cemagraphics

Thesis highlight

I believe Enfusion (NYSE:ENFN) is undervalued as of today. By helping investment managers make educated investment choices, the company is committed to revolutionizing the investment management industry. Several positive trends in the investing industry are driving intense competition among market participants. ENFN, coupled with its structured go-to-market strategy, possesses a superior and custom-made solution that it is continuously developing to generate leads and meet the needs of its clients.

Company overview

ENFN is a global SaaS provider that aims to revolutionize the investment management industry. Investment managers are given the ability to make and act on better-informed investment decisions in real-time thanks to the company’s solution, which is meant to remove technological and informational roadblocks. By consolidating data from multiple sources into a centralized repository, ENFN creates a single truth that can streamline investment and operations processes. To sum up, this facilitates better communication and collaboration across the client’s entire organization throughout the investment management lifecycle.

Investments merits

Several tailwinds in the investment industry to support ENFN’s growth

I believe that because the industry keeps growing, the investment management community is at a crossroads and going through a lot of generational shifts right now.

With low interest rates and more competition in the market, it’s becoming more and more important for investment managers to find new and creative ways to make money on their investments. In practice, this may include investing in a wider range of alternative and less liquid assets across a wider range of global markets, further complicating risk and operational management concerns. Because of this, I think investment managers are looking for cutting-edge solutions that can keep up with the fast rate of change and help them make smart trades at the right time while using dynamic risk management.

Furthermore, industry-wide consolidation has resulted from competitive and return-on-investment pressures. Due to this, vast, centralized operations and technology ecosystems have emerged, all of which must collaborate to produce effective capabilities and reliable data. However, they are swamped by legacy and ad hoc systems that are becoming increasingly difficult to manage and produce subpar results. As a result, investment managers are looking for ways to centralize their data, processes, and workflows to lessen the impact of the consolidation process and return attention to performance.

Lastly and most importantly, rising regulation and regulatory surveillance are being driven by the pace with which the world is changing, the complexity of markets, and the number of market participants. Increased transparency on returns, investments, operations, and controls is becoming more important to investors. Investment managers need solutions that help them stay in line with constantly changing regulations.

All these issues, one might assume, have answers. But no. In spite of the importance of addressing these issues, there is a dearth of comprehensive and integrated solutions currently available to investment managers. Existing options are a patchwork of “task-specific” point solutions from various vendors, technologies acquired through mergers and acquisitions, technologies developed in-house, and high-priced options accessible only to the wealthiest investment managers. Since these solutions are cloud-migrated rather than cloud-native, they lack the agility required to support scale, forcing investment managers to resort to expensive methods like physical provisioning and the employment of large teams of specialists who can be difficult to find and retain. As a result, costs rise, strategies become more rigid, and decision-making times lengthen; there is more information leakage and less data integrity and reporting.

ENFN has a better solution that is evolving

By combining portfolio management, order management, execution management, valuation and risk, accounting, reconciliation, and portfolio monitoring and reporting, ENFN’s cloud-native solution is a real turnkey. By combining all of the different systems into a single, cloud-native solution, ENFN and its clients can spend less time and money managing their different IT infrastructures and get the most out of their investments.

Furthermore, the company can finish implementations rapidly due to the cloud-native solution’s architecture being based on a single codebase. In addition, the ENFN architecture facilitates a shorter time to market for new features and enhancements. Financially, this means that ENFN’s R&D spending would be more efficient than a legacy player, which translates to better margins.

Custom-made solution to fit the needs of customers

A key reason why I believe ENFN will be well adopted is because the cloud-native solution it provides is accessible and flexible. This is crucial, as I believe not all clients have the funds to upgrade all of their systems at once, and ENFN has created a solution that allows clients to gradually increase their use of its technologies as their finances and requirements grow. Clients can pick and choose whatever systems they want to use, thanks to the adaptable nature of ENFN’s architecture and the ease with which they can be integrated. The scalability of ENFN’s solution lets it grow steadily and naturally as clients gradually add more systems and features as they learn about and appreciate ENFN’s benefits.

More importantly, by supporting its software with cutting-edge tech services, ENFN aims to help its clients get the most out of the Enfusion solution. ENFN’s clients can focus on their highest-value business activities and realize the full benefit of ENFN’s solution by leveraging expert teams empowered by technology to address time-consuming administrative tasks related to the investment lifecycle. Among these tasks are balancing different funds and positions, taking care of actions and trade break settlements, and checking accounts with fund controllers.

Structured GTM strategy

I believe any solution is only as good as its marketing strategy. A good product will not be well adapted unless it is distributed. Managing and nurturing outbound leads, creating new business, and demonstrating products are all responsibilities of ENFN’s seasoned sales team. Once a lead has been found, the team works with the solution engineers to create a sketch of an end-to-end solution that fits the lead’s workflow.

I also think that an integral part of ENFN’s marketing and sales strategy is its partnerships. To further increase its reach, the company utilizes its extensive global network of contacts with trading platforms, fund administrators, tech providers, investment system consultants, and prime brokers. These connections are important, in my opinion, as they provide ENFN with a steady stream of high-quality lead referrals. Because of the operational benefits associated with collaborating with clients who have unified data, convenient information access, enhanced workflows, and a secured control environment, ENFN channel partners regularly recommend its solution to clients. With ENFN’s streamlined implementation process, its clients can bring their products to market much more quickly, which is good news for the clients that provide support for ENFN’s business model. I could also argue that this forms a virtuous cycle for ENFN; as they get bigger, with more connections, they get more leads, and the entire cycle repeats.

Graphic design, digital and social media marketing, public relations, and events are all part of the ENFN marketing team’s efforts to support the company’s go-to-market strategy. ENFN’s marketing initiatives center on producing high-quality inbound leads, streamlining the company’s lead generation strategy, capitalizing on the persuasiveness of client references and testimonials, creating a reputable and widely recognized brand, and encouraging direct sales. To spread the word about who they are and what they can do for the community, ENFN leverages both online and offline marketing strategies, including social media, digital marketing, and event participation.

Competition

ENFN faces tough competition from both new and well-known companies that offer everything from single-solution apps to full suites of solutions for investment management.

I believe that ENFN competes favorably against its competitors. Even though market incumbents like BlackRock’s (BLK) Aladdin, Broadridge’s (BR), State Street’s (STT) Alpha, SS&C’s (SSNC), and SimCorp’s (OTCPK:SICRF, OTCPK:SMCYY) (SIM) may offer end-to-end systems, these solutions are not cloud-native or developed for the cloud. Instead, they are single-tenant and cloud-migrated. Therefore, they are not flexible enough to support growth, often requiring physical provisioning, relying on large teams of specialized personnel that prove challenging to hire over time, experiencing latency problems, and adding to the investment manager’s overall costly and inefficient dependencies on legacy technology. They are unable to provide frequent or simultaneous upgrades to all of their clients because of their single-tenant and cloud-migrated architectures, which severely limit their flexibility. Single-feature products like trading, fund administration, or portfolio analytics are often provided by new entrants in the industry with the intention that they will be used in tandem with existing products.

To differentiate itself, ENFN has developed a multi-tenant cloud-native solution that combines mission-critical systems with a set of services. Because of its cloud-native, single-codebase architecture, it can support the whole investment lifecycle in a unified manner, consolidating all relevant data from all relevant systems and actors into a single, real-time dataset. The single codebase design used by ENFN also contributes to the company’s ability to adapt to changes quickly and add new features often. This allows ENFN to continue to innovate at a rapid pace, providing the superior, more adaptable solution that investment managers need to meet the ever-increasing demands of the global marketplace.

Earnings update

The third quarter earnings were a mixed bag for Enfusion. Revenue was up 2% and EBITDA margin was up 200 bps. As a result of tough comparisons, net retention dropped to 112.7% from 117.8% in 2Q22. The 4Q22 revenue forecast was lowered by 3%, and the EBITDA forecast was reduced by 9%.

Hedge fund launches have slowed, according to Enfusion, which is concerned about the current macro environment but confident in its own ability to win over new investors. Past recessions have prompted an uptick in the industry’s emphasis on digital transformation as a means to cut costs, and that trend appears to be continuing in this cycle, as well. The two primary ways in which Enfusion aids funds in achieving this goal are by providing a more cost-effective solution than many legacy providers, and minimizing operational inefficiencies within the fund’s own infrastructure. Over time, the company expects conversions to make up a greater percentage of total revenue. Although in the long run this is good for the company as it will lead to lower churn and a better LTV to CAC ratio, it is having the unintended consequence of increasing the frequency with which new logo sales cycles are required.

On the other hand, Enfusion’s interim CEO is making strides to enhance the quality of service provided to customers. The customer support and implementation teams will now be involved in the sales process at an earlier stage than before. This will help customers get to know the people who will be working with them throughout their entire relationship with the company. This change would help Enfusion get bigger funds, which need better customer service. In the third quarter, the company announced 8 new institutional asset manager clients and emphasized that it could land deals worth seven figures.

Valuation

Price target

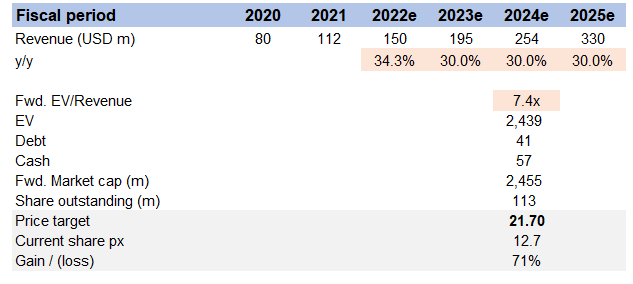

My model suggests a price target of $21.7 in FY24. This assumes that revenue will continue its high growth rate, and the forward revenue multiple will be 7.4x in FY24e.

Own estimates

For FY22e, I used FY22 guidance and for FY23e and beyond, I believe ENFN can continue to grow at historical high growth rates due to the big TAM.

As for how much ENFN is worth, it trades at 7.4x forward revenue right now, and I assumed that the multiples wouldn’t change. To put things into perspective, my price target is where ENFN was trading at the start of last year.

Risks

Cloud-based financial solution might not be well adapted

There is a large investment of time and money in legacy software at many financial organizations. It is possible that some organizations are hesitant, unwilling, or unable to make the switch to ENFN’s unified solution due to their dependence on legacy or incompatible IT infrastructure. Also, financial institutions may be hesitant, unable, or unwilling to use cloud-based investment management technology for a number of reasons, such as data security and the reliability of the delivery model.

Conclusion

ENFN is undervalued. This firm aims to empower investment managers to make well-informed investment decisions. Investors are competing fiercely and ENFN, with its well-defined approach to the market, offers a superior, cutting-edge cloud-based solution for generating leads and meeting the requirements of its clients.

Be the first to comment