onurdongel/E+ via Getty Images

Investment Thesis

Marriott Vacations Worldwide Corporation (NYSE:VAC) is a US-based vacation company. Prior to the pandemic, the company had been on an upward trajectory, with three consecutive years of increasing revenues from $1.43B in 2017 to $3.15B in 2019 and six straight years of growing dividends from $0.25 in 2014 to $1.89 in 2019. The company’s momentum was halted when the pandemic hit, and its revenue and dividends began to fall.

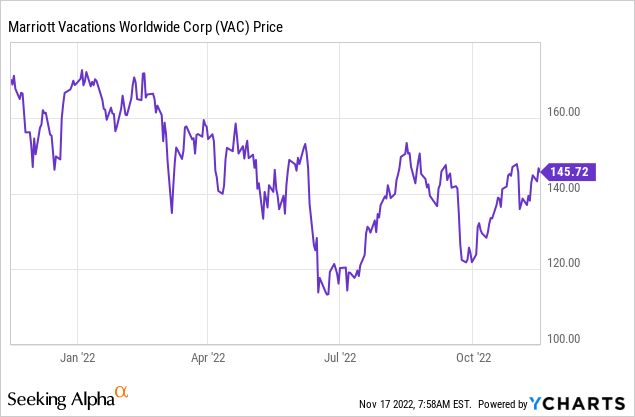

In the wake of dismal performance in the Covid era, the company’s stock price has plummeted, losing over 14% in the last year.

It appears that the company’s pre-pandemic impetus has been restored in the post-Covid era, with rising revenue, dividends, and earnings per share. Not only that, but it has very desirable profit margins. According to my estimates, its revenues will exceed the pre-Covid highest price, and its earnings per share [EPS] will reach a record high in the fourth quarter of 2022. If you’re looking for a growth stock in this sector, I think this is a compelling reason to recommend a purchase. By trading at a discount to its DCF-calculated fair value, the stock provides value investors with an entry point into the market.

Getting back on track after Covid-19

According to the investment thesis section data, the firm has a decent chance of picking up where it left off before Covid-19. In this part, I’ll talk about the revenues, earnings per share [EPS], and dividends before and after Covid-19.

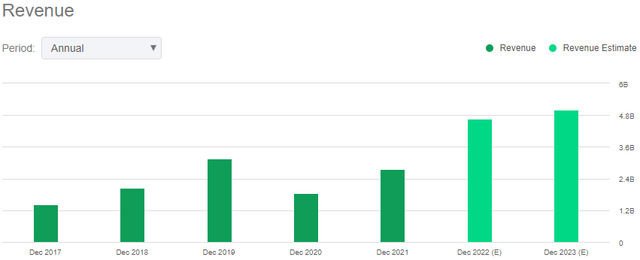

Revenues

Before the pandemic, VAC enjoyed three consecutive years of revenue growth, which I attributed to the country’s growing penchant for leisure activities.

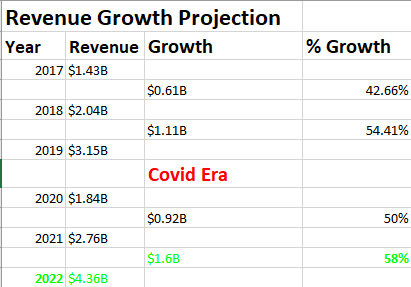

Tracking the revenues from 2017, VAC reported $1.43B, which grew to $3.15B in 2019. With the onset of Covid, its revenues declined to $1.84B in 2020. In 2021, with the new normal and economies picking momentum, its revenues grew to $2.76B. Guided by this data, below is my future projection for the company’s revenues.

From 2017 to 2018, revenues grew by $0.61B[42.66%], and between 2018 to 2019, revenues increased by $1.11B[54.41%], marking the summit of the pre-pandemic era. I will ignore the Covid era loss since it forms the pivot of the two eras I am interested in. In the post-Covid-19 growth, the company reported revenue growth of $0.92B[50%]. Given this data and the fact that the company is almost back to pre-pandemic capacity, as reported during the Q3 transcript call, I assumed an incremental 8% revenue growth in the pre-pandemic era to project the company’s Q4 ’22 revenues. With an 8% incremental growth rate, I arrived at 58% revenue growth into Q4, representing an increase of $1.6B. Cumulatively, I arrived at $4.36B as total revenues in Q4, slightly below the company’s estimates of $4.67B.

Author’s Computations

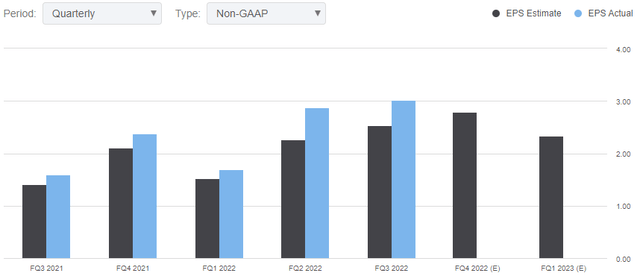

Earnings Per Share

Before my profitability section, the company’s growing EPS is a testament that it’s generating enough profits to pay out more to its shareholders. Since Q3 2021, the company has been increasing its EPS quarterly and beating estimates with significant margins, thanks to its high profitability.

My primary focus was forecasting its fourth-quarter earnings per share, and I used historical data on the typical deviation between these numbers to inform my projections. These discrepancies were as follows:

- Q2 ’22: $0.6

- Q3 ’22: $0.49

On average, I arrived at a figure of $0.42. Adding this figure to the estimated EPS of $2.79 yields $3.21, which would be the highest in 2022. I believe this is possible given the consistent EPS growth and considering that revenues will grow as earlier estimated, implying improved profitability.

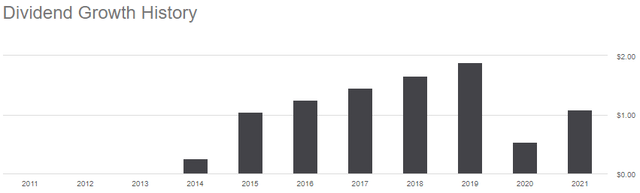

Dividend

VAC has reliably distributed dividends to its shareholders for the past eight years. Its dividend compound annual growth rate is 12.20%. VAC’s six-year sequence of dividend increases was broken during the Covid era. I believe that the pandemic played a role in the company’s poor financial performance, which resulted in dividend payments falling from a high of $1.89 per share in 2019 to a low of $0.54 per share in 2020. As the company gains traction, the dividend payment has increased from $0.54 in 2020 to $1.08 in 2021.

Based on my revenue projections, which call for total sales to surpass their level before the pandemic by December 2022, I anticipate a dividend increase to roughly $1.89 by December this year.

With a dividend yield of 1.65% and a payout ratio of 24.07%, I find the dividend payment policy quite sustainable. I am confident the firm will continue paying dividends seamlessly in the long run.

Considering the aforementioned information, I believe the corporation will be able to match or perhaps surpass its pre-pandemic highs by the end of 2022.

High profits justify rising EPS and Dividends

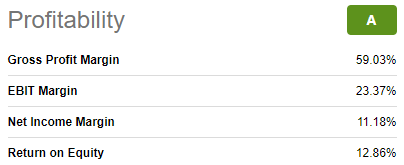

Having discussed the company’s dividends and EPS, it is essential to touch on its profitability which directly impacts these parameters. VAC has a gross margin of 59.03%, an EBIT margin of 23.37%, and a return on equity of 12.86%. In my view, these margins are very healthy especially given the harsh economic times posed by Covid-19.

Seeking Alpha

Additionally, the company is very lucrative compared to its competitors, with a $420M cash flow from operations balance compared to the industry median of $86.60M and a 26.30% levered FCF margin TTM compared to the industry median of 1.43%.

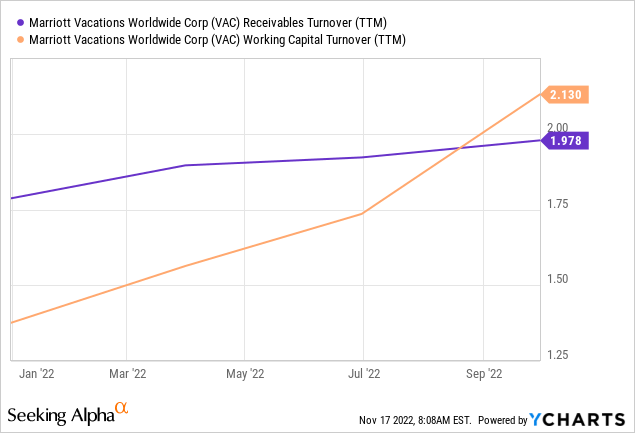

I believe the company’s strong profit margins directly result from its efficiency, as seen by the fact that its receivable turnover ratio is 1.978 and its working capital turnover ratio is 2.130, which are not only pleasing but growing.

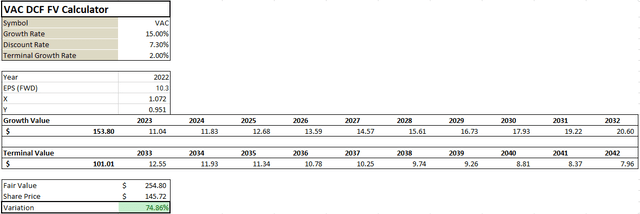

A win for value investors

With the interest of value investors in mind, I considered it wise to evaluate the company’s share fair value and growth potential. Using an EPS-based DCF model, the model gave a fair value of $254.80 per share compared to the current price of $145.72.

This result implies that the company is trading below its fair value, with an upside potential of about 75%. To potential value investors, they should seize this opportunity and enter this company cheaply and reap the benefits in the future.

In my analysis, I used an EPS[FWD] of $10.30, a discount rate of 7.3%, and a growth rate of 15% despite the company’s 3-year EPS CAGR Of 50.26%.

Risks

Despite my optimism, investors should be wary of this company’s risks. Investment risks include;

First off, the annual US inflation rate is 9.1%, the highest level seen in 40 years. Month after month, prices have gone up, and consumer confidence has plummeted to all-time lows. The other risk is the impending economic downturn. The start of the possible American recession is predicted for 2023.

Due to the severe impact of economic downturns on stock prices, investors should be cautious as they make their financial decisions. For example, during the economic slump brought on by Covid-19, the whole travel industry felt the impacts, with stock in airlines plummeting by 68% and stock in hotels, resorts, and cruise lines falling by up to 74%.

If you’re considering investing in this company, you must keep an eye on these risks because they’re the biggest drawbacks. I believe the company’s top and bottom lines will suffer if the risks aren’t managed appropriately

Conclusion

VAC is well positioned to recover to its pre-Covid period performance levels and improve upon them. My calculations show that shareholders stand to gain significantly from investing in this company in the form of higher earnings per share, dividend payments, and overall share values. Given the company’s bright outlook, it’s in the best interest of investors to get in on the ground floor immediately so that they may reap the company’s short- and long-term rewards; however, they should be wary of the impending risks.

Be the first to comment