Mario Tama

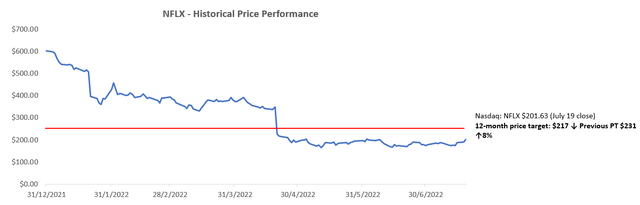

The Netflix, Inc. (NASDAQ:NFLX) stock has lost almost three-quarters of its value this year. The stock had succumbed to two steep overnight drops of more than 20% and 30% in late January and April, respectively, following signs of worsening subscription churn that has investors worried about whether the direct-to-consumer (“D2C”) streaming service leader’s growth days are over.

During the first quarter earnings call, management confronted the possibility of losing two million subscribers in the second quarter, without expectation for re-acceleration in the second half of the year as it returns to the planning table to strategize on what the company’s next leg of growth might need and look like:

I just want to make sure there’s not a read-through when we guide to negative 2 million paid net adds in Q2…We’re not expecting our growth to reaccelerate, our revenue growth to reaccelerate before the end of the year, but we will grow revenue. And there will be paid net add growth. As we get to the back half of the year, Ted talked about the stronger slate. We get further away from some of the big price increases. We get into a stronger seasonal period. So I just want to make sure that that’s understood as you think about the full year, even though we’re not providing full year guidance.

Source: Netflix 1Q22 Earnings Call

The announcement unleashed an immediate violent selloff in the stock as investors rushed to price-in the new reality for Netflix’s near-term growth slowdown. And, considering macro data in the second quarter had not looked good either – with consumer sentiment dropping to its lowest level on record in decades, while living costs surged with runaway inflation and financial conditions tightened with aggressive Fed rate hikes – Netflix’s dire 2Q outlook provided during its April earnings call had set the stage to quell investors’ expectations. The stock rallied as much as 12% in post-market trading Tuesday after reporting better-than-expected results – net subscriber churn came in at only 970,000, less than half of what was guided three months ago.

This has set the foundation for a potential turnaround for the Netflix stock, albeit a fragile one. Investors are expected to regain confidence and keep rewarding the Netflix stock, but only if it shows consistency in returning to growth in the second half of the year as guided and through the longer-term. The stock currently trades at about 3x NTM EV/sales (or ~2.2x EV/’25 sales), which is already a significant downward adjustment from its peak in November and 10-year average of about 6x. It is also underperforming the tech-heavy Nasdaq 100 index, which is currently priced at 3.6x NTM sales. This suggests that there is still room for the Netflix stock to break out of its first-half slump this year – especially after it successfully assuaged investors’ fears during the latest earnings call that it can return to growth without losing material market share to competitors and without failing to withstand the near-term macro headwinds facing the business.

In short, Netflix’s 2H performance will act as a tell-tale on the stock’s fate. The key focus area this time around remains on the slew of new growth strategies that have either been announced or are in the process of implementation. These include expectations for positive progress and impact analysis on the price hikes and password sharing fees that Netflix rolled out earlier in the year, as well as the launch schedule for an ad-supported subscription option in early 2023. Investors will remain focused on related commentary for clues of how Netflix will fare in the second half of the year – a critical determinant for whether long-term sustained growth is still in the books for Netflix after it conquers the near-term hump, or if its glory days are numbered from here on out as it succumbs to overwhelming competition within the increasingly saturated D2C streaming market.

Three Detrimental Headwinds Facing Netflix

Intensifying competition, a weakening macro backdrop for consumer discretionary spending, and over-saturation in its core North American and European markets are three immediate headwinds that Netflix must show consistent progress in overcoming to prevent a structural downturn for the stock. Considering Netflix has benefited from years of first-mover advantage that has led it to conquer the majority of the North American and European D2C streaming markets, maintaining its leadership will be a steep uphill battle – especially considering it is one of the most expensive offerings in the market right now, while providing few options outside of leisure content (e.g., news, sports, etc.), which does not bode favorably with weakening consumption trends.

1. Intensifying Competition

Rising competition is something that Netflix finally came around to acknowledging as it grappled with increasing churn rates this year. Recognizing the growth opportunity presented by on-demand video streaming, many traditional entertainment and media companies have launched their own platforms. And, with the streaming industry becoming increasingly crowded, there has also been a lot of consolidation among the big players, which has further heightened competition for Netflix.

For instance, the blockbuster merger of Warner Bros. Discovery (WBD), and the completion of Amazon’s (AMZN) acquisition of MGM have created competitive content libraries that will be hard for Netflix to match, let alone top, going forward. The migration towards sports content offerings at D2C streaming services like Apple TV+ (AAPL), Prime Video, and Disney’s ESPN+ (DIS) are also bolstering subscription retention rates, an advantage that Netflix lacks. These competitors have increased their D2C streaming market share by 15% in recent years – the same extent to which Netflix has lost.

In the meantime, Netflix has been relying on blockbuster title releases like “Squid Game” and “Stranger Things” to retain existing subscriptions and attract new subscriptions. This is an unsustainable measure given most hit releases have typically lost their shine within two weeks or less. This has proven to be a temporary, yet costly, strategy to keep up with.

Although Netflix’s commitment to releasing quality content all at once every two weeks or so might have historically worked to its favor in acquiring subscriptions, the growing list of D2C streaming options for consumers mean they can now access more for less (note that Netflix is currently the most expensive D2C streamer on the market). This accordingly forces Netflix to rethink its content investments and roll-out strategy in order to prevent the risk of overreliance on big hits for growth – a stale strategy where associated costs now outweigh the benefits.

2. Inflation and Consumer Slowdown

While the increasingly saturated D2C streaming landscape has dialed up concerns over “the maximum number of subscriptions that consumers may be willing to take on,” as we had warned of in previous coverage on related industry tickers (namely WBD, NFLX and AMZN), rising inflation has heightened related risks. Consumers are becoming increasingly budget-conscious and scaling back on purchases of discretionary goods and services – like D2C streaming subscriptions – as rising price pressures continue to erode their purchasing power.

While the latest retail sales data indicate that “buying conditions for household durable goods/services” have remained resilient, consumer sentiment fell to a historical low in June. This underscored more headwinds for Netflix and its D2C streaming peers over coming months as Fed policy makers try to quell the hottest inflation in four decades.

And as Americans start to chip away at their savings amidst an increasingly uncertain global economic outlook, discretionary spending will likely look worse in the near-term before it gets better. Netflix’s recent price hikes also do not bode well, with increasingly price sensitive consumers ahead of the looming economic downturn. Paired with a weak macro backdrop for discretionary spending, Netflix is becoming more susceptible to extended periods of churn compared to most of its peers, which are partially insulated by lower prices and smaller subscription bases that are still in early stages of growth.

Increased subscriber churn in UCAN – Netflix’s largest market – as well as EMEA already shows early signs of impact from both macroeconomic challenges and rising competition. Specifically, UCAN lost 1.3 million subscribers in the second quarter, more than double of churn experienced in the previous quarter. EMEA experienced the same, with second quarter subscription losses approaching 800,000, more than 2.5x churn reported in the previous quarter. Although average revenue per membership (“ARM”) in UCAN rose 10% from the prior year and 7% from the prior quarter to drive sequential revenue growth of 6% from $3.35 billion $3.54 billion, signs of slowing consumer sentiment in the U.S. economy suggest that Netflix may be walking on thin ice here. The company’s use of price hikes to compensate for increasing churn likely will not last, indicating its continued struggles with maintaining growth in its core markets.

3. Over Saturation in North America and Europe

Although much of Netflix’s net subscription adds have come from outside of North America in recent years, which indicates that it may be “nearing a ceiling” on subscription growth from the region and pivoting strategy to subscription retention instead, there is still close to half of “North American broadband households” that Netflix has yet to penetrate. Meanwhile, in the U.S., on-demand video streaming has only replaced about one third of total TV viewing time. And specific to pay TV in the U.S., Netflix accounts for two-thirds of related viewing time, while also representing an all-time high contribution to total U.S. TV viewership of 7.7%. This, together, indicates that there is still significant runway for further expansion in Netflix’s core “UCAN” operations alone.

But as long as Netflix’s content is limited to leisure offerings like docuseries, TV shows and films, acquiring new subscriptions will become an increasingly difficult feat in its core markets. This is especially true under the current macro climate where consumer budgets are tight and everyone is looking for a “bang for the buck” offering that includes everything from scripted and non-scripted leisure content, to live sports and news streaming – the latter two are key retention offerings that Netflix, despite its premium fee charged, currently does not provide. And competitively priced offerings by rivals like free Prime Video offered by Amazon’s Prime membership that most Americans already have, which includes both scripted and non-scripted leisure content, as well as sports and news content, is making it even more difficult for Netflix to retain its market share, let alone expand further.

Desperate Times Call for Desperate Measures

Recognizing the three immediate headwinds that threaten to structurally erode Netflix’s global market share in D2C streaming services, management has introduced one of its biggest slate of new strategies since inception, aimed at jumpstarting renewed growth and restoring investors’ confidence in the stock’s long-term valuation prospects. And most of these new strategies share a common theme: diversifying its revenue drivers from solely relying on subscription growth.

In addition to the introduction of an additional charge on password sharing earlier this year, Netflix has finally loosened up on the idea of introducing an ad-supported tier in order to capitalize on additional demand from budget-conscious consumers, as well as increase monetization of its market leading subscription base. Other strategies that are currently being considered also include ramping up marketing spend, investing heavily in non-English programming, testing the waters on in-theatre film releases, as well as licensing Netflix Original titles for broadcast on peer networks/platforms. These strategies, which Netflix has long rejected, given its pledge to offer viewers easy-to-access content with no strings attached, underscores the company’s increasing urgency to regain its ground as the market leader in D2C streaming services.

1. Paid Sharing

While Netflix has reported 222 million global subscription as of its last reporting date, its content is likely being viewed by more than 700 million individuals worldwide, considering the average household size in its core markets consists of approximately three headcounts. This is also corroborated by Netflix’s Premium plan offering, which allows up to four devices to stream at the same time. Netflix estimates that there are currently more than 100 million households outside of its 222 million subscriber base that have access to its content on a password sharing basis.

In order to maximize monetization on its non-paying audience and restore subscription growth acceleration, specifically those outside of a single household subscription, Netflix has introduced a password sharing fee. The strategy was first introduced as a $3 surcharge per extra member in Chile, Costa Rica, and Peru earlier this year as part of its initial test run. The experiment was also recently extended to Argentina, El Salvador, Guatemala, Honduras, and the Dominican Republic, where subscribers in these five Latin American countries have been “asked to pay an extra fee [ranging from $1.70 to $2.99] if they use an account for more than two weeks outside of their primary residence,” excluding views on mobile devices and during vacations. The test runs conducted on the different roll-out strategies will pave the foundation for paid sharing’s ultimate launch across all markets in 2023.

On one hand, Netflix is hoping the strategy would help increase its recurring ARM and recoup the years of lost revenues through password sharing. But on the other hand, levying the additional password sharing charge risks losing out to competition for the streaming giant – especially given Netflix’s premium charge compared to rival offerings as discussed in earlier sections. And, as consumers become more price sensitive to discretionary goods and services ahead of a potential economic downturn, charging additional for password sharing is not ideal.

Although charging for password sharing is within the rights of Netflix and reasonable from a business’ perspective, it will likely be met with aversion by subscribers unless, or until, competing streaming platforms start to do the same. The strategy could also potentially cost Netflix its crown within the industry, which in our opinion, is too high of a price to pay for the meager returns that will not even materialize until others do the same in years down the road.

2. Ad-Supported Tier

Another new strategy that underscores Netflix’s increasing urgency in regaining market share is its incorporation of an ad-supported tier that will be rolling out in early 2023. Netflix’s implementation of ads – a strategy it has long rejected given the deviation from its commitment to offering a simple streaming platform – again underscores its increased urgency in maintaining market share gains.

The implementation of ads is expected to Netflix’s topline in two main ways: 1) reaccelerate subscription growth by targeting budget-conscious consumers; and 2) maximize monetization of its vast user base:

- Reaccelerate subscription growth: Offering an ad-supported tier would cater to a new market of budget-conscious, and price sensitive consumers that otherwise would not have signed up for Netflix (or free-ride off of a friend/family’s subscription). Ad-enabled sign-ups represent more than half of rival streamers’ subscription bases, underscoring how the additional offering might just be what Netflix needs to rekindle growth. In fact, the strategy might be even more effective than its proposed implementation of a password sharing fee across all markets. The addition of an ad-supported tier would put the subscription choice back into consumers’ hands and not risk worsening churn, and allow Netflix to practice price discrimination and maximize its penetration – especially in its core markets where growth is reaching the ceiling and spilling over to rivals.

- Maximize user base monetization: As linear TV advertising continues to show softness as consumers migrate towards subscription-based streaming services that can be viewed wherever and whenever, Netflix’s market leading subscription base of 222 million comes in as an attractive choice for advertisers. While global TV advertising opportunities are only expected to grow at a compounded annual growth rate (“CAGR”) of 5% over the next five years, internet advertising is expected to advance at a CAGR of more than 8%, driven by accelerated online data consumption in coming years. Specifically, video streaming platforms are now home to about 23% of total ad spend in the U.S., and the figure is expected to expand further as digital advertising’s more than 60% share of the broader advertising market today is projected to grow at an 11% CAGR through 2030. This accordingly sets a strong base for Netflix’s impending launch of its ad-supported tier. While Netflix’s decision to partner with Microsoft (MSFT) on the roll-out of its ad strategy has raised some eyebrows, given the latter lacks experience in digital advertising other than placements through its Bing search engine and LinkedIn professional social media platform, it could be a strategic move to drive greater long-term value and synergies for both companies. For Netflix, partnering with Microsoft could potentially reduce competition within the increasingly crowded video streaming landscape as opposed to partnering with other ad tech peers that have their own video streaming platforms like Google (GOOG, GOOGL) or Amazon, or broadcasters with an established advertising presence like WBD. And for Microsoft, a successful partnership with Netflix will help bolster its presence within the growing digital ads industry – an area that the software giant hopes to expand in over the longer-term considering its recent acquisition of ad agency Xandr from AT&T (T). Netflix has also alluded to the new strategy as a potential driver of profit growth, considering the higher-margin nature of digital ad sales.

Market forecasts currently expect the addition of an ad-supported tier to contribute an incremental $500 million to as much as $1.4 billion in quarterly revenues for Netflix once the service ramps up. While the number may seem overwhelming, it remains a far cry from competitors like Disney, which secured $9 billion in advertising dollars for the 2022 to 2023 TV season, with 40% of the amount going to its D2C streaming platforms. But given Netflix’s subscription base beats all of its rivals’ by wide margins, the advertising dollars acquired by Disney for next year instead bolsters the prospects of tremendous revenue growth opportunities that the introduction of ads will bring to the streaming industry leader over the longer-term if executed properly.

3. Games

Beyond video streaming, Netflix has also gotten its hands on games – another key driver of consumer spending on media and entertainment, with anticipated growth at a CAGR of 10% over the next five years. While Netflix continues to lack an edge in live sports streaming – a genre well-liked by consumers and proven effective in reducing churn given extended seasons – the incorporation of games within its core video streaming app might offer the company an exclusive advantage in luring demand from avid gamers. Netflix can also leverage its gaming platform to help promote its Netflix Original content library, which reinforces its subscription growth story over the longer-term.

However, Netflix’s investments into gaming could potentially chip away the funding needed for quality content creation needed to stay relevant and competitive. To date, Netflix has spent more than $200 million on gaming-related acquisitions, including the $69 million recently spent on its acquisition of Next Game. While the mobile games strategy is still in early stages of implementation, and the additional feature is intended to help subscribers view Netflix’s premium-priced offering as an improved value for money purchase and give them another reason to stay, the offering seems to lack momentum still. Netflix has been releasing new game titles frequently to accommodate its fast-changing content library, but it is too soon to tell on whether it is gaining enough traction given the feature’s lack of awareness among existing subscribers still.

Under the current macroeconomic climate where investors demand evident returns from significant investments, Netflix’s gaming segment will remain a key focus area in the near-term. Any signs of mediocre results or expectation misses from the new segment could further encourage investors toward the exit.

4. Testing Different Program Release Strategies

Netflix has long tried to justify its premium subscription cost to peers by touting the service’s simplicity. This includes no ads and no wait times on episode releases, satisfying most subscribers’ binge watching habits. While Netflix’s upcoming implementation of an ad-supported tier gives subscribers a choice to choose what they prefer, its recent experiment with multi-volume / batch releases on hit shows like “Ozark” and “Stranger Things,” which applies to all existing subscribers, deviates from its initial commitment to simplicity and availability. Although the strategy might be another desperate measure taken to reduce churn, it leaves a sour taste in the mouths of subscribers who pay a premium for value-add features that are getting stripped one by one.

While viewership on hit shows like Ozark and Stranger Things, which Netflix has chosen to test its new strategy on, remained strong, a wide-spread implementation of release wait times could potentially hasten subscribers’ decisions to move away and backfire. Let’s put this into perspective – if other services like Prime Video, for example, do the same and also offer new episodes on well-liked and well-followed shows like NBC’s “This Is Us” (CMCSA) or Prime Original’s “The Boys” on a week-to-week or volume basis at a cheaper price, then it might be a brainless decision to cancel Netflix when the budget is tight. As such, the practice of releasing new season episodes by volume or on a week-to-week basis must be implemented strategically in order to achieve the intention of sustaining subscribers’ interest and prevent churn.

It is likely that Netflix is testing out the new content roll-out strategy to accommodate its upcoming release of an ad-supported tier. Specifically, advertisers have been known to “secure TV commercials months in advance, but they can also buy spots mid-season if a show suddenly becomes popular.” On this basis, if Netflix sticks by its historical practice of rolling out all episodes of a new show at once, it could potentially complicate the process for advertisers:

Netflix could insert ads into shows that suddenly become part of the cultural zeitgeist, but that may be too late for advertisers. The bulk of the viewing would likely have occurred before an advertiser decided to build a campaign around the program. It can be easier to do this when a program runs over a conventional multimonth schedule.

Source: Bloomberg News

5. In-Theatre Film Releases

While rival WBD has taken a conscious decision to “skip the traditional theatre release window and go straight to [streaming] distribution” through HBO Max in order to make its D2C offering more enticing and gain share in the burgeoning video streaming business, Netflix is trying to do the exact opposite. Releasing new films in theaters first is another strategy that Netflix is contemplating in hopes of maximizing monetization on its production investments – especially considering its increased number of capital-intensive productions in recent years, including “The Red Notice,” “The Adam Project,” and “Don’t Look Up,” which have featured some of the hottest, and most expensive, stars in Hollywood.

For Netflix’s upcoming release of its new Original film, “Gray Man,” which stars Ryan Gosling, the streaming giant is planning an initial release in theatres one week before it is made available on the streaming platform. The theatre release will be absent from “most of the major chains,” though, likely to circumvent the additional marketing dollars and multi-week release window required by franchised movie theatres. However, we view the test run as a moot point – if Netflix is not going to debut its movies at large chains like AMC (AMC), it will not be able to generate an appropriate gauge on the effectiveness and extent of additional returns on the strategy under consideration.

6. Content Distribution Licensing

It has also long been speculated that Netflix is considering licensing out its blockbuster titles like Stranger Things to broadcasters to diversify its revenue stream and maximize monetization on its production investments. While Netflix has continued to profit from IP rights on its hottest franchises, the prospects of licensing its titles out to third-party broadcasters or rival streaming platforms has yet to show substantial progress.

The content distribution strategy, which has long worked for traditional broadcasters-turned-streamers like WBD, might bring mixed results to Netflix, though. While content distribution could help Netflix maximize returns on production investments by introducing an additional revenue stream, the strategy risks losing market share to rival streaming services. Yet, the lost market share could be partially or fully recouped through the content distribution fees, which essentially enables Netflix to partake in profit-sharing from its rivals’ success.

But whether the strategy would be worth it depends largely on whether Netflix’s content distribution fees charged is sufficient to compensate for the value on its lost market share to rivals. For now, Netflix’s Original hits like Stranger Things and Squid Game have been credited as its core driver of subscription growth, which in our view as discussed in earlier sections, is not a sustainable strategy. Especially when budgets are tight, consumers are more inclined to cancel subscriptions after their binge-watching sessions on the handful of hit titles are done. This is further corroborated by recent research data, which shows that more than a fifth of Netflix subscribers as of April have dropped the service within a month, underscoring a faster churn rate than most rivals. Based on this consideration, content distribution could work for Netflix to restore top-line growth, but it would need perfect execution to ensure no market share is lost to rivals – otherwise, it would be a counterproductive act.

7. Capitalizing on Non-English Programming

Despite APAC being Netflix’s smallest market by subscription and revenues, the market is showing tremendous growth potential. Subscription growth in Netflix’s APAC market during the second quarter almost single-handedly reversed worsening churn observed across its core UCAN and EMEA markets. APAC added more than 1 million subscribers in the second quarter, repeating the momentum observed in the first quarter.

Much of APAC’s impressive results were driven by two main factors: 1) low prices; and 2) increasing investments in non-English programming:

- Lowered Prices: In addition to stiff competition against prominent industry players, Netflix has also been dealing with a streaming arms race against smaller local platforms in emerging markets that offer more relevant, local-language-based content. Netflix is currently offering subscriptions to India – one of its largest APAC markets, since the service is unavailable in China due to “governmental disapproval” – at a bargain price of as low as $4. While the aggressive pricing strategy has helped Netflix grow its presence in APAC, it will need to do a lot more to scale profitability from the bargain offering. This is further corroborated by APAC’s sequential drop in ARM and regional revenues by 4% and 1%, respectively, during the second quarter, despite paid membership growth of 3%, which contrasts revenue growth in UCAN despite increasing churn. Market forecasts currently project a need for 20 million to 30 million subscribers in India alone for Netflix’s revenues in the region to be “meaningful.” However, Netflix only has about 5.5 million subscribers in India right now, underscoring the “uphill challenge” ahead.

- Investing in Non-English Programming: Following its “Squid Game” sensation last year, Netflix has been dialing up its investments in non-English programming as a core driver of ongoing efforts in expanding its APAC user base. The strategy is critical, considering viewer preferences in Asian markets appear to be drastically different from those in UCAN, EMEA and LATAM – the share of Netflix’s top 10 programs in Japan, South Korea and India show almost no overlap with those in its bigger Western markets. This means Netflix’s hopes of leveraging Asian market opportunities to jumpstart its growth trajectory will be a challenging and expensive one, though not impossible as shown by the global sensation of Squid Game, and other Asian-language-based mega-hits like “Hellbound” and “Crash Landing on You.”

Fundamental and Valuation Outlook for NFLX

The Netflix stock’s post-market performance immediately after the release of its second quarter results was largely positive, which is expected given its outperformance against the dire guidance management had provided in the previous quarter. Today’s market response reflects investors’ positive, yet still skeptical, view on management’s outlook provided on 2H. Specifically, the stock’s post-market rally indicates that the worst was already previously priced in, but any material upsides will depend on whether Netflix can deliver on consistent positive progress over coming quarters to restore investors’ confidence that the company can “return to a lasting multi-year growth trajectory.”

Adjusting our previous forecast for Netflix’s actual second quarter performance, as well as management’s guidance for the third quarter and recent developments regarding the company’s revamped growth strategy, we are projecting total revenues of $31.9 billion (+7% y/y) and 3.4 million net subscribers by year-end. Much of the second half pickup will continue to be driven by momentum in APAC, helped by reacceleration in North America and Europe – Netflix’s two core markets that have showed deceleration/declines in the first half – buoyed by the anticipated release of new hits like “The Gray Man,” “Enola Holmes 2,” “Glass Onion: A Knives Out Mystery,” “Cobra Kai” Season 5, “The Crown” Season 5, and “Dead to Me” Season 3 Finale. The topline is expected to further advance at a CAGR of about 3% towards $37.6 billion over the five-year forecast period, which is consistent with the mild growth assumption applied in our previous forecast to reflect Netflix’s mixed growth outlook still.

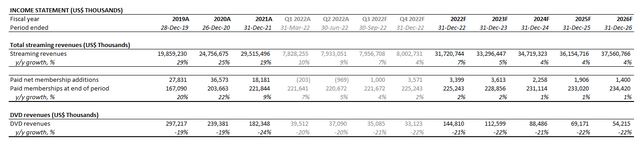

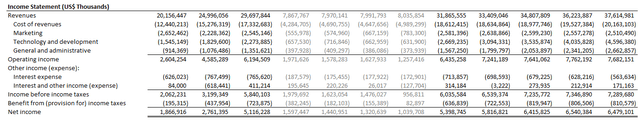

Netflix Revenue Forecast (Author) Netflix Financial Forecast (Author)

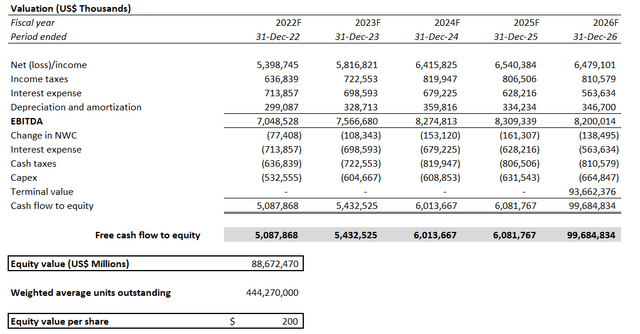

On the valuation front, we are adjusting our near-term price target for the stock from $231 to $217 to reflect the anticipated bottom-line impact from near-term FX headwinds, macro challenges, and additional costs of ramping up new growth strategies, such as the upcoming launch of an ad-supported tier. This would approximate the stock’s pre-market price of about $216 on July 20th, reflecting investors’ view that the stock’s growth story remains consistent with the broader macro outlook. More progress is needed to restore confidence for a greater premium.

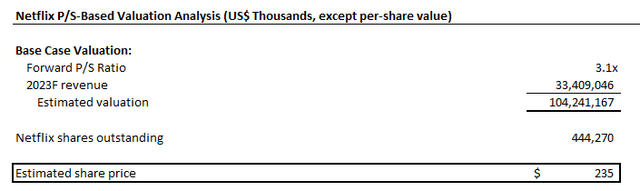

Netflix Valuation Analysis (Author)

The base case near-term PT is derived using the same method key valuation assumptions as before. Specifically, we have equally weighed a sales-based and discounted cash flow (“DCF”) valuation approach to determine the $217 PT for the stock.

Netflix Valuation Analysis (Author)

The forward 3.2x forward sales multiple applied in our valuation analysis continues to reflect Netflix’s projected long-term growth profile amongst its streaming peer group, which is expected to moderate ahead of mounting competitive headwinds. Please see peer comp analysis here for further detail.

Netflix Valuation Analysis (Author)

For the DCF approach, we have drawn the projected cash flow streams from the base case fundamental forecast discussed in earlier sections, and applied an exit multiple of 13.3x and WACC of 9.6%. The valuation assumption applied considers perpetual growth at 3%, which is conservative but consistent with the blended economic growth outlook within Netflix’s operating regions over the longer-term and reflective of the business’ maturing state based on recent performance. It also considers the company’s capital structure and continued ability in delivering positive free cash flows to fund its strategic pivot towards new growth initiatives in both the near and longer term.

Netflix Valuation Analysis (Author)

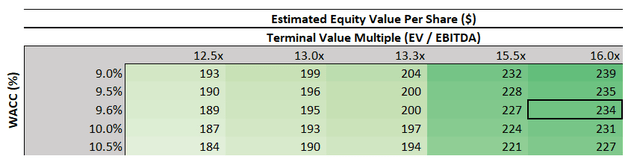

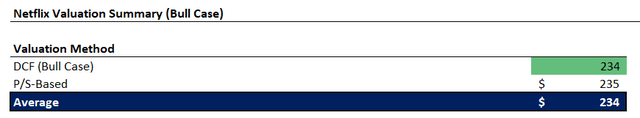

We have also performed a sensitivity analysis on the assumptions applied in our DCF analysis to gauge where Netflix’s valuation could be headed if its new strategies show positive improvement for sustaining a long-term growth trajectory. Applying an exit multiple of 15.5x to reflect perpetual growth at a premium of 4%, while holding other key valuation assumptions constant (i.e., 9.6% WACC and fundamental cash flow growth assumptions), would yield an estimated intrinsic value of $234 apiece. This represents upside potential of 8% based on the stock’s pre-market price of about $216 on July 20th.

Netflix Valuation Sensitivity Analysis (Author) Netflix Valuation Sensitivity Analysis (Author)

Final Thoughts

Netflix’s 2H performance will be a tell-tale on whether management can right the company’s ship and restore investors’ confidence in the company’s growth trajectory in the still-burgeoning, though increasingly competitive, D2C streaming landscape. Despite the current risk-off environment in equities created by the increasingly uncertain global economic outlook, market expectations for the Netflix stock are not high – this is further corroborated by the stock’s moderate post-market rally in response to management’s latest earnings commentary.

As long as the company can show consistency in providing gradual improvement to subscription and top-line expansion via its new growth strategies in 2H, then there is still room for investors’ confidence to return. However, if the 1H slump continues to worsen ahead of a potential recession in 2023, the stock just might not make it, as investors are becoming less and less forgiving this time around given the cloudy market outlook.

Be the first to comment