WHPics

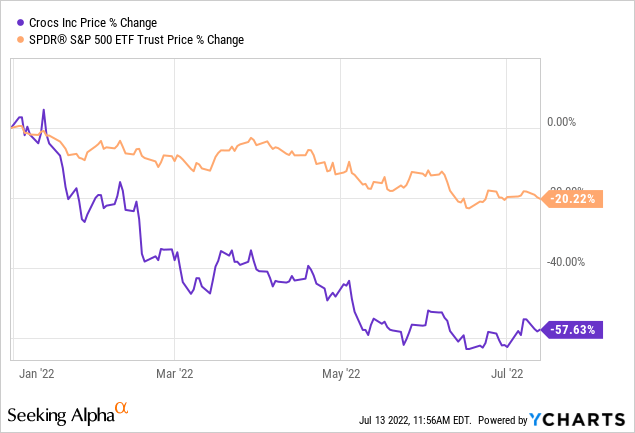

Crocs’ (NASDAQ:CROX) stock price has declined by more than 58% year to date, however it is about 3% higher since our previous article on the firm. Although CROX has substantially underperformed the broader market in 2022, which has declined by only about 20%, we reiterate our “buy” rating on the stock.

While in our previous article we pointed out three reasons why we think Crocs is a good buy, in this article we will take a look at what potential macroeconomic headwinds could negatively impact Crocs’ near-term performance, while we highlight some of the key analyst upgrades on the company in the recent weeks.

Let us start with consumer confidence.

Declining Consumer Confidence

Consumer confidence is often referred to as a leading economic indicator, which could be used to predict potential near-term changes in the spending behaviour of the consumer.

Low consumer confidence indicates that people are concerned about their financial outlook and safety, and may start to spend less and save more. This kind of behaviour is likely to lead to reduced demand for durable, discretionary, non-essential products. Firms that are selling such goods are expected to face the most severe impacts on their financial performance.

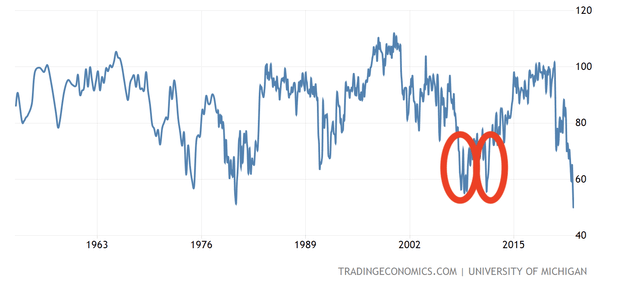

In the last year, consumer confidence has been declining steadily, falling even below levels seen during the 2008-2009 financial crisis. Although consumer spending has remained high in the first half of 2022, we believe that it was partially fuelled by the easing COVID-19 restrictions in the U.S. and Europe. People have been keen to go out and travel, which they have not been able to do during the pandemic. We expect this positive effect to gradually diminish, resulting in a potential weakening of the consumer spending in the near term.

So how could it actually impact Crocs’ business?

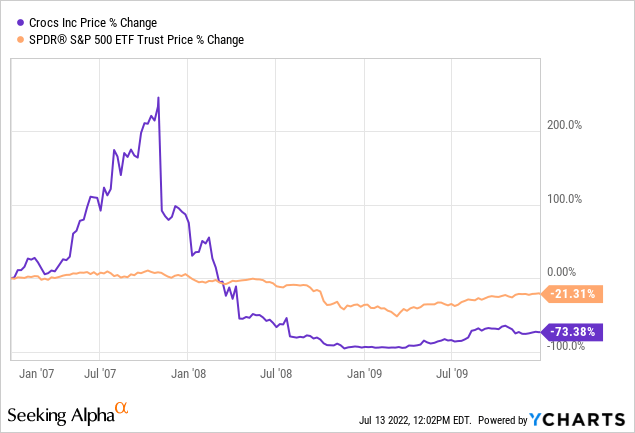

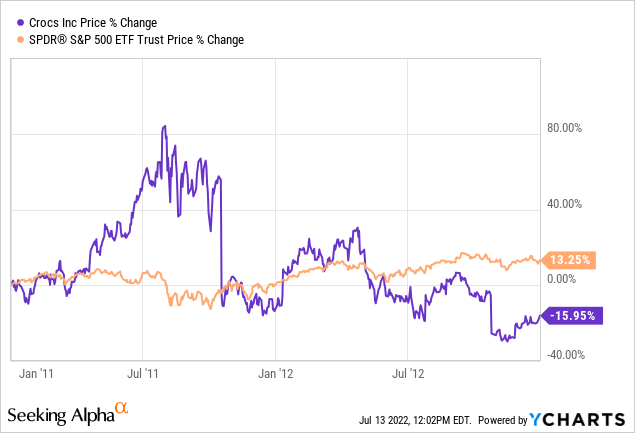

Since the firm’s IPO, there have been two time periods characterized by low consumer confidence: 2007-2010 and 2011-2013.

U.S. Consumer confidence (Tradingeconomics.com)

During low consumer confidence, the firm has significantly underperformed the broader market. In these two periods, the firm has lost 73% and 16% of its market value, respectively.

As the stock price has already declined by almost 60% year to date, we believe that most of this risk is already priced in. We, however, do not exclude the possibility of further near-term downside risk.

Strong U.S. Dollar

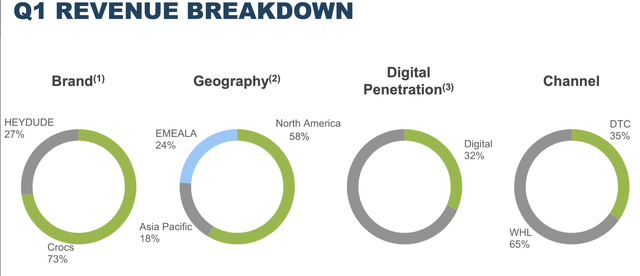

58% of Crocs’ revenue is generated in the North American region, while 42% in the Asia Pacific and EMEALA regions combined. The firm’s long-term strategy is to increase the revenue from the Asia Pacific region, aiming to reach 25% from this region (with about 10% contribution from China).

In our opinion, there may be obstacles in the near term to reach this target as, for example, USD to EUR has reached its highest in 20 years.

On the other hand, the easing COVID-19 restriction in China could lead to increased demand, offsetting the negative impacts of the strong USD.

Elevated Raw Material And Transportation Prices

Raw material and energy prices have skyrocketed in the first quarter of 2022. The sharp increase in commodity prices has been primarily driven by the unfolding geopolitical tension in the Eastern European region.

Increasing oil and gas prices have led to elevated transportation and freight costs. While Crocs had a strong first quarter, this phenomenon has resulted in a downward pressure on the margins of many firms. Although we have seen some positive developments recently, including the higher than planned increase of oil output by OPEC+, we remain cautious with our energy price expectations for the rest of 2022. Even though oil prices have fallen significantly in July, as the uncertainty about the duration and the resolution of the conflict remains high, we expect commodity prices to remain elevated compared to 2021.

Crude oil WTI (USD/bbl) (Tradingeconomics.com)

Elevated prices and high inflation lead to the following question: Can Crocs maintain its margins, without significantly hurting demand?

Crocs offers relatively unique products. The brand is well-recognized and popular. These factors could give the firm substantial pricing power. In our opinion, the firm is well-positioned to raise prices to partially offset the negative impacts of the increasing costs, they may not be fully offset the negative impact of the strong USD, combined with rising costs.

To sum up, despite the macroeconomic headwinds, we believe that Crocs is still a buy. As pointed out in our previous article, we believe that Crocs is trading at very attractive valuations, coupled with promising growth prospects. In our opinion, the current price already accounts for potential near term headwinds related to slowing demand and elevated costs.

Let us now take a quick look at how analysts have been changing their views on the firm.

Analyst Upgrades

In the last months, several analysts have become more bullish on Crocs and have set price targets far above the price, where the stock is currently trading at.

Loop Capital Upgrades Crocs To Buy

Loop Capital analyst Laura Champine upgraded Crocs’ stock from a hold rating to buy on July 6.

She has also set a price target on the stock of $75, representing a more than 40% upside from the current price levels.

Champine highlighted: “We are willing to step in despite the dodgy macro environment. Our checks point to healthy sell-through and normal discounting at the end of the quarter. We think the Hey Dude acquisition may accelerate the overall long-term growth rate given CROX’s ability to sell the brand into its legacy distribution, and we are seeing some success in the family channel.”

In our opinion, the price target set by Loop Capital is reasonable as the stock is currently trading at a significant discount, based on price multiples, compared to the consumer discretionary sector median.

Baird

Baird’s Komp highlighted: “While most management teams acknowledge the rising pressures on consumers, the footwear category appears to be holding up well, especially relative to selected other down trending consumer categories.” “Most brands are closely monitoring the health of sell-throughs and inventory levels across key partners, while touting operating agility in the case spending were to soften.”

“In our view, those best positioned include brands with exposure to higher-income consumers, categories that are trending well, especially functional/performance, comfort/casual, as well as dress and western”.

Crocs is expected to benefit from more casualwear trends.

Improving supply chain trends are also likely to positively impact the firm’s financial performance in the second half of 2022.

Key Takeaways

Macroeconomic headwinds in the near term may have negative impact on CROX’s financial performance, main driven by low consumer confidence, the strong USD and elevated raw material and transportation prices.

On the other hand, we maintain our buy rating on the stock due to the attractive valuation and its growth prospects in the mid- to long-term.

Loop Capital and Baird are also having an optimistic view on Crocs’ business.

Be the first to comment