Tom Cooper/Getty Images Entertainment

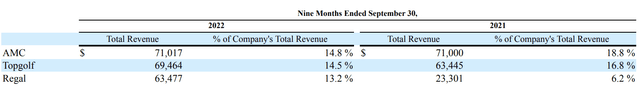

AMC Entertainment (AMC) is EPR’s (NYSE:EPR) largest tenant. The beleaguered cinema operator leased 46 properties and constituted 14.8% of EPR’s total revenue for the nine months to the end of the fiscal 2022 third quarter. This was down from 18.8% in the year-ago comp due to the timings of deferred rent payments from Regal.

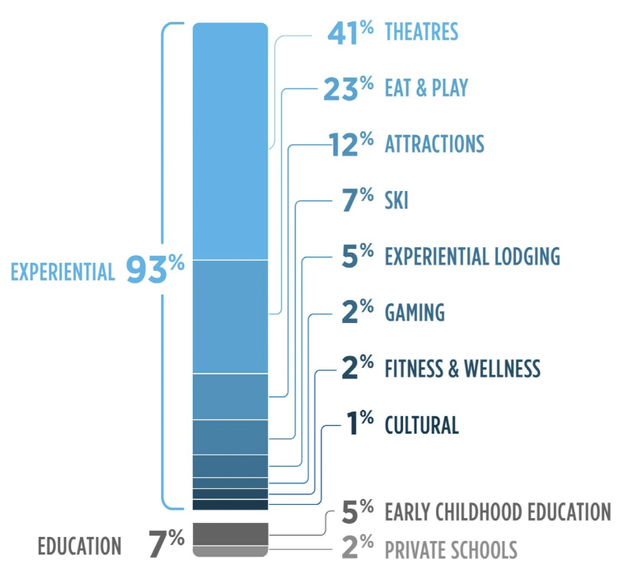

AMC essentially pays around $95 million in annual rent payments to EPR under its triple net lease. Assuming a like-for-like in terms of FFO will mean AMC accounts for around $0.693 of EPR’s FFO expected for 2022. With theatres accounting for 41% of EPR’s total revenue, AMC’s near-term future will have a marked performance on EPR’s common shares.

Everything from the viability of the monthly cash dividend, its coverage ratios, and its future investments are at risk with a potential AMC bankruptcy. According to AMC’s bears, this should have happened but is sure to be imminent. The company has a nearly 20% short interest with the bulk majority of analyst coverage rating the company as a sell.

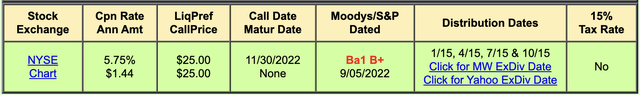

Hence, an assessment of the probability of an AMC Chapter 11 bankruptcy filing is required to gauge the possible near-term performance of EPR. Prospective investors who want to do away with volatility altogether might be interested in EPR’s Series G Cumulative Redeemable Preferred Shares.

These currently trade at $17.35, which is $7.65 below their redemption value. Further, as these are past their call date, holders of the Series G could be subject to an almost instant 44% return on their investment if the company was to redeem the preferred before the end of the year. They’ll also be paid a quarterly cash dividend payment of $0.36 per share to wait.

EPR has been aggressive with redeeming their preferreds, hence the currently marked pullback of the preferred below its redemption price will likely retrospectively form an aberration that all but guarantees a positive return for current holders. Even in the event of an AMC bankruptcy, there is very little risk of the dividend on the preferred being suspended.

A Difficult Few Years But Bankruptcy Calls Are Premature

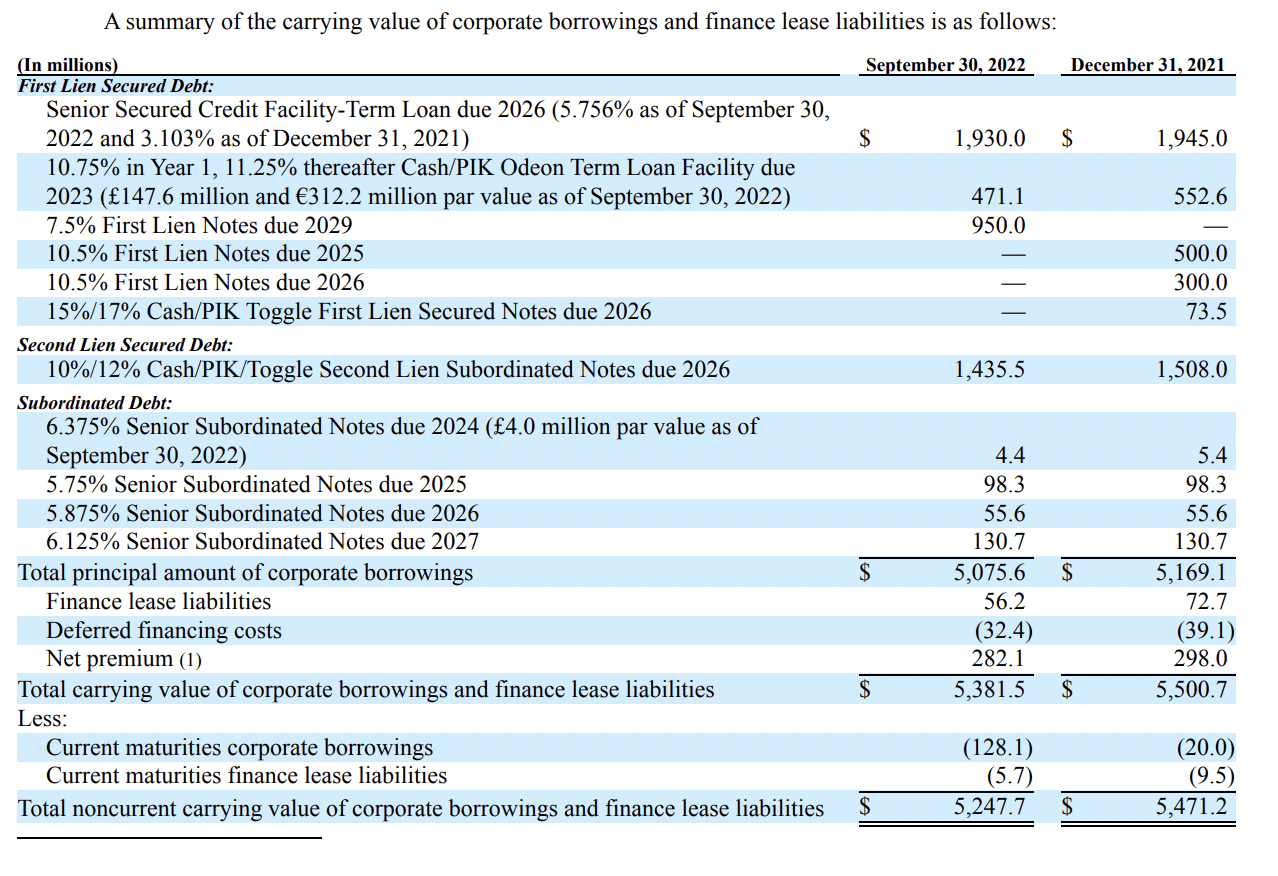

AMC currently has long-term debt of $5.3 billion against cash and equivalents that stood at $684 million as of the end of its last reported fiscal 2022 third quarter.

AMC

The largest of these is a variable term loan due in 2026 that sported an interest rate of 5.756% as of the end of the third quarter. It’s important to note that bankruptcy happens when a company is unable to service its debt from normal operations and needs to restructure. With the bulk of AMC’s debt coming due in 2026, the company’s main risk will come from the normal movie slate and the timing of blockbusters.

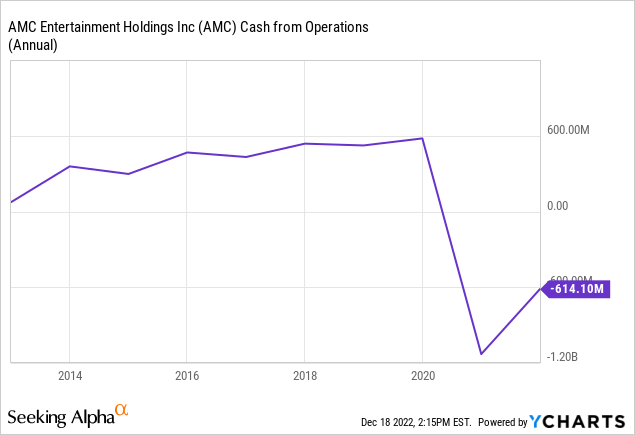

AMC’s cash burn from operations during the third quarter was $179.2 million, which meant a significant erosion of its cash position. AMC bears would be right to state that the company’s cash position is being significantly eroded and it could face a near-term liquidity crisis ahead of its debts coming due.

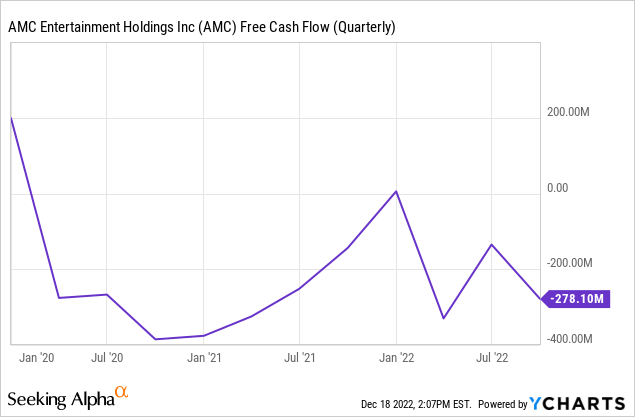

AMC’s free cash flow position has also been less than ideal with FCF for the last reported quarter coming in at $278.10 million. Fundamentally, against its current cash position, AMC will have less than a year of runway left. This has heightened the importance of the coming movie slate. The fourth quarter is expected to be extremely strong with both Black Panther: Wakanda Forever, and Avatar: The Way of Water set to drive the best quarterly box-office receipts since before the pandemic.

EPR’s Investments Should Drive Greater Diversification

AMC was more intensely profitable in the years before the pandemic which saddled it with more expensive debt and disrupted the movie slate for two years.

The trend is only now beginning to reverse with AMC very much in the swing of a recovery that should speed up next year. The 2023 movie slate is looking to be the strongest in years with likely blockbusters coming from Guardians of the Galaxy Vol. 3, Indiana Jones and the Dial of Destiny, and Transformers: Rise of the Beasts. AMC can return to its profitable state without going through chapter 11 but its variable debt burden presents the most significant barrier to this as the Fed is set on hiking rates until something breaks. The extent of how strong the fourth quarter is will determine how AMC’s runway evolves. Bulls will be hoping the company generates enough FCF to expand its runway into 2024 and then fully ride the strong movie slate next year.

EPR continues to make headway with new investments in non-theatre properties. This will be important to diversify its rental revenues in the quarters ahead. EPR’s management can also always take more defensive measures by disposing of prime AMC properties for a positive return. AMC’s fate will hinge on the health of the box office over the next 12 months and shareholders would be prudent to weigh up their position against this risk. I remain long the commons and have reached my full position.

Be the first to comment