Maskot

It feels like the digital world is taking over.

From traditional newspapers to the menus at restaurants, practically anything that used to be printed is now available in digital form.

Well, don’t tell this to Ennis, Inc. (NYSE:EBF), arguably the largest provider of business forms, pressure-seal forms, labels, tags, envelopes, and presentation folders in the U.S.

Ennis, which has been around for over a century after being founded in 1909, markets all sorts of print products under dozens of different brands.

They have carved out a specialty side of the industry and look to maintain their market share in the shift to even more digital media after the pandemic.

Today, we’ll break down the company’s fundamentals, sentiment and technical to see if Ennis is a buy or sell…

About Ennis

Ennis, based out of Texas, truly believes they are the largest producer of these forms and folders in the U.S., using independent distributors.

The company’s strategic locations and buying power permit them to compete on a favorable basis within the distributor market on competitive factors such as service, quality and price. As they face rising raw material costs, these are coming from a variety of quality of paper for business products purchased from one major supplies at favorable prices based on the volume of business.

This is something to watch. Having a single provider of the bulk of your supplies puts them at risk of that supplier and any material changes to that relationship. Just something to keep in mind with a company that has been around this long. Don’t want them to be too stuck on their old ways and still try to innovate.

While they don’t have to deal with seasonality, the company has mentioned that economic conditions create fluctuations in sales from quarter to quarter. Again, something to keep an eye on. We are basically in an unofficial recession at the moment, which would classify as a contraction to the economy. This could eventually impact the revenues generated at Ennis.

To maintain its leading industry status the company has made a few key acquisitions, one in 2021 of AmeriPrint that generated about $6.5 million in sales in 2020. Then, just last month, Ennis acquired certain assets, including customer lists and intellectual property, from Gulf Business Forms, though the terms of that deal were not disclosed.

Let’s take a look at the fundamentals to see how the company has been doing since the pandemic…

Fundamental Analysis

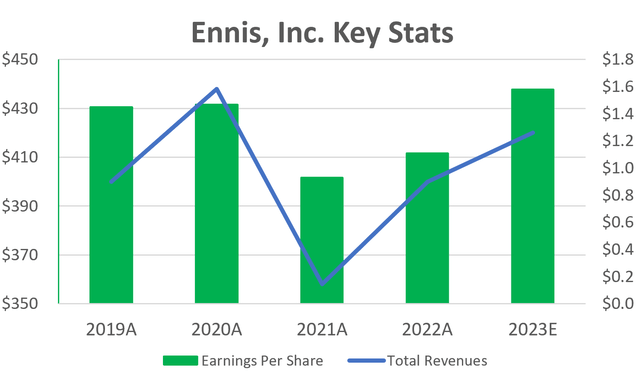

For the fundamental take, I like to look at two main metrics – top of the line numbers with revenues and bottom of the line numbers with earnings per share.

These two numbers tell us the most about the company without getting into the weeds of their accounting processes.

Below, you can see the revenues represented as the blue line on the chart (prices on the left in millions) and earnings per share as the green bars on the chart (prices on right).

It’s important to note that the company’s fiscal year ended on February 28, 2022 for the 2022 actual results.

That means the dip from the pandemic shows up in 2021 actual results and not 2020, which explains the decline in revenues and earnings in 2021 results.

Realizing that, it is expected to see earnings and revenues improve since then, with expectations of getting back to basically pre pandemic numbers in 2020.

But inflation is a threat to this outlook.

In the first quarter of the 2023 fiscal year ending May 31, 2022, the company posted an 11.1% increase in revenues and a 60.7% increase in earnings per share. The company continued to see strong demand to start this year and was able to make price adjustments to cover inflationary costs, while improving the overall efficiency of its operations.

But, since the pandemic created shortages, the industry hasn’t caught back up yet. Most of the manufacturing is running at high capacity and failing to re-stock shelves. They are merely filling new orders. Ennis is leveraging their relationship with their supplier to meet customer demand.

With no debt and significant cash (just over $91 million), the company has been able to acquire new companies and fund their operations without the need for leverage in this market. But the credit is available if they ever need it or see an opportunity worth using it on.

Ennis remains focused on giving back to their shareholders through a stock repurchase program and dividends. The company repurchased 64,000 shares in the first quarter and pays out a 4.71% dividend as of September 2nd.

Next up, we’ll look at a few sentiment indicators to see how investors feel about the stock.

Sentiment Readings

Short interest is a key sentiment reading because it tells us how much leverage investors are willing to take to bet on the stock to decline. Typically, anything under 5% is not meaningful, while more than 20% is a reason to be cautious. Ennis is at 2.84%, so this isn’t a meaningful level to be worried about.

It’s not a widely covered stock, despite being around for over 100 years, with just one analyst providing ratings on Yahoo Finance. They rate the stock as a buy, with a price target of $26, about a 25% increase from current prices. At least the lone analyst is bullish on the stock.

Now let’s see how the price action looks for the stock.

Price Patterns

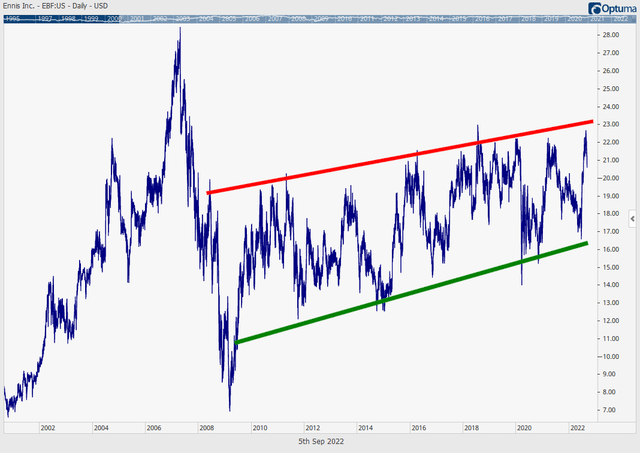

I don’t usually do this, but we are going to take a very long-term look at the chart. I usually follow short-term trading patterns because stocks mostly react to these short-term levels.

But Ennis is a bit different.

Take a look:

This chart goes all the way back to 2001, to show this big run up to the 08′ crash. Then, for the last 14 years, the stock has been in this steady upward price channel. It’s actually amazing when you think about it. Stocks don’t typically stay in clear price patterns like this for much longer than one year.

On the short-term price chart, the stock’s recent run up looked very bullish. It made a higher high and then went into a correction to get us to the price level we see today. And its stock has a history of bouncing around that red resistance line at the top but has not been able to break out of it for more than a decade.

The green support level at this point is a 17% drop. Not a huge decline given the volatility we’ve seen in this market recently.

Conclusion

If you are looking for a stable stock, strong dividend yield and potential for double-digit growth, Ennis has you covered.

The fundamentals were strong, rebounding swiftly from the pandemic-related weakness. Ennis has been able to control pricing power in an inflationary environment so far to generate increasing revenues and earnings. Its sentiment was fine, with only one analyst covering the stock, but rated it as a buy. And the price chart is bullish in the short-term, with two clear levels to watch over the long-term.

With the stability this stock has shown, I am landing it on my Bank It list today.

A 17% drop is a modest cushion to give a company like Ennis paying 4.7% in a dividend yield and long business track record to manage varying economic environments.

Be the first to comment