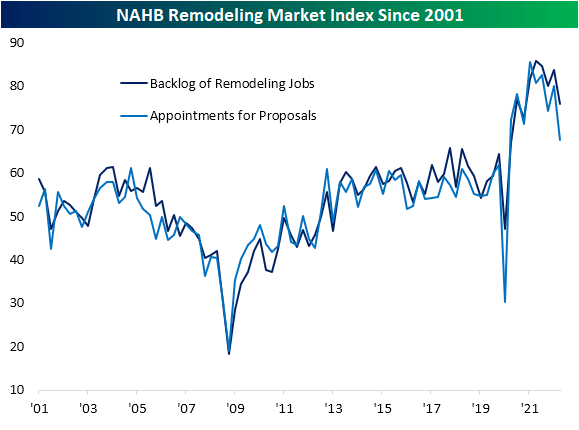

Backlogs have been unwinding as well, even if they are historically elevated. A likely big reason for that has been a deceleration in new projects. The index for Appointments for Proposals is much less elevated in the 48th percentile, compared to 56th for the headline reading or 68th for Backlog of Remodeling Jobs.

NAHB Remodeling Market Index – Since 2001 (Author)

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment