imaginima

Gran Tierra Energy (NYSE:GTE) is an oil producer in Colombia and Ecuador. The company has raised production throughout the first half of 2022 and is benefitting greatly from high oil prices. The company is also in the process of paying down debt, which should improve its balance sheet and shareholders’ equity.

Rising Production, High Oil Prices

Gran Tierra is currently benefitting from soaring oil prices and higher production volumes that promise a strong free cash flow for 2022.

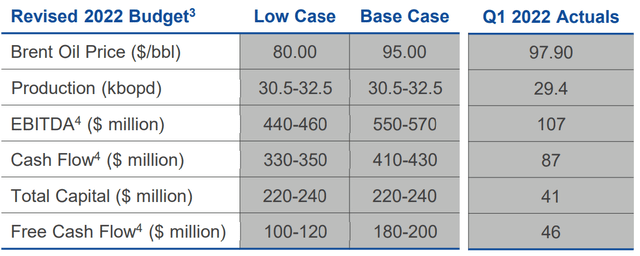

The company’s 2022 budget projections (revised in June) assume $95 per barrel in the base case (a level Brent hasn’t seen since late February). This seems like a fairly safe bet given the company’s already-locked-in first and second quarters.

Gran Tierra Energy June Presentation

Additionally, we can expect to see a true whopper of a second quarter when the company reports, as we already know production volume was up 4% from the first quarter and 33% up from a year ago. With an average 30,607 barrels of oil per day over 91 days and a Brent oil price consistently above $100, that oil should be very profitable (even if the company isn’t quite achieving that Brent price for its production). And the company still has strong reserves of 81 million barrels of oil equivalent (BOE) in proved reserves and 125 million BOE in proved + probable reserves.

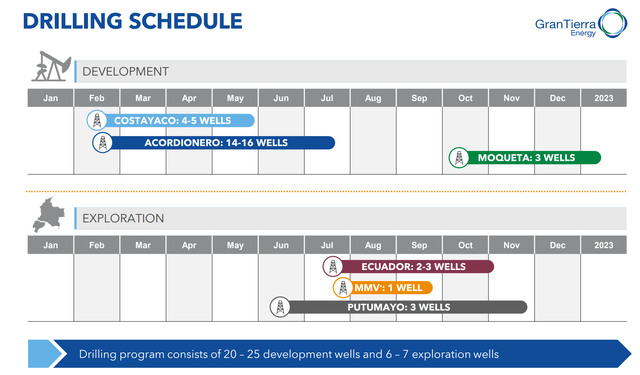

The company has thus far drilled 16 new wells in Acordionero this year; 10 new production wells and 6 exploration wells. Five new wells in Costayaco have also been drilled, on track with the company’s drilling schedule.

Gran Tierra Energy June Presentation

The third quarter looks to be an exciting time for the company’s exploration and the second quarter conference call may offer more color on the progress there.

Improving Balance Sheet

Gran Tierra is aiming at reducing its net debt to under $400 million by the end of 2022. As of June 2, the company has fully paid off its credit facility (down from $207 million in 2020). The company has a $109 million cash balance and aims to replace its former credit facility with a new, smaller one. The company’s remaining two $300 million senior notes mature in 2025 and 2027 giving the company significant room to maneuver before they mature. Though the company’s net debt is fairly high (especially compared to any of the supermajors), the company is clearly focused on bringing this level down by utilizing its extraordinary free cash flow.

Risks

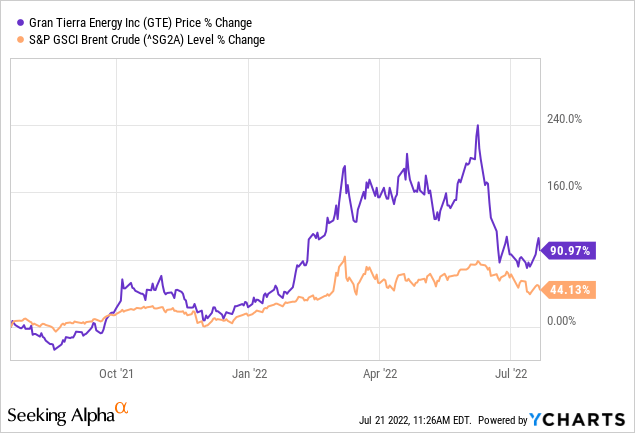

Gran Tierra’s primary risk relates to fluctuating oil prices. If we were to see a recession drive down demand and bring oil back to lower levels, Gran Tierra’s shares would likely follow. Even though oil prices probably will not crater to a level where the company is wholly unprofitable, given how highly-correlated its shares are to oil prices, the impact would be significantly negative all the same.

Additionally, while the company has in the past hedged some portion of its production, it has no hedging going forward. So long as oil remains above $100 per barrel, this is excellent for the company, but if oil drops significantly, that would quickly prove detrimental.

There is also a perceived political risk in Colombia as the new President Petro has pledged to halt new oil and gas exploration/production in the country. However, he has also clarified that he will honor existing contracts (which Gran Tierra has) so as not to utterly shock the economy while transitioning to a more environmentally sustainable program. In addition to this, the likelihood of even achieving a ban on new exploration has been called into question as we have yet to see how the debates play out in Congress.

Valuation

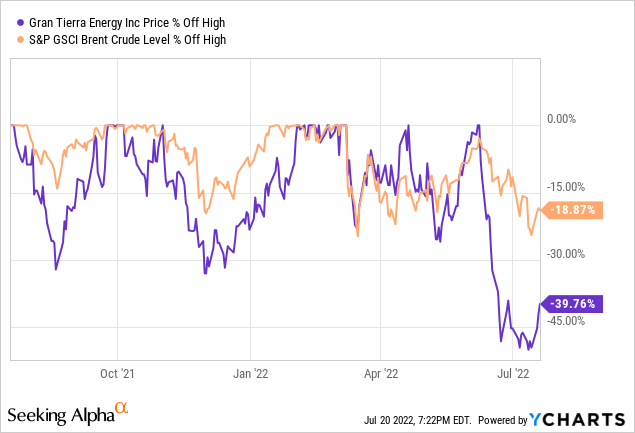

As seen in the risk section, Gran Tierra trades very similarly to crude oil (which makes some sense given the company’s business). However, the company has also sold off much more steeply than the decline in Brent might suggest and is nearly 40% off its recent high, and GTE usually trades with much more volatility as well.

The company currently trades at around 1x 2022 cash flow or 2x expected free cash flow. In other words, shares are incredibly cheap. The company’s five year average trailing price to cash flow ratio of 3.10 would value shares at $3.45 per share (cash flow per share of $1.11 at the lower end of the base case). This would be an upside of 188% from the current share price.

Conclusion

Gran Tierra is experiencing a true boom right now in the oil industry. And even though shares are up year-to-date, they are still cheap relative to the company’s ever-improving condition. If Gran Tierra can continue to execute for the third and fourth quarter, I believe shares could be headed meaningfully higher, barring a massive selloff in crude oil.

Be the first to comment