This article was first published to members of Trade With Beta on October 02, 2022.

Colin Anderson Productions pty ltd

In all our future articles, we will have a small intro presenting the yields of various asset classes so that the reader gets an idea of what is normal in the current environment. This includes the treasury yield curve, mortgage rates, corporate bonds, fixed-rate preferred stocks, and a number of instruments we find interesting and representative at the moment. We call this “the big picture.” After the big picture, we present our income idea in the shortest way possible hopefully without any fluff.

The Big Picture

US Treasury

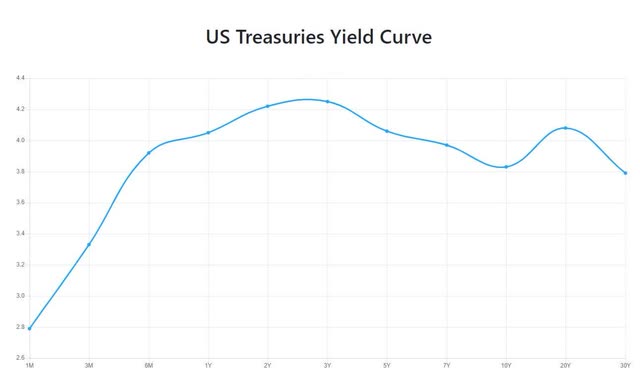

As we all know, in the last weeks the U.S. Treasury yields jumped to their highest levels in the last decade. The curve is now inverted:

US Treasury Yields (Investing.com) US Yield Curve (Fed Data)

Fed Funds Rate

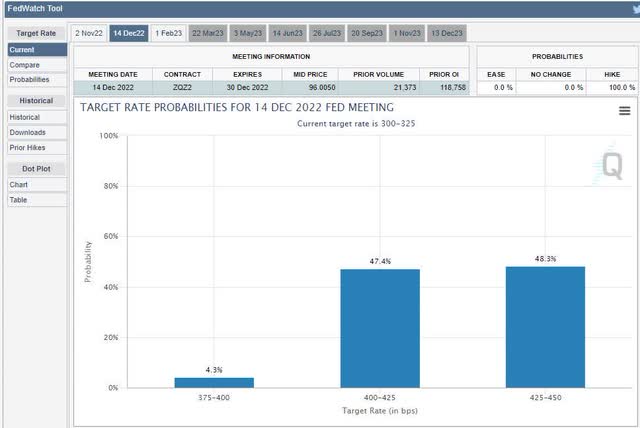

The federal funds rate is currently 3.25%. Fed officials have signaled their intention to keep increasing interest rates as much as needed to fight inflation. The market expectation can be seen below:

Fed Funds Rate Expectation (Cmegroup.com)

LIBOR

The London Interbank Offered Rate (LIBOR) is a benchmark interest rate at which major global banks lend to one another in the international interbank market for short-term loans. The current 3-month LIBOR Rate is 3.75%, while at the beginning of the year it was at levels around 0.2 – 0.3%. It is highly likely that LIBOR will continue to be higher than Fed Funds as it makes sense

What will happen to LIBOR

This question is raised after almost any article that includes the good old benchmark. In our last article, D.S. Leach & C.E. Leach was helpful enough to post the following link and comment:

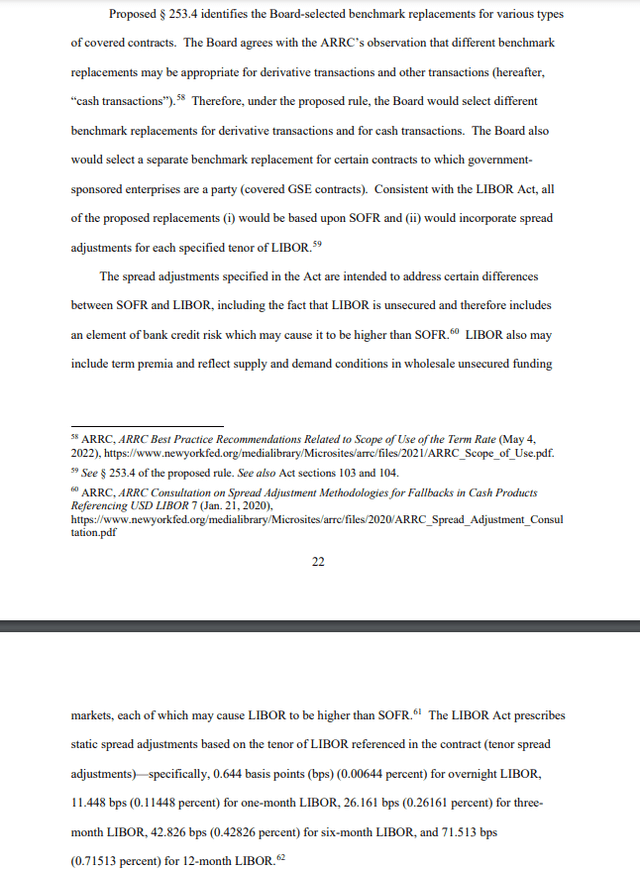

The FED text is as follows:

Most likely the 3-month LIBOR will be SOFR +0.26%

Mortgages Rates

The average interest rate on a 30-year fixed mortgage is 6.83%, up from 3.3% at the start of the year. The average rate for a 15-year loan is 6% as of the time of writing.

Corporate Bonds

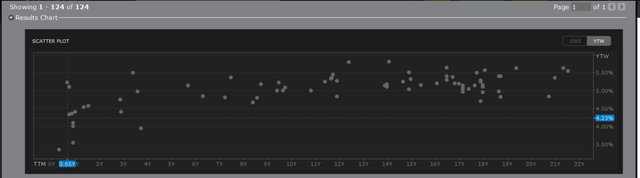

Here we will use BAC “A-” corporate bonds yield curve again:

BAC Yield Curve (Interactive Brokers)

Yields are in the range of 4%-6% depending on the duration and liquidity.

Fixed-Rate Preferred Stocks

We have over 100 fixed-rate preferred stocks with investment grade credit ratings by S&P or Moody’s. Some of them are qualified for lower tax rates some are not but in general, their yields are in the range of 5.7% – 6.8% depending on company specifics

Fixed-rate preferred stocks BBB- or higher (Proprietary Software)

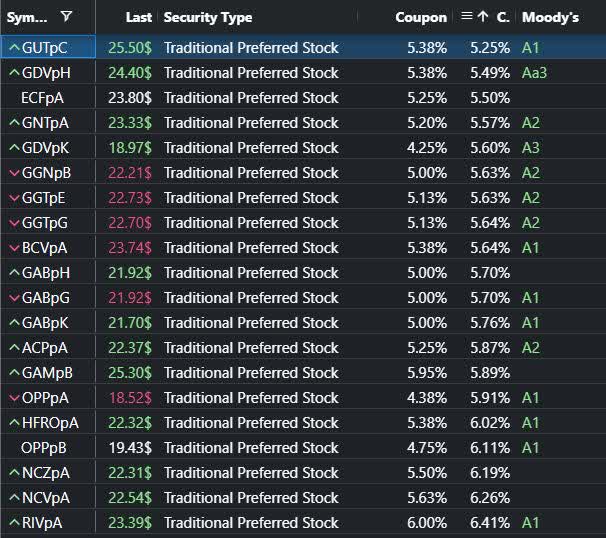

CEF Preferred Stocks

From a credit perspective, these are the safest preferred stocks on the exchange, and their yields are in the range of 5.25% to 6.4% depending on the issuer and some tax differences.

CEF Preferred Stocks A- or higher (Proprietary Software)

Our recent articles

Interest Rate Protection From Allstate Baby Bonds With A 16% Potential Return (NYSE:ALL)

Today’s Idea

The stock that got our attention is Enbridge, 6.375% Fixed/Float Subordinated Notes Series 2018-B due 4/15/2078 (NYSE:NYSE:ENBA). We believe that this is a fixed income investment that is both suitable from a credit risk perspective and from an interest rate risk perspective. It carries a BBB- rating by S&P and in April 2023 will be floating which is supposed to fight interest rate risk.

The Company

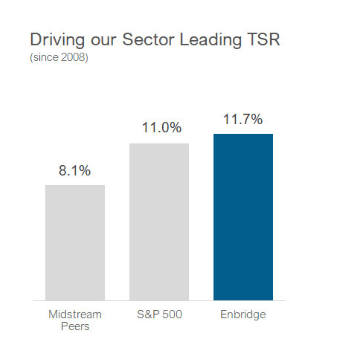

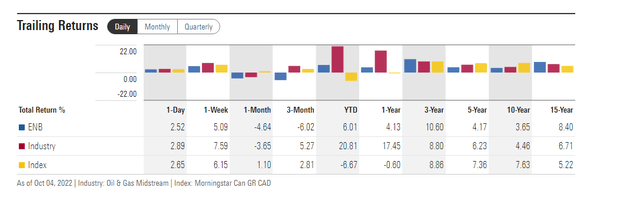

Before reviewing the bond of the company, we need to shine some light on the company itself as represented by its common stock. At the time of writing the article, the dividend yield of Enbridge Inc. (NYSE:ENB) is 7.26% and the forward P/E ratio of the company stands at around 20.70, with a forward P/E of around 12. This is around an 8.5% earnings yield. Historically the company has been able to generate around 8.4% yearly for the last 15 years:

and has been an outperformer vs peers in the long term:

ENB Performance (Company’s outlook)

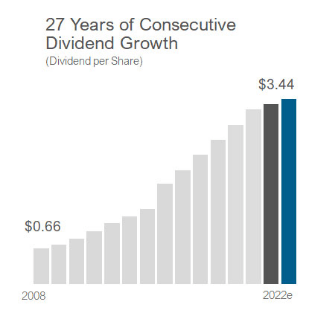

The company has an outstanding track record when it comes to raising dividends per share:

Dividend Growth (Company’s outlook)

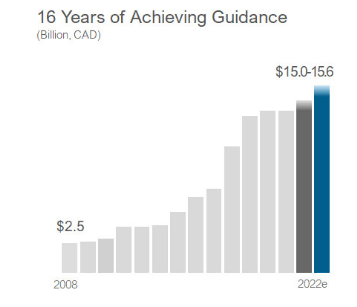

On top of that, ENB management has been pretty consistent with meeting their own expectations which builds a lot of trust among investors and rating agencies:

Guidance of ENB (Company’s outlook)

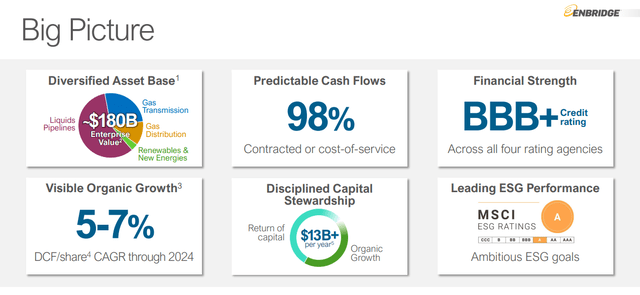

In times when the world is mostly concerned with energy for obvious reasons, this BBB+ rated company is well-positioned to take full advantage of its diversified asset base as shown in its last financial outlook:

ENB Basic Info (Company’s outlook)

The company has a target to keep debt at levels of 4.5- 5 times EBITDA with a dividend payout ratio of DCF/s of 60-70%. The company targets a 7% CAGR on its Adjusted EBITDA and its discounted cash flow (“DCF”) per share while it expects a 3% CAGR for the dividends per share.

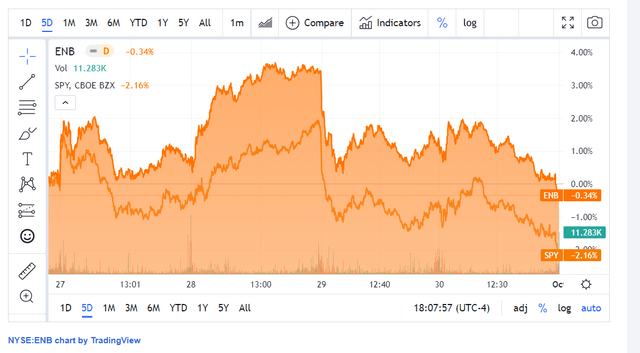

The investor has every reason to believe in the growth prospectus of the company based on past performance and plain financial logic. As the markets currently are a little more volatile than the average investor enjoys, we try to concentrate on great companies with great balance sheets and search for value even higher in the capital structure so that our credit risk is as low as possible. In the last year, the price behavior of ENB has been pretty much correlated with the overall market:

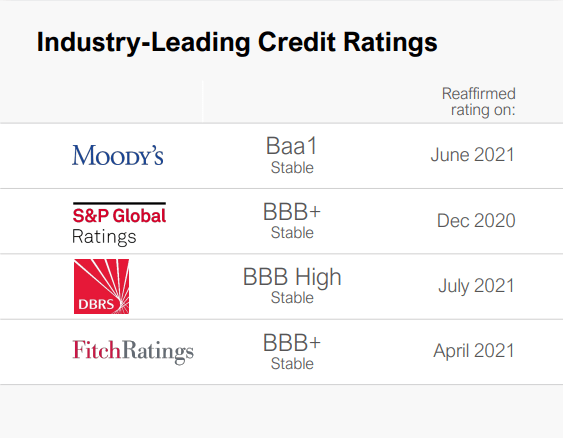

On top of that, interest rate risk has been the main topic for many investors. Even though ENB has a clear 7% CAGR target, one is not able to buy ENB at book value today to get full benefit even if the company meets its targets ( which is very likely based on its performance so far). Being invested in a great business like the one of ENB does not mean only buying the equity of the company. One can take full advantage of the great credit quality of the company by being invested in the bonds for example. At the time of writing, the company is rated BBB+ by all major rating agencies:

ENB Credit Ratings (Company’s Outlook)

By buying the company today, one can expect to earn a perpetual “DCF yield” of 13.63% as per the company’s projection. This of course sounds like a tough number to beat. Still one needs to make sure he understands the risks of being invested in the price and not the fundamentals of the company. Once the big picture of the company is clear it is time to take a look at our idea today

Description of ENBA

ENBA is Fixed/Float Subordinated Notes issued by Enbridge. This exchange-traded debt security pays a fixed dividend of $1.59 per year until it becomes floating-rate security on 4/15/2023, and matures on 4/15/2078. As of the moment of writing this article, the stock trades at around $23.60 This security is rated BBB- by S&P and Baa3 by Moody’s. The specific feature of this fixed-to-floating baby bond is that in the years ahead the fixed part of its floating rate is growing. After its call date from 4/15/2023 until 4/15/2028 the interest rate of the Notes will be equal to the 3-month LIBOR plus 3.593%. From 4/15/2028 until 4/15/2043 the rate will be LIBOR plus 3.843%. From 4/15/2043 until 4/15/2078 the rate will be LIBOR plus 4.593%.

Possible Scenarios

The first possible scenario for ENBA is to be redeemed. We think the redemption probability is quite high, considering the LIBOR rate. Let’s see the numbers in the graphic below.

ENBA Basic Info (Proprietary Software)

ENBA at a price of $23.60 has a yield to call 18.07%. This is an enormous yield even in the current environment so this is the best possible scenario for an investor in ENBA.

The second scenario for ENBA after its call date of 4/15/2023 is to not be redeemed. That means ENBA will become floating and its coupon rate will be 3.593% + the 3-month LIBOR until 4/15/2028. The 3-month LIBOR at the moment is at 3.75%, and as FED continues to raise rates it is supposed to increase as well. We will take a 4% rate for the 3-month LIBOR at the call date(giving our idea a lower rate than what is expected). So the basic expectation for ENBA if not redeemed is to have a floating nominal rate of around 7.6% (4.00% + 3.593%) until 4/15/2028. As long as the purchase price of ENBA is below par, a possible redemption will always be positive so the worst one can get at the moment is the floating 7.6% which is around 8% if one buys at around $23.60.

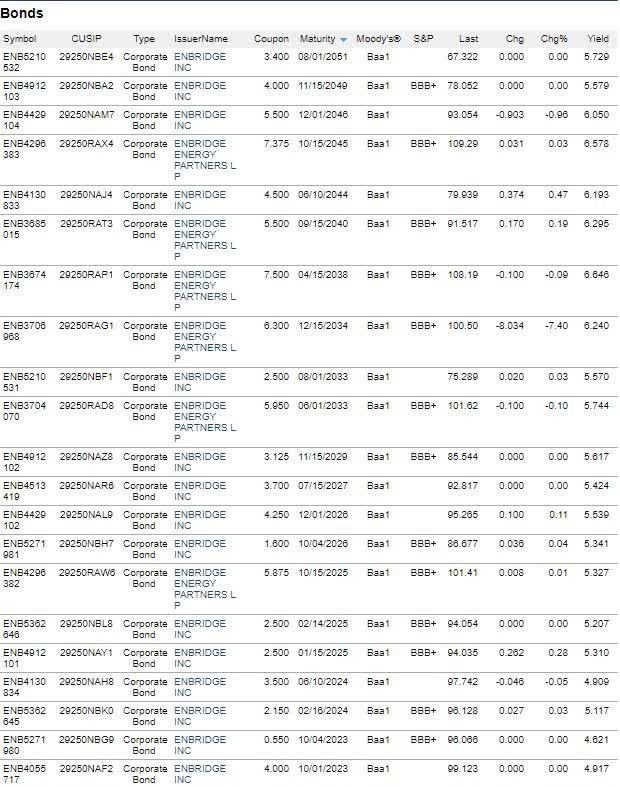

The Corporate bonds of ENB can be seen here:

ENB Corporate Bonds (Finra Website)

These bonds are 2 notches higher compared to ENBA and it is up to the reader if a 2% yield spread is fair keeping in mind that ENBA is a floating instrument with embedded protection from rising yields. To us, the comparison is very straight forward and we believe ENBA is way superior to anything presented in the article

Conclusion

The selloff of fixed-rate instruments is just a pure shift in the curve event which is well expected and logical. The passive nature of fixed income exchange-traded funds (“ETFs”) brings selling pressure to floating-rate instruments as well. ENBA is one such example that is mistreated by the market. Its worst-case scenario(except for credit shocks) is an 8% floating rate that is superior to almost anything fixed-income one can find on the primary exchanges. With such a great company it is hard to believe this bond will become outstanding and the projected 18% return to redemption makes the bond the best investment in the entire capital structure of ENB.

Be the first to comment