Khanchit Khirisutchalual

Investment Thesis

My growth/tech portfolio (although many stocks are different, to approximation it has mimicked Cathie Wood’s ARK (ARKK) both on the way up in 2020 and then on the way down) has seen a relentless decline since November. Basically, in half a year growth stocks have gone from being perhaps a bit overvalued (some more than others, for example I didn’t own Cloudflare (NET)), to becoming exaggeratedly undervalued. I now hold growth stocks with P/Es that value stocks should trade at.

I have added to many of my stocks on the way down. But the extent, pace and magnitude of the decline has been quite depressing. This continuously selling of stocks because the companies are investing in their long-term business instead of showing immediate returns is not what growth investing should be about. Although I have considered pausing investing altogether to let the dust settle, these declines have provided compelling investment opportunities nevertheless.

Background

My previous portfolio update can be found here: Tech Portfolio: From Hero To Zero. The portfolio was created in late 2019 with the intention to find growth stocks to hold for the long-term, with minimal selling.

Overview

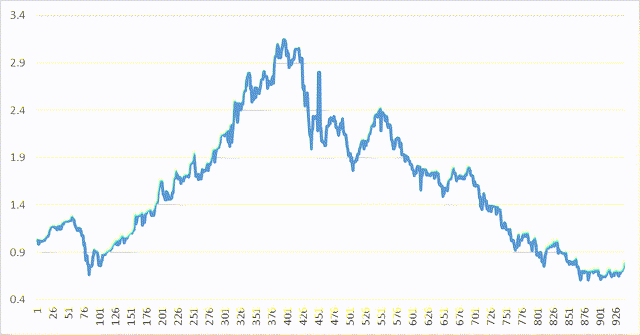

My portfolio was a COVID-19 (and “Fed 500”) beneficiary in 2020, mimicking Cathie Wood’s ARK performance, driven by NIO (NIO) and Pinterest (PINS), and to lesser extent by DocuSign (DOCU), Roku (ROKU) and Twilio (TWLO). However, the similarities in performance have also remained true on the way down since February 2021. The sell-off since mid-November corresponds to a bit before day 700 of the portfolio in the graph below, and indeed has continued relentlessly for about 200 days.

The bottom of the portfolio occurred in early May, when it was only worth 0.6x the invested capital. The portfolio has been hovering around 0.65-0.7x returns in the last month or so, but in the last few days due to the rally and the ironSource (IS) acquisition, the portfolio has popped back to 0.8x. I would assume that the last month may have been the bottom. While calling the bottom may be considered a foolish attempt, it is nevertheless a fact that growth stocks have gone from overvalued to tangibly undervalued compared to historical valuations. As indicated in the summary, several of my growth stocks now have a lower P/E valuation than many of the “safe” value stocks.

In any case, my investment approach has remained fairly consistent and similar by continuing to add to growth stocks as they dropped further. Perhaps the main lesson I have learned from this downturn, though, is to become more conscious of earnings and profitability, as just top-line growth isn’t sufficient. Nevertheless, growth investors should still recognize that the reason for a lack of profitability may be the investments in pursuit of further growth.

Note: the chart above compares the actual portfolio value to the invested capital. However, since I have taken some profit over time in some positions, this means I have actually invested more money in stocks than the invested capital (“nest egg”). This means that a graph that compares the portfolio value to the total invested dollars would should show the portfolio being much more underwater. I estimate the portfolio was down around 45% in value over the last month at the low end, and down by 50% in value at its bottom in May.

Portfolio activity and discussion

I have continued to add to ironSource on the way down, since the company is profitable (which arguably provides a strong protection against downside once the P/E drops into the teens) and has a history of best-in-class multi-year growth. However, as I’ve discussed, the company sold itself to Unity (U) recently (for what I considered to be a severe discount to what its value could be in a more average investment climate, absent of wars, rampant inflation and interest rate hikes). Unity is a stock I held a few shares of but sold close to the top as I recognized Unity’s overhyped overvaluation, similar to Asana (ASAN) and Cloudflare around fall 2021. However, due to sell-off, all three of these names have become more or lesser extent investable again.

As discussed in my ironSource discussion, Unity itself, while more expensive than ironSource even after its own decline, arguably has been sold off too much when looking at the multi-year opportunity for continued growth. However, Unity did reduce its guidance for the second time this year, so it seems management may have underestimated its blunder and/or the macro environment in gaming may be worse than expected, so I will continue to monitor Unity’s progress.

In any case, due to the merger and the recent rebound in Unity shares after the initial dip (which hence also lifted IS), the valuation has become slightly above my average cost (although I envisioned IS standalone could easily have become a multi-bagger even from its current ~$4 price).

I have used this opportunity to slightly reduce my ironSource stake in favor of Innovative Industrial (IIPR), Asana, PubMatic (PUBM) and Smartsheet (SMAR). I also bought a few SentinelOne (S) and Upstart (UPST) shares.

IIPR had been one of the initial cornerstones of my portfolio due to its combination of growth and dividend, but sold the position in late 2021 for more than $200 (in order to buy growth stocks after the initial few weeks of declines). When I saw the stock had fallen back below $100 despite its solid growth since 2020, this seemed like a nice opportunity to perhaps add a bit more dividend safety to my portfolio.

Asana had been my top stock for 2021, but sold a portion for triple digits due to its extreme overvaluation in fall 2021. But with the stock falling to new all-time lows, firmly below $20, this presents a nice opportunity for a re-entry. Asana has also been growing even faster than ironSource lately, although it is not profitable given that it is investing pretty much everything back into further growth. I do not consider this to be irresponsible management given the unit economics of software. The same goes for Smartsheet.

PubMatic remains the largest nest egg in the portfolio, and with the stock also falling well below $20 I am firmly underwater. Nevertheless, I have not been inclined to add too much to it due to the decelerated growth rate. However, the investment case of the company being nicely profitable combined with a cheap P/S valuation stands. In addition, PubMatic should be able to keep growing for many years due to the secular growth in digital advertising as well as by taking market share, with management having the aggressive/aspirational goal to quintuple market share (although without a provided timeline). As such, the growth rate may reaccelerate.

SentinelOne is the new kid on the security block with a best-in-class product, the new CrowdStrike (CRWD). While its valuation remains high, it is not excessively high given its exceptional growth rate, and the company has been executing very well in that regard.

Lastly, I thought Upstart was the real deal, but the “bubble” has collapsed, so I am firmly underwater on this one. Upstart was compelling for two reasons besides its strong growth. First, although it may be called a fintech company, it really is actually a SaaS company, which bodes well for margin expectations. Secondly, the company was already and remains profitable. (Just like with ironSource, this arguably pops the narrative that growth companies being profitable are shielded from the severe stock declines in the last half a year.)

A last company worth mentioning is Invitae (NVTA), which recently announced a reorg to focus even more on cost reductions, which is impacting the growth expectations going forward. Although this thesis obviously isn’t working out as planned for now, obviously Invitae was infamous for way overspending above its actual cash generation capabilities. Nevertheless, the valuation had become so cheap that a small bet seemed opportune. Arguably, Invitae doesn’t necessarily even need to grow that much, it just needs to show the money (profits), with any further growth being a bonus.

A few other stocks I have added to include Affirm (AFRM), DiDi (OTCPK:DIDIY), Alteryx (AYX), Global-e (GLBE), UiPath (PATH) and Intel (INTC).

Dogs of the portfolio

My greatest flops (down between 75-90% from the nest egg):

The next three stocks are Upstart, Invitae and Teladoc Health (TDOC).

Investor Takeaway

I believe the portfolio is down, but not out. While multiple stocks clearly haven’t worked out with the companies not execution to their thesis, some of them like Pinterest, Upstart, SentinelOne, PubMatic and ironSource/Unity (which happen to account for the majority of invested capital) clearly have the potential to become multi-baggers compared to where they currently are. For example, data has shown (as presented in the All-In podcast) that software companies are well below their historical average (which is quite the change compared to just 1-2 years ago).

Although the portfolio is still down by around 35% in value (after the rally and ironSource merger in the last few days), due to a bit of profit taking over time, the portfolio is currently down to “just” 0.8x the invested capital. My pessimism due to the multi-month sell-off had caused me to expect that it would take perhaps a full decade to get back to breakeven, but perhaps it may not even take that long.

For example, what will happen when food and energy prices come back down from their elevated level? Higher oil and gas prices will simply accelerate the transition to greener and cheaper alternatives, and perhaps other countries may start producing more food if Ukraine’s output remains reduced. In addition, the chip shortages will also end at some point as all the fab capacity that has been built over the last few years catches up to demand.

Be the first to comment