redtea

Investment Thesis

Enbridge (NYSE:ENB) owns a large portion of North America’s pipeline systems and is essential to North America’s energy infrastructure. The company also invests in wind farms to further future-proof and diversify its cash flow. As a result, the expected annual return could be double digits if the stock returns to its P/E average. But solid single digits would also be attractive, considering this stock is for safety and income-oriented investors.

Revenue stream overview

With this company, there is no need for a detailed introduction since almost everyone knows it. And if not, there are several excellent articles here on Seeking Alpha. Here is a brief overview of the different divisions and how much they contribute to the total revenue.

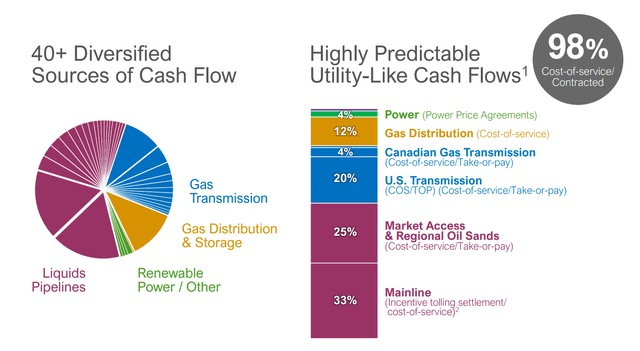

- Liquid Pipelines: Approximately 30% of crude oil is transported through Enbridge’s pipelines. This segment accounted for 58% of revenue in 2022.

- Gas Transmission: Approximately 20% of U.S. consumer natural gas flows through the company’s pipelines. Revenue contribution 26%.

- Gas Distribution & Storage: Under the corporate name Enbridge Gas Inc. the conventional gas supply business is managed. Enbridge is the market leader in the Ontario and Quebec regions. Revenue contribution 12%.

- Renewables: The company’s generation is approximately 2.2 gigawatts. Further investments in the future are expected to increase total capacity to 8 GW. Mainly onshore wind in the U.S. and offshore wind in Europe. The contribution to earnings is 4%.

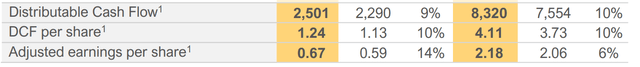

Recent results

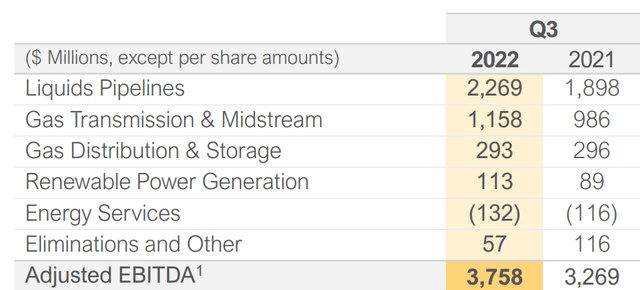

Results in the third quarter and the entire year of 2022 were solid. Three of the four main segments grew strongly. Only gas distribution and storage achieved slightly less. As mentioned earlier, the company wants to expand renewables fourfold in the next few years. If we now imagine that renewables would not generate $113M but $450M, this would already be a significant share of total revenue.

Since the company’s costs fluctuate strongly and it is generally a slow-changing business, an annual comparison makes more sense than a quarterly comparison. An important figure of the company is the distributable cash flow because this represents, in one figure, the business’s bottom line. For the full year 2022, this number has grown 10% year-over-year.

Valuation

The company is currently valued at an enterprise value of $144B. The market cap is $78B, and the total debt is $60B. Nevertheless, the company receives a relatively good BBB+ credit rating because behind the enormous debt, there are valuable assets that generate constant and predictable cash flows.

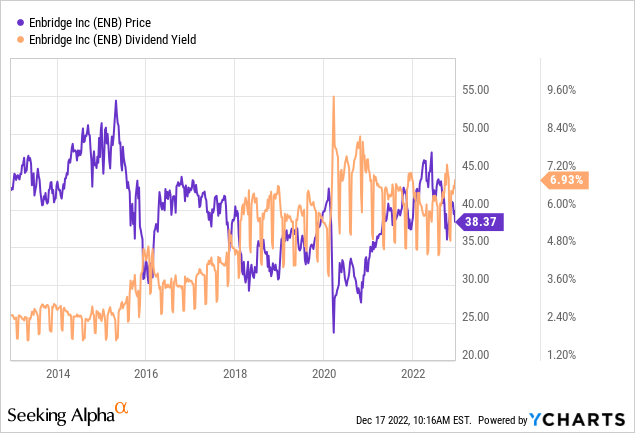

On a longer-term chart, we see that the current dividend yield is historically relatively high. However, the share price has stayed the same for years. The stock’s total return over the past ten years has been only 52%, versus 230% of the S&P 500.

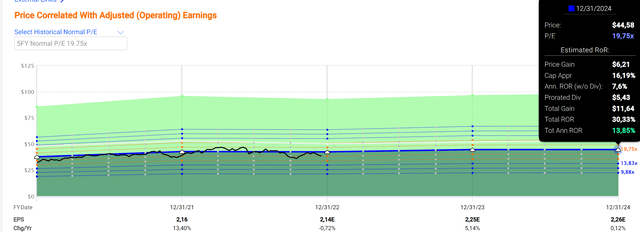

According to Fastgraphs, the average P/E ratio of the stock is 19.75. If the stock were to trade at its average price again at the end of 2024, an annualized return of 14% could be expected. That would be a solid return for such a slow-growing value stock. However, I would like to point out that only minor changes significantly impact the annualized return. Since we are just coming out of the interest-free period, it may be that in the next few years, the average P/E ratio will be lower than in the past. At a 2024 P/E of 16, the return would already be only 3.5% per year.

Future strategy

Enbridge is pursuing a two-pronged approach. On the one hand, the company knows that its essential oil and gas pipelines will be needed for decades. Therefore, the company does not hesitate to invest heavily here to secure future cash flows. These cash flows are required to expand into other fields. The company calls these other fields low-carbon growth opportunities. So, for now, there is no need to worry too much about the company doing a complete 180-degree turnaround and focus only on renewables. In the next few years, most of the CapEx will go into gas pipelines and only a small part into renewables. This smaller portion would be a lot of capital for many other companies, but given the scale at which Enbridge is operating, $1.7B to build offshore wind by 2024 seems relatively small.

Risks

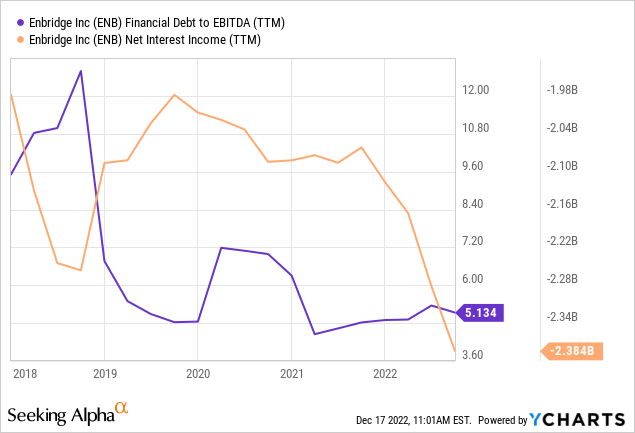

A much-noted issue with this company is debt. If we divide the net debt of C$76.5 billion by the most recently generated EBITDA of C$15.8 billion, we get a ratio of 4.9, which is very high but common in this industry. After all, there are valuable assets and constant long-term cash flows behind the debt. With rising central bank interest rates, however, interest payments should become more expensive in the long run, which almost has not happened yet – but it looks like this development is underway.

Nevertheless, one can see that $2.4B in interest payments in the past 12 months is a significant amount considering that the distributable cash flow in Q3 was only $2.5B. Or, to put it another way, the company has benefited enormously from low-interest rates but needs to be more careful from now on. In 2023, $2.3B of debt will mature. We will see if the company then restructures this amount or pays it back.

But it’s not a real threat to the company. The free cash flow is too strong for that. And in an absolute emergency, the dividend could be raised only minimally for a few years to repay more debt.

Apart from that, the risk that comes to my mind is that some investments in renewable energies might run the risk of burning money instead of making money. I think this is unlikely with wind energy but could happen with hydrogen investments because hydrogen is not competitive yet, and it is unclear if mankind will rely on it in the future.

Share dilution and insider selling

I always want to look at stock dilution and whether there is insider selling. The number of outstanding shares has remained constant over the last three years, and I have not found any info on insider sales either.

Conclusion

The company operates in very slowly changing but growing markets. Gas consumption in North America is increasing, as are gas exports. In my opinion, the need for electricity from renewable energy is politically enforced. The company has an excellent track record and is generally very shareholder friendly. I think a return to the P/E average is unlikely, at least in the next few years, but it could be if interest rates are lowered again. In that case, the company would be an excellent buying opportunity at the current price because, as an investor, you can expect to participate in probably rising profits and dividends for decades to come. However, I would not be surprised to see the S&P 500 outperform the stock again in 10 years. The business model is very capital-intensive, and the interest burden will likely increase further.

So I give the stock a buy rating, even though I’m not buying it myself at the moment. I think there are still better opportunities in the current market, and the stock does not quite fit my style as I already own some value stocks and am otherwise willing to take more risks.

Be the first to comment