MikeMareen

Thesis

Leading energy infrastructure company Enbridge Inc. (NYSE:ENB) has delivered robust results in FY22, despite the surge in inflation rates and rising power costs. It benefited from its inflation escalators, cost-of-service contractual agreements, and diversified midstream assets (across oil and gas), providing significant visibility on its free cash flow.

The strength in the dollar index (DXY) has also been a welcome tailwind. Moreover, despite the increase in interest costs, its largely fixed-rate debt portfolio (90% fixed) has shielded the company from the Fed’s record rate hike cadence. As such, it has kept Enbridge’s balance sheet healthy (BBB+ rating) while raising $8B in funding in 2022 for growth opportunities. Notably, it also has a renewables portfolio which is expected to provide accretive optionality moving forward, leveraging the Inflation Reduction Act (IRA).

As a midstream player, ENB has not benefited tremendously from the surge in underlying oil and gas prices, unlike its peers in the value chain. However, its business model has also provided tremendous cash flow visibility and solid profitability.

Consequently, midstream players like ENB have consistently attracted higher earnings multiples (relative to their upstream or downstream peers), even though they are not immune to underlying market weakness moving forward.

ENB has recovered remarkably from its recent October lows, surging 20% to its November highs. It’s a solid performance compared to its 5Y and 10Y total return CAGR of 9% and 5.6%, respectively.

We view ENB constructively within the context of the oil & gas industry. However, we believe its valuation seems relatively well-balanced at the current levels. Also, its price action suggests caution, given its rapid surge from October lows, as the market anticipated a solid FQ3 earnings release.

As such, we urge investors to wait patiently for a pullback first to improve their reward/risk before adding exposure.

Rating ENB a Hold for now.

ENB: Well-Positioned For Drivers In Natural Gas

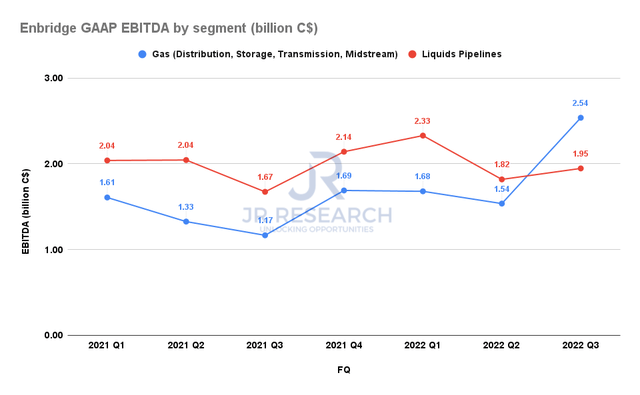

Enbridge GAAP EBITDA by segment (Company filings)

Enbridge has continued to ride the natural gas tailwinds, which lifted its Gas segment EBITDA above its Liquid Pipelines segment in Q3, as seen above. The company remains confident that the natural gas tailwinds will continue to drive its operating performance, as outgoing CEO Al Monaco articulated:

Not much doubt that global gas demand will grow given its abundance, security benefits and lower emissions. We see gas continue to be a critical part of the energy supply mix well into the future. North America’s gas advantage will lead to growth in global market share with LNG exports tripling to over 30 Bcf by 2040. We’re really pleased with how we’re situated to capitalize on these fundamentals. (Enbridge FQ3’22 earnings call)

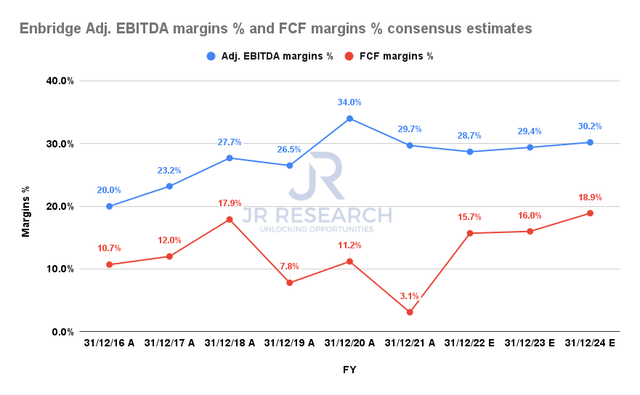

Enbridge Adjusted EBITDA margins % and FCF margins % consensus estimates (S&P Cap IQ)

Furthermore, Enbridge’s business model provides robust margins and free cash flow (FCF) visibility. Given its in-built escalators and contractual agreements, the company’s operating performance is expected to be sustained, despite ongoing energy market volatility.

Unless there is a massive collapse in energy prices (which is not our base case), we believe Enbridge will continue to be a critical beneficiary.

But Normalization In Earnings Is Expected

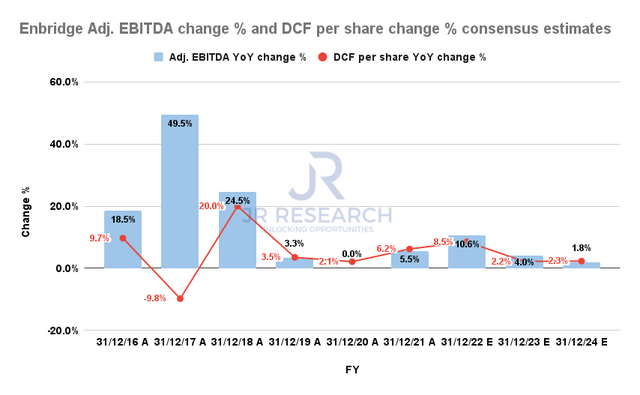

Enbridge Adjusted EBITDA change % and DCF per share change % consensus estimates (S&P Cap IQ)

The consensus estimates (bullish) suggest that Enbridge’s profitability growth could normalize over the next couple of years. As a result, it’s expected to impact the growth of its distributable cash flow (DCF) per share.

We believe the estimates are credible, as the underlying energy markets could undergo a period of normalization after surging since its COVID lows in April 2020. Furthermore, Enbridge’s inflation-linked escalators are expected to moderate, given the impact of the Fed’s rapid rate hikes. Notwithstanding, Enbridge could face less significant interest rate headwinds and lower power costs.

However, we believe the most significant risks are still linked to underlying commodities volatility, which could affect the company’s operating performance if a weaker environment persists. Enbridge also highlighted in its filings.

Is ENB Stock A Buy, Sell, Or Hold?

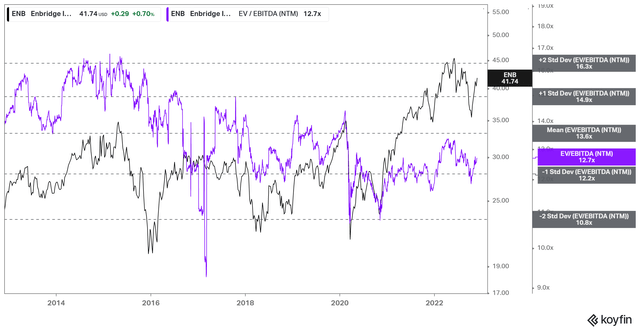

ENB NTM EBITDA multiples valuation trend (koyfin)

ENB last traded at an NTM dividend yield of 6.4%, above its 10Y average of 5.2%. ENB’s NTM EBITDA multiple of 12.7x is also below its 10Y average of 13.6x. Hence, ENB’s valuations do not appear to be aggressively configured despite the risk of earnings normalization.

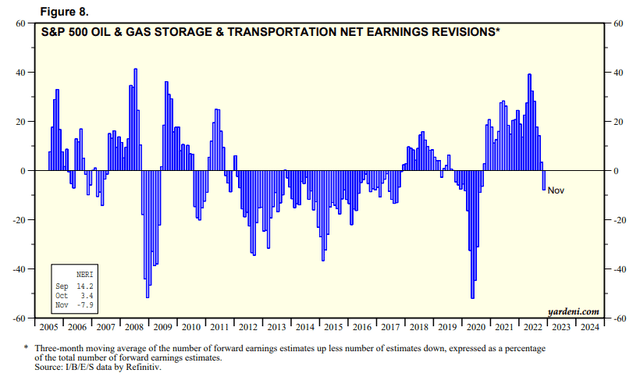

S&P 500 Oil & Gas Storage and Transportation Net earnings revisions % (Yardeni Research, Refinitiv)

However, we discerned that oil & gas analysts have just started to cut their earnings estimates for the S&P 500 oil & gas storage and transportation industry. Hence, further weakness in the underlying markets could continue to pressure its medium-term re-rating and potentially cause further earnings compression on ENB.

Furthermore, ENB’s NTM normalized P/E of 18.1x remains discernibly above the industry’s forward P/E of 16.2x. Therefore, we postulate that ENB would not be immune to a marked hit if industry earnings estimates were to be cut further.

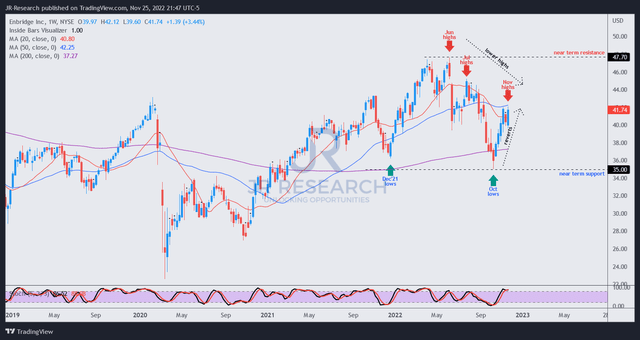

ENB price chart (weekly) (TradingView)

ENB surged 20% from its October lows toward its recent November highs, as the market likely anticipated a robust Q3 release. However, with the rapid recovery, ENB bulls appear to be losing momentum as sellers look to digest their recent gains.

We assess that caution is warranted after its rapid surge, as ENB’s 50-week moving average (blue line) could also stanch further buying upside, rejecting ENB buyers’ attempt to regain its medium-term bullish bias.

We believe ENB’s October lows are robust. Hence, we welcome a pullback closer to its October levels for much-improved reward/risk entry zones.

Rating ENB as a Hold for now.

Be the first to comment