andresr

Recommendation

I recommend buying Genius Sports (NYSE:GENI). The global sports betting market is evolving and growing. The availability of data and technology to serve the end-user with a seamless experience is the driving factor and a differentiator between successful and unsuccessful businesses. GENI bridges the gap between sports organizations, leagues, and sports betting platforms. By obtaining exclusive and non-exclusive data rights from sports organizations, GENI serves a number of huge sports betting companies with real-time data and technology. With vast expertise, exclusive data rights, trained statisticians and a broad range of customers, GENI presents itself as an authority in the industry, and I expect good growth moving forward.

Business

According to the annual report, GENI is a sports data and technology firm that provides customer engagement tools to organizations like sports leagues, sportsbook operators, and media outlets. From reliable real-time data capture applications to the generation and provision of in-game betting odds, GENI’s software bridges the entire sports data journey. GENI also offers digital content to its clients to help them make products that are interesting and fun for their users.

GENI also provides value-added solutions like live data services to its customers. These solutions are integrated into most of the regulated sportsbook operators, representing over 300 sportsbook brands worldwide.

Rapidly growing industry

There are many reasons out there that indicate that sports betting is a fast-growing industry. However, to me, the key reason is that sports betting services assist leagues in offering a compelling experience for their fans, which is why they’re used in several leagues to create exciting moments. As a sports fan myself (and I am sure other fans can connect with me), the existence of in-game sports betting while watching the sport in real time creates an extra layer of connection for fans, especially when the favorite team wins. Based on my personal experience, I strongly believe that as sports betting markets mature, in-game betting will become the most popular form of betting, both in terms of GGR and number of bets. In fact, based on the prospectus, this is proven by factual data published by EGBA in 2019 stating that 63% of the bets placed among its membership are in-game.

Based on my research, the best example is Germany, which is seeing a fast growth in sports betting due to the government loosening controls. As Germany has set a precedent, I believe Europe is a big opportunity for GENI to capture a large part of the market. In order to capture this demand, my research suggests that GENI has made strategic investments across the sports betting industry, establishing a foundation upon which it can generate revenue regardless of which sportsbook operator dominates in a given jurisdiction. What is interesting is that the GENI revenue model provides them with potential for expansion and growth along with their clients, thereby resulting in a levered growth model.

A leader within the industry

I believe stating some basics here would help readers understand this part better. In the Sports betting data market, a sportsbook operator’s expenditure is heavily dependent on in-game data consumption. Official data is a live feed of statistics that has been authorized by sports rights holders. It’s used to create betting markets, provide real-time odds updates, and also settle bets in an accurate and timely manner. GENI’s growth opportunity lies in securing additional rights and providing official live data. This is also where GENI’s competitive advantage shines, it has a portfolio of official data that is larger in comparison with competitors’ portfolios. For instance, GENI has some of the most valuable rights to NFL, EPL, and NBA data (source: prospectus pg. 93).

As I mentioned above, I strongly believe that the sports betting industry, and in-game betting in particular, will rapidly expand in the coming years, necessitating an increase in the demand for high-quality data. A rudimentary Google search will tell you how fast the industry is growing (here is a Bloomberg report that suggests that same); in fact, looking at the growth of DraftKings (DKNG) will give you a good idea as well. Because of this, I think GENI’s technology and relationships are key to its ability to make money from the sports betting market’s inevitable adoption of official data.

Among all of GENI’s strategies, I believe the strategy to develop beneficial partnerships with leagues globally and to integrate its technology and services in most of the sports and leagues has been made possible because of GENI’s stroke of genius, and that is by classifying the sports and related rights from Tier 1 to Tier 4. Sports rights in Tier 1 are from leagues with global name recognition and are acquired through rights fees alone. The rest are from regional leagues, and GENI gets the rights through a “contra” model in which it gets long-term deals in exchange for its technology and software solutions. While sports that aren’t in Tier 1 come from lower-profile leagues and don’t have a huge international following, they still have passionate fans in their home communities, hence it made sense to have a presence there as well. Because of this, GENI is able to maintain its lead and competitiveness for Tier 1 and non-Tier 1 rights at all times.

This idea is simple but genius, as the risks of rights inflation for this content are reduced thanks to this two-pronged approach, which focuses on both Tier 1 and non-Tier 1 sports. Also, this strategy lets GENI turn promising sports into long-term partnerships.

Scale matters

The way to view this business is by looking at the unit economics of each “data point” provided to customers. GENI’s core systems are highly scalable to provide real-time data to the growing number of customers, sports event coverage, and volume of bet types. Its main offering, real-time data, is captured by robust technologies, machine learning, and complex analytical capabilities. With that understanding, my research suggests that these capabilities allow GENI to capture, process, and distribute vast amounts of data points in milliseconds. Since GENI is the leader with a large scale and the most data, it would be able to support multiple sports leagues at a low incremental cost (i.e., the cost of each data point is amortized across a large set of customers).

It may sound easy to “just replicate what GENI is doing.” No, that does not work as easily as it sounds. GENI’s extensive portfolio is the result of years spent honing the company’s technological prowess, cultivating meaningful relationships, and integrating with various sports leagues. My opinion is that a new player can have strong technological capabilities, but relationships and integration with several sports leagues are the hard parts, as it takes a long time to build trust. Trust is obviously not easy to build (in all instances). To amass this portfolio, GENI had to study the technical and strategic needs of various sports leagues and adapt accordingly, and all of these things take time. To give perspective on the “trust” that GENI has gained, more than 80% of all organized basketball competitions use GENI’s basketball league technology, which is used by more than 180 leagues in 120 countries around the world (source: prospectus). I believe this is a core competitive advantage that is hard to replicate or disrupt.

Competition

The business-to-business market for providing sports data-driven technology and related services to sports and betting companies is flooded with competitors—small, medium, and huge-sized companies. I believe the smaller players are not an issue for GENI as they have limited distribution capabilities and meaningful scalability. GENI’s main competitors are huge companies like GENI, offer similar products and services to the same target customers. Some of the competitors are: Sportradar (SRAD), IMGArena, and Stats Perform.

In most cases, GENI serves a customer alongside at least one competitor, who has their own portfolio of exclusive and non-exclusive data rights. This is because sportsbooks rarely agree to be served by just one company. If they did, they wouldn’t be able to offer as many betting markets, which would hurt them.

I believe GENI stands apart from its rivals thanks to its extensive sports data rights, partnerships with sportsbooks and leagues, seamless integration, and trustworthy core services. When compared to its rivals, GENI stands a good chance of success thanks to its products, services, experience, and company culture.

3Q22 updates

Consistently high growth in the media business helped drive 3Q22 revenue growth to 28% on a constant currency basis compared to 14% on a reported basis. However, media revenue was slightly below expectations as GENI lapsed the NFL contract, causing 3Q22 media revenue growth to fall short of expectations. An increase in NFL in-play mix, with in-play handle growing nearly 70% YoY, also contributed to the nearly tripling YoY growth in US revenue in the first nine months of the year.

During the quarter, GENI announced a multiyear agreement with Amazon to supply augmented video technology and data-related services for a supplemental feed of Thursday Night Football. Although the next renewal of this contract is still several years away, I believe it serves as evidence that GENI has increased its value to the NFL and its partners.

GENI’s new wins in the third quarter of 2018 totaled 27, more than doubling the number won in the first and second quarters. In addition, GENI announced in October that they would be expanding their partnership with bet365 by launching a beta version of next-generation betting products built on Second Spectrum. The fact that GENI’s Media division recently signed over ten new non-betting advertising customers from sports organizations and consumer brands makes me even more sure that management can handle organic growth in a sustainable way.

Valuation & model

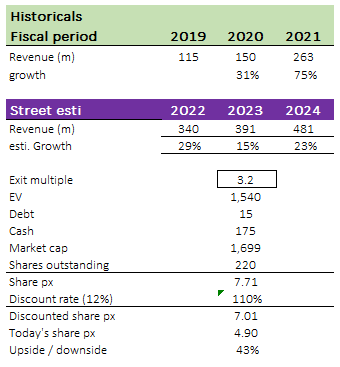

GENI is a high growth company and I believe GENI should continue to ride on the rapid expansion of the industry, and continue to win share due to its leadership in data rights. Historically, the company has been growing in the low-30s% until COVID gave it a huge boost.

There are two key things to note here, TAM and profits. GENI’s top-line growth will be supported by the large and growing TAM, but profits will only come online when GENI scales larger. Given the lack of profits today, I believe valuing it using a revenue multiple is more appropriate.

For FY22, I used management’s guidance since we are already coming to the end of the period. Moving forward, I expect GENI to continue growing at a high rate due to the large TAM, but at a slower rate than historical figures due to a larger revenue base. Note that despite a lower percentage growth rate, I am still expecting GENI to add nearly $100 million of revenue a year. To sense check my projections, my estimates are more or less in line with the street.

GENI currently trades at 1x forward revenue, which is unjustified in my opinion. GENI closest comp, SRAD, trades a 3x forward revenue, which I believe GENI should trade at similar levels too.

With all my assumptions, I believe GENI should be worth $7 today after discounting by 10%. This is based on high revenue growth over the next 2 years until FY24.

Author’s own calculations

Risks

As good as a middlemen

GENI acts as a middleman between sports organizations and sportsbook operators, collecting and supplying sports data. All their offerings and services use exclusive and non-exclusive data they obtain from sports organizations and then supply to their customers. If the partnerships GENI has with sports organizations are discontinued or offered at terms that are not commercially viable, they will lose their competitive advantage by either discontinuing or limiting their products and services.

Revenue concentration

GENI’s major revenue comes from a few large companies. This is a risk because if these customers experience losses or reduce their businesses, GENI’s business will be negatively affected. If they are in a profit-sharing arrangement with a customer and the customer loses in the betting market, GENI’s revenue will be significantly lowered.

Summary

To conclude, I believe GENI is undervalued. The sports betting industry is growing by the day, and sportsbook operators rely on trustworthy, experienced data and technology providers to stay afloat in business. GENI has proven to be among the leading providers, and with a massive resource of expertise and human resources globally, they compete effectively for businesses.

Be the first to comment