Timon Schneider

We have seen a meteoric rise in Foot Locker’s (NYSE:FL) share price after the release of Q2 earnings. FL managed to surpass low analysts’ expectations in terms of EPS but fell short of a more realistic revenue target marginally. Coincidentally, the company announced the retirement of its long-term chief, Richard Johnson, of the helms of one of the leading athletic footwear and apparel retailers worldwide. Replacing him as the President and Chief Executive Officer is the 35-year veteran of leading consumer-driven businesses, Mary Dillon.

We think that despite the cheap trading multiples that FL possesses, the company is not a buy at this level as the company still faces secular challenges as reflected in its latest earnings call and existing strategy. We also believe that Dillon’s success would not be replicated in FL as compared to her previous ventures and that the market is over-exuberant about the thesis of a turnaround fairy-tale.

Secular Challenges

After the company’s announcement of succession on the same day as the earnings report was released, Wall Street seems positive about what Dillion could bring to the table, as the stock price rose amidst the red inks we spotted. We continue to believe that FL faces secular challenges as a mall-based retailer and would require some time to replace Nike’s (NKE) diminishing allocation to third-party retailers. This could be seen in a decline of comparable-store sales (comps) by 10.3% year-over-year during the quarter. This does not sit well with investors of any retail business as the metric is used to gauge the organic growth of the company. Despite revealing that non-Nike sales in their core business recorded high single-digit growths, it would take a few quarters for FL to rebalance their product assortment to stock up more of Adidas, Puma, New Balance, and the remaining top 20 vendor’s product lines. Furthermore, the outstanding performance in 2021 that was led by COVID fiscal stimulus would not be applicable in the subsequent quarters to come, especially in North America and Europe.

In a more positive light, the comps in the APAC region were up 17.7% year-over-year during this quarter as Australia phased out its zero-COVID strategy and parts of Asia such as Israel, Saudi Arabia, and the UAE benefited from reduced travel restrictions in 2022, allowing for FL’s retail stores to operate. However, this temporary boost in comps is likely to end at most after Q4 FY22 as most APAC countries lifted most generalised public health restrictions and allowed for international travel, reverting the economy back to the norm.

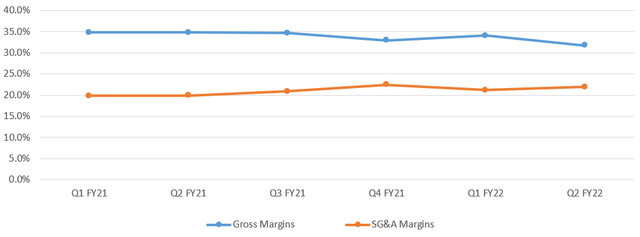

FL’s Operating Margins (Capital IQ)

Another secular issue lies in its operations, and for that, we have to look at its SG&A margin. For Q2, it was deleveraged by 200 bps at 21.9%, particularly driven by labour wage inflation. For the past few quarters, the company is pulling gross margins above 30% but its SG&A is approximately 20% on average, revealing a major profitability issue as the net income margin decreases for 2 consecutive quarters. The issue lies with its overhead cost. For the past 5 years, the company has been increasing its total number of employees, where it could have utilised its cash flow to build out an e-commerce network with functioning distribution nodes to streamline the sales of sneakers and apparel to consumers. With the rise of e-commerce, there is no need for stores to have that many sales assistants to help consumers with their purchases anymore. Furthermore, in such a bearish economy, FL should seize the opportunity to reduce the number of staff and SG&A costs, pivoting the company into the digital space.

Problems with its Existing Strategy

Diversification of Merchandise and Vendor Mix

Despite having multiple partnerships and exclusive access to product lines, the truth is that FL is underpenetrated in most of its brands apart from Nike, and it is likely to remain that way for the foreseeable future. The news of Nike cutting back on the shoes that FL could sell saw the company pivoting towards a stronger partnership with its rival, Adidas. Perhaps Nike knew that a direct-to-consumer approach would see their profit margins increase, as they need not give a cut to major retailers in times of higher supply chain costs and inflationary pressures. We think that the partnership between Adidas and FL would continue to remain strong as Adidas looks to dethrone Nike, the most valuable sportswear and athleisure brand. Since the management guided that no single vendor will represent more than 55% of FL’s purchases by Q4 2022, the impact of reduced allocations from Nike would be felt in the last quarter of this fiscal year as the company actively repositions its product assortment from there.

While we do acknowledge that non-Nike sales have been growing y-o-y in both fiscal quarters, it will be challenging to keep up with the growth in these brands (i.e., Converse, Vans, New Balance, Crocs, Brooks, ASICS, Puma and more) as marketing campaigns and great storytelling through exclusive products and concepts could only introduce that much hype to relatively obscure brands compared to Nike. Thus, onboarding and diversifying more merchandise from different vendors might not fill the void left by Nike’s reduced presence, translating to a decline or stagnation in sales figures.

Share Repurchase Plan

For the past decade, FL has been consistently decreasing its number of outstanding shares as part of its long-term share repurchase plan. However, with the Biden administration rolling out a 1% excise tax on the purchase of its own shares, the company will be less likely to authorise a huge sum for the subsequent repurchase of its shares in 2023 when the law takes effect.

To illustrate the financial impact it may cause, FL repurchased 1.4 million shares of its common stock for $40 million and paid $38 million in dividends. A 1% excise tax would mean an additional $400,000 in a financial quarter being paid to the federal government instead of the pockets of stockholders in the form of dividends. Although dividends would be subjected to double taxation, individual investors should be concerned about the company increasing dividend payments just to keep stockholders holding the stock due to lucrative yields. We believe that most companies that pay high amounts of dividends relative to their net income are usually not high-growth leaders as companies with more growth potential would have a better use for their dollars (eg: R&D, capital expansion, and/or mergers and acquisitions (M&A). In the case of FL, the retail company is definitely not one of high growth after looking at their comparative sales declining 10.3% in Q2 and 1.9% in Q1 this year. The only prudent way that it should spend its net income would be only on the expansion of stores and M&A of brands or companies.

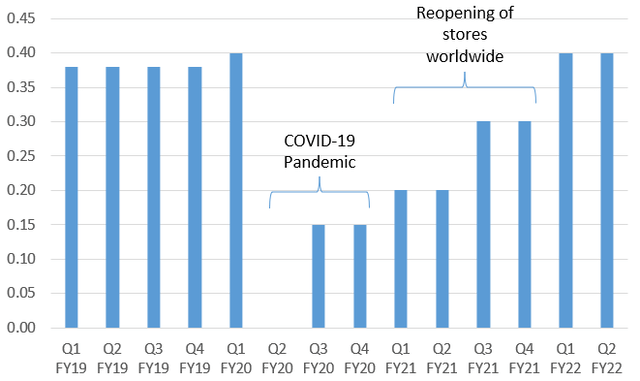

FL’s Dividend per Share in USD$ (Capital IQ)

In other words, dividend payments are not guaranteed and are subject to management decisions. As discretionary spending on goods and services continues to decline, we believe that the dividend per share for FL could have much room to decline back to FY21, when its stores are beginning to open up across the world as pandemic restrictions relaxed. This conservative estimate likely mirrors the potential sales as the company moves into tighter fiscal management of its finances.

Overexuberance after Executive Change

The arrival of Mary Dillon spurred investors to consider a potential appreciation of share price in the same fashion as Ulta Beauty (ULTA). Highlighting her time in her previous firm, she managed to engineer a best-in-class loyalty program that saw the stock more than quadrupled in price, giving shareholders an ROI of 16.6%. On top of that, her time at previous appointments in McDonald’s Corp. (MCD) and PepsiCo (PEP) allowed her to display strong operational experience and most notably, shareholder value creation. Investors may think that her deep consumer marketing and digital transformation expertise is exactly what FL needs to turn itself around. We are here to think otherwise.

We think that her expertise in the beauty industry is not transferable to the fashion industry, where it would require someone who understands streetwear and sneakers, with a keen eye for spotting trends and securing exclusive launches. This would allow the company to onboard successful products that would sell out, reducing inventory turnaround time and increasing sales. We believe that this is something that would take more than just a loyalty program and targeted consumer marketing to accomplish. Perhaps her digital transformation expertise could come in useful to pivot the company into the digital space.

Thus, the exuberance in the announcement of her arrival saw the stock price shoot up over 20% after dismal earnings are definitely unwarranted and illogical in our opinion. We believe that the company should be trading closer to its long-term fundamentals instead.

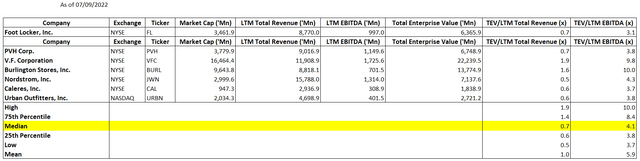

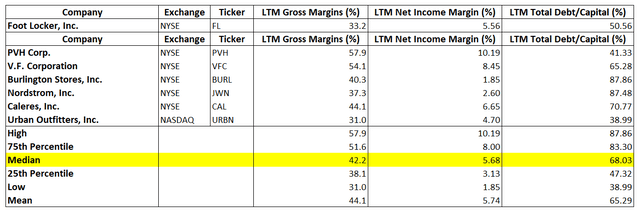

Peer Comps

Among its peers, we have selected those that are distributors of multiple apparel brands that are similar to the business model of FL. Since the growth of these businesses heavily relies on opening more stores to increase sales, we decided to look at both their revenues and EBITDA to gauge where FL stands. Based on the median figures of the peer comps, FL is priced fairly on an EV/Total Revenue basis with its peers. However, it lags behind when comparing EV/EBITDA, further illustrating the point made about high SG&A margins and an inefficient mode of operation in the secular challenges discussed above.

Clearly, we can also interpret from the diagram above that the sales of only sporting apparel and sneakers are not as profitable as a more diversified product mix. FL is 100 bps behind the median figure for gross margins and LTM net income compared to its peers. However, on a slightly positive note, FL is better positioned in a persistent rate hike climate compared to its peers as its debt-to-capital ratio comes in way lower than its peers. This would mean that there could be still ample room for FL to issue more notes to raise more capital now for any expansion plans under new leadership.

Valuation

On top of the secular and macroeconomic headwinds covered above, the general consensus towards FL is still a hold with limited upsides based on the analysts’ stock price targets.

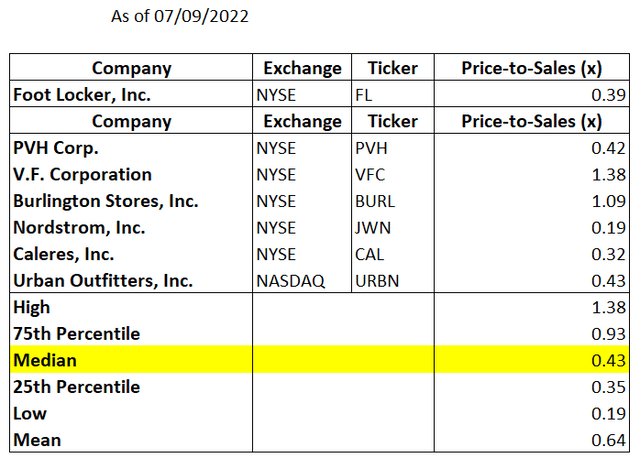

FL Price-to-sales Peer Comps (Capital IQ )

To sense-check the figures, we compare FL’s price-to-sales (PS) figures to its peers. Despite trading at a ridiculously low PS, we find that it is relatively close to its peers. This means that the general sentiment of this industry is more or less priced in, with little or close to no margin of safety.

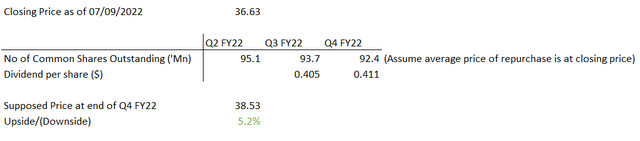

Author’s Spreadsheet Calculations (Capital IQ )

As the company continues to remain at half of its 2021 peak, we believe that the only way to increase shareholder value would be to continue buying back shares when it is cheap. Although the management guided that they would be repurchasing lesser of the company’s stock, FL ended the quarter with $386 million in cash and $600 million undrawn on its credit facility. After considering their $455 million in debt, we assumed that the company continues to pay out quarterly $38 million in dividends as it did previously and continues to spend $50 million in share repurchases (which is the average of the previous few quarters, factoring in the current macroeconomic condition and management guidance). Assuming constant revenue and earnings, the company would return $176 million to shareholders, which would translate to an approximate 5% upside in its stock fundamental value by the end of 2022. Stockholders with a longer investment horizon would need to brace themselves for little to no growth for this year, apart from a massive earnings beat and increase in FCF which is unlikely to materialise until Q1 2023.

Risks

We have basically covered many concerns above but the biggest risk for us in valuing this company would be its strategy, which inherently is the most unpredictable among all of their concerns. Recently, FL secured a long-term deal with another sportswear merchandising and retail superpower, Fanatics, which will see the latter fulfilling FL’s online orders and access to a portion of their sporting inventory. We think that such partnerships beyond footwear would positively impact FL in the time to come. However, we noticed that FL’s strategy of opening more community and Power stores could be too aggressive, after opening or converting 100 of such stores out of its target of 300 globally by 2024.

Nike’s Shoecase Concept in FL’s Washington Heights, Manhattan Store (Foot Locker Website)

Call ‘N Collect Window in FL’s Markham, Canada store (Xandrae Ramdeem, Retail Insider)

The community and Power stores will feature some of the vendor’s proprietary technology such as Nike’s Shoecase concept, spaces for events to be held, and even a Call ‘N Collect window for customers to easily access items they would like to purchase without going to the physical store. From the pictures, it is evident that such a design would require a significant amount of store space, which would mean lesser display space for shoes and apparel. In our opinion, we are also unable to determine if such a strategy would improve the overall customer experience and desirable space for customers to connect with one another or the local community. However, we are certain that the company would incur a significant amount of CapEx if the management were to move forward with their plans to open or convert another 200 community and Power stores. This will cause a dent in their cash flows and more volatility in the efficacy of such a strategy.

Conclusion

Foot Locker used to be a renowned middleman for many astute brands in the footwear and sportswear industry. However, the shifting trend of retailers selling direct-to-consumer to keep up with their margins could further hurt FL’s profitability in the long run. It seems to us that the strong partnerships with their top vendors are keeping them going for the time being. It is perhaps cheaper to sell it to retailers like FL than to build out their own distribution network. However, should these vendors decide to improve their profit margins and streamline their distribution through a direct-to-consumer approach, it could be the end of FL as footwear takes up a large proportion of its sales.

In all, taking into consideration its secular challenges and current macroeconomic headwinds, Foot Locker is not worth the risk to invest despite overexuberance by the market as a result of a new executive. Intrinsic calculations based on peer comps of trading multiples, projection of share buybacks and dividend payouts have revealed limited upsides for the stock. Investors could consider looking at the ticker again after a rebalancing of FL’s product mix and a different set of macroeconomic conditions in 2023.

Be the first to comment