Khanchit Khirisutchalual

Article Thesis

Inflation continues to defy expectations, accelerating to a new 40-year high in July and remaining well north of the Fed’s target level. It is unclear whether we will see inflation coming down in the near term. Investors that want to position themselves for a scenario where inflation remains high for some time, or even accelerates further, could take a look at three ETFs that provide solid inflation protection. In this article, we’ll showcase the SPDR S&P Metals and Mining ETF (XME), the Vanguard Real Estate ETF (VNQ), and the Energy Select Sector SPDR ETF (XLE).

Inflation: Not So Transitory

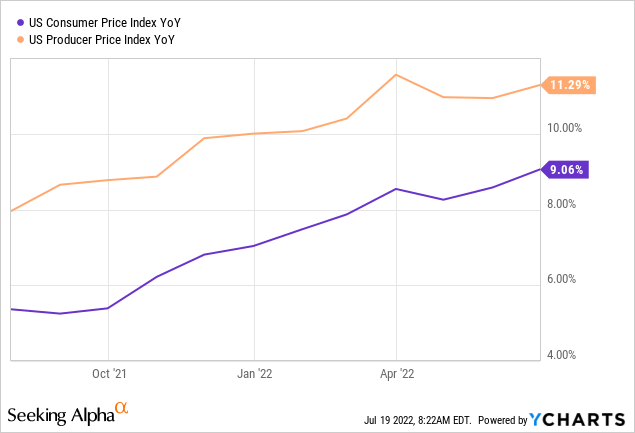

When inflation first rose above the target rate of 2%, many central bankers and other professionals argued that this was a transitory issue and that inflation would soon revert back towards the target range of 2% or less. That has, so far, not happened. Instead, inflation continued to soar:

In June, CPI growth breached 9% on a year-over-year basis, for the first time in more than 40 years. Since then, some commodities have pulled back, including oil. But that does not necessarily mean that inflation has peaked and that CPI increases will shrink in the coming months. Producer price index readings have been leading CPI readings by a couple of months in the recent past, and PPI has reaccelerated over the last month. If that connection between PPI increases and subsequent CPI increases remains in place, consumer inflation could remain high and possibly rise to an even higher level. That is not guaranteed, of course, but it at least seems possible.

Some components of the CPI, such as the cost of housing, which is measured via owners’ equivalent rent, are slow-moving and could remain at an above-average level for quite some time, thereby preventing CPI growth from dropping back towards 2% in the foreseeable future. In such a scenario, holding cash or treasuries could be risky, as inflation will likely lead to net losses in real terms for those that decide to hold these asset classes. Investors that want to position themselves for a scenario where inflation remains at an above-average level for quite some time can do so by investing in assets that benefit from high inflation readings.

XLE Benefits From High Energy Prices

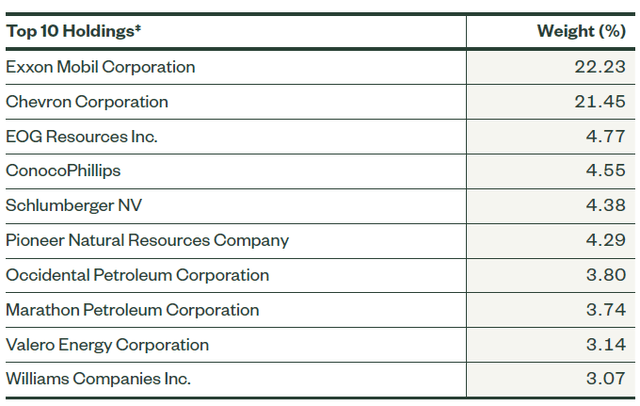

The first ETF we want to showcase is XLE, the SPDR Energy ETF. XLE is a large ETF with more than $30 billion in assets, whose fact sheet can be found here. The ETF invests in large-cap names of the American energy industry, distributed over supermajors, E&Ps, energy midstream/infrastructure names, and energy services.

Its top holdings are the following 10 companies:

Not surprisingly, the two largest holdings by far are the two largest supermajors on the planet, Exxon Mobil (XOM) and Chevron (CVX). EOG (EOG) and ConocoPhillips (COP) are high-quality E&Ps, Schlumberger (SLB) is an O&G equipment/services company, etc. The ETF’s top holdings benefit from high commodity prices, namely crude oil and natural gas. High LNG prices due to hefty spreads between natural gas prices in North America and other markets, namely Europe, are also beneficial for those companies with LNG exposure, such as XOM and CVX. Last but not least, companies with refining exposure, such as the supermajors or Marathon Petroleum (MPC) and Valero (VLO) benefit from high crack spreads that make their operations way more profitable than is the norm.

There are good reasons to believe that energy prices will remain high, or even climb further. OPEC spare capacity is slim, as the cartel has been underperforming its own production goals for many months, with the underperformance growing over time. President Biden’s visit to Saudi Arabia has not resulted in meaningful production growth promises, which is why oil prices have risen over the last couple of days. Most forecasts see global oil demand growing next year and hitting a new record level, while supply remains constrained due to years-long underinvestment, political and regulatory issues, supply chain issues, and so on. When China fully opens up its economy, that will add meaningfully to global energy demand as well, although the timing of that is uncertain.

At the same time, many energy names are not at all priced for a $100 per barrel oil price environment. Instead, some analysts are calculating that major energy names are currently pricing in oil prices of $60 or $70, thus there is considerable upside potential for the whole industry if oil prices remain anywhere close to where oil trades now. If oil were to rise further, which seems possible in a high-inflation environment and which could be caused by the very tight market, then energy names would be even more undervalued. Many energy producers are trading at single-digit earnings multiples, including XLE’s top holdings XOM and CVX – these are valued at just 7.2 and 7.8x this year’s forecasted profit right now.

The low valuations across the industry, and a reluctance to commit to large growth projects due to political and regulatory uncertainties, are why free cash flow yields are very high for many energy names. This allows for large dividend payouts and hefty buyback yields. XLE thus is able to offer a dividend yield of 4.7%, based on the most recent quarterly payout of $0.82. With many energy companies committing to growing shareholder payouts, XLE’s dividend could climb further this year, we believe. Investors thus get diversified energy exposure from XLE, a dividend yield of close to 5%, and substantial upside potential if oil prices remain high or climb further. This makes XLE a nice ETF to hold when one seeks inflation protection. The fact that the ETF’s expense ratio is very low, at just 0.1%, is another positive, as mutual funds that offer exposure to this space are generally way more costly.

Real Estate As An Inflation Hedge

Energy is a very obvious inflation beneficiary, but it is not the only one. Real estate is poised to do well, too. Properties should climb in value over time, due to inflation, as replacement costs increase and since rents can be increased, thereby increasing the net operating income and thus the value of the property over time. At the same time, REITs benefit from the fact that the debt they use to pay for some of their assets gets inflated away. When REITs have locked in interest rates at 3%, 4%, or 5%, while inflation is taking 9% of the debt load away (in real terms), then that’s value-generating for shareholders. VNQ’s fact sheet is available here.

The ETF offers a dividend yield of 3.1% based on the payout over the last year. Income growth potential in the near term isn’t as pronounced as with XLE, but in the long run, rising rents should allow VNQ to increase its payments to investors. VNQ is down more than 20% from its 52-week-high, despite the fact that real estate prices remain high, which may indicate that it’s a good time to enter following this selloff. With an expense ratio of 0.12%, VNQ is not a costly ETF. Investors get broad-based exposure to different real estate segments, including residential, retail, hospitality, industrial, and so on. When inflation stays high, VNQ should do well in the long run while offering a reliable payout with growth potential.

Mining And Metals For Inflation Protection

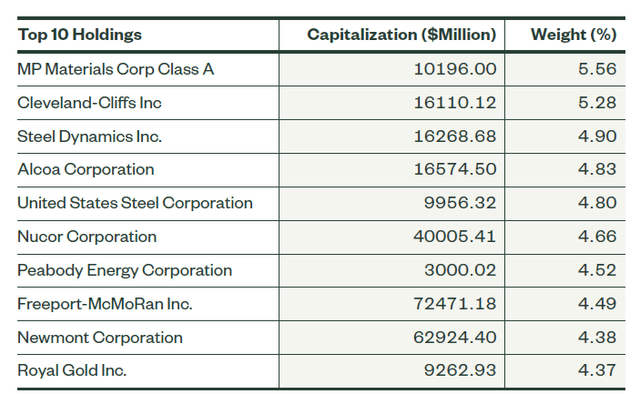

XME, the SPDR Metals and Mining ETF, offers exposure to a range of metals companies and mining companies. Its top 10 holdings are the following companies:

There are some steel producers, such as Cleveland-Cliffs (CLF), United States Steel (X), and Nucor (NUE), some mining stocks, such as copper miner Freeport-McMoRan (FCX) and gold miner Newmont (NEM), while the top holding is MP Materials (MP), which is a rare earth company.

These companies benefit when commodity prices are rising, and they also have exposure to the “new energy” theme. The buildout of electrical grids, the construction of windmills, the production of solar panels and EVs all require steel, copper, aluminum, rare earth elements, and so on. The companies in this ETF could thus benefit from ESG themes on top of benefitting from a high-inflation environment. Recently, some commodities have pulled back on the back of recession worries. But with a large infrastructure investment need in the US and many other markets, and with China seeking to bolster its economic growth by increasing infrastructure spending, commodity prices could easily start to climb again. The longer-term outlook is also positive, as opening new mines is increasingly difficult due to political and regulatory factors, which should be helpful for commodity pricing.

XME has a somewhat higher expense ratio, at 0.35%, and its dividend yield isn’t very high, as many of the top holdings aren’t paying large dividends. XME is thus more of an appreciation investment, whereas XLE and VNQ offer sizeable income streams.

Takeaway

Inflation is high and has so far not been transitory at all. Some commodity prices have pulled back in recent weeks, but at the same time, the producer price index is still at a very high level which might indicate further inflationary pressure.

For investors that want to position their portfolios for a high-inflation environment, ETFs that contain companies that benefit from inflation could be a solid idea. XLE is a good example of that, as it combines a high dividend yield and upside potential if energy prices remain high or climb further. Other industries, such as real estate or mining/basic materials/metals could also be reasonable choices.

Be the first to comment