tifonimages/iStock via Getty Images

Energy Recovery (NASDAQ:ERII) is an American designer and manufacturer of repressurization systems that help water intensive industries like desalination, wastewater treatment, etc. save energy.

The company’s products seem to be leaders in their industry, technologically reasonable and have accompanying long-term trends backing them. Despite the success of the desalination related lines, management is also expanding the company’s lines towards future markets (like wastewater management and refrigeration).

ERII has no debt whatsoever and $80 million in cash and securities. It seems like an interesting e company with great products and an aggressive management.

The problem is that ERII is trading at crazy multiples. With operating income that could reach $20 million yearly, the company trades close to a $1 billion market cap.

Such lofty valuation implies that the company can grow tremendously in the next few years. Management may be responsible for infatuating the market by providing ultra-bullish expectations as far away as 2026. In the latest earnings call, management provided a $570 million revenue and $142 million net income guidance for 2026, compared with current $120 million and $16 million, respectively. I have never seen any management do something like that.

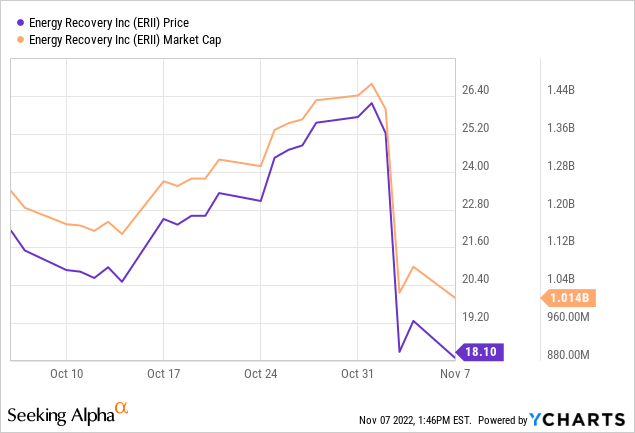

The risks of purchasing a small-cap company at more than 50 times earnings in this context are enormous. Mr. Market’s bullishness can easily translate into bearishness. Just a week ago, ERII was trading at $26 per share, and now trades at $18, after an earnings release that was not that bad at all (compared to previous ones).

For these reasons, I consider ERII a very interesting, hopefully successful company, but an extremely risky investment, particularly trading at these levels.

Note: Unless otherwise stated, all information has been obtained from ERII’s filings with the SEC.

A promising growth company

ERII is definitely being valued as a company with a bright future ahead. Let’s evaluate its markets and circumstances.

Pressure exchangers for desalination

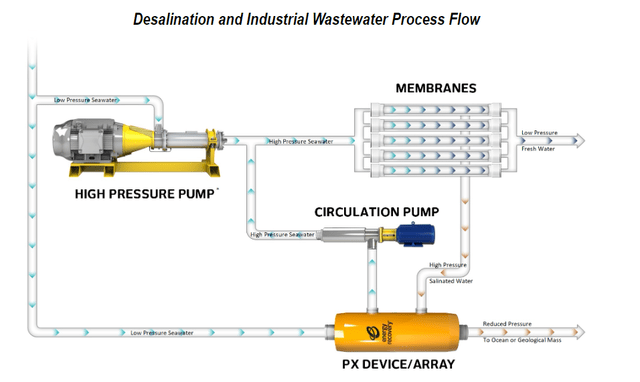

ERII’s main product is the PX pressure exchanger. This patented device helps high pressure water systems reduce energy consumption by recycling pressure from excess water (reject) into input water.

The figure below helps understand the functioning of the device in the context of desalination. For osmosis desalination to occur, seawater has to pass at high pressure through membranes. The process yields two outputs: high pressure salinated water (reject) and low pressure fresh water. The PX device moves pressure from reject water into salinated input water.

ERII’s 10-K report for FY21 filed with the SEC

By recycling that pressure, the system requires less input pressure generated by a pump, therefore the pump can be smaller and reduce energy consumption. The PX device can help save up to 60% energy consumption in the desalination process.

Because it has only one moving part and no power whatsoever, the PX device is simple to maintain and has low breakage. ERII has a suite of devices suitable for different pressure levels and they can be combined in arrays to treat different levels of volume.

It is indeed an interesting invention, for which ERII holds a patent. However it is not the only one. Flowserve’s DWEER is substantially similar, having few moving parts and requiring no engine.

The PX exchanger is used in large scale projects, which constitute 77% of ERII’s revenues for the last few years, according to the company’s 10-K for FY21. Geographically, 70% of the ERII’s sales are concentrated in the Middle East, where the biggest desalination projects are located.

For smaller applications, the company also offers turbochargers, similar devices that require an engine. In this segment, it competes with Danfoss iSave, or FEDCO’s Turbocharger.

Expanding into new lines: waste water and refrigeration

It is good to know that despite the PX’s recent success, ERII has continued expanding its lines towards other applications that require similar capabilities.

Industrial waste water treatment operates using similar systems to those of desalination. Contaminated water has to pass at high pressure through a series of membranes to capture the pollutants. In this area, ERII does not need to significantly modify its products and can start expanding. Today, industrial waste water treatment makes a very small portion of the company’s revenues, approximately $2 million of the $83 million sold for the period 9M22, according to the company’s 10-Q for 3Q22.

An even younger technology is the application of pressure exchangers to refrigeration systems that use CO2. The first commercial tests of the PX G1300, an adapted PX version for CO2, began in 2022 in Europe and the US. The CO2 refrigeration industry is in early development but is poised to grow because of environmental regulations (more on this below).

ERII also had failed incursions in other markets. VorTeq, announced as a revolution in the fracking industry in 2015, was licensed to Schlumberger (a leader in O&G midstream) and was discontinued in 2021. The VorTeq story, of a promising product that failed, calls for caution when forecasting ERII’s future performance.

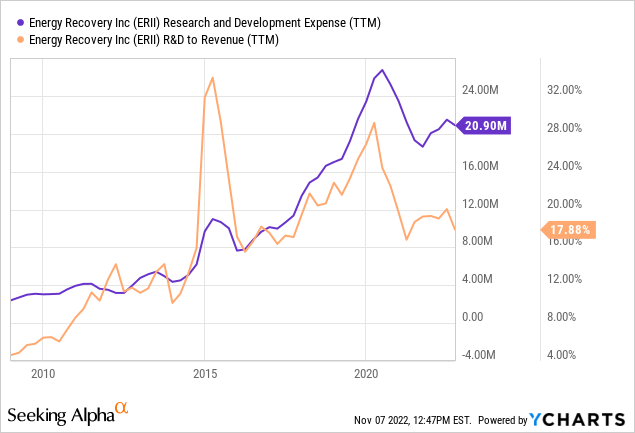

In general though, it is good to know that ERII spends in R&D and market development, trying to open avenues for growth in related markets.

Industry and competitive characteristics

As usual for an initiation coverage article, I like to include a section of industry analysis to understand the competitive dynamics behind ERII’s results.

In all of its lines, ERII participates in technical markets, which means customers have sophisticated ways of evaluating supply. A technical market is generally more difficult to defend than a non-technical market. Adding that most of ERII’s sales are oriented towards big capital projects only adds to this problem. When demand is knowledgeable and has metrics to judge supply, it is more difficult to gain a meaningful advantage. Even if the company has a “moat” provided by quality, that quality has a cost at the R&D level.

With gross margins close to 70%, ERII does not seem to suffer from supplier pressure on its products. The company has a small fixed structure, with only $35 million in net PP&E. ERII has two manufacturing facilities in the US, one in California and the other one in Texas.

It seems that with a technical market and low fixed assets, the main competitive driver of the market is technology. As we saw, ERII does have patents on its core product PX, but at least one competitor, Flowserve (FLS), offers a similar alternative. FLS is much bigger than ERII, with almost $3.5 billion in revenues in 2021, against $100 million for ERII. Truth is FLS participates in many more segments than ERII, but it could dedicate significantly more R&D expenditure to the pressure exchanger segment if it considered necessary. This means that although ERII has an important technological advantage today, it may not be able to defend it in the future. If it can, it will be at the cost of significant R&D expenses.

This all signals to me that competitively, ERII is not in a fantastic industry. It may very well sustain a competitive advantage in technology, and even manage R&D efficiently to expand to other markets and grow, but is not in a position to develop a significant moat, at least not on its current scale.

In terms of cycles and industry life stage ERII is much better positioned. All of its markets are expanding and have strong secular tailwinds. Desalination can expand outside the Middle East and become a worldwide method of obtaining fresh water if natural sources are threatened, as is happening in the US, China, or South America. Wastewater management is obviously an imperative of a green economy, particularly in certain industries. Finally, the refrigeration industry is mandated in Europe (and probably later in other regions) to abandon HFC gases, and CO2 is considered the best replacement technology.

Generally, growing markets are not as rival prone as mature markets, albeit they attract competitors. This could prove beneficial to ERII, and offsets part of my previous considerations regarding the undesirable competitive characteristics of ERII’s markets.

ERII’s strong balance sheet and capital allocation

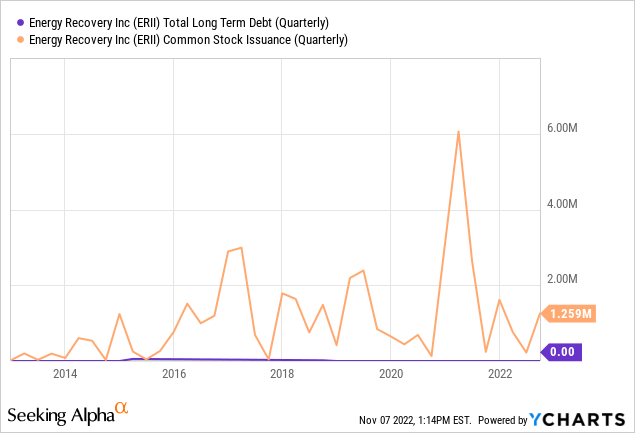

It is always pleasant to observe a company that has grown using its own capital and that has been conservative in capital allocation.

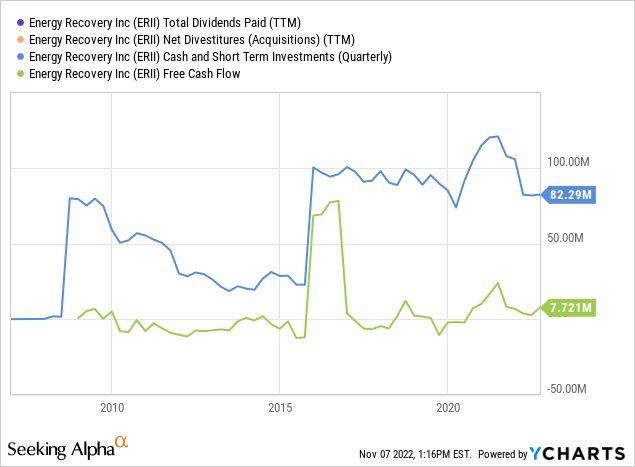

Probably because ERII’s businesses do not require significant CAPEX, the company has been able to triple its revenues since 2012 without resorting to debt or equity issuance.

The company has not paid dividends or initiated important acquisitions either. Rather it has accumulated most of the FCF as a cash and securities reserve that now stands close to $90 million.

The company does have an open revolving credit facility with JP Morgan that allows it to borrow up to $60 million for working capital needs. The facility pays LIBOR 1 month plus 2.5%.

The problem is valuation

If the company has a technological advantage, market aggressive but financially conservative management, a strong balance sheet and secular tailwinds, what’s the problem?

As Howard Marks said: ‘Investment success does not come from buying good things but buying things well’. What he meant is that no company is so good that it can be bought at any price nor so bad that it can’t be bought at any price.

In this case, ERII seems an interesting company with a lot of potential, but its current valuation already discounts every single positive development available, and then some more.

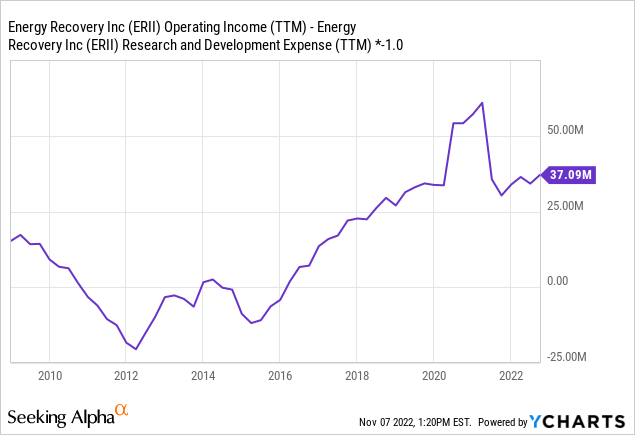

Consider the chart below, showing operating income plus R&D expenses. I think this is a good profitability metric for a company that has low debt and low CAPEX but a lot of R&D expenses.

That metric has grown substantially, albeit slowing down after 2019. However, it currently stands at $40 million. How can it possibly sustain a valuation that one week ago was $1.5 billion for ERII?

Irresponsible guidance

In my short experience as a stock picker, I have never encountered the sort of guidance regularly provided by ERII’s management on its earnings calls. I think this kind of guidance is a factor inflating ERII’s valuation.

Usually, managers are very conservative when providing guidance, both in terms of growth prospects, and in terms of time horizons. Rarely do managers comment on the next fiscal year’s results unless the current year is already quite advanced.

However, ERII’s management consistently comments on expected revenues and profitability margins as far away as 2026.

Take the latest 3Q22 earnings call as an example. In that call they commented targets of $200 million in revenue for desalination, $100 to $300 million for CO2 refrigeration and $30 to $70 million for wastewater. All of them for 2026. Cumulatively they account for $570 million in the upper range, against $100 million for FY21. It seems aggressive, to say the least.

But management did not stop there. It also provided long-term margins for the 2026 period. They commented gross margins of 60%, operating margins of 30% and an effective tax rate of 15 to 20%. This implies a 25% net margin, again, not conservative at all.

Those kinds of numbers justify the incredible valuation of $1.5 billion for ERII. Considering $570 million in revenues and a net margin of 25%, we arrive at $142.5 million in net income for FY26.

The perils of optimistic investing

The problem with investing with such lofty valuations is that the only way to obtain a profit is everything going according to plan or even better. Not only this, the whole market has to keep being as optimistic as always. If the company does not deliver on its promises, or if the market believes it will not be able to do so, the capital losses can be tremendous.

I started preparing this article more than one week ago, when ERII was trading at a market cap of $1.5 billion. I decided to wait for the 3Q22 results, released on November 3. The results were ok, not extremely bullish nor negative. The company is still showing growth, profitability, and margins. However, something changed in the market’s psychology and the stock fell 35% in a day. $500 million in market cap, lost in a day. That is an example of what can happen when one pays more than 90 times earnings.

Obviously, ERII is still expensive at a market cap of $1 billion. The company is trading at 50 times operating profit, or 25 times operating profit plus R&D expenses. Again, the only way for such a price to end up being a good investment is for everything to happen exactly as planned, without a single problem in the middle.

Despite ERII’s not very conservative guidance management, and the fact that it is grossly overvalued, the company is still interesting. As mentioned, it has growth, profitability, good technological management, a strong balance sheet and positive secular trends. Price has to accommodate significantly though. It should trade below $9 to be even considered a possibility at this stage.

Be the first to comment