bymuratdeniz/iStock via Getty Images

Executive Summary

The price of the shares of Tornado Global Hydrovacs Ltd., “Tornado Global” (OTCQX: OTCPK:TGHLF $0.48 USD TSXV: TGH.V $0.57 CAD) has appreciated over the past 12 months since we first projected a rise to $1.50 (our Initiating report provided an industry summary, discussion of the Infrastructure bill and a distribution overview) but continues to provide a rare opportunity to invest in an undervalued and ever-emerging leader in the hydrovac industry. Recent developments, interviews with Company management and the $1.0 Trillion Dollar Infrastructure Bill passage reinforce First Bridge Finance’s previous projections of earnings growth.

The Toro Company (TTC), based in Minnesota with over 100 years of operating history, a market cap of $8 billion and annual revenue of $4 billion, is building on its Ditch Witch division’s leadership in the underground construction industry by selecting Tornado Global for its entry into the hydrovacs market. The hydrovacs industry has continued to grow throughout Canada and the United States because of the tremendous efficiency and safety it brings to daylighting, soil trenching, piling hole excavation, debris removal and cold-weather digging. While initially tailored to the oil and gas sector, the hydrovac industry has rapidly expanded into the utility market where damages are common and more efficient solutions are in demand as well.

Co-developed and manufactured by Tornado Global, the new product line for Ditch Witch will be the first hydrovacs industry innovation of its kind to be delivered in over a decade. Since acquiring Ditch Witch parent company Charles Machine Works in February 2019, The Toro Company continues to seek opportunities around infrastructure and no doubt plans to make an impact with its new, ‘Tornado Global-manufactured’ product line to maintain its position as “The Underground Authority”.

Custom Truck One Source continues to be an important distribution partnership for Tornado Global. On April 1, 2021, Custom Truck was acquired for $1.475 billion by Nesco Specialty Rentals, another leader in the industry focused significantly on utilities and utility contractors, with an equity investment of $850 million by Platinum Equity (a previous Nesco owner) and $100 million from existing shareholders Blackstone Group, Energy Capital Partners and Capitol Investment. Custom Truck’s combination with Nesco Specialty Rentals has allowed Tornado to work with a vast rolodex of customers and unite elite management teams with decades of experience focused on servicing the oil and gas, construction, telecom and utilities industries – where Tornado plans to diversify its product towards better positioning in particular. Both companies continue to strategically grow together to outperform the marketplace and expand into new sectors.

Tornado Global Hydrovacs Background

Tornado Global designs and manufactures innovative hydrovac trucks for safe digging in areas with critical underground infrastructure (gas, telecom, water). The Company sells popular F2, F3, F4 and F5 Eco-Lite lines (10-12 yards3 debris, 1,250-1,950 gallons water capacity). Competitor units range from 6 to 15 yards3 debris bodies with prices ranging from $350,000 to $500,000.

Nearly $400 billion in new infrastructure spending from the “American Jobs Plan” will require the type of safe excavating that Tornado Global and the rest of the hydrovacs industry is uniquely focused on. $109 billion to modernize 20,000 miles of highways, roads, and main streets along with 10,000 small bridges and 10 of the nation’s most “economically significant” bridges. $65 billion to put hundreds of thousands of people to work laying thousands of miles of transmission lines for affordable, reliable, high-speed broadband to all Americans, including the more than 35 percent of rural Americans who lack broadband at minimally acceptable speeds. $55 billion to upgrade aging water systems (small water, household well and wastewater systems) and eliminate all lead pipes and service lines in our drinking water systems (six to ten million homes still receive drinking water through lead pipes and service lines). $47 billion for weatherproofing, upgrades to coastal infrastructure and severe weather mitigation. $73 billion for power grid improvements, $21 billion for environmental projects and $16 billion to cap hundreds of thousands of orphan oil and gas wells and abandoned mines.

The Company’s new 63,500 square foot facility in Red Deer, Alberta, has tripled Tornado’s hydrovac production capacity from 80 units in a former leased facility to now 240+ units annually in an owned facility, eliminating outsourcing entirely at the new location.

Ongoing Innovation

Ditch Witch/Toro seems to agree with long-time customers that Tornado Global is a leader in bringing innovations to the production of hydrovacs. Innovations that demonstrate an appreciation of the fact that operators spend more time working in their hydrovacs than they do at home when not on the road.

|

2005 ‘Top gun’ boom design replaces side boom design for better mobility and increased operational efficiencies. |

2012 Transition from roots blowers to the Robushi product line. |

2015 Introduction of lighter Eco tank design for greater fuel-economy and on-site performance. |

|

2016 New tank design for improved weight distribution and load dumping. |

2017 New boom design, 400 pounds lighter Eco tank and rear door locking innovations. |

2020 New Red Deer facility for significantly increasing production. |

Currently the Company is exploring new air only offerings (no water or slurry disposal needed), remote monitoring technology for owners to keep an eye on their fleet in the field and the design of fiberglass/conductive separators with insulated booms for ongoing safety enhancements.

With a strong marketing push, ever-expanding distribution throughout North America and a new generation of Tornado products that will compete heavily in the energy and utility markets, more and more customers are expected to take part in the Company’s growth.

A Management Team with Deep Industry Expertise and Financial Reporting Excellence

In June 2021 the Company hired CEO Brett Newton, a hydrovac industry leader. He was the Vice President of Operations and Fleet Manager for Badger franchises in Toronto, Hamilton and Niagara, before starting his own hydrovac service operation in Ontario (utilizing Tornado trucks). For the past five years before joining to lead Tornado Global, Brett was a co-founding partner of Rival Hydrovacs where he oversaw the sale of almost 500 hydrovacs into the municipal market. Brett is utilizing his network of over 30 years in the industry to attract additional top-tier talent to Tornado Global from the hydrovac industry. In the past few months, highly regarded salespeople, fitter/fabricators and tank designers have joined the Company to build on over 130 years in combined industry experience in upper management. Individuals that have led hydrovac design, fabrication and production innovations elsewhere are coming together at Tornado Global “with the freedom to create and build the right way”. This also means further cost efficiencies including new chassis production improvements at the OEM level.

With an eye on new product innovation, expansion, and meeting market demand, Tornado Global began trade on the U.S. OTCQX exchange in May of this year; an important step in attracting new investors on a path that we expect will also lead to a further up-listing in the United States. The OTCQX market is the top tier according to OTC Markets where the 400+ companies trading must “meet high financial standards, follow best practice corporate governance, demonstrate compliance with U.S. securities laws, be current in their disclosure, have a board of directors with at least two independent directors and an audit committee.”

Chief Financial Officer Al Robertson and Vice President of Finance Derek Li lead the financial reporting and investor relations responsibilities. Tornado Global Chief Financial Officer Al Robertson has held the position since July 2017. Prior to this he was Chief Financial Officer of CYGAM Energy Inc., a TSX Venture Exchange listed oil and gas company with operations in Tunisia and Italy. From 1982 to 1996, he had a 14-year career culminating as Senior Vice President and Chief Financial Officer of Nowsco Well Service Ltd., a TSX and NASDAQ listed oilfield service company with operations in Canada, the US and internationally. He is also a former Director and Chairman of the audit committee of Wentworth Resources Ltd (formerly Artumas Group Inc.), an Oslo listed public company involved in oil and gas and power generation, with operations in East Africa. Vice President of Finance Derek Li has spent over 15 years in finance positions at businesses in the greater hydrovac industry. For the last 5 years he has been overseeing finance at Tornado Global; previously he was regional finance manager for Clean Harbors.

Further Growth Projected Ahead

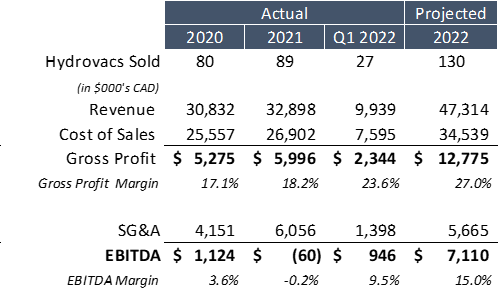

2021 Annual and Q1 2022 Quarterly Financial Statements showed great revenue growth amid increasing demand in the United States. Q1 2022 revenue of $9.9 million is up 25% YOY with two consecutive quarters of ~$9.5+ million in revenue or $19.4 million over the past 6 months.

2021 revenue of $32.9 million was below our projection one year ago of $37.7 million but management confirmed industry-wide supply-chain issues had an impact (changing plans for its parts and services business) and $2.6 million in one-time write-downs and charges lowered EBITDA unexpectedly1. With the strong end to 2021, a 25% gross profit margin in the first quarter of 20222 and “a healthy Q2 expected amid very high demand and increasing build capacity”, we still expect tremendous EBITDA growth will take place going forward that could exceed $7 million in 2022 from revenues of $47+ million. We have slowed down our revenue projections from one year ago but increased our margin expectations based on the strong showing in Q1 2022. *** The Ditch Witch contract is not included in projections.

First Bridge Finance

Tornado’s Stock Continues to Trade at a Discount

Tornado insiders represent over 50% ownership and are aligned with the Company’s growth as visibility of the Company’s public equity has greatly increased since it began trading on the OTCQX exchange on May 5, 2022, making it more easily available to U.S. investors; over 50,000 shares trading daily on average vs. 10,000 shares daily on average just 4 months ago (based on a combination of the volumes of the U.S. and Canadian exchanges)

However, at a current share price that’s only 1.3x projected 2022 revenue and 8.5x projected 2022 EBITDA, Tornado remains undervalued as it enters a new era of industry leadership in design, development, and manufacturing. Badger Infrastructure Solutions Ltd., the largest cap leader in the industry, trades at 20.8x EBITDA.

Liquidity

Per the Company’s most recent quarterly filing, “as of March 31, 2022, TGHL had $790,000 cash which together with the available line of credit and operating cash flow is expected to meet the budgeted requirements for the next 12 months.” With regards to the available line of credit “$2.4 million of the Operating Line (up to $3 million) was used and the Company is in compliance with the sole financial covenant ratio contained in the Credit Facility.” There is then an additional $600,000 on the Operating Line in addition to $312,000 from the Term Loan (Note 11). All total, that is $1.7 million in immediate additional financing available if needed.

Conclusion

Tornado Global carries zero finished goods inventory and effectively zero receivables given that most ($2.5 million) is < 30 days. Business cash flow is not tied up, rather supporting cost reductions with effective supply chain management practices in place; the Company has stated that future chassis for customers have already been secured, presumably through a floor plan financing arrangement.3 Management plans accordingly based on advance order volume for trucks that cost many hundreds of thousands of dollars to manufacture. With the recent $44 million Ditch Witch/Toro supply contract announcement, existing equity in the business, additional available liquidity, major distribution partners such as Custom Truck and the successful onboarding of the new 240+ annual truck capacity Red Deer facility we view our earnings projections and $1.50 share value targets conservative as Tornado Global continues to add cash to its balance sheet. The Company is an emerging leader in a growing industry that stands to benefit a great deal from the increase in infrastructure spending that is starting to take shape in the United States.

Risks

Future growth is a key part of the share price increase that we project. There are a number of negative events, that if they were to take place, would surely impede the ability for the type of revenue and EBITDA improvement that we have discussed. The newly opened manufacturing facility in Red Deer, Alberta, is expected to be able to produce up to 240 units annually. If it is unable to do so, and customers need to shift their orders elsewhere, the company would lose revenue opportunities. The hydrovacs industry is competitive, with multiple companies providing trucks. Mergers between smaller competitors could create economies of scale and market reach that might increase the overall competition faced by the company, above and beyond what it is already dealing with. Badger Infrastructure Solutions, the largest company in the industry, might expand its operations even further than already planned and create ongoing pressure. Covid-19 had a significant effect on the Company’s earnings in the past. If the pandemic returns to peak economic disruption, earnings would once again be significantly affected. Lastly, if the electrification of commercial vehicles in North America far exceeds current expectations and municipalities prefer only electrified vehicles, the company will need to integrate production and engineering changes to its vehicles much faster than we have anticipated.

[1] Includes $0.4 million repayable to the government for wages based on new claw-back provision in Canada’s COVID Wage Subsidy, $0.4 million for moving expenses to Red Deer, and the write-down of $1.8 million of intangible assets, non-core hydrovac equipment, and inventory equipment that is no longer useable due to product design changes and improvements.

[2] Management stated there were production efficiencies including labor utilization at the Red Deer facility, state-of- the-art production tools/technology updates and strategic relationships with suppliers.

[3] ‘Secured key manufacturing components, including chassis, into future years through strategic relationships,’ 2021 10K Filing

Note: Actual Hydrovacs sold is our own estimate, not confirmed by the Company

Be the first to comment