Vasil Dimitrov/E+ via Getty Images

Investment Thesis

EOG Resources (NYSE:EOG) is committed to returning 60% of its 2022 free cash flow back to shareholders.

Since my previous article, last month, the oil has become increasingly jittery. As an extension, the potential for oil prices reverting lower and dampening EOG’s total payout is much more pertinent now than it was then.

Indeed, back in May, investors were still unsure just how much the FED would tighten rates. Will it be 25 or 50 basis points? It turned out that it was 75 basis points.

This has led to EOG’s share price falling by more than 20%. The biggest downward move in the past 12 months. A move that hasn’t escaped anyone invested in the stock.

In this article, I offer fresh perspectives to show that despite the recent sell-off in oil prices, that oil is going to remain high for longer.

We are now halfway through 2022, and there’s no reason to expect the second half of 2022 not to match the first half.

Here’s why paying approximately 7x free cash flow for EOG makes a lot of sense. Furthermore, the bull case is supported by EOG’s commitment to a 60% free cash flow return, which approximates an 8% capital return to shareholders in 2022.

Here’s why I rate this stock a buy.

EOG Resources’ Near-Term Prospects

Oil prices have sold off in the past few days. Investors have become shaky that the economy is going to a substantial and prolonged slowdown that will lead to oil demand coming down.

What’s the oil price right now? The oil price at the time of writing is around $109 WTI. Thus, need I remind you that back in April, oil prices were on average $100 WTI?

This means that even though investors are really shaky that the ”oil party” is done and dusted, I argue that this is not the case. It’s all about perspective. Right now, oil prices are close to the highest they have been over the past 5-years.

And the dynamics that got us here, over the past 18 months are still in place. We live in an oil-based economy. Here’s one minor example, agriculture uses 17% of all the fossil fuels (oil, coal, and natural gas). And then, heating, electricity, and building, all require oil, lots of oil and natural gas.

And while there’s ample news of global economies slowing down, that’s hardly ”new news”. And even with those considerations now being priced into the WTI price on the spot market, WTI prices are still about 5% to 10% higher than they were in April. Again, it’s all about perspective.

And with this framework in mind, I’ll discuss why investors would do well to get behind EOG Resources.

Capital Allocation Strategy, +60% Committed Return

EOG is going to return at least 60% of its free cash flow to shareholders. I estimate that EOG could be on a run-rate of $9 to $9.5 billion of free cash flow over the next twelve months. More details on this estimate, are to be found in the next section.

If my estimates prove accurate, this would see EOG returning to shareholders approximately $5.5 billion over the next twelve months. This implies that shareholders should expect to see approximately 8% capital return at EOG’s present valuation.

EOG Stock Valuation – 7x Free Cash Flow

When it comes to EOG’s stock valuation, there are many moving parts.

The most pressing of which is what will oil prices be for the remainder of 2022? I have no idea. And yet, that’s the biggest driver of my bullish case.

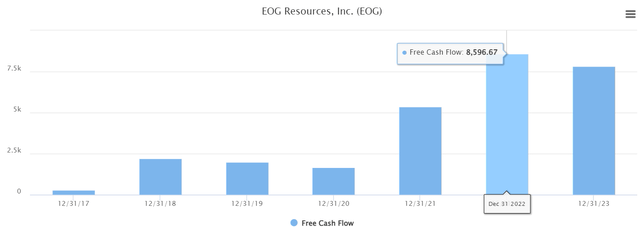

EOG’s analyst free cash flow estimates

For now, analysts are still expecting that EOG’s free cash flow in 2022 would reach $9 billion. And that in 2023, EOG’s free cash flows will revert lower, to approximately $8 billion.

For my part, I believe that EOG’s 2022 free cash flows will be substantially higher than this. Indeed, EOG notes that it’s on target for $8 billion of free cash flow at $95 WTI. However, as discussed already, WTI is $109 right now.

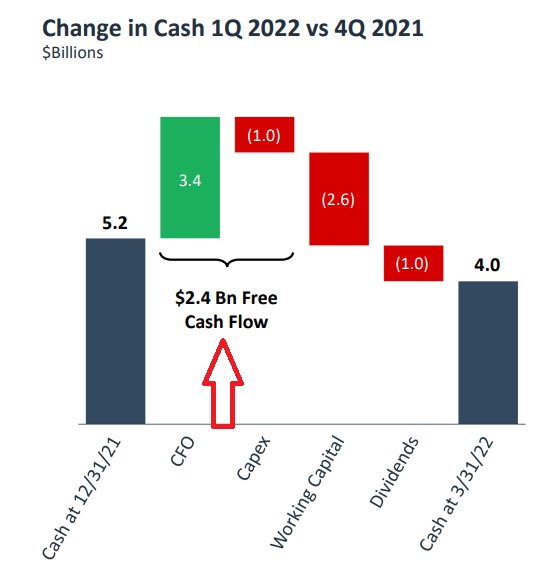

EOG Q1 2022

What’s more, from EOG’s 10-K filing, we know that every $1 of WTI, leads to $107 million of net income. Consequently, all figures conclusively point to EOG reporting approximately $9.0 to $9.5 billion of free cash flow over the next twelve months.

Here are the maths:

- $109 WTI-$95 WTI previous estimate=$14 WTI

- $14 WTI*$107 million=$1.5 billion

- $8 billion of free cash flow+$1.5 billion upwards revised estimate=$9.5 billion of free cash flow as a new runrate.

Hence, despite different potential assumptions unfolding, I believe that paying 7x free cash flow for EOG is an attractive valuation.

The Bottom Line

EOG is not the cheapest oil and gas play. That being said, the one aspect that makes EOG particularly attractive is its clear-cut capital allocation strategy. With EOG investors need not be worried that EOG will squander precious capital by reinvesting back into the business.

The focus for EOG is on returning capital to shareholders. I estimate that EOG will return 8% capital to shareholders over the next twelve months.

Be the first to comment