Marcin Klapczynski/iStock via Getty Images

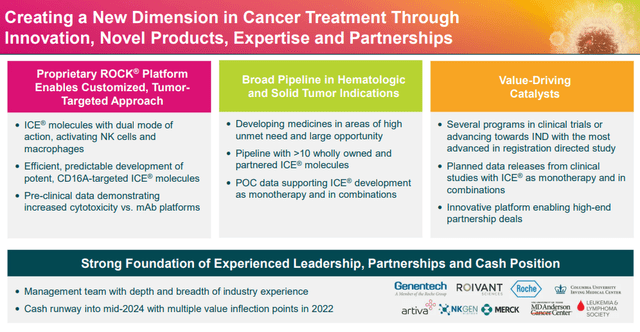

Over the past few years, Affimed (NASDAQ:AFMD) has constructed a distinguished pipeline of innate cell engagers and has verified their three-pronged development strategy to move the company closer to the next stage of growth. In recent times, Affimed has expanded its R&D prowess and revealed significant proof-of-concept data in heavily pretreated patients with a combination of an innate engager and allogeneic natural killer cells. Moreover, Affimed recently finalized a $103.5M public offering, which will help fund the company’s wholly-owned programs to hit key catalysts over the remainder of 2022 and into 2023. Sadly, none of this progress has been able to fend off the selling pressure that has crushed small-cap biotechs over the past year and AFMD is now trading just above its 52-week lows. I believe this is an opportunity to add to my AFMD position ahead of some key inflection points that could spark a potential turnaround in the share price.

I intend to provide a brief background on the company and will discuss some upcoming catalysts that could trigger a potential turnaround. In addition, I go over some downside risks that investors should be aware of. Finally, I take a look at the charts to identify some key levels and highlight my strategy for adding to my AFMD position.

Background on Affimed

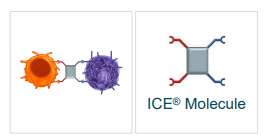

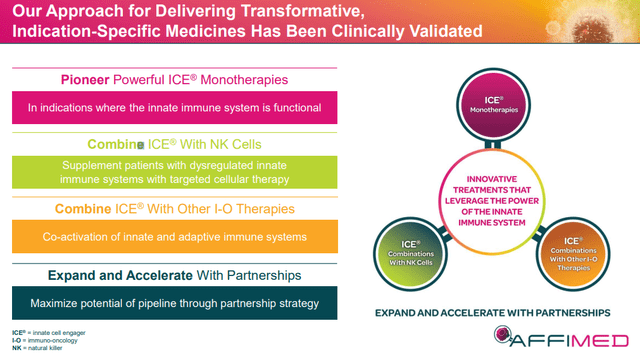

Affimed is a biotechnology company that utilizes their “fit-for-purpose” Rock platform to develop “innate cell engagers” or “ICE Molecules”. The platform creates multi-specific antibodies that will unlock the body’s immune cells to attach to their target that is specific to an indication. Affimed’s ICE Molecules link to natural killer “NK” cells and macrophages by the CD16A-binding area, while concurrently binding to the target cancer cells. This connection will allow the innate immune system to engage the cancer cells and will trigger the release of perforins to create holes in the cancer cell’s membrane to allow granzymes to initiate apoptosis of the cancer cell.

ICE Molecule ( Affimed) Rock Platform Overview (Affimed)

It is important to note that the company’s ICE Molecules are taking the innate immune system that had essentially missed cancer in the first place and has now allowed it to attack the cancer cells. Moreover, Affimed’s ICE molecules won’t require harvesting the patient’s NK or T-Cells, which gives it a significant advantage over most cell therapies.

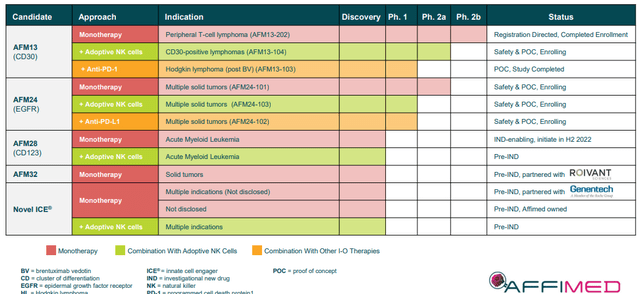

Affimed’s pipeline is filled with ICE Molecule programs in an assortment of indications both as a monotherapy and combination therapies.

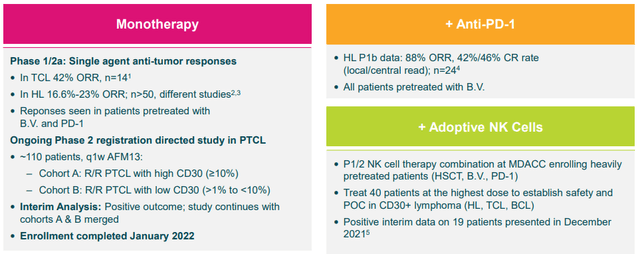

The company’s lead candidate, AFM13, is being tried as a monotherapy, as well as in adaptive NK cells combo, and in combination with an anti-PD-1 in CD30+ lymphomas.

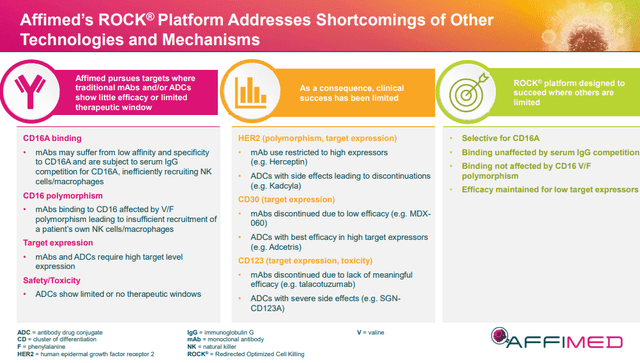

To date, AFM13 has generated impressive data both as a monotherapy and in combination.

Extraordinarily, the NK cell combination (AFM13-104) showed inspiring results in 40 heavily pre-treated patients that had a median of six prior lines of therapy. 13 of these patients in the highest dose responded to the treatment with 5 of them undergoing a complete response. Moreover, one of these patients had previously failed CD30 CAR-T therapy.

AFM13+NK Cell Combo Complete Response (Affimed)

Currently, Affimed has completed enrollment in AFM13’s registration-directed study in peripheral T-cell lymphoma. AFM13 has been a proof-of-concept product candidate for Affimed and has the potential to validate the remainder of the company’s pipeline programs both as monotherapies and in combination therapies.

The company’s AFM24 is taking aim at EGFR+ solid tumors, which over 400K patients in the U.S. and 1.5M patients around the world. AFM28 is targeting CD123 in AML which is ready for an IND in the first half of this year.

AFM28 is the company CD123 targeting innate cell engager is preparing for IND for acute myeloid leukemia. AFM28 encourages lysis of CD123-positive leukemic blasts in AML patients, either pre-complexed or co-administered with cryopreserved NK cells.

In addition to the company’s wholly-owned assets, Affimed has partnered programs ROIVANT and Roche’s (OTCQX:RHHBY) Genentech. These programs have already provided notable milestone payments and the company still has billions in potential milestones outstanding.

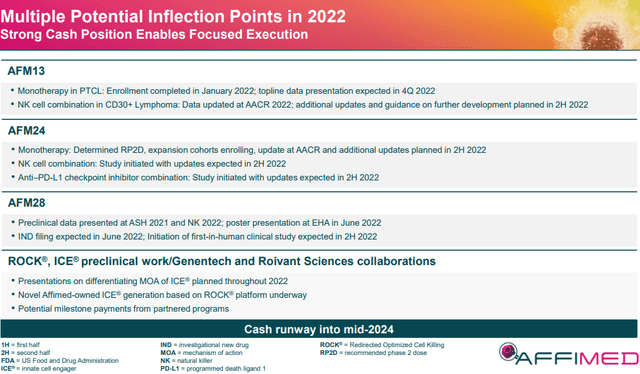

Upcoming Inflection Points

The company’s platform, pipeline, and partnerships should produce several potent catalysts over the coming quarters that should improve the company’s outlook and potentially fuel a turnaround in the share price.

Affimed Upcoming Inflection Points (Affimed)

My focus will primarily be on AFM13, which has completed enrollment for the monotherapy REDIRECT study for relapsed/refractory PTCL. Affimed anticipates topline data from this study in Q4 of this year. So far, the AFM13+NK cells combo has displayed a robust increase in complete responses following two cycles of the recommended Phase II dose. Affimed is moving forward and expects to update investors on its development later this year and potentially present data at a medical conference in the second half of this year.

Affimed continues to enroll patients in all three AFM24 clinical trials and is planning to present data in the second half of this year. This should reveal the efficacy of the company’s three-pronged strategy.

The company recently presented data at EHA that showed AFM28 produced potent anti-tumor activity with “no evidence of off-target cytotoxicity.” AFM28 is on track for an IND this month for relapsed and refractory AML. Affimed anticipates starting the Phase I clinical trial in the second half of this year.

Affimed is also working with their partners to safeguard access to an off-the-shelf cryo-preserved natural killer cell to use in the development of the company’s ICE therapies. Affimed expects to update on their NK cell development strategy in the second half of 2022.

Affimed is also working with their partnered programs including their Genentech programs. Affimed has been working on several preclinical programs and has handed them over to Genentech for further preclinical development. Affimed’s partnership with Roivant is still pushing AFM32 forward and is in IND-enabling studies. Affimed is eligible for additional milestones in the near term.

Turnaround Potential

Affimed made significant progress in the first half of 2022 with AFM13, AFM24, and AFM28, all of them showing potential to address major medical needs using the company’s three-pronged strategy. The planned updates on all three programs for the second half of this year will keep the company on track to be among the first companies to bring innate cell engagers to registration-directed studies and potentially to the market. But most importantly, Affimed extended the company’s cash runway to mid-2024, which allows the company to run past these key inflection points for all their innate cell engagers.

So, not only does the company have several scheduled for the second half of this year, but they also have adequate cash position to get them through the docket of events. As a result, I suspect these updates will have a durable impact on the share price. Whereas underfunded biotech tickers typically experience a selloff in the subsequent weeks as investors fear a follow-up secondary offering. What is more, Affimed has the potential to collect upsized milestone payments from their partners that could extend that cash runway projection beyond mid-2024.

It is possible that we are looking at a biotech that is approaching registration trials with a healthy cash position and has the potential to collect additional milestone payments to add to the coffers. To me, these seem like the conditions needed to entice the market to permit a turnaround in the share price.

Downside Risks to Consider

Affimed investors need to consider a few looming downside risks when managing their position. First is cash… which is not an immediate threat at the moment. However, Affimed might have to pull the trigger on an offering in order to fund their pipeline and prepare for commercialization. Therefore, investors need to accept there is a strong risk the company will have to perform some form of dilutive funding, which could have a negative impact on the share price.

Another risk comes from a potential regulatory failure or weak clinical data. The company is fixated on their Rock Platform and their ICE molecules, so a miss or setback in any one of their programs could cast doubt on all their pipeline programs.

Last but not least is competition from other cell therapy companies. At the moment, Affimed has a long list of competitors who are using NK cells and T cells to take on various cancers. Even if Affimed is able to produce best-in-class results in the clinic, the company is going to have to battle in the market to establish a beachhead while several other cell therapy products attempt to do the same. This could make the first few quarters of commercialization a little rocky, which would most likely hurt the share price until the company can prove their products can compete in the market.

As a result, I have put AFMD in the Compounding Healthcare speculative “Bio Boom” Portfolio with a conviction grade of 3 out of 5.

Charting Out the Strategy

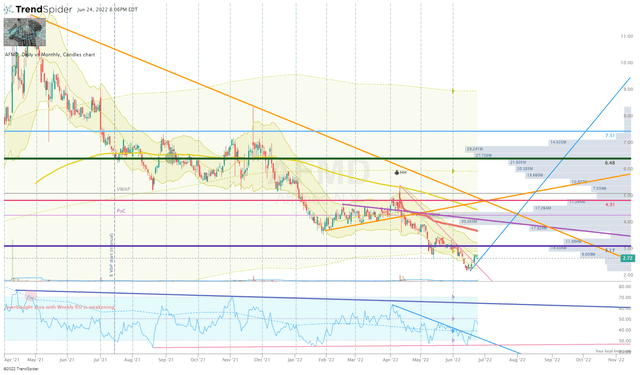

In my previous article, I discussed how was going to “take my AFMD position out of mothball and apply some profits in the coming months while it is still trading under $5.00 per share.” At that time, I was looking to employ a DCA approach by making additions every couple of weeks until the charts show signs of a potential reversal as long as the share price was below $4.50 per share. I am still going to stick to that strategy, but I am also looking to make one or more discretionary additions in the near term to take advantage of the present share price.

Currently, AFMD is showing a small bounce off the $2.25 area, which coincides with a longstanding uptrend ray on the Daily RSI and long-term support from 2016-2018.

AFMD Daily Chart (Trendspider)

AFMD Daily Chart Enhanced View (Trendspider)

The share price was able to break out of the downtrend established back at the beginning of April 2022 and break the downtrend on the Daily RSI. What is more, we can see some bullish divergence on the Daily chart. So, it would appear we have a few bullish signals on the Daily chart that could develop into a good setup in the coming days or weeks.

I am looking to take a chance and pull the trigger on a small addition in the immediate term but will be on the lookout for a potential setup for a substantial addition if we see a higher-low set in the near term. Once I make these additions, I will return to the DCA approach, however, I am still going to refrain from going “all-in” until we see AFM13 top-line data.

However, I still have a few sell orders placed in order to generate some profit and maintain my “house money” position.

My goal is to reestablish a “house money” status after hitting Sell 2, and will book additional profit at Sell 3. I will keep a sizeable core position for a long-term investment.

Long-term, I still plan on holding AFMD in the Bio Boom portfolio for at least five years in anticipation that I will get a large return on my investment.

Be the first to comment