LockieCurrie/E+ via Getty Images

Stocks got a big lift at the open yesterday after China’s Ministry of Finance announced consideration of a $220 billion stimulus plan to fund infrastructure spending. I think the real reason the S&P 500 finished up for a fourth day in a row, which amazingly matches its longest streak of the year, is that a growing consensus realizes that the market has too many rate hikes priced in for this cycle. As the rate of growth slows and the rate of inflation looks to fall faster than expected during the second half of the year, the Fed should be able to pull back on its monetary policy tightening campaign. That should precede a second half recovery. While the bears get whipsawed between fears of inflation and recession, a summer rally may be emerging in the background.

Finviz

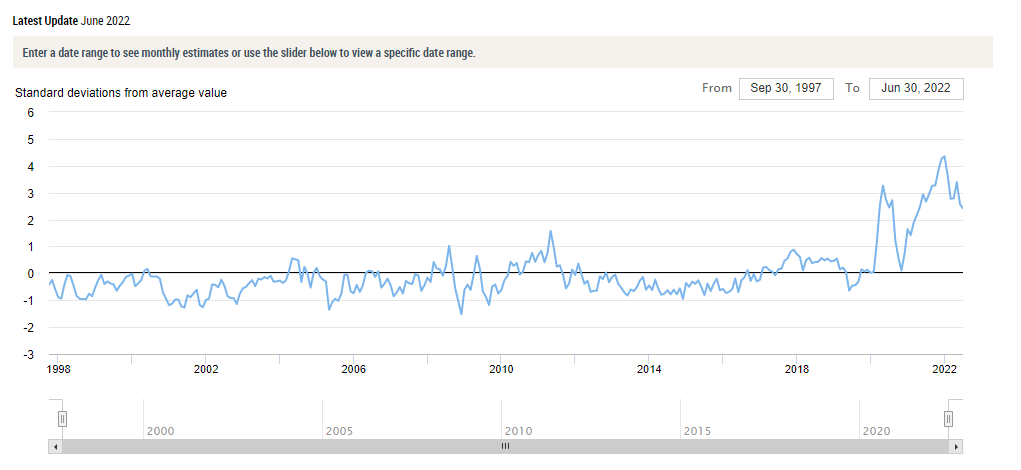

I think the most important lesson investors can learn over time is that markets focus on rates of change and not absolute numbers. In other words, a rate of inflation of 8.6% is a horrible absolute number, but if that is the peak, and it begins to decline. Then the rate of change is a positive moving forward. In similar fashion, a rate of inflation of 2% is an ideal number, but if that is the low, and it will be doubling moving forward, then the rate of change is a negative. Consider the bottlenecks in the global supply chain that have caused prices to rise and led to a multitude of shortages in various industries. The Fed’s Global Supply Chain Pressure Index has now declined three months in a row through June. While supply chain pressures remain elevated, that is a positive rate of change that is deflationary.

New York Fed

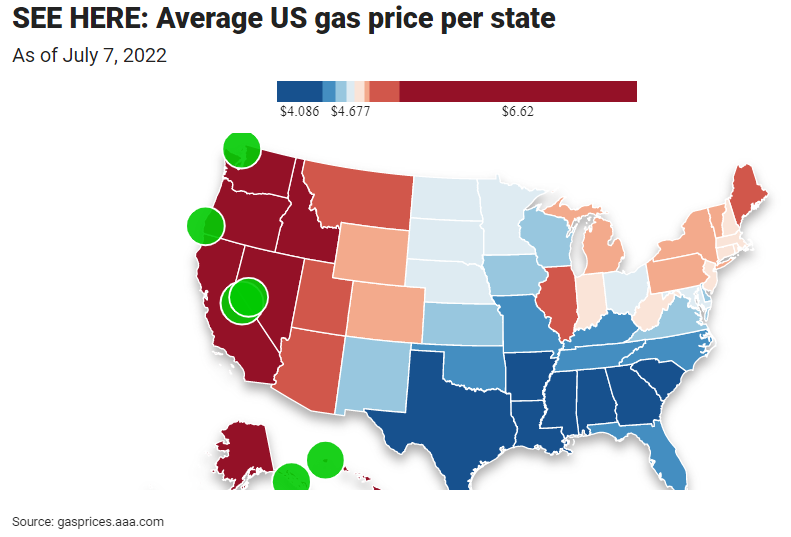

Do you remember when the cost for a gallon of gas rose above $5 per gallon? That was an absolute number that weighed heavily on consumer sentiment last month. Yesterday, Gasbuddy reported that the price fell below $4 at approximately 2,535 stations located predominantly in the Gulf Coast region and that the number could triple in coming weeks. Gasbuddy’s head of petroleum analysis, Patrick De Haan, estimates that American consumers are spending $100 million less per day than when gas prices peaked a few weeks ago. That is an extremely important and positive rate of change.

Fox Business

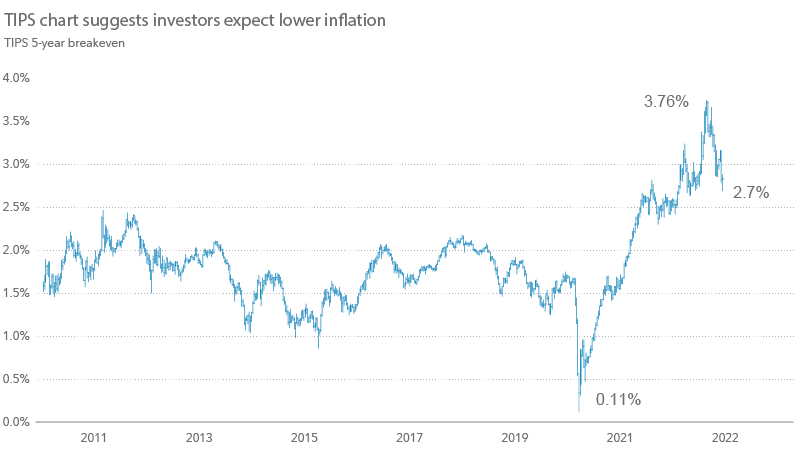

The Fed is extremely concerned about inflation expectations, as should they remain elevated, it would increase the likelihood that price increases remain embedded in the economy. The good news on this front is that the difference between the 5-year Treasury Note rate and the 5-year Treasury Inflation Protected Security (TIPS), which measures what investors expect the inflation rate to be over the next five years, peaked at 3.76%. It has now fallen more than 100 basis points to 2.7%. Again, this is a hugely positive rate of change for the markets.

Fidelity

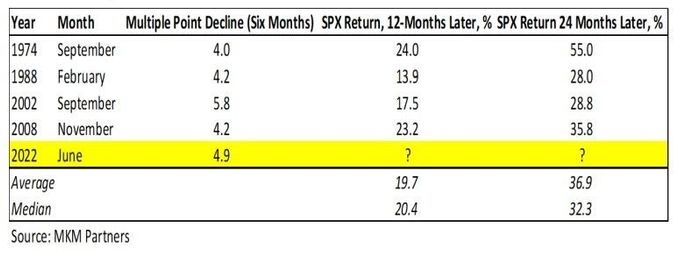

When I combine the growing number of positive rates of change, I see with the valuation adjustment we have had over the first half of 2022, I see significant upside in the market. History is on my side, as seen in the chart below from MKM Partners. During previous periods when we have seen the price-to-earnings multiple for the market fall 4-5 percentage points over a six-month period, the S&P 500 has produced outsized gains in the 12- and 24-month periods that followed.

Yahoo Finance

I think the market is set to rally during the second half of this year, and I am growing increasingly convinced that June 16th was our low for the year in the major market averages. The Fed may very well be successful in its campaign to lower the rate of inflation without choking off the rate of economic growth to the extent that it results in recession. Even if we do realize a recession when second quarter GDP is reported in coming weeks, it would likely be over and behind us, which further supports the outlook for a recovery in the second half. It is not only time to fight the negatives, as I mentioned yesterday, but embrace the positives.

Lots of services offer investment ideas, but few offer a comprehensive top-down investment strategy that helps you tactically shift your asset allocation between offense and defense. That is how The Portfolio Architect compliments other services that focus on the bottom-ups security analysis of REITs, CEFs, ETFs, dividend-paying stocks and other securities.

Be the first to comment