cagkansayin

Introduction

When reviewing the first quarter of 2022 results from Energy Transfer (NYSE:NYSE:ET), my previous article also discussed how their hidden value could unlock 20%+ of free distribution growth, which is especially appealing given their existing high yield of 7.88%. Upon subsequently releasing their results for the second quarter of 2022, management also spoke on the direction of their capital allocation strategy and thus this time around, it seems timely to also discuss their acquisition-focused strategy that in my eyes, sees them as the Berkshire Hathaway (BRK.A) (BRK.B) of the midstream industry.

Executive Summary & Ratings

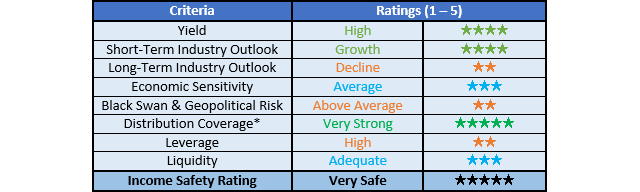

Since many readers are likely short on time, the table below provides a very brief executive summary and ratings for the primary criteria that were assessed. This Google Document provides a list of all my equivalent ratings as well as more information regarding my rating system. The following section provides a detailed analysis for those readers who are wishing to dig deeper into their situation.

Author

*Instead of simply assessing distribution coverage through distributable cash flow, I prefer to utilize free cash flow since it provides the toughest criteria and also best captures the true impact upon their financial position.

Detailed Analysis

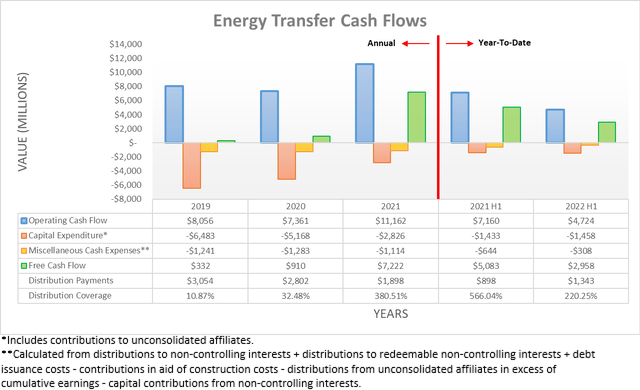

Similar to the first quarter of 2022, their cash flow performance following the second quarter appears terrible on the surface with their operating cash flow of $4.724b for the first half far below its previous result of $7.16b for the first half of 2021. Thankfully, this was once again merely due to the first quarter of 2021 seeing a massive one-off boost from the freak Texas Winter storm dubbed Uri, which unfortunately skews this comparison. If zooming into the second quarter of 2022, their operating cash flow was $2.354b and thus an impressive 17.41% higher year-on-year versus their previous result of $2.005b during the second quarter of 2021, thereby making for a solid quarter. Moreover, their working capital build of $320m from the first quarter of 2022 kept growing during the second quarter and now sits at $731m for the first half, thereby weighing down their surface-level operating cash flow whereas the first half of 2021 saw a benefit of $661m from a working capital draw.

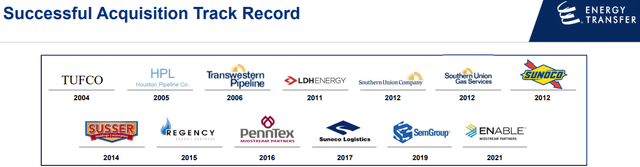

Even in the face of these hurdles, they still produced $2.958b of free cash flow during the first half of 2022 that easily provided very strong distribution coverage of 220.25% to their distribution payments of $1.343b. This makes funding their latest 15% quarterly distribution increase to $0.23 per unit very easy, whilst also leaving scope to fulfill their promise of returning them back to their former glory of $0.305 per unit that were reduced in late 2020, as my earlier article highlighted. Whilst they have spent tens of billions of dollars over the last two decades building their massive asset footprint that underpins this free cash flow, a significant portion of their impressive size stems from a series of acquisitions, as the slide included below displays.

Energy Transfer September 2022 Investor Presentation

Apart from various smaller bolt-on acquisitions across the years, they have collectively made thirteen large acquisitions since 2004 that have played a central role in becoming what they are today. Whilst no business could ever directly equal what Berkshire Hathaway became under the leadership of Warren Buffett, in my eyes, Energy Transfer is more similar than not when viewed at its core. On the surface, they appear different as a midstream partnership but beneath the surface, they are similar to the former because they comprise a collection of quality businesses that have been acquired across the years along with further equity investments, such as their stake in USA Compression Partners (USAC) and Sunoco (SUN). Regardless of whether or not other investors also view them as an energy-focused version of Berkshire Hathaway as myself, their acquisition-focused strategy appears poised to continue, as per the commentary from management included below.

“…we do feel very, very strong that consolidation makes a lot of sense in the midstream space. So starting with the midstream space, we would – you would see us look around the assets we have right now…”

“When Kelsey kind of gave us the directive that we need to step in to pet chem, we certainly are doing that, two perspectives: one, we’re – from an M&A perspective, anything that’s for sale, we’ll take a look at pretty much like anything in the industry; and then on the organic side…”

-Energy Transfer Q2 2022 Conference Call.

Admittedly, acquisitions can often receive negative reactions from investors but in my view, they are not only a valid strategy but in this situation, they also carry various benefits over organic growth projects. Since the midstream industry is obviously mature with limited growth prospects given the outlook for oil and gas demand from the clean energy transition, it makes growing the partnership without increasing industry-wide capacity appealing because it reduces the risk of building capacity that is ultimately not utilized to the extent envisioned.

Not to mention the regulatory issues and risks surrounding building new projects, such as their North Dakota access pipeline that faced years of legal issues or more recently, the Mountain Valley Pipeline by Equitrans Midstream (ETRN) that had permits vacated right before completion. Whilst acquisitions are never risk-free, nothing ever is when it comes to business, although with an acquisition, at least they should have a clearer view of the assets in question, both in the forms of their earnings but also the regulatory risks as they are already in place.

Since the two-year mark after announcing their most recent large acquisition of Enable Midstream is fast approaching, I would not be surprised to see their next move coming within the following six to twelve months, especially given the subsequently quoted commentary from management regarding the capital allocation strategy. Whilst I will refrain from publishing any speculation regarding their likely targets, suffice to say, they have a wide range of options thanks to their healthy financial position.

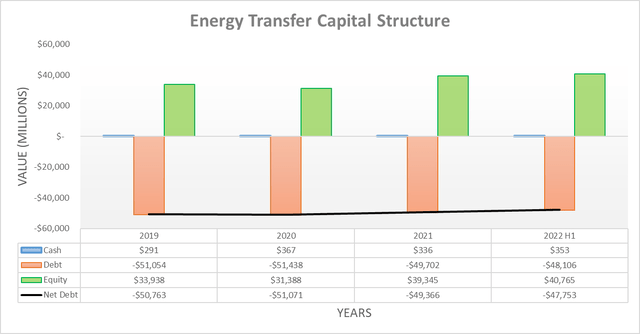

Once again, they made further inroads reducing their net debt following the second quarter of 2022 with their ample free cash flow pushing their net debt down to $47.753b. Apart from already representing a decrease versus where it ended the first quarter at $48.367b, if not for their working capital build, their net debt would have been down to circa $47b. When looking ahead into the second half of 2022, barring any acquisitions, this downwards trajectory should continue unabated as their ample free cash flow continues outstripping their distribution payments.

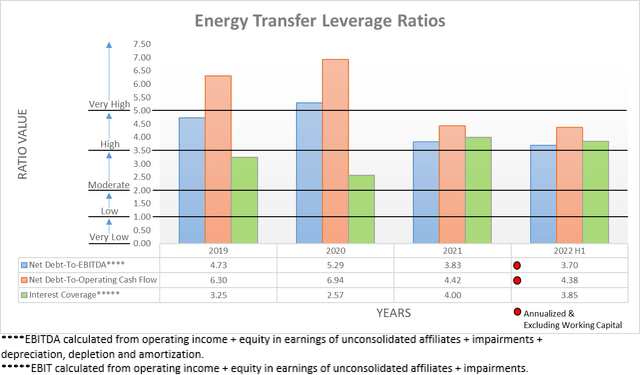

Even though their surface-level financial performance softened versus their storm-boosted results of 2021, their lower net debt still saw their leverage following in tandem. This now sees their respective net debt-to-EBITDA and net debt-to-operating cash flow down to 3.70 and 4.38 following the second quarter of 2022, versus their respective results of 3.74 and 4.50 when conducting the previous analysis following the first quarter. Whilst not a particularly big change and still leaves their results within the high territory of between 3.51 and 5.00, the downwards trajectory is nevertheless positive and builds upon earlier decreases with their net debt-to-EBITDA now close to falling below this range. Whilst their net debt-to-operating cash flow of 4.38 is still above this level, it does not pose any material risks given their solid financial performance and ample free cash flow.

Thanks to deleveraging during 2021 and 2022, going forwards, they have increased firepower to pursue acquisitions, even large ones without creating too much risk. In theory, they could add $6.75b to their net debt and still keep the higher of their two leverage ratios, their net debt-to-operating cash flow within the high territory with a result of 5.00 or less based upon their results for the first half of 2022. Since any acquisition would obviously boost their financial performance, realistically, they appear to have at least $10b of spare capacity for an acquisition, which is quite sizeable relative to their current market capitalization of approximately $36b. Regardless of when they pursue their next large acquisition, this still provides plenty of scope for growth in general, which should take a greater focus within their capital allocation strategy heading into 2023, as per the commentary from management included below.

“We also expect to reach our leverage target range by the end of this year and going forward, expect our strong coverage and balance sheet strength to allow us to further prioritize growth within our capital allocation strategy.”

-Energy Transfer Q2 2022 Conference Call (previously linked).

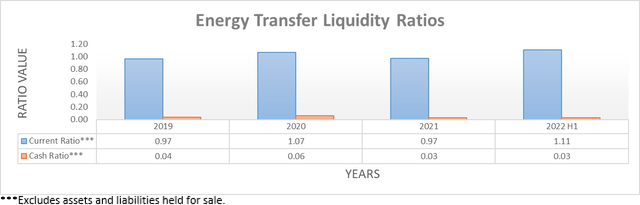

Quite unsurprisingly, their ample free cash flow ensured their liquidity is still adequate following the second quarter of 2022, as their respective current and cash ratios of 1.11 and 0.03 are immaterially different versus their respective results of 1.10 and 0.09 when conducting the previous analysis following the first quarter of 2022. Despite their relatively low cash balance, thankfully this is not too concerning given their ample free cash flow and credit facility retaining $2.44b of availability, plus further multi-billion-dollar balances that are available within separate credit facilities for some of their various subsidiaries. Thanks to their very large operational size and healthy financial position, they should continue seeing easy access to debt markets to provide liquidity as required for refinancing debt maturities or funding acquisitions, even if central banks further tighten monetary policy.

Conclusion

On one hand, their capital allocation strategy prioritizing growth likely means less for distribution growth once they fulfill their promise to return them back to their former glory, whereas on the other hand, growing their asset base larger should translate into higher free cash flow in the medium to long-term and thus even higher distributions further down the track. Even though an acquisition-focused strategy can deter investors, it lowers risks of both unnecessary midstream capacity and regulatory issues. Regardless of whether other investors view them alike to an energy-focused Berkshire Hathaway, their units still appear to offer very desirable value with a high yield that should grow even higher and thus following another solid quarter, unsurprisingly, I believe that maintaining my strong buy rating is appropriate.

Notes: Unless specified otherwise, all figures in this article were taken from Energy Transfer’s SEC filings, all calculated figures were performed by the author.

Be the first to comment