metamorworks/iStock via Getty Images

Even in the mud and scum of things, something always, always sings. – Ralph Waldo Emerson

Today, we take another trip to EV/lithium battery land, a space that has become strewn with “Busted IPOs” in recent quarters as the market has gone “risk off” on so many high beta parts of equities. A profile of this silicon-anode lithium-ion battery maker follows below.

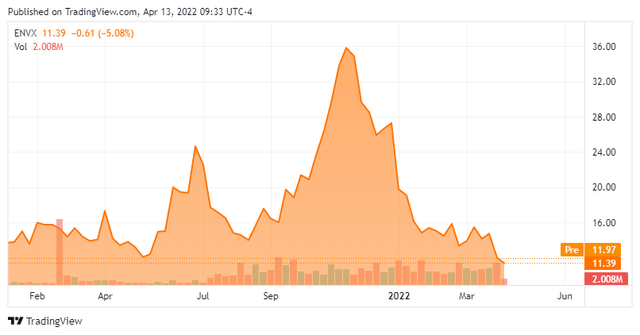

ENVX – Stock Chart (Seeking Alpha)

Company Overview

Enovix Corporation (NASDAQ:ENVX) is headquartered just outside of San Jose, CA. The company designs, develops, and manufactures silicon-anode lithium-ion batteries. The company went public early in 2021. The stock had a huge run into late that year, before the air came out of the space. Since then the stock is down some two-thirds from all-time highs. It currently trades just above $11.50 a share and sports an approximate market capitalization of $1.8 billion.

ENVX – Manufacturing Advantages (March Company Presentation)

The company is just getting to the production stage of its journey. Management believes its production process has several advantages over the competition (above). Enovix rolled out the first battery cells from its first automated factory in Fremont, CA, in late summer of 2021.

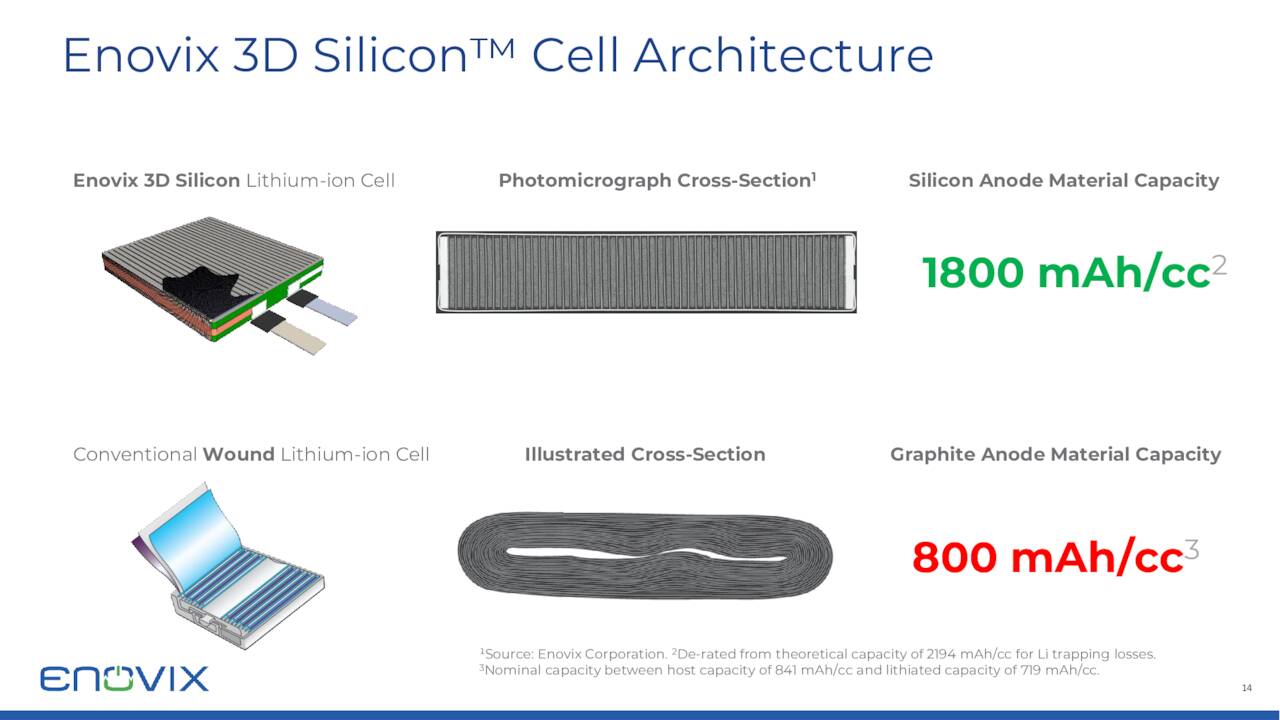

ENVX – Battery Cell Architecture (March Company Presentation)

The manufacturer’s proprietary 3D cell architecture increases energy density and maintains high cycle life. Enovix is building an advanced silicon-anode lithium-ion battery production facility in the U.S. for volume production. The company has an aggressive ramp-up plan and is targeting multiple industries that use lithium-ion batteries.

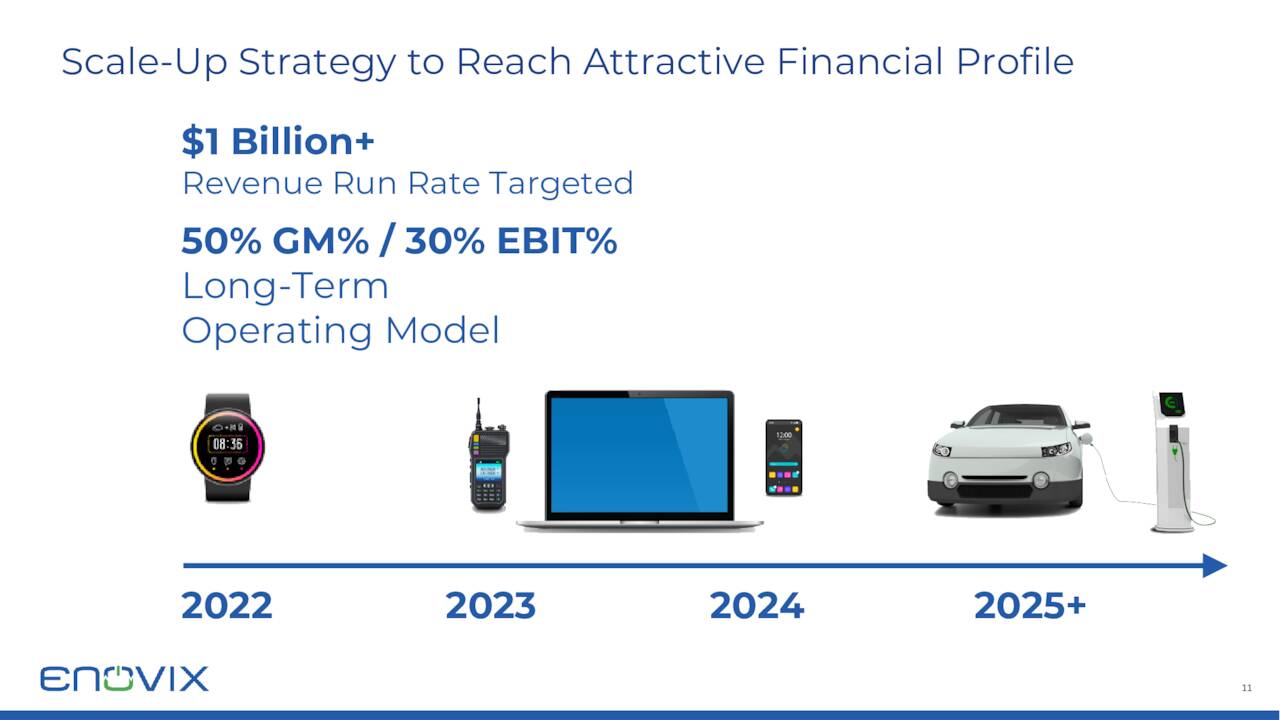

ENVX – Growth Targets/Plan (March Company Presentation)

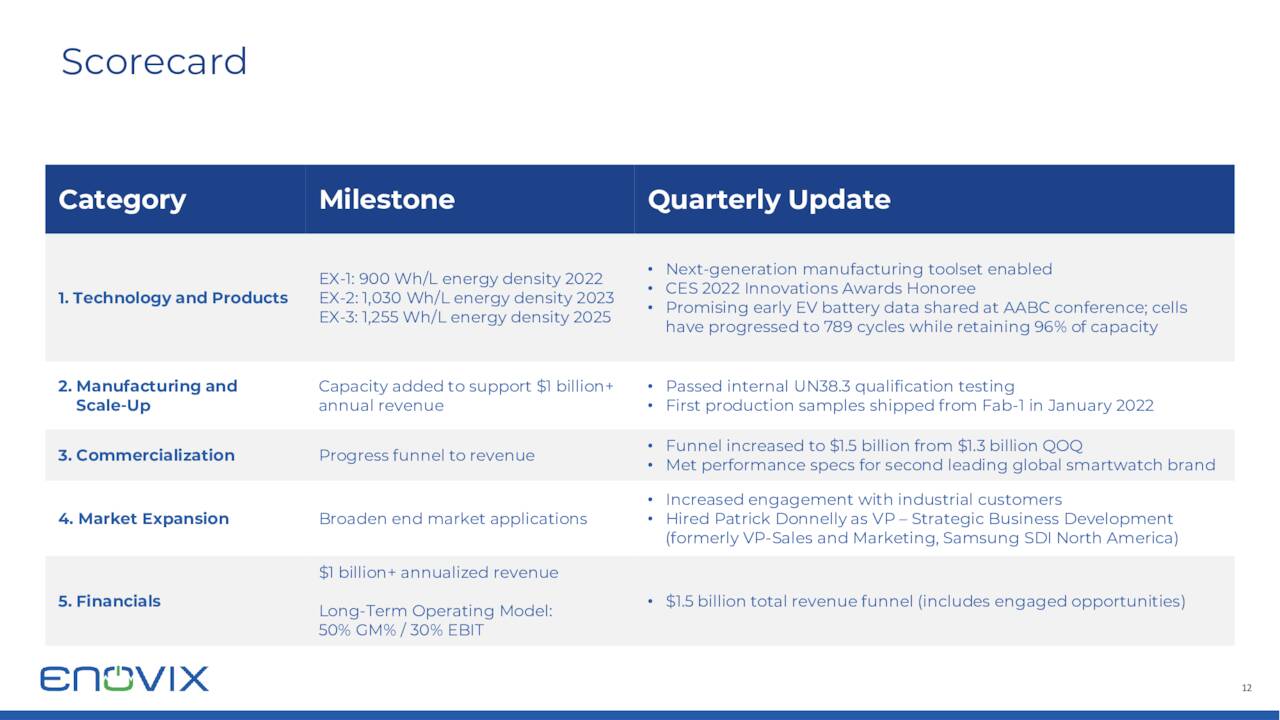

Fourth Quarter Results

On March 3rd, the company posted fourth quarter results. The company reported a net loss of 60 cents a share for the quarter. Management expects to consume $190 million and $210 million worth of cash in FY2022, with roughly 55% allocated towards capital expenditures. Recognized revenues are expected in a miniscule $6 million to $12 million range in this fiscal year as the company brings manufacturing capacity online. The company’s revenue funnel increased by roughly $200 million during the quarter to $1.5 billion. Management stated on the conference call that “Indications of demand for our battery remain well above what we can supply for several years.”

Analyst Commentary & Balance Sheet:

So far in 2022, five analyst firms, including Piper Sandler and Cowen & Co., have reiterated Buy or Outperform ratings on the stock, albeit two with downward price target revisions. Price targets proffered range from $29 to $65 a share. Here is the commentary from the analyst at Northland Securities who reissued his Outperform rating and $35 price target on ENVX four weeks ago:

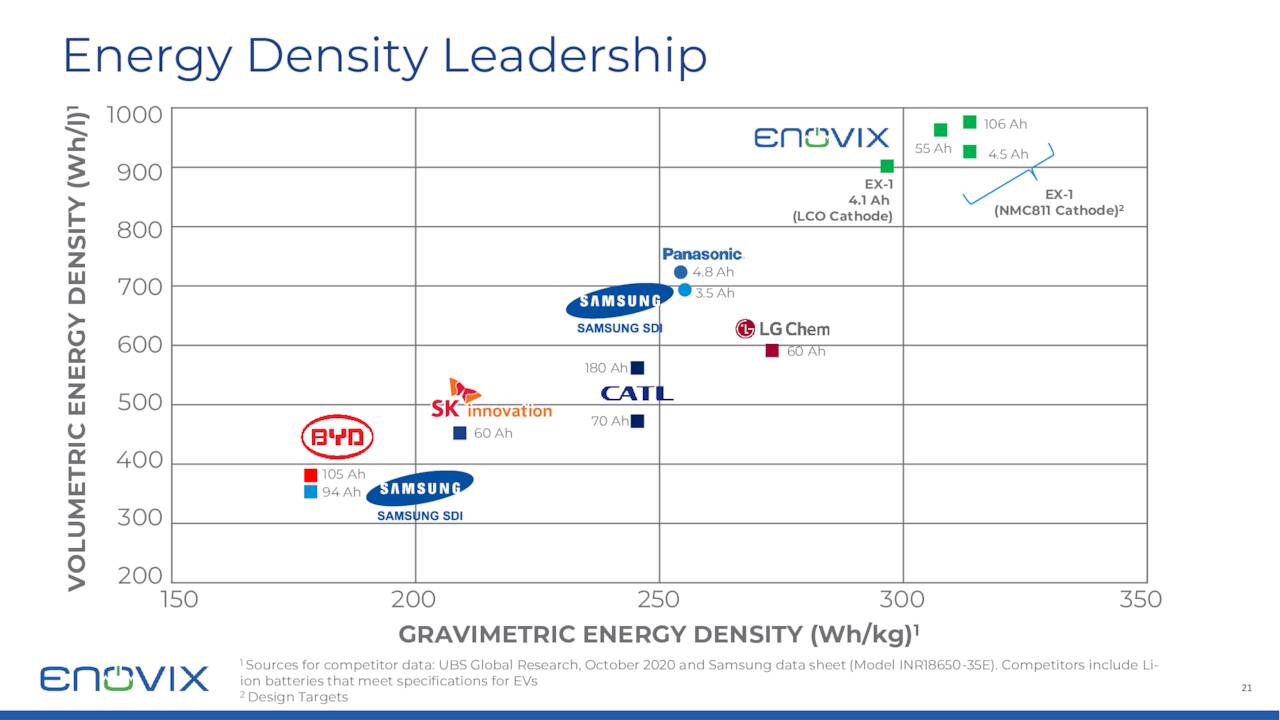

ENVX architecture lends itself to heat dissipation allowing for rapid charging. Also, the ENVX battery’s claim to fame is it has a high energy density. This would improve the form factor in the performance EV market. ENVX is working on a DOE program to achieve 700 watt-hours per liter. Due to the problem of the deterioration of Si anode battery capacity after multiple charging cycles ENVX is first demonstrating 80% of capacity after 1000 cycles. ENVX battery cells targeted for EV applications have already achieved 789 cycles while retaining 96% of their capacity.” He also learned that “ENVX is engaged with one of the largest real estate firms that specialize in manufacturing sites. In addition, due to demand from both US and Asian customers, it is likely that ENVX will build 2 facilities dedicated to laptops and cell phone batteries.”

The company ended FY2021 with approximate net cash of $385 million in net cash. Another $53 million of cash came in during a warrant exercise in the first quarter of this year. A director and CEO purchased just over $340,000 worth of shares in aggregate on March 8th. There have been no insider sales in the stock since the company came public. Less than four percent of the outstanding shares are currently held short.

Verdict

Energy Density (March Company Presentation)

The current analyst consensus projects a net loss of 70 cents a share in FY2022 on revenues of just $9 million as the company is in the initial stages of its production ramp. For FY2023, analysts see similar losses but expect sales to soar to $130 million, within a wide range of projections of roughly between $80 million to $165 million.

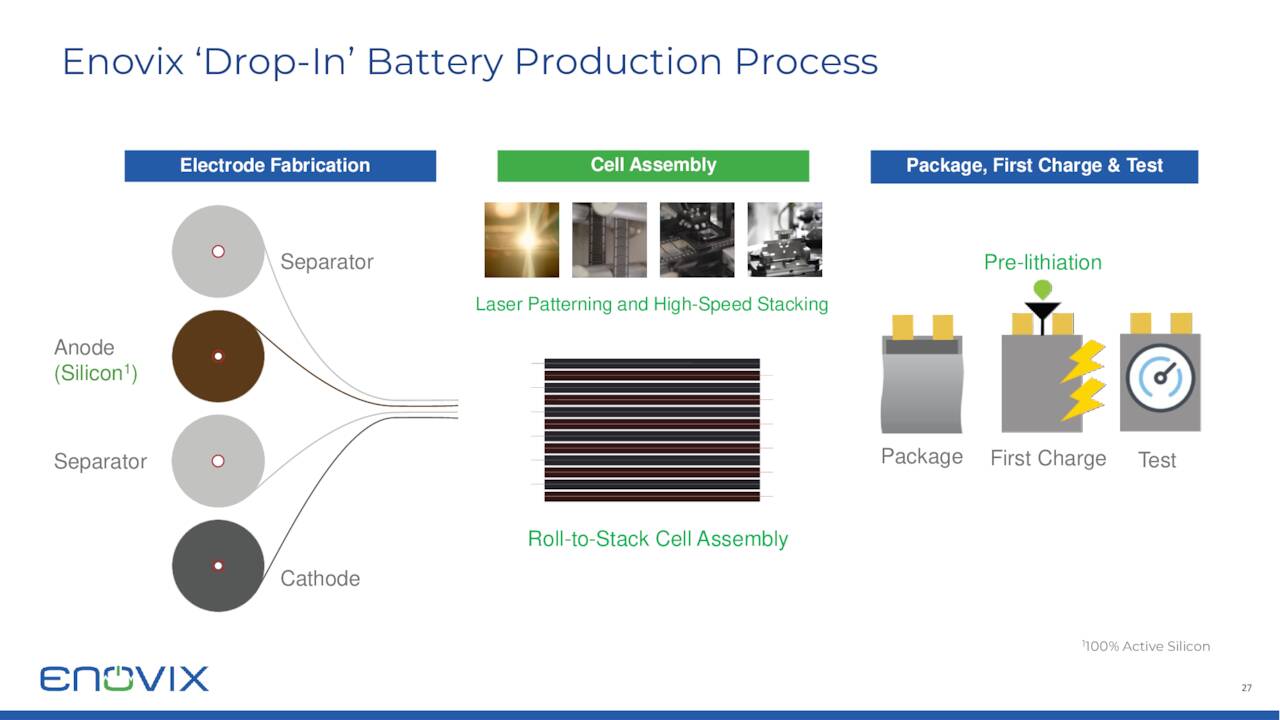

ENVX – Battery Production Process (March Company Presentation)

The company is betting that its superior manufacturing process will lead to rapid market share gains in various markets.

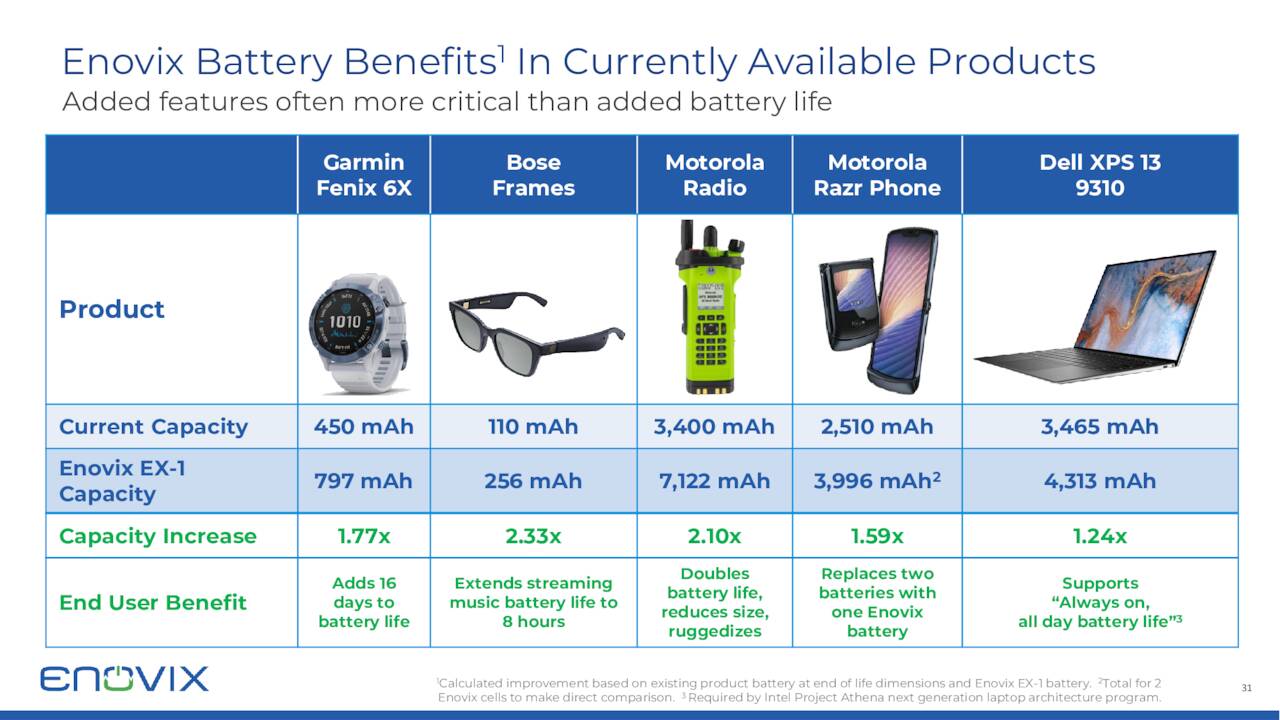

ENVX – Superior Battery Capabilities (March Company Presentation)

Analysts seem sanguine on the company prospects judging from the analyst community’s commentary on Enovix in 2022 as well as their price targets on the stock. Insiders are holding their shares tightly, which is encouraging as well.

Company Milestones (March Company Presentation)

The problem is that real revenues are more than a year off and profitability is further still on the horizon. The company will burn through some $200 million of cash in FY2022, which is nearly half of its net cash after the recent warrant exercise. This sector also continues to see significant impacts from the bottlenecked global supply chain, and prices for lithium have soared in recent months, from $5,000 per ton to as much as $25,000 on the spot market.

Based on management commentary, there seems to be substantial demand for the company’s output. However, given all the unknowns but the usual challenges of being out of manufacturing capacity, at best ENVX is a small “watch item” position at the current time despite several positives.

“Everything that is done in this world is done by hope.” – Martin Luther

Be the first to comment