Pavel Byrkin

Embraer S.A. (NYSE:ERJ) has been one of the companies that took a big hit from a combination of the pandemic and the problems that Boeing (BA) faces as a joint venture agreement with the U.S. jet maker was terminated. In this report, I will analyze the second quarter result of the Brazilian aerospace company and explain why I believe that shares of Embraer could offer a valuable investment opportunity, despite the fact that I am not impressed by the Embraer E2 family that is serving the Commercial Aviation market.

Embraer’s Q2 Revenues Are Not Impressive, Margins Are

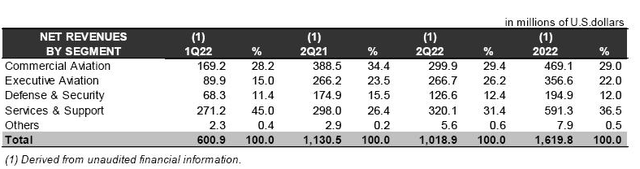

Q2 2022 revenues by segment (Embraer)

In the first quarter of 2022, Embraer results were impacted by a nearly one-month shutdown due to the reintegration of the Commercial Aviation unit into the main company. Results took a hit, but it was important to realize that this stark decline in revenue was not driven by any operational issues such as the current supply chain issues faced throughout the industry. So, Embraer’s Q2 results provide a better view on the state of things for Embraer. Revenues declined from $1.13 billion to $1.02 billion, marking a 10% decline, driven by lower sales in Commercial Aviation and Defense offset by higher Services & Support sales. The lower revenues were driven by lower Commercial Aviation deliveries and lower Super Tucano sales for Defense while Executive Aviation sales benefited from a better pricing environment.

That 10% reduction can be attributed to supply chain disruptions, but Embraer is optimistic about the mid-term and cautiously optimistic about the year-end results.

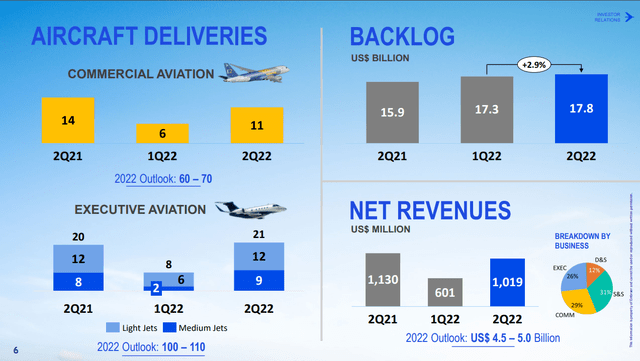

Embraer deliveries and backlog Q2 2022 (Embraer)

All with all, I have some concerns about the delivery trajectory, but Embraer pointed out that they are just four commercial jets behind on their projections, which would point at a very strong second half of the year. Also, the backlog currently stands at a multi-quarter high with $17.8 billion.

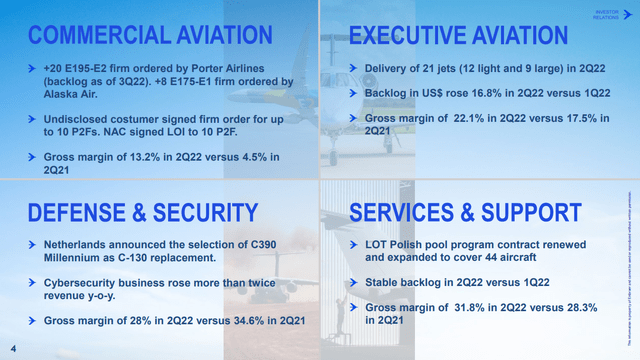

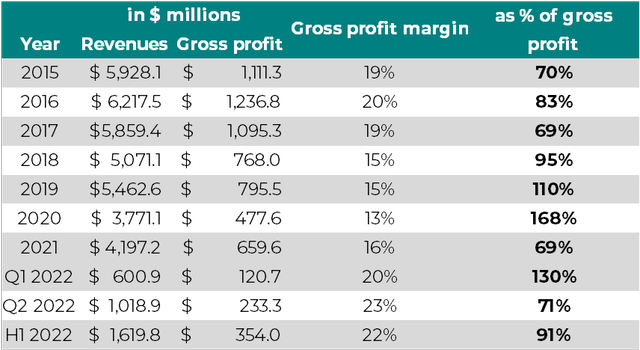

Embraer gross margins (Embraer)

So, I am not quite impressed with revenues, but margins were good with only Defense being a big let-down. Year-over-year, we saw strong margin expansion in all segments. Even Commercial Aviation margins swung to a double-digit margin, and Executive Aviation and Services performed extremely well when considering the cost efficiency. Also, important to note is that sequentially, there was margin expansion. Commercial Aviation margins expanded from 11.3% to 13.2%, Executive Aviation margins went from 18.7% to 22.1%, Defense margins went from 14.4% to 28% and Services support margins which were already strong ticked up to 31.8% from 26.5%. So, sequentially we saw major improvement in the gross margins resulting in company-wide gross margins increasing to 22.9% from 9.5% in Q1 and 18.2% in the same quarter last year. So, the margin expansion that we were expecting was there.

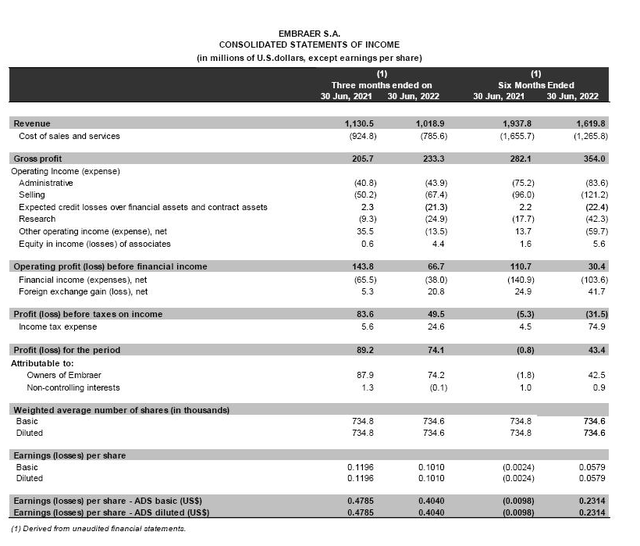

Embraer Q2 2022 results (Embraer)

Year-over-year, adjusted net results were $39 million compared to $44 million in the same quarter last year. Interesting to note is that while gross margins looked good, the operating expenses really brought the operational earnings down due to higher Selling and Administrative costs, credit losses (reflecting a $21 million bad debt provision), higher R&D costs and an operating expense of $13.5 million rather than a $35.5 million income and lower equity income.

Adjusted EBIT declined from 9.3% to 8% but up from -4.5% in the previous quarter while Adjusted EBITDA declined from 14.2% to 12.2% but still up from 2.2% in the previous quarter. That really brings us to our observation from the previous quarter when I pointed out that the gross margins are quite OK and have room for improvement, but it is mostly the operational expenses that eat away the profits.

Revenues and operational expenses Embraer (Embraer)

However, in Q2, we saw a significant step-down in operational costs as a percentage of gross profit. We have to see how gross margins develop, but at this stage, they are stronger than what we saw in the past years, and with a strong second half of the year expected we should be seeing a significant step-up in the margins. Until now, it has often looked as if Embraer has costs that are far too high compared to what they generate in revenues, and I am hoping that the jet maker has used the pandemic work in a more cost-conscious way.

A positive for Embraer is that it had adjusted free cash flow of $91 million, more than doubling year-over-year and up significantly from a cash outflow of $68 million in the previous quarter. That will help the company reduce its $3.2 billion debt, which has already reduced $864 million year-to-date and interest expenses have been brought down by $28 million.

Embraer – Guidance Reaffirmed

For the full year, Embraer is expecting 60-70 Commercial Aviation deliveries and 100-110 Executive Aviation deliveries, which should aid the company in achieving $4.5 billion to $5 billion in revenues and generate an EBIT margin of 3.5%-4.5% and free cash flow better than $50 million. So, despite the one-month shutdown in H2, there is a lot of improvement expected in H2, and beyond that, Defense will continue growing margins while Commercial Aviation might take a bit longer to regrow margins due to some pricing headwind on older contracts.

Conclusion: Slow But Steady, Embraer Stock Could Be A Buy

Embraer to some extent has to prove itself. The company’s E2 commercial jet family is not an overwhelming success and pre-pandemic it had an extremely inefficient operation in my view that would not allow the company to see EBIT margins of 10% or higher. However, I am seeing some signs that, despite a smaller operation, those margins might actually get better than before. The company seems to be more focused on cash generation and debt reduction, which will provide it with a much better liquidity position going forward.

With a strong second half of the year ahead, I am optimistic about the company’s ability to generate more profits, though I am also eyeballing the gross margins as the E2 jets that will be delivered in the second half of the year are potentially dilutive to margins. Nevertheless, I am rating Embraer stock a buy as I feel the company is much more focused on containing costs than it was before and reducing debt.

Be the first to comment