Courtney Hale/E+ via Getty Images

Introduction

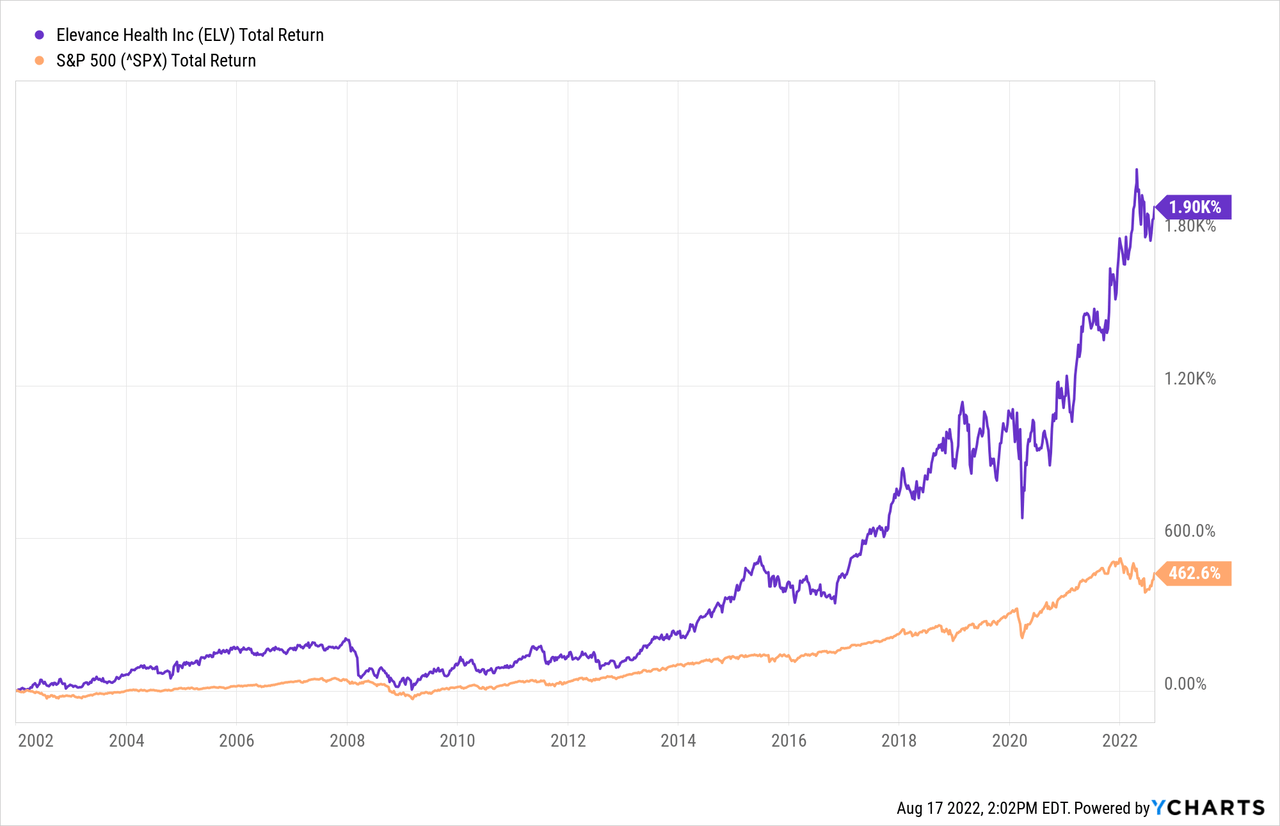

Elevance Health (NYSE:ELV) has surpassed the S&P 500 (SP500) by far in the past 20 years. Total return, including dividends, is 1900% (CAGR: 16.2%). The S&P 500 grew ‘only’ 463% (CAGR: 9.0%). UBS puts Elevance Health on its list of top stock ideas. Elevance Health is a health insurance company, these companies have the character to show stable and predictable profit growth. They will not show big one-time profits. The stable growing character appeals to me.

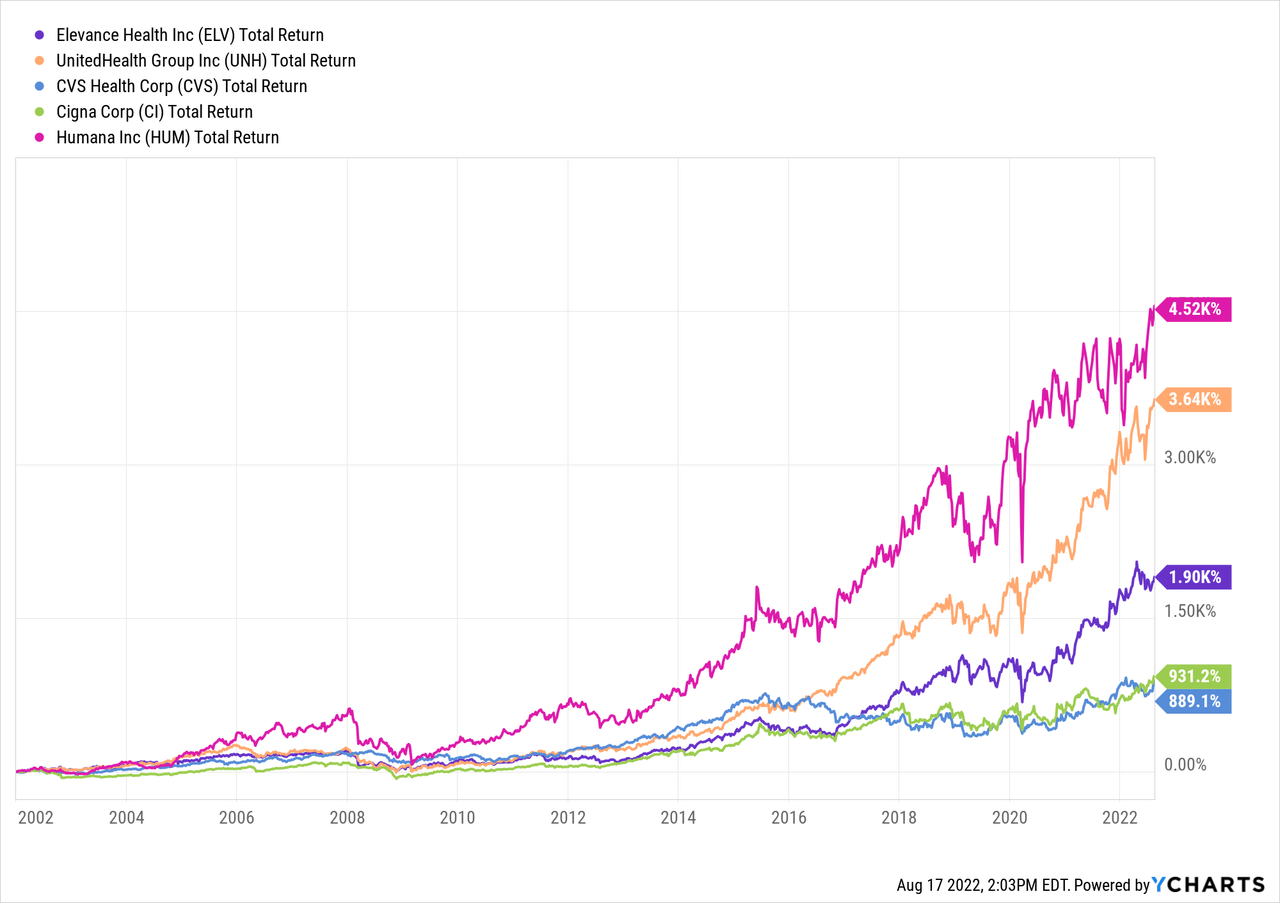

Publicly traded companies in the same industry include UnitedHealth (UNH), Aetna Health Insurance (CVS), Cigna Health Insurance (CI), and Humana Health Insurance (HUM). These companies have also performed strongly over the past 20 years. Humana leads the way, followed by UnitedHealth and Elevance Health. All have strongly beaten the S&P 500.

It is worth investigating Humana and UnitedHealth in more detail. This article describes Elevance Health’s strong historical revenue and earnings growth, strong outlook, attractive stock valuation, and share repurchase program. Strong growth catalysts for a further upward movement of the share are the increased interest rates, strong membership growth and the share buyback program. The stock is a strong buy.

About The Company

Elevance Health is a health benefits company that offers a variety of health care plans through affiliates such as Anthem Blue Cross and Blue Shield, Empire Blue Cross Blue Shield in New York State, Anthem Blue Cross in California, Wellpoint, and Carelon. Blue Cross provides coverage for hospital services and Blue Shield for physicians’ services.

Elevance Health is the largest for-profit healthcare company in the Blue Cross Blue Shield Association. The company had 46.8 million members within their affiliated companies’ health plans.

Elevance Health was formally known as Anthem and changed its name to Elevance Health in June 2022 to optimize and streamline the company’s brand portfolio.

Stable Growing Profits And Good Prospects

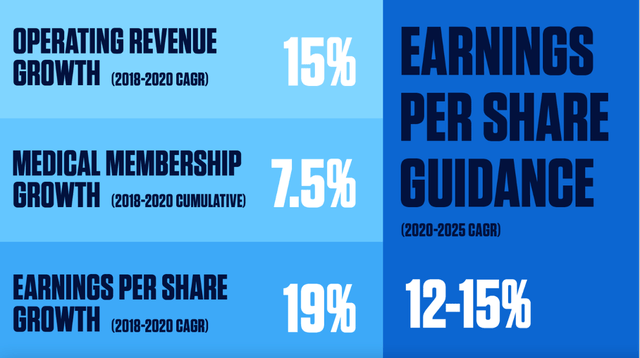

During the past years, the company has experienced rapid growth. From 2018 to 2020, operating revenue grew an average of 15% per year, medical membership grew by 7.5% in total and earnings per share grew by an average of 19% per year.

2020 Investor Day Presentation (Investor Relations – Elevance Health)

During the 2021 Investor Day presentation, Elevance Health expected earnings per share to grow at an average annual rate of 12-15% from 2020 to 2025. Earnings per share rose 15.6% in 2021, ahead of expectations.

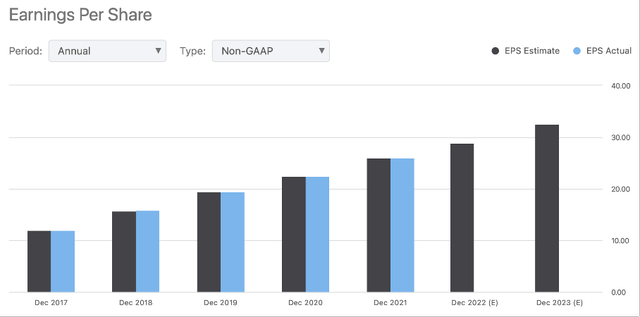

In recent years, Elevance Health has consistently exceeded analyst expectations. Elevance’s earnings are stable and predictable. I prefer to invest in companies that can grow their profits stably with some predictability.

Elevance Health EPS Growth (Seeking Alpha)

The second quarter of 2022 was a strong one. Operating revenue grew 15.6% and medical enrollments grew 6.1% year-over-year. Adjusted earnings per share grew 14.4% year over year.

Elevance Health raised outlook for 2022, adjusted earnings per share expected to reach $28.70 (10.5% year-over-year growth).

Elevance Health invests its premiums in a bond portfolio, the value of bonds fluctuates with changes in interest rates. That’s not a problem for Elevance Health, as it holds the bonds until maturity. Rising interest rates go hand in hand with higher bond yields, boosting Elevance Health’s earnings. Profits are reinvested in bonds, further increasing profits. The Fed announced further increases in the Federal Fund Rate to calm inflation. Rising interest rates coupled with strongly growing membership numbers are both two strong growth catalysts for Elevance Health.

Dividends, Share Repurchase Program, And Valuation

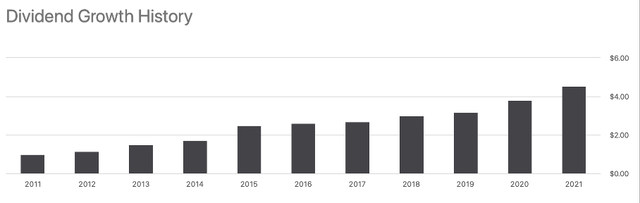

The management of Elevance Health rewards shareholders well by paying dividends in combination with a share repurchase program. The company increased its dividend year-over-year, growing at an average rate of 16.3% per year from 2011 to 2021.

Dividend Growth (Seeking Alpha)

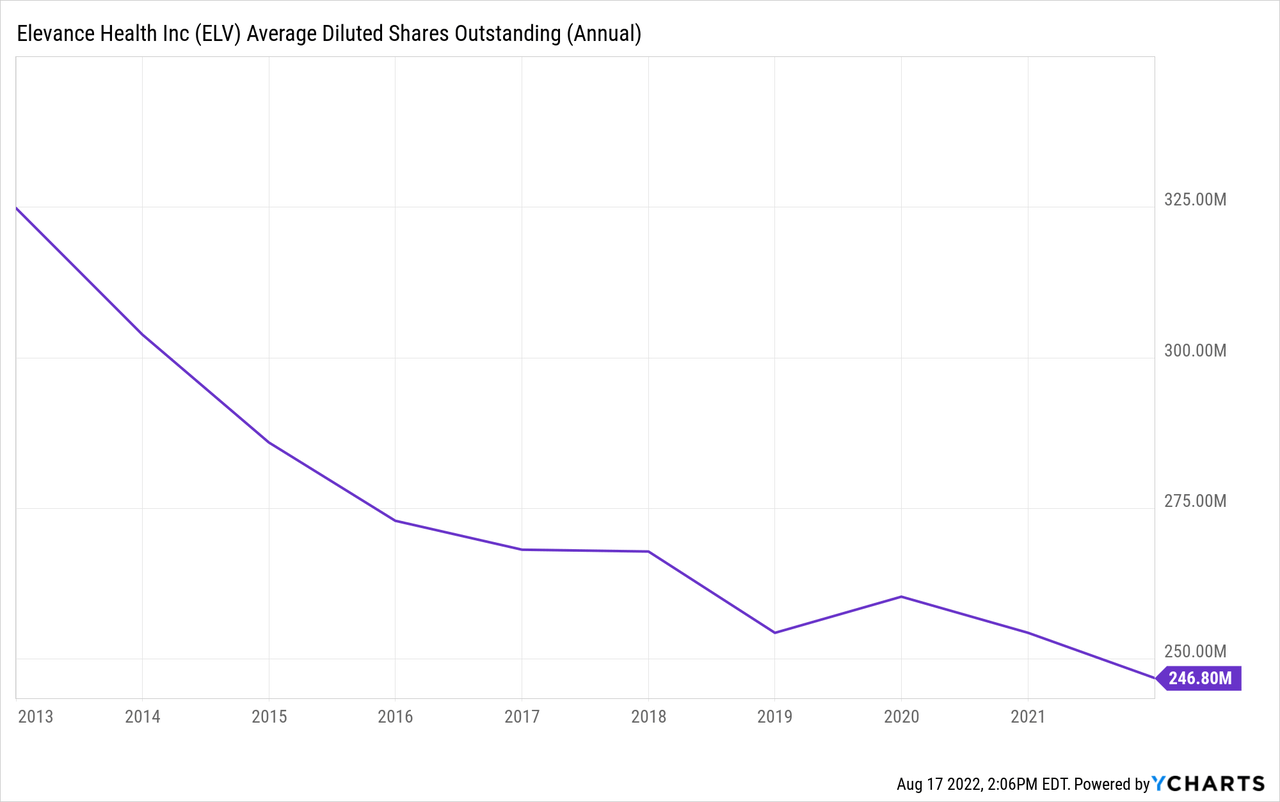

Repurchasing shares is a strategic move to increase earnings per share. The extra demand and reduced supply cause the share price to rise. Over the past 10 years, Elevance Health’s outstanding shares have been reduced from 325M to 247M, representing an annual decline of 2.7%. I expect this trend to continue, shareholders benefit greatly from share repurchases. As of June 30, 2022, $3.0B is available to repurchase shares, and equates to a buyback yield of 2.5%.

The stock’s valuation is in line with the valuations of competitors’ stocks. The table below shows the PE ratios and estimated total EPS growth from 2022 to the end of 2025 of Elevance Health and competitors.

|

Company |

PE-ratio |

Estimated total EPS growth 2022-2025 (source: SA) |

|

Elevance Health |

19.6 |

44.9% |

|

UnitedHealth Group |

28.3 |

47.5% |

|

CVS Health |

17.3 |

29.3% |

|

Cigna |

17.4 |

33.4% |

|

Humana |

20.2 |

44.8% |

UnitedHealth Group is highly valued with a PE ratio of 28.3. UnitedHealth’s EPS growth expectations are slightly higher than others, but the hefty premium isn’t worth examining the stock further. The other companies look attractive with their PE ratios between 17 and 20 and their strong EPS growth expectations.

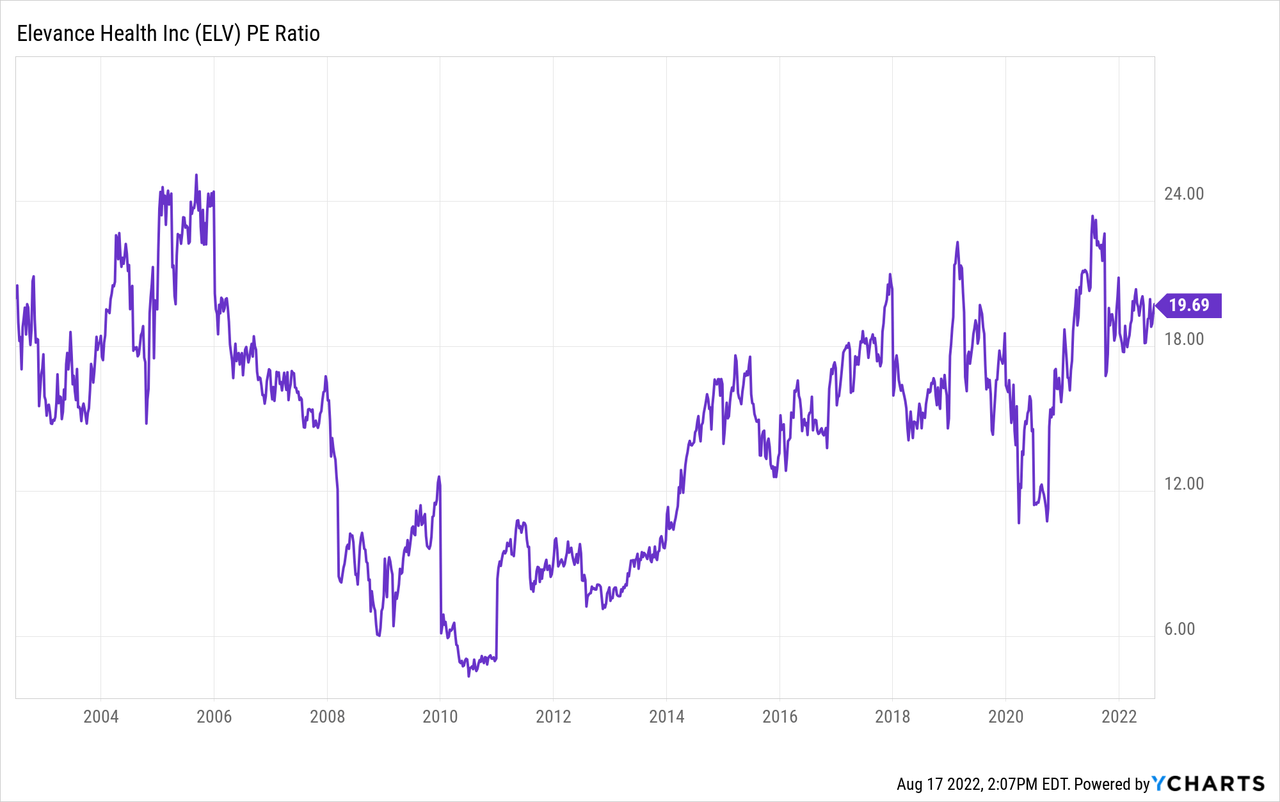

In the chart below I have visualized the PE ratio of Elevance Health from 2003 to now. The financial crisis of 2007-2008 has left a strong imprint on the entire financial sector. Confidence in financial companies had completely disappeared by then. To determine the average PE ratio, I do not include the period of the financial crisis. Elevance Health’s average PE ratio is then 16.

With the average PE ratio of 16, I calculated what the share price will be at the end of 2025. Analysts expect earnings per share of $41.80 in 2025. The stock will then be valued at $669. An annual return of 14.6% excluding dividends can be expected. Including dividend, this equates to an annual pre-tax total return of 15.6%.

Conclusion

Shares of Elevance Health have risen an average of 16.2% over the past 20 years and have greatly overtaken the S&P 500 (CAGR: 9.0%). Elevance Health is a health insurance company that offers health insurance through various affiliates. The company is growing at a rapid pace, with average revenue growth of 15% over 2018-2020, membership growth totaled 7.5% over the same period, and earnings per share grew at a CAGR of 19%. The second quarter of 2022 was a strong quarter, and management raised its outlook for 2022. Analysts expect Elevance Health 2025 adjusted earnings per share to be $41.80. Calculated using Elevance Health’s average PE ratio, an annual pre-tax return of 15.6% can be expected. With historically strong growth, increased outlook, share repurchase program and attractive stock valuation, Elevance Health is a strong buy.

Courtney Hale/E+ via Getty Images

Be the first to comment