HATICE GOCMEN/iStock via Getty Images

Recent developments and ELVT overview

Since I first wrote about Elevate Credit (NYSE:ELVT) in November 2021, many things happened. First, the company announced two major settlements at the beginning of Feb 2022. Then, Q4 and FY2021 results have been published, with the stock dropping 12% the day after. I strongly believe that there are many short and long-term catalysts for this small stock, such as:

-

Growing loan receivables leading to higher revenues and margins in 2022;

-

Changing accounting policies boosting EPS in the upcoming quarters;

-

Lower idiosyncratic risk as the recent settlements free the company from dangerous litigations;

-

A favorable (upcoming) political environment will reduce regulatory risk;

-

Continued long-term superb performance and aggressive buybacks.

There are many positive points and the market is just ignoring most of them. The multiples are the same as months ago while the prospects for the next quarters are probably going to surprise the market and thus forcing a re-rate. Multiple expansion will be one of the drivers of the stock price growth, but this will come along with better fundamentals.

Favorable (turning) political environment and reduced idiosyncratic risk

Two major things are happening that are not related to fundamentals and that could easily be an underlying cause of EVLT’s success in the upcoming months. (1) The increased likelihood of a republican win for 2022 mid-terms, and (2) the recent $33 million settlement in the Think Finance litigation. The reason why Elevate Credit is linked to mid-term outcome is quite simple: they are a subprime lender and regulators happen to be quite tough with such businesses, especially democratic senators and house members. Indeed, in July 2021, the democratic house representative Jesus “Chuy” Garcia and senator Jack Reed introduced the S.2508 – Veterans and Consumers Fair Credit Act. Such law, if passed, would force every subprime lender to cap the interest rates charged at 36% per year. While the legislative project has now been granted bipartisan support, with both Senate and House republicans by the end of 2022, the chances of such a law passing would be considerably lower.

The other major (positive) point is about the Think Finance settlement. Elevate Credit is indeed born as a Spin-off from Think Finance, the lender that fall in disgrace and was overwhelmed by lawsuits. Since ELVT was part of such a company less than 5 years ago, the lawsuits called Elevate to payoff part of Think Finance liabilities, in a claim that was estimated at around $250 million. Finally, in February 2022, the company was able to secure a settlement of “just” $33 million. This made the stock jump some 20% in about a week since the idiosyncratic litigation risk affecting the company is no longer here. So, to summarize, ELVT is now better positioned thanks to an upcoming political environment that could be more favorable than the past one, and a resolved litigation that put Elevate at risk of bankruptcy.

Why Q4 results matter: loan growth and accounting changes

The last earning release was quite interesting because of (1) an announced new accounting policy coming into effect in Jan 2022, and (2) confirmed loan receivables expansion that will lead to higher 2022 revenues. Revenue grew by some 40% YoY compared with Q4 2020 results, while receivables expanded by another 40% YoY and 9% QoQ. Net result was horrible for two reasons: the settlements that cost the company about $19 million ($0.6 per share) and are responsible for more than 50% of the losses; in time of growing receivables, provisions eat up the majority of earnings.

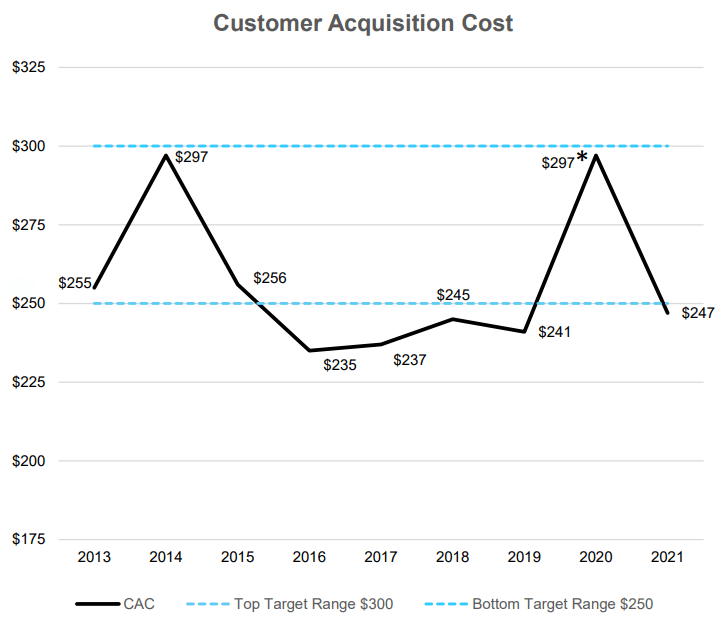

At the same time, the company did some advancements in margin improvement by lowering CAC. Indeed, marketing expenses grew less than new customers grow, leading to a CAC lower than the bottom target range. To acquire a new customer, Elevate spent $247, or about 20% less than in 2020. Despite massive new loans generation, marketing costs remained under 10% of sales.

ELVT CAC (Investors Presentation)

But the most interesting aspect of the latest results is not the numbers. The company announced a new way of reporting results that will start beginning Jan 2022. While the change of accounting methods usually does not affect FCF generation, a lender like Elevate could benefit a lot. The switch to fair value reporting will allow the company to stop accumulating provisions before the actual depreciation of the loans, which is currently responsible for poor EPS during periods of loan receivables growth. With the newly adopted rules, they will report changes in the fair value of assets (loans) as a gain/loss in the income statement. This will increase the EPS even with growing loans and will likely negatively affect net income during periods of poor loan growth.

A tougher macroeconomic environment will drive loan growth and EPS

As the war in Ukraine continues, so do supply-chain disruptions and spiraling inflation across the globe. As ELVT demonstrated before the pandemic, it is able to reach a positive net margin (3-5%) while having a big loan portfolio. Assuming gross receivables above $600 million by the end of 2022, they should be able to monetize that in a positive EPS in a matter of months.

The average American is now in need more than ever of short-term lending, as basic costs (such as fuel) are rising uncontrolled while salaries can’t keep pace.

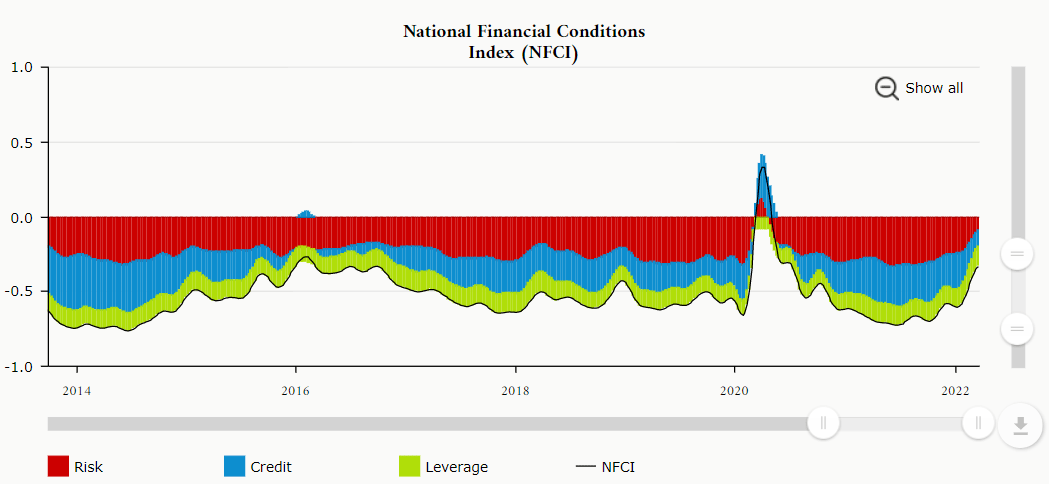

Chart of financial conditions (Chicago FED)

The National Financial Conditions Index reported by the Chicago FED is showing signs of worsening conditions across the country, with the possible comeback of June-Sept. 2020 levels. This will create an unfortunate (for the economy), but a positive environment for Elevate. And what about loan losses driven by higher default rates? Well, this is where ELVT software capabilities kick in.

If Elevate is able to lend at the same credit quality levels seen in 2018-2019, when it reached pick efficiency, we should see equally positive results in the upcoming periods. This is surely a form of systemic risk affecting the company, but past results provide an encouraging outlook.

Conclusion

Elevate Credit is a well-positioned company to take advantage of both short-term and long-term catalysts that could drive its valuation towards fair value. Right now the subprime lender is expected to benefit from (1) changing accounting policies in Q1 2022, (2) aggressively growing loan book, and (3) improved profitability. I keep my view on the fair price of this stock according to my detailed model available in the last article. The overall upside potential is now above 240% at the reach of a target price of $11.5.

Be the first to comment