Kelly Sullivan/Getty Images Entertainment

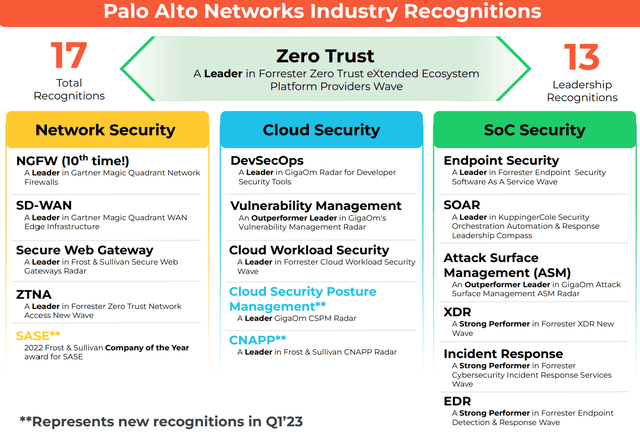

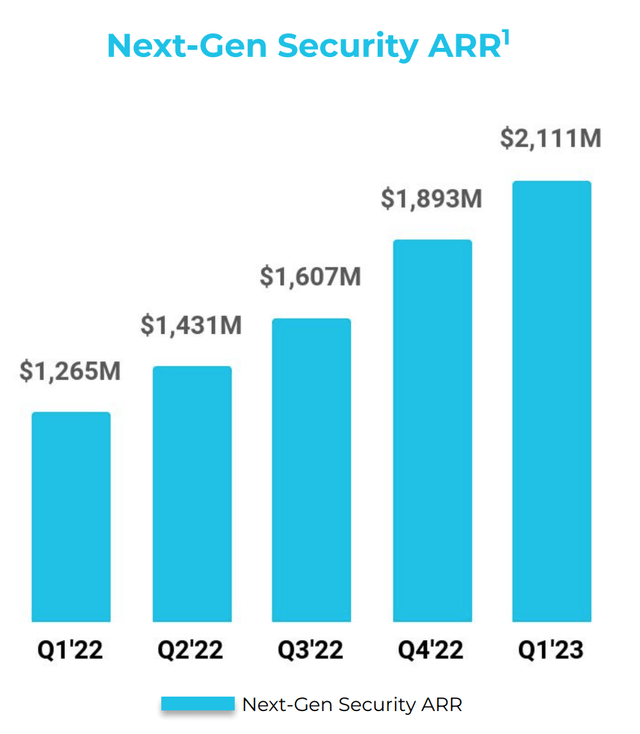

Palo Alto Networks (NASDAQ:PANW) is an iconic cybersecurity company that is known as a best-in-class provider of hardware-based firewalls. However, over the past few years, the company has reinvented itself with a series of cloud and software-based security products. This transformation has gone exceptionally well as the company now has 13 leadership recognitions across Network Security, Cloud Security and Threat Detection.

Palo Alto Networks Business Model (Q1, FY23 report)

The cybersecurity industry is forecasted to grow at a 13.33% CAGR, between 2022 and 2026 reaching a market value of $299 billion by the end of the period. Palo Alto is poised to ride this growth trend as organizations require security for their multi-cloud services. In this post I’m going to break down the company’s financials and valuation, let’s dive in.

Strong Financials

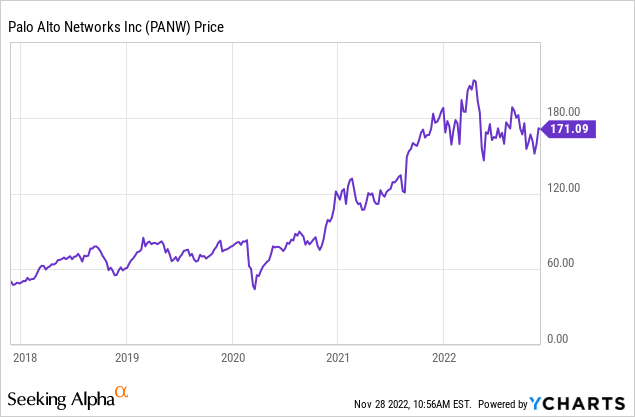

Palo Alto Networks reported strong financial results for the first quarter of the fiscal year 2023. Revenue was $1.56 billion, which increased by a rapid 25% year over year and beat analyst expectations by $12.21 million.

Total Revenue (Q1, FY23 report)

Overall revenue was driven by solid Product revenue growth of 12% and total services revenue growth of 30%. By geography, the business saw growth across all regions with the EMEA region being a standout performer, as revenue increased by 32% year over year. This was followed by the JPAC countries (26% revenue growth) and the Americas at 24% revenue growth.

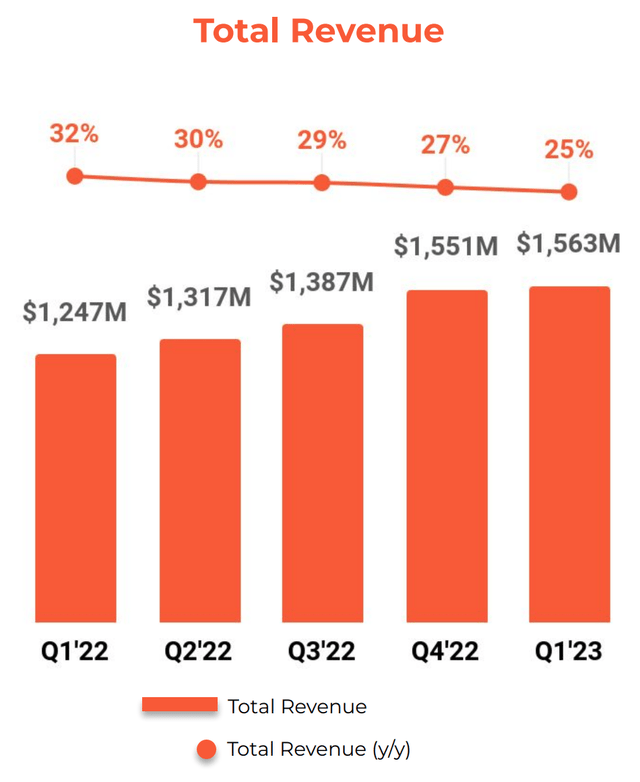

The company’s “next generation” security [NGS] platform, which includes the Cortex, Prisma Cloud and Prisma SASE reported solid growth. NGS Annual recurring revenue [ARR] increased by a blistering 67% year over year to a record $2.11 billion. For more on the company’s products, you can read my past report on Palo Alto Networks.

Next Generation Security ARR (Q1, FY23 report)

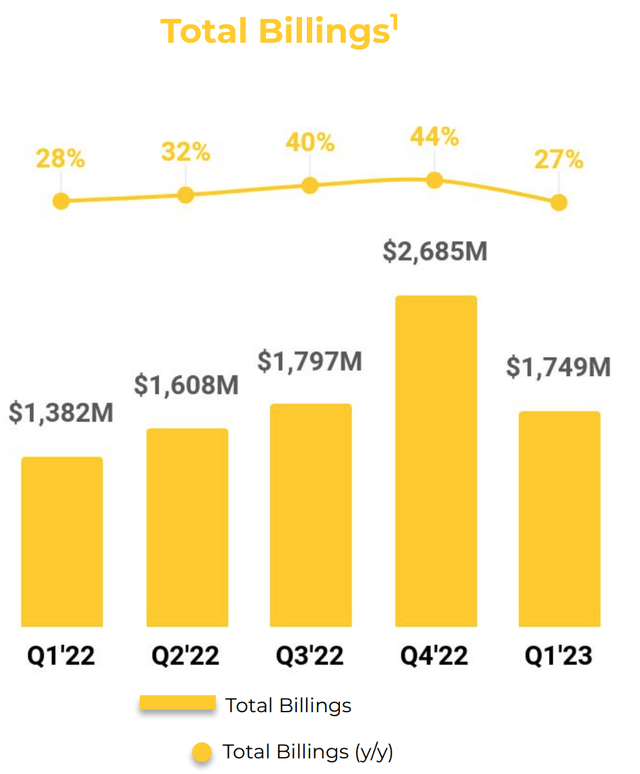

Taking a step back, “Billings”, which is the amount actually invoiced to customers and the true “top line” for SaaS companies also showed solid growth. Total Billings increased by 27% year over year to $1.75 billion.

Total Billings (Q1, FY23 report)

Remaining performance obligations (RPO), which is the sum of Deferred Revenue and Backlog, was increased by a rapid 38% year over year to $8.3 billion.

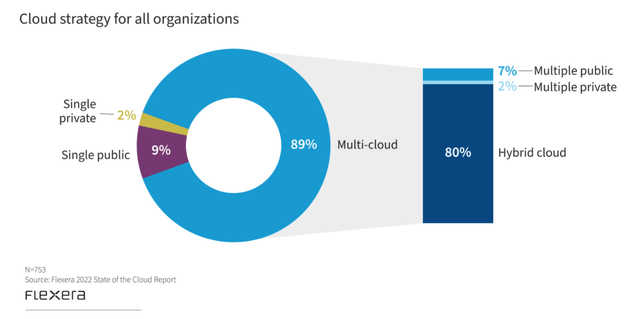

Notable customer wins in the quarter included a 9-figure deal with a U.S Federal government agency for the Cortex product. There was also a 7-figure deal with a large U.S Utility company for its software firewalls and Prisma Cloud technology. The company in question opted to use Prisma cloud as the platform to offer standardized security across 4 public clouds. This is an interesting point to note as a study indicates that 89% of IT decision-makers have a multi-cloud strategy. This is for a few reasons, firstly is security as some companies may prefer to keep some of their applications or data onsite due to regulations or legacy setups. In addition, each major cloud provider AWS, Azure and Google Cloud has various advantages in different areas. Therefore adopting a multi-cloud approach allows organizations to get the best of both worlds while not being tied to a specific vendor.

Multi Cloud report (Flexera)

Historically many cybersecurity companies offered single-point solutions, this was great in the short term as specialist businesses produced the best products. However, as organizations adopt multiple solutions the IT security tech stack can become time-consuming and complex to manage with multiple different updates, patches, and dealing with multiple vendors. Palo Alto Networks aims to simplify this with its single vendor, the Next generation security platform. In the most recent quarter, the company signed an 8-figure multi-product deal with a major European media company, as they consolidated all their legacy security platforms. The company also closed a 7-figure deal with a U.S technology company that adopted all three of its next gen products.

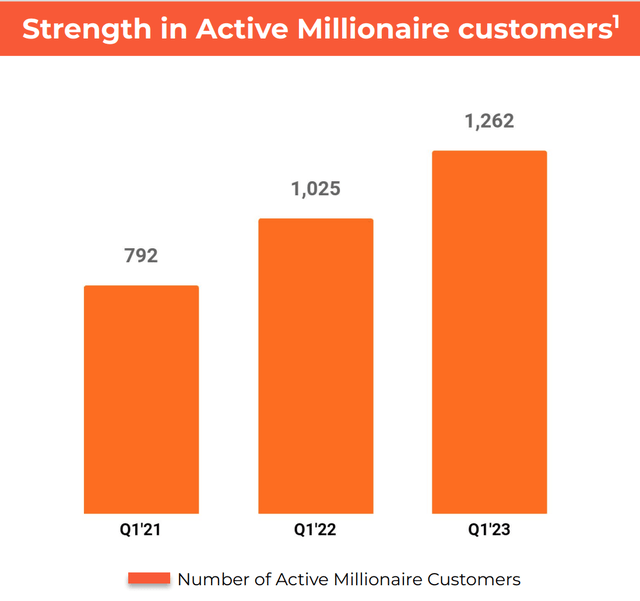

Palo Alto Networks has also continued to generate strong upsells and cross-sells for its products for its largest customers. For example, the number of “Millionaire” customers, which are those with over $1 million in bookings over the past year, has risen substantially. Over 230 more of these “high ticket” customers have been added over the past year.

Millionaire Customers (Q1, FY22 report)

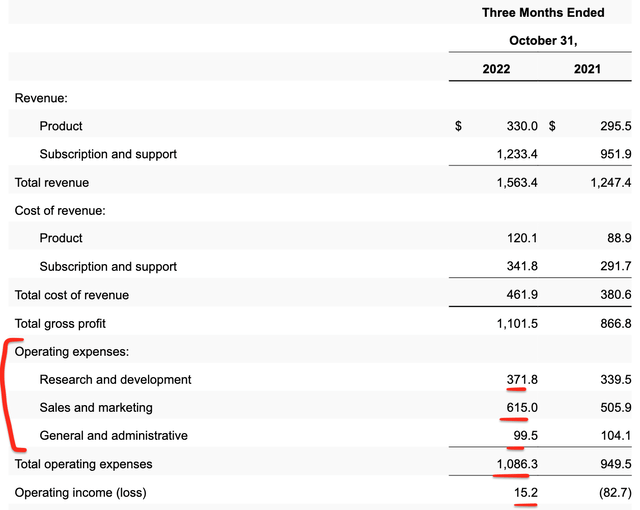

Profitability and Expenses

Palo Alto Networks reported a Non-GAAP Gross margin of 74.35 which declined by 10% year over year. This was mainly due to supply chain expenses related to component shipping and doesn’t look to be a long-term issue. The good news is the company reported an Operating Margin of 20.6% which increased by 260 basis points year over year. This was driven by lower expenses as a portion of revenue across its three main expenses, R&D, Sales and Marketing, and G&A. This is great to see as it shows the business is demonstrating operating leverage while still continuing to grow the top line.

Non-GAAP Net income increased by a rapid 56% year over year to $266 million.

Palo Alto Networks Financials (Q1, FY22 report)

Earnings Per Share were $0.06, which beat analyst expectations by $0.11. The company also reported cash flow from operations of $1.24 billion and reported a record free cash flow of $1.2 billion. This was driven slightly by strong collections in the quarter, but still a great achievement overall.

Palo Alto Networks has a solid balance sheet with $5.9 billion in cash, cash equivalents and short-term investments. However, the company does have $3.68 billion in current debt of the Convertible senior note type, which must be taken into account.

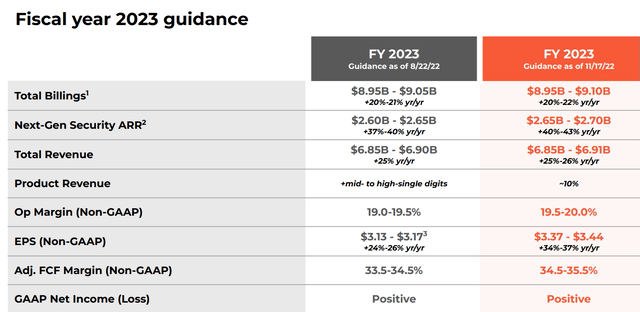

Management has raised its guidance on the strong quarter, full details are in the table below.

Palo Alto Networks (Q1, FY23 report)

Advanced Valuation

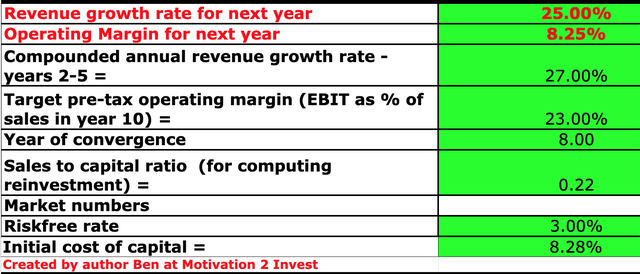

In order to value Palo Alto Networks, I have plugged the latest financials into my advanced valuation model which uses the discounted cash flow method of valuation. I have forecasted 25% revenue growth for next year which is aligned with management estimates. However, I am forecasting this revenue growth to accelerate to 27% per year in years 2 to 5, as the economy recovers and the Next Gen Security offering continues to make up a larger portion of total revenue.

Palo Alto Networks stock valuation (created by author Ben at Motivation 2 Invest)

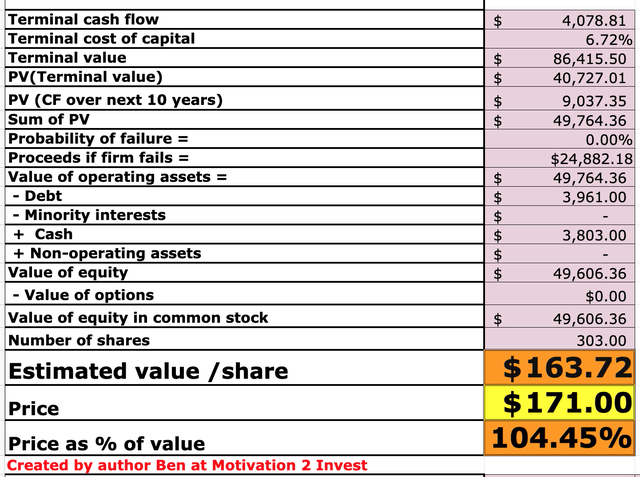

To increase the accuracy of the valuation, I have capitalized R&D expenses, which has lifted operating income. In addition, I have forecasted the business to its operating margin to 23% over the next 8 years, as it continues to generate high operating leverage.

Palo Alto Networks stock valuation (created by author Ben at Motivation 2 invest)

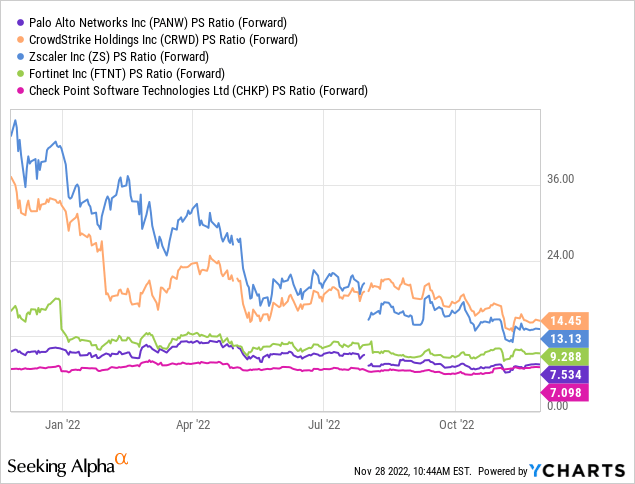

Given these factors, I get a fair value of $163 per share, the stock is trading at $171 per share at the time of writing and thus is fairly valued but not exactly cheap. Palo Alto Networks also trades at a Price to Sales ratio = 8 which is fairly valued relative to its 5-year average. Relative to other companies in the cybersecurity industry, Palo Alto Networks is trading at one of the cheapest levels.

Risks

Recession/Longer Sales Cycles

The high inflation and rising interest rate environment have caused many analysts to forecast a recession. Therefore, many companies are likely to reduce or delay spending which could result in longer sales cycles. So far, we are not seeing many signs of this with Palo Alto Networks but it is a general market risk.

Final Thoughts

Palo Alto Networks is a tremendous cybersecurity company that has reinvented their product suite in immense style. The company has continued to produce solid financial results despite tough economic conditions. However, the stock isn’t exactly cheap, it is “fairly valued” at the time of writing.

Be the first to comment